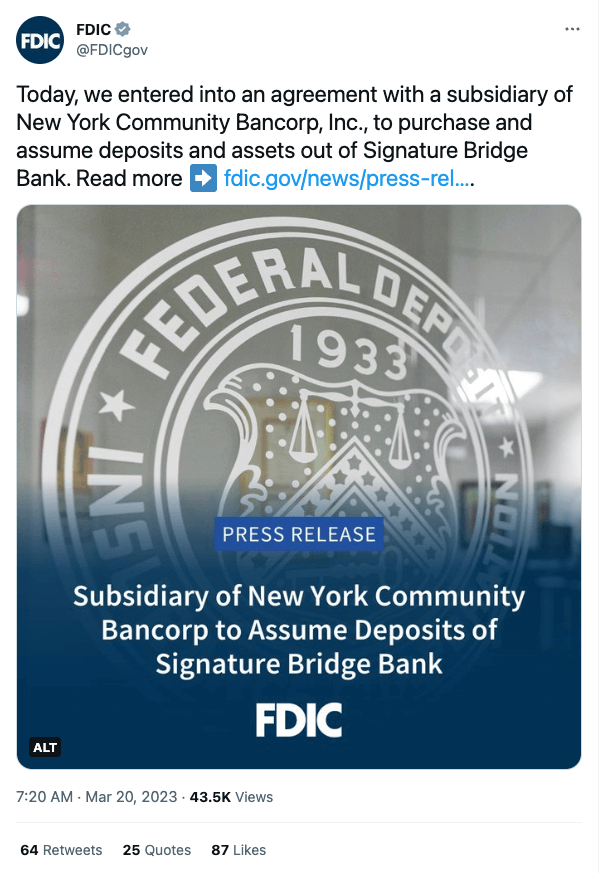

Flagstar Financial institution — a subsidiary of New York Group Bancorp, Inc. — will purchase Signature Financial institution, as per a press launch despatched out by the Federal Deposit Insurance coverage Company (FDIC) on March 19.

Signature was up on the market and being auctioned by the FDIC — with the caveat that any purchaser could be pressured to divest from crypto and digital banking providers, based on a Reuters report.

That warning has confirmed to be true, as said by the FDIC in its press launch:

“Depositors of Signature Bridge Financial institution, N.A., aside from depositors associated to the digital banking enterprise, will mechanically turn out to be depositors of the assuming establishment.”

The FDIC added that every one deposits assumed by Signature’s new house owners will proceed to be insured by the FDIC as much as the insurance coverage restrict, including that:

“Flagstar Financial institution’s bid didn’t embrace roughly $4 billion of deposits associated to the previous Signature Financial institution’s digital banking enterprise.”

The $4 billion deposits not lined by Flagstar Financial institution’s bid might be supplied by the FDIC “on to clients whose accounts are related to the digital banking enterprise.”

In line with public filings, Flagstar is owned and operated by the New York-based Group Bancorp, Inc. — which fits again to 1851 — established in Vermont as a growth-orientated financial institution that’s now one of many largest regional banks within the nation, with 395 places.