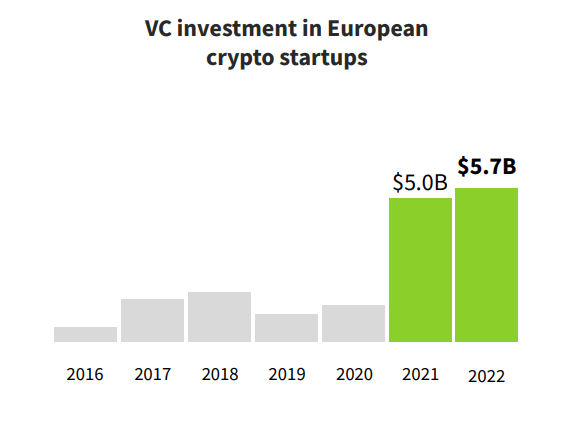

The crypto business in Europe defied the bearish traits of 2022 and noticed a file stage of funding. Startups within the crypto house raised over $5.7 billion in 2022 whereas international and U.S. enterprise funding within the business contracted. It is a notable enhance from the $5 billion E.U. firms raised in 2021.

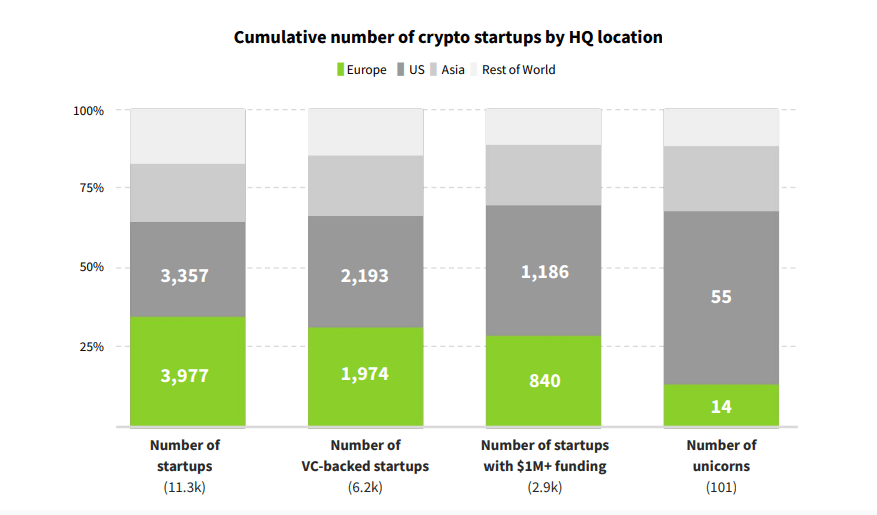

Based on information from RockawayX and Dealroom, Europe has the biggest variety of startups engaged on blockchain and crypto options — surpassing each the U.S. and Asia. The vast majority of them are early-stage, small-to-mid-sized firms with modest funding. Additional alongside the startup funding journey, the U.S. leads the way in which because it has the biggest variety of unicorns.

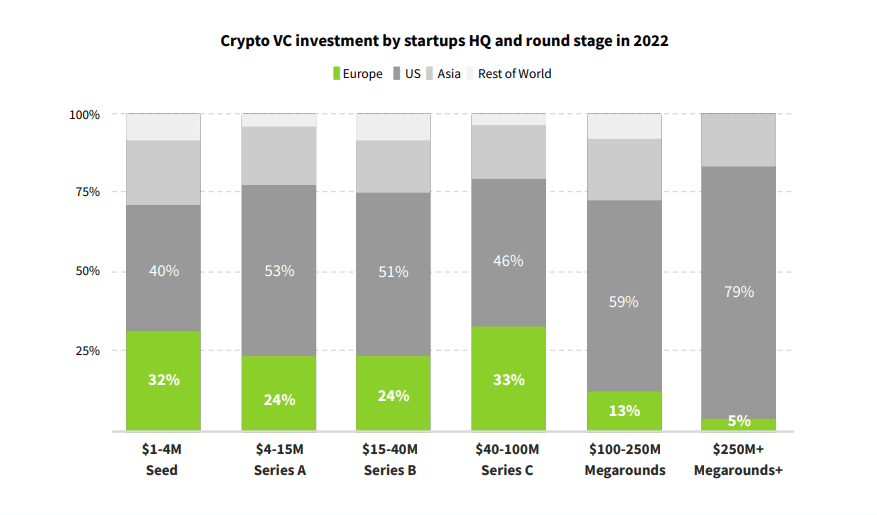

Whereas European firms accounted for 20% of the whole international early-stage crypto startup funding, U.S. firms dominated funding rounds exceeding $100 million.

