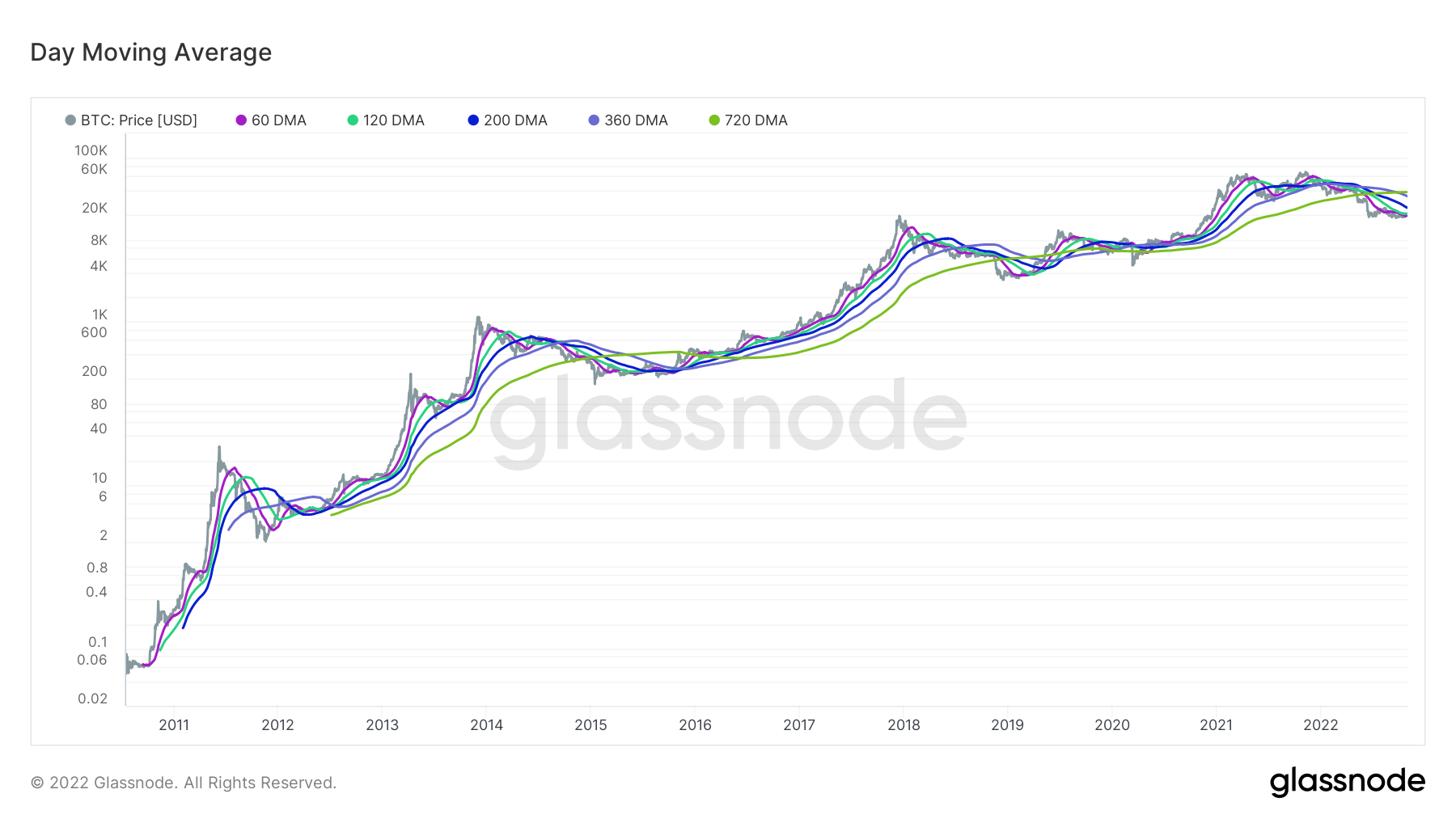

Final month, CryptoSlate reported that the value of Bitcoin fell beneath all 5 key medium to long-term shifting averages for less than the fifth time in its historical past.

Earlier cases of this occurring resulted in a robust rally for BTC, resulting in some technical analysts calling these occasions “a generational purchase alternative.”

Six weeks on from the unique put up, how is Bitcoin faring?

Bitcoin Transferring Averages

Transferring averages check with a technical evaluation indicator used to establish the development route of a specific crypto asset.

It’s calculated by summing all the value information factors throughout a particular interval, then dividing the sum by the variety of time durations. Any interval can be utilized. Nevertheless, 5 generally used durations for assessing medium to long-term tendencies are the 60-day, 120-day, 200-day, 360-day, and 720-day.

As the information is plotted utilizing previous information, shifting averages can’t be utilized in isolation as a buying and selling sign. Reasonably they’re usually used along with different indicators to kind an total evaluation of future tendencies.

