The largest information within the cryptoverse for Nov. 7 contains Bitcoin mining problem’s lower by 0.19%, Binance’s choice to liquidate all its FTT holdings, and FTX CEO Sam Bankman-Fried’s assurance that the trade just isn’t going bankrupt.

CryptoSlate High Tales

Bitcoin mining problem barely adjusts downward by 0.19% as miner stress continues

Bitcoin’s (BTC) mining problem was adjusted on Nov. 7 and recorded a small 0.19% drop.

The latest adjustment earlier than this was on October 24, when the mining problem recorded a brand new all-time excessive, reaching 36.84 trillion. The 0.19% drop retreated it again to 36.76 trillion.

Fears of Terra Luna type collapse of FTX native token FTT as Binance liquidates its holdings

Binance’s CEO Changpeng Zhao (CZ) Tweeted on Nov. 6 and mentioned that Binance would liquidate all FTX native tokens (FTT) it held due to “revelations that got here to gentle.” Binance had over $500 million in FTT tokens on the time of CZ’s Tweet.

This kindled the discussions of FTX’s potential collapse and dropped the FTT token down by 9.4% in sooner or later.

SBF says ‘FTX is ok. Belongings are fantastic’ with over $1B in extra money amid rumors of liquidity crunch

FTX‘s CEO, Sam Bankman-Fried (SBF), observed Binance’s choice to liquidate its FTT reserves and revealed a thread to deal with considerations relating to FTX’s chapter.

1) A competitor is making an attempt to go after us with false rumors.

FTX is ok. Belongings are fantastic.

Particulars:

— SBF (@SBF_FTX) November 7, 2022

SBF ensured the neighborhood by saying that FTX “has sufficient to cowl all shopper holdings” and known as out to Binance’s CZ to work collectively for the ecosystem.

Over 50K BTC from Silk Street value formally seized by DOJ after 10 yr investigation

The U.S. Division of Justice formally seized 50,676 Bitcoin in reference to the 2012 Silk Street fraud. The quantity equates to roughly $1.05 billion at the moment.

The prosecutors mentioned that the Bitcoins had been discovered hidden in units belonging to Silk Street attacker James Zhong, who has been taken into custody after his trial on Nov. 4.

Might Bitcoin miner promote stress point out additional upside potential?

Bitcoin miners have been promoting their belongings since early 2022, and on-chain information reveals that the sell-out charge is accelerating.

Whereas this normally implies that the market is underperforming, Bitcoin historical past proves it has additionally been a precursor to the upwards motion in worth ranges.

