Within the aftermath of the FTX fallout, Bitcoin noticed its worth drop to a two-year low of $15,000, the trade’s native token is on its option to turning into basically nugatory, and stablecoins throughout the market have been struggling to maintain their peg.

Nevertheless, the autumn of Sam Bankman-Fried’s empire is much from over. The contagion and second-order results are but to be felt and will push the market deeper into the crimson.

However, what brought about the fallout that might set the crypto trade a number of years again?

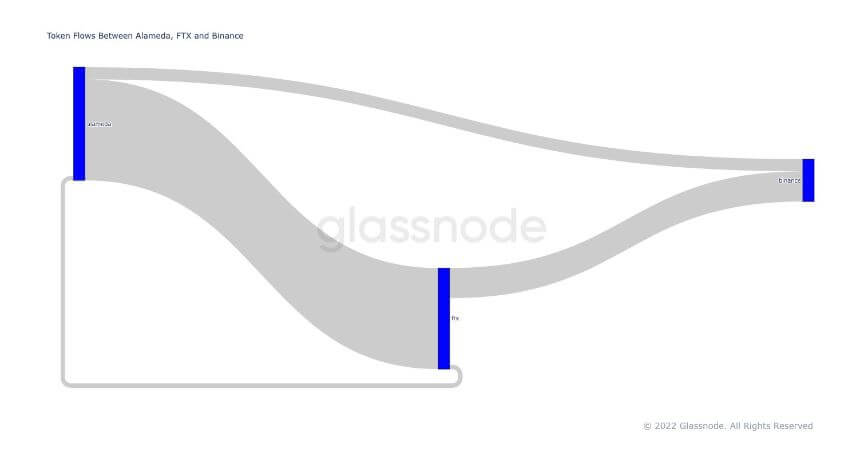

CryptoSlate’s in-depth evaluation of on-chain knowledge reveals the connection between FTX and Alameda and the way the 2 firms siphoned cash off of one another utilizing Binance as an unsuspecting middleman.

Alameda and FTX — two sides of the identical coin

To know the scope of Alameda’s ties to FTX we should dig deep into each firms’ token flows.

As the vast majority of their holdings lay in numerous stablecoins and altcoins, emitting Bitcoin (BTC) and Ethereum (ETH) from the information paints a a lot clearer image as to how the 2 transacted.

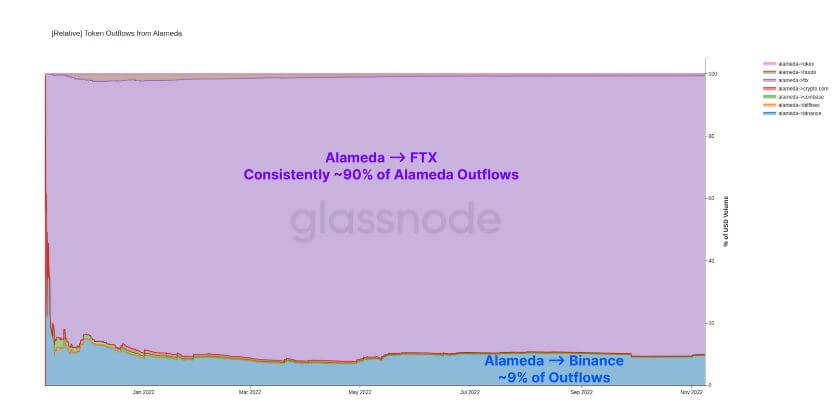

Information analyzed by CryptoSlate confirmed that, prior to now yr, over 90% of tokens from wallets related to Alameda ended up at FTX. Round 9% of all outflows from Alameda ended up at Binance.

