Failed crypto change FTX disclosed the names of assorted shareholders and buyers in a current chapter courtroom submitting dated Jan. 9.

VC corporations led funding rounds

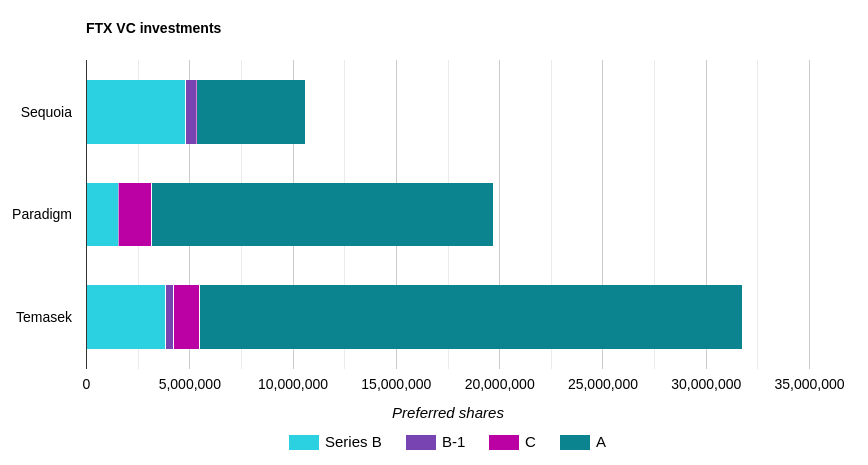

FTX carried out 4 rounds of fundraising between July 2021 and January 2022, labeled Sequence B, Sequence B-1, Sequence C, and Sequence A.

These fundraising rounds have been largely led by VC corporations recognized for his or her involvement within the crypto trade, together with Sequoia and Paradigm, in line with evaluation by CNBC.

Sequoia Capital made two giant investments in sequence B and sequence A, by which it obtained 4.8 million most well-liked shares and 5.3 million shares, respectively. It additionally gained simply over 572,000 shares in Sequence B-1. Regardless of acquiring comparatively few shares total, it was the biggest investor in Sequence B and was liable for 16% of that spherical.

Paradigm made its largest funding in Sequence A and obtained 16.5 million shares. Nevertheless, it solely led Sequence C, the place it obtained simply 1.6 million shares however was liable for 20% of all funding. It additionally obtained 1.5 million shares in sequence B.

Temasek — a Singapore state-owned funding firm that not too long ago moved into crypto VC funding — led FTX’s bold sequence A funding spherical. Temasek obtained 26.3 million shares and accounted for 16% of that funding spherical. It additionally gained roughly 5.4 million extra shares within the different three funding rounds.

Crypto corporations and people invested in FTX

FTX’s shareholder submitting additionally disclosed plenty of different smaller investments of curiosity. Coinbase held 1.3 million most well-liked shares and 4 million widespread shares — a notable funding, as the 2 exchanges have been direct rivals.

Varied different crypto-adjacent entities invested in FTX as nicely. Huobi or certainly one of its executives, held 247,700 widespread shares. The Japanese crypto financial institution Softbank, the Bitcoin ETF applicant Van Eck, and the funding corporations Multicoin Capital and CoinFund held combos of most well-liked shares and customary shares.

FTX’s submitting revealed ties to the billionaire hedge fund supervisor and crypto advocate Paul Tudor Jones. Although household trusts, Jones owned 476,918 most well-liked shares, making him the fifteenth largest investor in FTX’s Sequence B funding spherical.

Different particular person buyers of observe embrace superstar trainers Denise and Katie Austin, “Shark Tank” host Kevin O’Leary (by O’Leary Productions), and New England Patriots proprietor Robert Kraft (by KPC Enterprise Capital).

Kraft is probably probably the most noteworthy of these names attributable to FTX’s earlier connections to the New England Patriots. In June 2021, the change struck a deal with group quarterback Tom Brady. Brady had 1.1 million widespread shares, in line with the shareholder submitting. His ex-wife, supermodel Gisele Bündchen, had 686,761 shares. Kraft had 155,144 most well-liked shares plus 479,000 widespread shares.

Sure FTX associates, together with former FTX CEO Sam Bankman-Fried and former Alameda Analysis CEO Caroline Ellison, have been additionally named within the shareholder submitting.

It must be famous that most of the above investments have been beforehand disclosed by these concerned. Nevertheless, the submitting supplies exact information on the matter and divulges whether or not buyers have been extremely — or solely barely — invested in FTX.