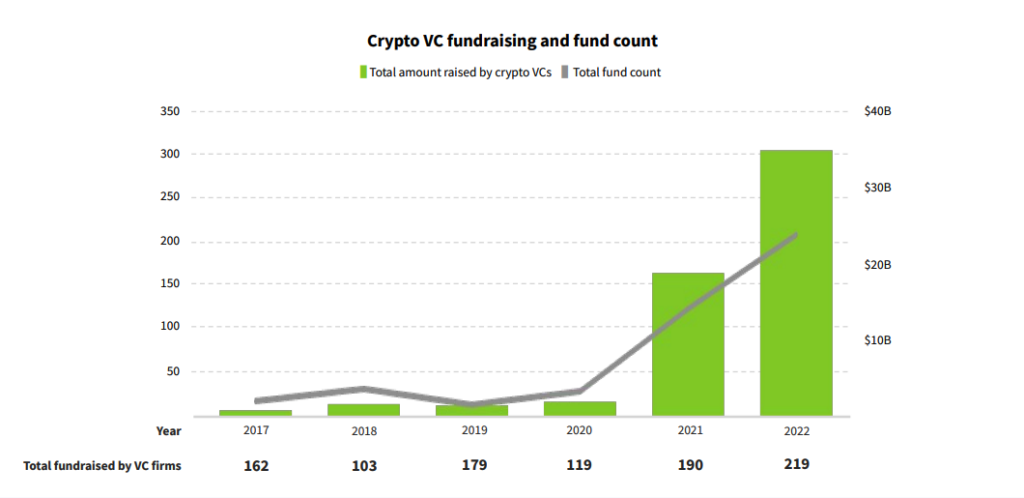

In 2022, crypto VC funds collectively raised over $35 billion, pushing crypto firms into the forefront of enterprise capital. Regardless of $35 billion accounting for under round 16% of the whole VC fundraising final 12 months, it nonetheless represents the best quantity ever raised within the business.

The continued bear market is but to scare buyers. Viktor Fischer, the CEO of RockawayX, stated that each market cycle — be it a bear one or a bull one — will increase VC exercise.

“Previously, VC funding remained comparatively steady, and even moved counter-cyclically, throughout crypto value downturns. Investments made when digital asset costs have been depressed materialized in tech and utilization traction alongside “bull market” value recoveries.”

Fischer famous that among the most notable firms within the crypto house at this time — together with Uniswap, OpenSea, Dapper Labs, and Sorare — have been funded and launched in the course of the 2018 crypto winter.

Samantha Bohbot, RockawayX’s chief development officer, stated that the largest distinction between investing in bull markets and investing in bear markets is the velocity of execution.

“As buyers, we see the slowdown change the way in which offers play out. The place fundraises have been as soon as quick — oversubscribed and frantically closed, typically in days after the method kicks off — raises usually stretch months now.”

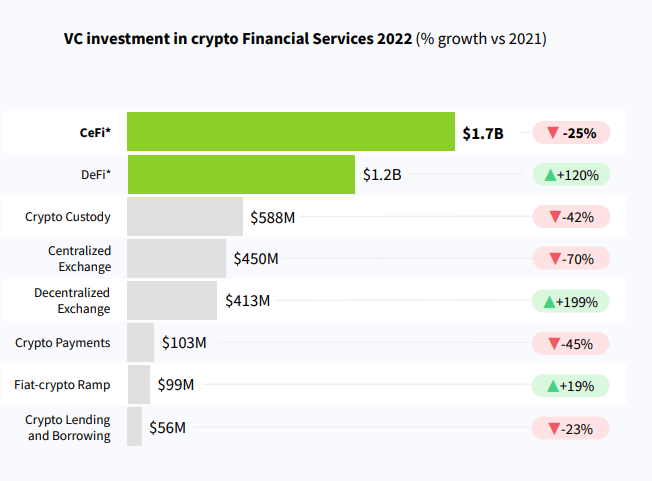

Whereas decentralized finance (DeFi) noticed a 120% enhance within the quantity raised, centralized finance (CeFi) nonetheless leads the way in which in relation to VC investments.