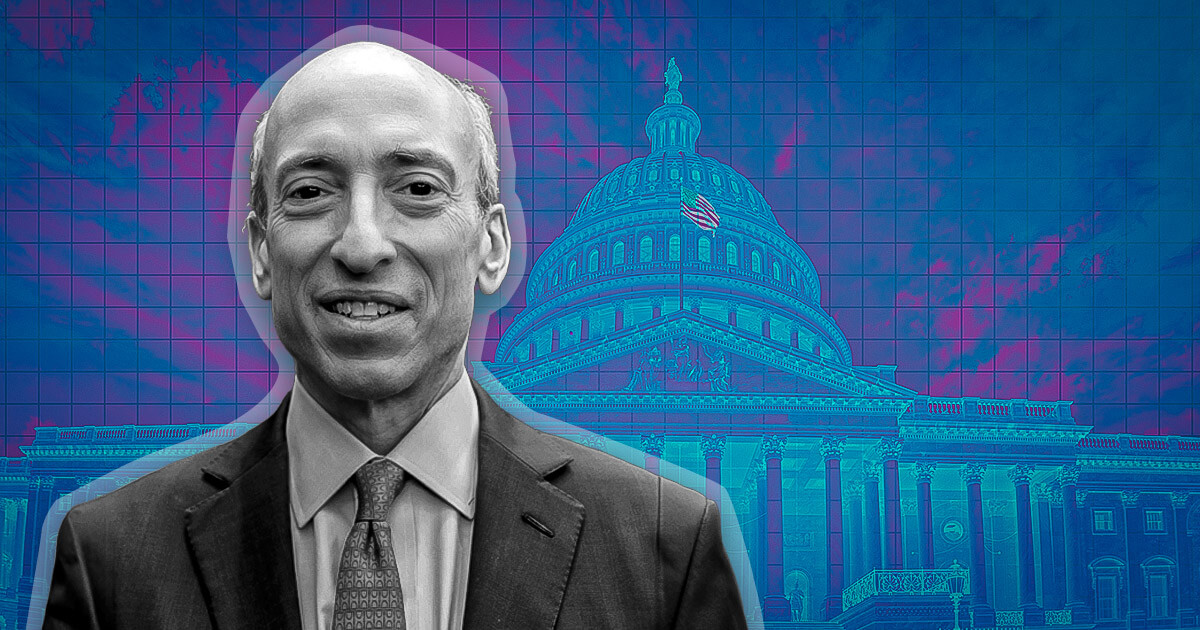

U.S. Securities and Change Fee (SEC) Chairman Gary Gensler defended the company’s file of regulation, enforcement, and its rulemaking authority throughout a contentious listening to earlier than the Senate Committee on Banking, Housing, and City Affairs this Tuesday, Sept. 12.

The listening to highlighted the strain between the SEC’s intensive rulemaking below Gensler’s tenure and those that consider it exceeds the SEC’s congressional mandate.

Gensler, disparagingly labeled an “unelected bureaucrat” by Sen. Steve Daines of Montana, was tasked with justifying the SEC’s method to cryptocurrency regulation and its broader rulemaking authority amidst quite a few criticisms. The chair replied the SEC has been appropriately following details and legal guidelines in its oversight of cryptocurrencies. This comes within the wake of a slew of enforcement actions towards the cryptocurrency area and its greatest individuals, together with Binance, Coinbase, and extra.

When queried a couple of current court docket determination that criticized the SEC for blocking a spot Bitcoin (BTC) exchange-traded fund, Gensler acknowledged that the company remains to be reviewing the ruling and a number of related filings.

Limits on authority

Gensler’s intensive rulemaking actions drew criticism from a number of Republicans who argued it exceeded the SEC’s congressional mandate and risked detrimental penalties for companies and traders. Nonetheless, Gensler stood agency, citing precedents in defending the scope of rulemaking and asserting it aligns with the actions of earlier chairs. He emphasised the company values enter from all forms of traders on proposed guidelines.

Sen. Elizabeth Warren (D-MA), criticized Gensler for not implementing stronger non-public fairness fund regulation rapidly sufficient. Gensler pointed to a not too long ago finalized rule requiring extra disclosures as a sign of progress.

Gensler’s stance on cryptocurrency regulation has persistently emphasised the necessity for larger oversight. Regardless of the presence of good religion actors throughout the business, he has persistently argued that the crypto setting is “rife with fraud” and lacks complete investor protections

He has repeatedly argued that the crypto area is “rife with fraud,” lacks complete protections for traders, and will be successfully regulated below present regulation. “I’ve been round finance for round 44 years now,” Gensler mentioned immediately in concerning the crypto business, “And I’ve by no means seen a area that’s so rife with misconduct… It’s daunting.”