Definition

- Future’s open curiosity is the full funds (USD Worth) allotted in open futures contracts.

- Liquidations are the sum liquidated quantity (USD Worth) from lengthy and brief positions in futures contracts.

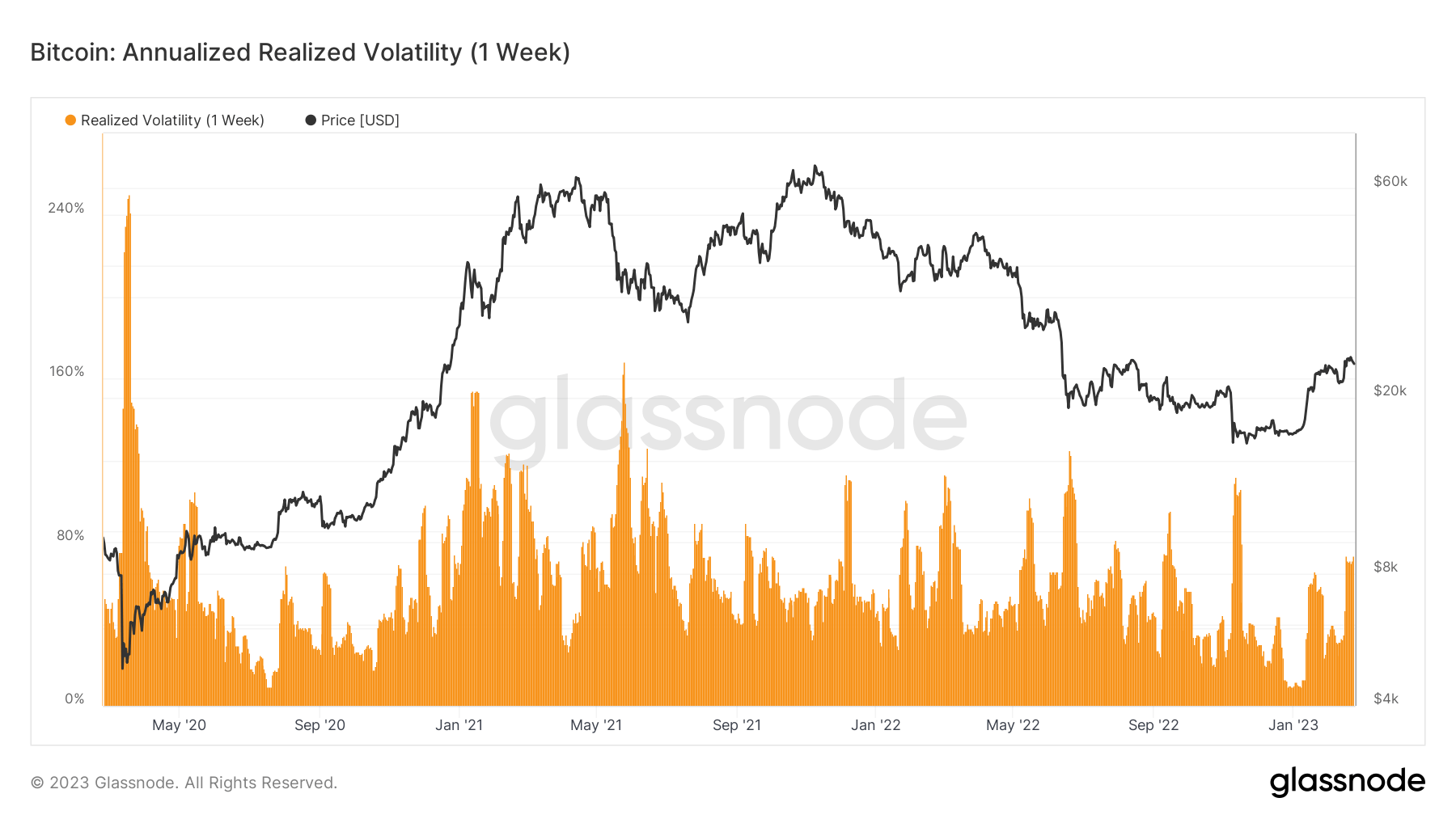

- Realized volatility is the usual deviation of returns from the imply return of a market. Excessive values in realized volatility point out a section of excessive threat in that market.

Fast Take

- Futures open curiosity exceeds 500k Bitcoin for the primary time in February, as buyers pile into futures contracts, a rise of over 20k BTC in February.

- Because of a rise in futures contracts has seen a rise in liquidations in February, primarily lengthy liquidations, as buyers proceed to pile into the constructive momentum of Bitcoin is up 50% YTD.

- As well as, the realized volatility has additionally picked up, including to Bitcoin worth volatility by over 70% vol the best degree because the collapse of FTX.

The publish Futures OI exceeds 500K Bitcoin – volatility, liquidations improve in consequence appeared first on CryptoSlate.