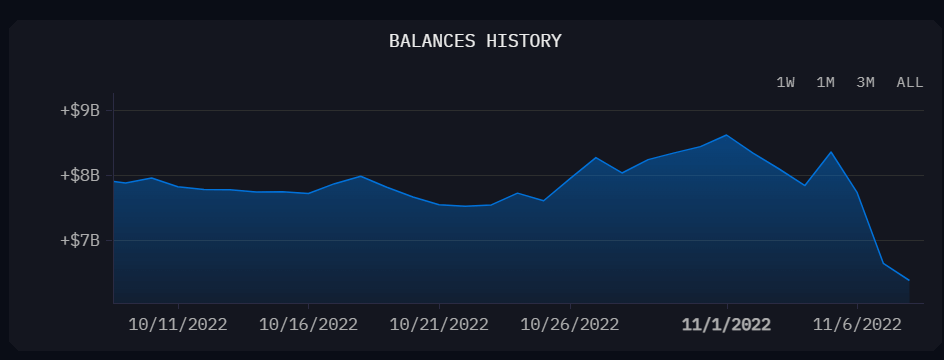

FTX treasury has misplaced over $3 billion because the begin of November, largely due to the implosion of its native token FTT and Solana (SOL) over the interval.

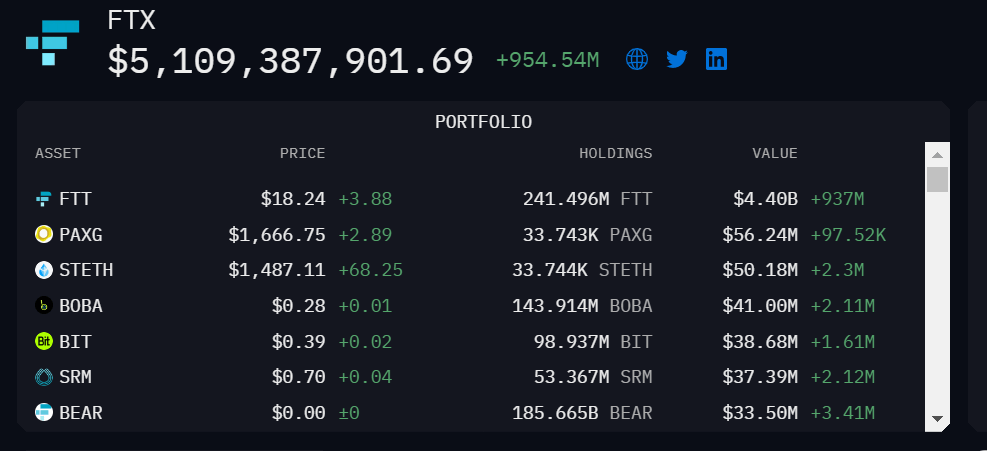

In response to CryptoSlate knowledge, FTT was buying and selling at over $26 on Nov. 1; nonetheless, the token skilled excessive volatility inside the final 24 hours, dropping 30% and pushing its worth to as little as $15.40.

Arkham Intelligence dashboard revealed that FT T accounted for round 90% of FTX’s $5.11 billion treasury holdings.

Reports revealed that Solana was the second-largest holding of Alameda (FTX’s sister firm). The buying and selling firm holds “$292 million of ‘unlocked SOL,’ $863 million of ‘locked SOL’ and $41 million of ‘SOL collateral.’

Whereas Solana began the month strongly, rising to $38 following Google Cloud’s announcement that it might be working as a validator for the community, the asset has skilled an enormous sell-off since Nov. 6, culminating in its worth dropping to a low of $26.15 on Nov. 8.

FTX experiencing huge withdrawals

The current FUD available in the market has led to huge withdrawals from FTX.

The trade has seen its Bitcoin (BTC) reserve plunge to lower than 10,000 BTCs after beginning the yr with over 80,000 BTC.

The trade Ethereum (ETH) reserve can also be down 99% within the final two days, in accordance with Santiment knowledge. The blockchain analytics firm reported that FTX’s ETH pockets was bleeding in some unspecified time in the future as a lot as 500 ETH per minute.

😮 In simply two days, the quantity of #Ethereum held in #FTX‘s principal pockets has dropped from 322k to 32k. At one level, the pockets was bleeding 500 $ETH per minute. With the continued feud between @SBF_FTX and @cz_binance, anticipate continued unpredictability. https://t.co/vILMoySIEu pic.twitter.com/ROQt7wxj0c

— Santiment (@santimentfeed) November 7, 2022

Binance treasury rising

Alternatively, Binance’s treasury has been rising because the month’s starting and at the moment stands at $43 billion versus $41 billion on the finish of October.

A senior analyst at Arcane Analysis, Vetle Lunde, revealed that Binance’s spot quantity dominance has risen from 50-60% to 80-90% of the market after its price removing coverage. Lunde continued that Binance accounted for 40% of perpetual futures open curiosity within the high two digital belongings.

Binance actually pushing to safe its dominance.

Binance’s spot quantity dominance has risen from 50-60% to 80-90% of the market after price removing.

Moreover, Binance accounts for 40% of perp open curiosity (ETH + BTC).

FTX OI dom has fallen from 25% to 14%. From 2nd to 4th. pic.twitter.com/ivmeXBSAEm

— Vetle Lunde (@VetleLunde) November 8, 2022

In the meantime, FTX’s open curiosity domination has fallen from 25% to 14%. Lunde mentioned:

“FTX will for positive have a tough time rebuilding its popularity… this ordeal might have a long-lasting influence on FTX’s relevancy in crypto derivatives.”

FTX is okay: Sam Bankman-Fried

FTX founder Sam Bankman-Fried tweeted that the trade is okay and has sufficient to course of all withdrawals. He added that FTX has greater than $1 billion in extra money.

The trade additionally confirmed that it had processed billions of transactions previously few days, including that it has “one of many highest income/revenue/valuations per worker of any firm on this planet.”