The most important information within the cryptoverse for Nov. 10 consists of SBF planning to lift funds to bailout FTX and make customers complete, SEC chairman Gary Gensler advocating for extra investor safety following FTX collapse, and Sequoia Capital writing off its over $200M funding in FTX as nugatory.

CryptoSlate High Tales

Leaked slack messages present SBF plan to lift funds for FTX bailout

Based on leaked slack messages reportedly despatched to FTX staff, Sam Bankman-Fried plans to lift extra funds to repay clients and traders affected by the collapse.

SBF added that FTX worldwide could merge with FTX US to extend its liquidity and fund operations.

Sequoia writes-off over $200M FTX funding as ‘nugatory’

VC agency Sequoia had earlier invested about $63.5 million into FTX and FTX US earlier than the crypto trade began struggling.

In mild of the FTX collapse, Sequoia knowledgeable its traders that it was writing off over $200 million as unhealthy debt to FTX.

SBF seeks to lift liquidity for FTX Worldwide; funds to go “straight to customers”

FTX’s CEO Sam Bankman-Fried (SBF) in a Nov. 10 tweet apologized for exceeding customers’ deposit margin which brought on the FTX collapse. Consequently, FTX had a better worth of belongings than consumer deposits.

SBF mentioned he was exploring all doable choices to lift funds and liquidate present collateral in order to refund customers affected by the collapse.

Crypto markets rocked as stablecoin reserves deplete, Curve 3pool concentrated by USDT, 60k BTC leaves Binance, Alameda shorts USDT

Following stories that Binance pulled away from saving FTX as a consequence of an $8 billion gap in FTX’s steadiness sheet, Binance revealed its Proof of Belongings, which revealed that Binance held roughly $18.3 billion value of belongings in its reserve

Nevertheless, the FTX collapse is posing some liquidity points for stablecoins. The Curve 3pool turned unbalanced, because the USDT, DAI, and USDC balances adjusted to 84%, 8%, and eight% respectively. Rumors additionally emerged that FTX’s Alameda was trying to dump about $550,000 value of USDT.

With the rising concern, uncertainty, and doubt rocking the crypto market, some Bitcoin holders moved to withdraw about 60,000 BTC from exchanges, indicating a sentiment to dump their belongings to keep away from additional contagion.

SEC’s Gensler says extra investor safety is required after FTX fiasco

The securities and trade fee (SEC) Chairman Gary Gensler instructed CNBC that he had warned crypto exchanges together with Sam Bankman’s FTX that non-compliance with regulatory legal guidelines would undermine investor safety.

Gensler reiterated that the easiest way forward will probably be for crypto exchanges to be duly registered with the regulators, in order to guard traders and forestall market crises brought on by large gamers, who “co-mingle” to commerce in opposition to their clients.

Solana postpones token unlock amid double-dip fears, builders unaffected

By design, Solana was imagined to unlock about 18 million SOL tokens between Nov. 9 and Nov. 10. Nevertheless, because of the FTX ecosystem collapse, Solana has postponed the unlock date until Nov. 12, in order to scale back the sale stress on Solana’s struggling token (SOL).

Counterintuitively, the staking unlocks for Solana builders have been accomplished immediately, which noticed about 353,687 SOL tokens launched into the market.

Bitcoin spikes to $17,800 on higher than anticipated CPI information

The FTX collapse of Nov. 9, noticed Bitcoin fall to a 103-week low of about $15,600. Lower than 24 hours later, Bitcoin spiked by 7.5% to commerce at $17,800 in response to the discharge of October’s Shopper Value Index (CPI) information.

The market had anticipated a report of a few 7.9% rise in inflation, nonetheless, the October CPI information revealed that inflation sits at 7.7% year-on-year.

Kraken’s Jesse Powell says crypto neighborhood ought to ‘increase requirements’ to place finish to unhealthy actors

Kraken‘s founder Jessee Powell in response to the FTX collapse mentioned that the crypto neighborhood although open-minded and trusting ought to undertake strict requirements in verifying crypto initiatives earlier than selling them.

Powell known as on enterprise capital corporations to be strict with their due diligence course of earlier than backing any challenge and endorsing them to the general public.

The Kraken chair added that the U.S. regulators want to supply a transparent regulatory framework for crypto companies to function and supply their companies in a supervised method.

Analysis Spotlight

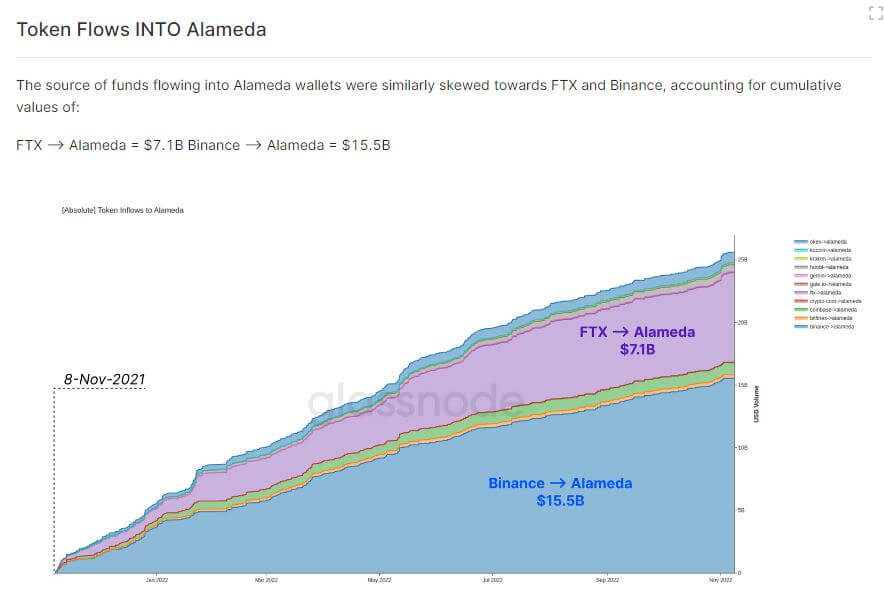

FTX, Alameda used Binance as middleman for his or her parasitic relationship

On-chain information analyzed by CryptoSlate revealed that between November 2021 and November 2022, Sam Bankman-Fried’s Alameda Analysis transferred about $49 billion value of tokens to FTX, with over $4.2 billion reportedly despatched in September 2022.