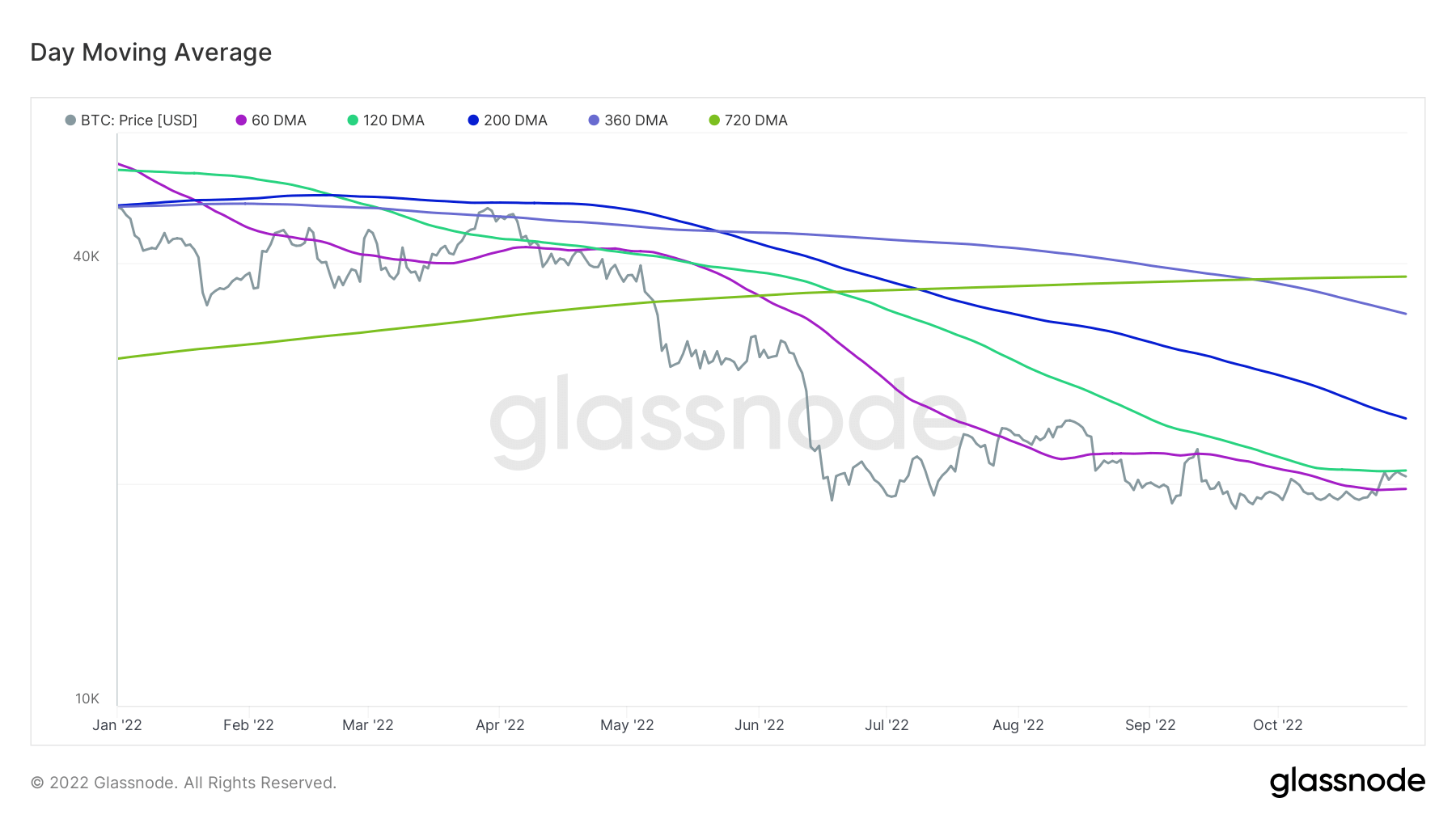

The chart beneath exhibits that Bitcoin remains to be beneath the important thing shifting averages aside from the 60-day MA, with BTC crossing above this era on October 25.

Regardless of a pointy sell-off at 14:00 (UTC) on October 31, BTC stays above the 60-day MA, and the “generational shopping for” uptrend stays intact.

Zooming in

Evaluation of the 5 key shifting averages on a year-to-date timeline exhibits Bitcoin above the 60-day MA at current.

What’s extra, since crossing above the 60-day MA, BTC has retested the 120-day MA on two events, being rejected each occasions. Bitcoin would want to construct on a every day shut above $20,900 to recapture this stage.

Final week’s rally to $21,000 introduced welcome reduction and a renewed sense of optimism. Nevertheless, Bitcoin’s failure to construct on this for the subsequent leg up has sentiment stuttering.

Mixed with the continued macro uncertainty, it stays to be seen if the current performs out as a generational shopping for alternative,