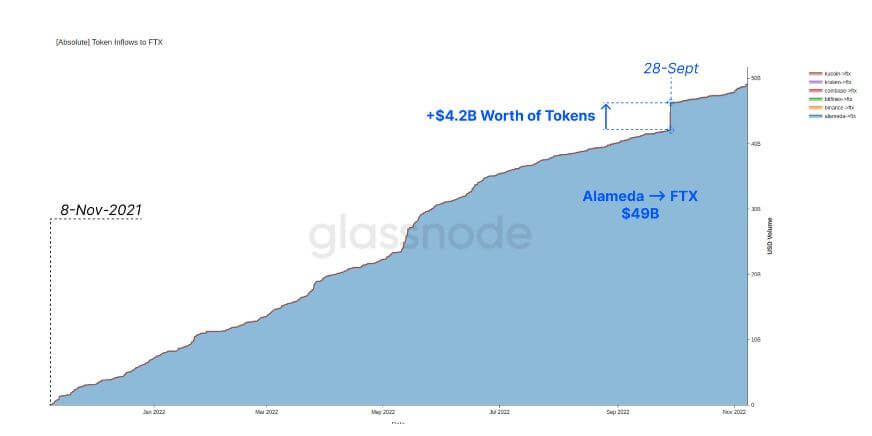

Taking a look at inflows to FTX reveals the scope of Alameda’s domination. Within the interval between November 2021 and November 2022, $49 billion price of varied tokens have been transferred from Alameda to FTX. The inflows have been rising month on month and noticed a vertical soar on the finish of September 2022 when over $4.2 billion price of tokens have been despatched to FTX.

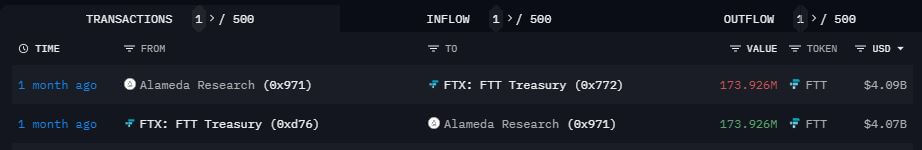

Arkham Intelligence, a cryptocurrency evaluation agency, confirmed the influx in its personal studies. The corporate’s scanner reveals an influx of round $4 billion price of FTT into the trade.

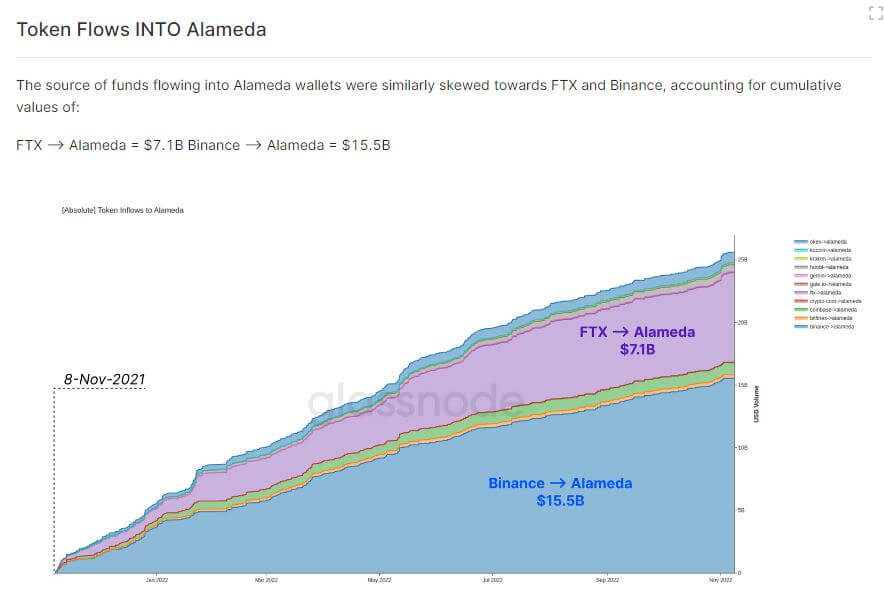

And whereas a lot of the cash going out of Alameda ended up at FTX, it seems to be like the vast majority of the cash that went again into the buying and selling agency got here from Binance. Since final November, round $25 billion price of varied altcoins and stablecoins went into Alameda. Out of the $25 billion, $7.1 billion got here from FTX wallets, whereas over $15.5 billion got here from Binance wallets.

The inflows from Binance and FTX dwarf inflows from different exchanges, as proven within the graph under.