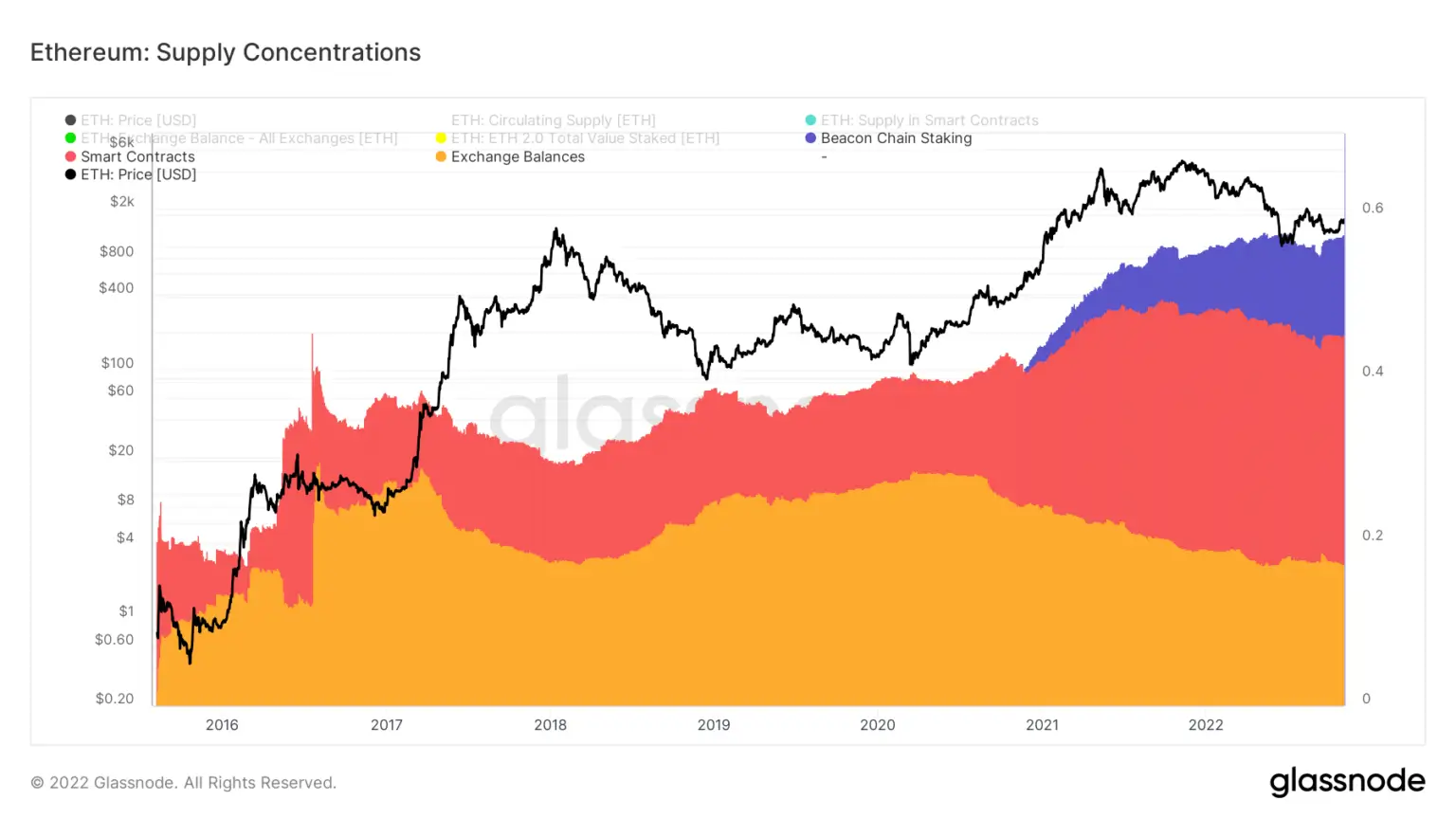

Ethereum provide focus in sensible contracts hits all time excessive

The quantity of Ethereum (ETH) provide concentrated in sensible contracts reached an all-time excessive.

Sensible contracts include 0.45% of all Ethereum behind staked Ethereum at 0.57% and trade balances at 0.17%. The provision focus on exchanges has been declining since mid-2020, whereas sensible contracts and staked ethereum has been rising since late 2020.

FTX stablecoin reserves plunge as neighborhood fears bankrun

Binance’s choice to liquidate its FTT belongings additionally influenced the remainder of the neighborhood. Whereas crypto influencers urged the neighborhood to exit FTX, crypto trade platforms like Bounce Crypto and Nexo additionally drained most of their belongings out of FTX during the last 24 hours.

Hoskinson’s Twitter proposal for Cardano-Dogecoin tie-in snubbed by Reddit mods

Cardano (ADA) founder Charles Hoskinson shared a video on Nov. 6 and supplied to construct a decentralized Twitter that operates with Dogecoin (DOGE) and Cardano.

Dogecoin Reddit moderators eliminated Hoskinson’s proposal video from their subreddit on Nov. 7, whereas the neighborhood blamed Hoskinson for “making an attempt to trip on Doge’s wave.”