From the chart, Alameda reportedly acquired about $25 billion value of stablecoins and altcoins, with $7.1 billion coming from FTX and over $15.5 billion being despatched from Binance wallets.

According to the on-chain information, Binance performed the intermediary to facilitate fund transfers between Alameda and FTX, which brought on the 9/11 crypto market collapse.

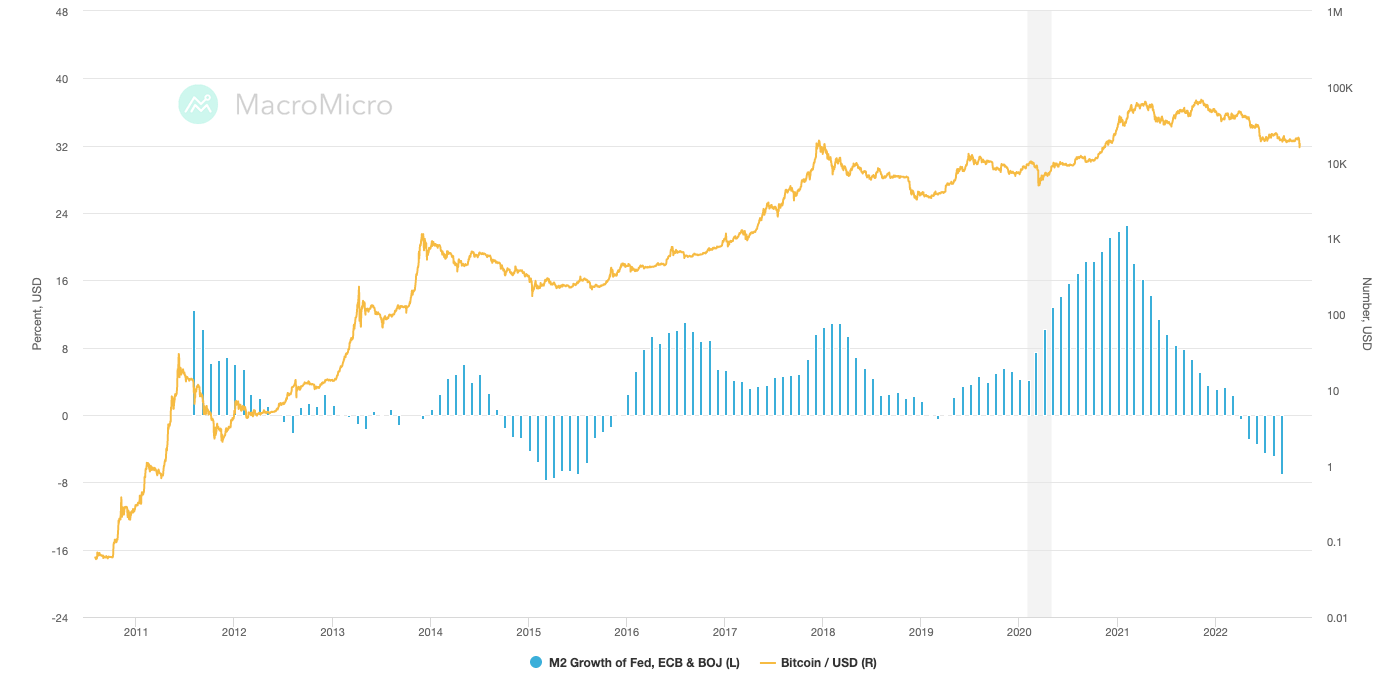

M2 cash provide might be a greater measure of inflation than CPI

Many Economists think about the M2 cash provide (which incorporates money and checking deposits, financial savings deposits, and cash market securities) as a greater measure of inflation than M1 which is used to trace the Shopper Value Index (CPI).

Based on the October CPI information, inflation sits at 8%, whereas the M2 determine stands above 25%. Many shoppers imagine that inflation could also be nearing the 25% mark set by M2.

As well as, the M2 determine is seeing a rising curiosity from Crypto Analysts because it tracks Bitcoin value efficiency.

From the chart, in the course of the durations of 2015, 2019, and 2022, the M2 determine noticed a decline, which coincided with a fall in Bitcoin value. Consequently, the worldwide M2 is turning into a metric that performs a key function in figuring out Bitcoin’s value motion.

Information from the Cryptoverse

Tron to help FTX

FTX has introduced that it’s working with Tron to permit TRX, BTT, JST, SUN, and HT token holders to swap their belongings 1:1 to exterior wallets.

For the primary installment, about $13,000,000 value of belongings will probably be accessible for withdrawal with plans to deploy extra belongings within the coming weeks.

Iranian corporations commerce about $8 billion through Binance

Reuters reported that main crypto trade Binance allegedly facilitated transitions value $7.8 billion from Iranian corporations that have been sanctioned by the U.S. authorities.

The funds flowed between Binance and Iran’s largest crypto trade, Nobitex, utilizing Tron cryptocurrency to cancel their on-chain id.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by over 4% to commerce at $17,476, whereas Ethereum (ETH) surged by 9% to commerce at $1,297.