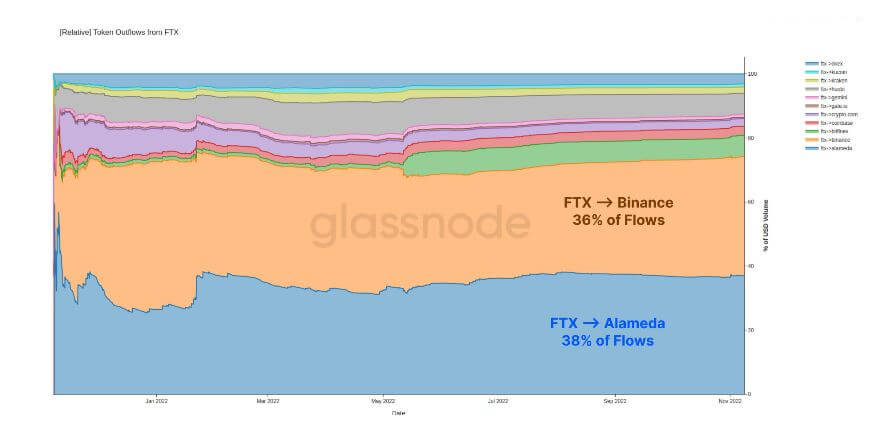

The trifecta of Alameda, FTX, and Binance is additional evident when outflows from FTX. Since final November, the trade noticed an virtually equal cut up of outflows between Binance and Alameda. Glassnode knowledge analyzed by CryptoSlate confirmed that round 38% of token outflows from FTX went to Alameda, whereas 36% went to Binance wallets. Solely 26% of the funds exiting FTX went to wallets related to different firms and exchanges.

Fingers pointed on the intermediary

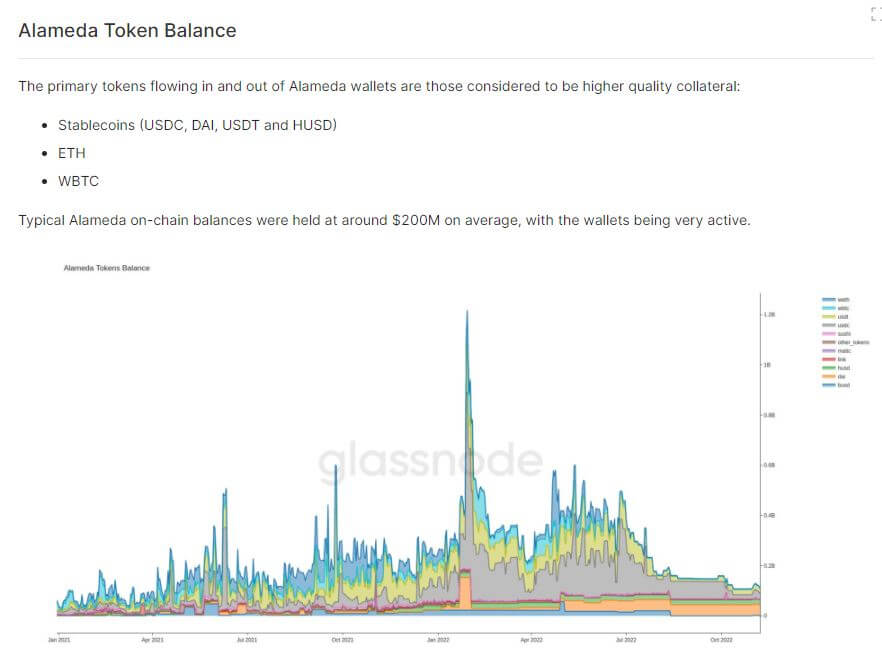

A deep have a look at wallets related to Alameda reveals that the corporate stored a wholesome stability of a basket of varied tokens all through 2021. On common, the corporate held about $200 million price of USDT, USDT, DAI, HUSD, ETH, and WBTC — all thought-about to be high-quality collateral.

The November bull run pushed Alameda’s balances by way of the roof, culminating in January 2022 at $1.2 billion.

Luna’s collapse in Could this yr brought about a large dent in Alameda’s balances. It took round two months earlier than the dent was proven, with the largest drop felt in August. The corporate hasn’t managed to get well since and has seen its balances drop frequently because it entered the fourth quarter.

It’s unclear what brought about the drop in Alameda’s balances. The trade has been ripe with rumors in regards to the firm panic promoting its reserves to cowl the losses it incurred after the Luna collapse.

Those who don’t consider this was panic promoting word that Alameda may have offered its reserves to return the funds again to FTX. The corporate’s present stability sheet issues additionally make promoting for revenue extremely unlikely.

Additional investigation into Alameda’s and FTX’s transactions is required to grasp the complete scope of the disaster they brought about. Nevertheless, the information analyzed to this point reveals an simple bond between Alameda and FTX. The 2 deepened their ties by way of Binance, which they could have used as an unsuspecting intermediary of their year-long escapade.