SBF reveals he donated to Republicans & Democrats as lobbying by crypto companies continues forward of the midterms

FTX’s CEO SBF Tweeted on Nov. 5 to disclose that he helps bipartisan politicians who assist permissionless finance.

1) I used to be a big donor in each D and R primaries.

Supporting constructive candidates throughout the aisle to stop pandemics and convey a bipartisan local weather to DC.

And dealing with them to assist permissionless finance.

— SBF (@SBF_FTX) November 5, 2022

FTX just isn’t the one crypto firm that helps politicians with a pro-crypto discourse. Nevertheless, SBF looks as if he’s additionally supporting politicians personally and the FTX treasury.

Robust Polygon rally outperforms Bitcoin, different giant caps

In accordance with CryptoSlate information, Polygon (MATIC) has outperformed Bitcoin since November 4. MATIC’s present worth marks at $0.00006085 mark its all-time excessive of 77 weeks towards Bitcoin.

CryptoSlate, Crypto Briefing onboard Entry Protocol Ecosystem to leverage Web3 Paywall

CryptoSlate and CryptoBriefing grew to become the most recent individuals to affix Entry Protocol Web3 Paywall. The 2 information retailers have over 1,5 million mixed month-to-month customers and might profit from Entry Protocol’s content material paywall system.

FTX’s FTT dangers drastic fall as tokens flood exchanges

Because of the exits from the FTX trade, round 50 million FTT tokens had been transferred to different exchanges inside 24 hours. Since 90% of FTX’s treasury is in. FTT, this site visitors brings the token so near the verge of a drastic fall.

Successful lottery 9x in a row simpler than breaching Bitcoin’s safety

In accordance with reviews, successful Lotto Powerball 9 instances in a row is simpler than breaching Bitcoin’s safety. Due to this fact, by investing in Bitcoin, traders can get pleasure from the next probability of securing their funds to make extra wealth.

Analysis Spotlight

Analysis: Bitcoin choices merchants anticipate worth to hit $30,000 in This autumn

CyrptoSlate analysts revealed that the Implied Volatility and Open Curiosity metrics point out choices merchants expect Bitcoin and Ethereum to spike within the fourth quarter.

Implied Volatility (IV) measures the market sentiment towards the chance of adjustments in an asset worth, and the Open Curiosity (OI) refers back to the whole variety of excellent derivatives contracts. Each metrics point out that bullish situations may be brewing within the fourth quarter.

Analysis: A contemporary tackle Bitcoin mining – Why utilizing extra power can result in abundance

The excessive power consumption of Bitcoin mining has been a main concern for a lot of within the crypto neighborhood. Despite the fact that Bitcoin’s share in world power consumption is at present solely at 0.45%, the general sentiment within the topic revolves across the thought of a disastrous future as a result of air pollution brought on by Bitcoin mining.

Nevertheless, when Bitcoin mining’s power requirement is in comparison with Gold’s, it’s evident that Gold causes extra environmental hassle.

Regardless of this, no authorities considers banning gold mining. CryptoSlate analysts checked out Bitcoin mining by means of the eyes of financial prosperity and GDP and revealed that it’s not an environmental catastrophe, as the present sentiment signifies. As a substitute, it might evolve into an business and produce a extremely expert workforce, report vital revenue will increase and enhance surrounding infrastructure.

Information from across the Cryptoverse

Hong Kong is seeking to legalize crypto ETFs

In accordance with Monetary Occasions, Hong Kong’s monetary watchdog is seeking to launch exchange-traded funds (ETFs) for retail traders. It is going to solely enable ETFs that originally put money into Bitcoin futures and will likely be expanded to different belongings within the following levels.

Society Move launches crypto funds characteristic

Society Move Integrated introduced that it inked a partnership cope with Canada-based crypto fee firm CoinSmart Monetary to start providing crypto fee options.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased by -1.83% to fall $20,814, whereas Ethereum (ETH) additionally fell by -0.64% to commerce at $1,600.