Be part of Our Telegram channel to remain updated on breaking information protection

- What The US’ Federal Open Market Committee conferences counsel a gentle recession to come back

- Why Inflation stays effectively above the Fed’s 2% goal whereas the labor market continues to be tight

- What subsequent Committee to keep up a restrictive stance for financial coverage, guided by a data-dependent strategy

In its minutes doc launched on July 5, the Federal Reserve Open Market Committee (FOMC) reaffirmed its dedication to preserving the federal funds price between 5% and 5.25% within the close to future. All members of the Fed expressed a robust dedication to bringing inflation again right down to 2%. Nevertheless, they anticipate a “delicate recession” someday within the 12 months, which might be proceeded by a “reasonably paced restoration.” Amidst the event, Bitcoin worth stays secure, holding above $30,500.

After a streak of ten consecutive price hikes over 15 months, the Federal Reserve determined to pause its rate-hiking program in June. This marked the primary month with none price modifications.

Federal Reserve’s Financial Coverage Outlook and Projected Curiosity Price Hikes

The Fed considers varied elements, such because the impression of financial coverage on financial exercise and inflation. These concerns are available play when deciding whether or not to decrease rates of interest. As a part of its discount efforts, they plan to promote company debt, Treasury securities, and company mortgage-backed securities, in response to the Federal Open Market Committee (FOMC).

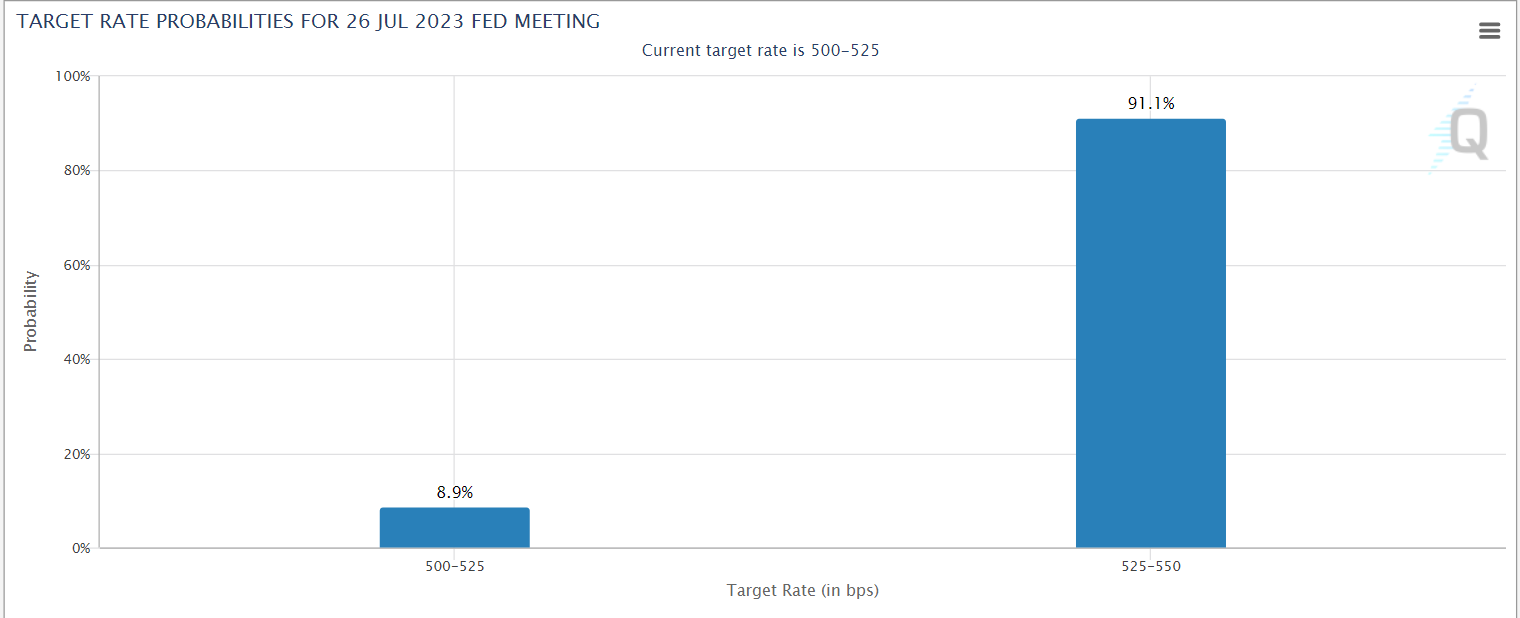

The CME FedWatch Instrument at present predicts a 91.1%% likelihood of a quarter-point price hike in July, about 21 days earlier than the following assembly. This chance has steadily elevated, notably previously week. This means a goal price enhance to five.25%-5.50% on the subsequent assembly. Consequently, the worth of Bitcoin, which has been performing effectively not too long ago, could also be influenced.

FOMC Assembly Suggests Uncertainty In Future Price Hikes and Gentle Recession

The Fed’s revised Abstract of Financial Projections signifies a key perception. The median projection of FOMC members expects the federal funds price to achieve 5.6% by the top of this 12 months. It represents a major enhance from the 5.1% projected in March. This factors to the potential of two further quarter-point price hikes within the remaining 4 classes of 2023.

The Federal Reserve assembly individuals agreed that the financial outlook and inflation ranges are unsure. Whereas they anticipate a average and non permanent financial downturn, Fed employees nonetheless predicts a recession within the US later this 12 months.

Nevertheless, Fed Chair Jerome Powell stays assured in reaching a “gentle touchdown.” He envisions a conditions the place inflation decreases with out triggering a extreme financial droop.

Additionally Learn:

Wall Road Memes – Subsequent Large Crypto

- Early Entry Presale Dwell Now

- Established Group of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Finest Crypto to Purchase Now In Meme Coin Sector

- Workforce Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection