Glassnode Particular Provide

Discover all of the reside charts lined on this report in Glassnode Studio.

⚡Particular supply⚡

For a restricted time, you possibly can save 40% on a month-to-month or yearly Glassnode Superior plan and entry the information and insights that are serving to 1000’s of crypto merchants and traders around the globe. Provide ends 29 November.

Introduction

The 2022 bear market has been an particularly brutal one, with digital asset costs experiencing persistent downtrends, rate of interest hikes tightening liquidity circumstances, and extreme credit score contagion taking maintain in crypto lending markets.

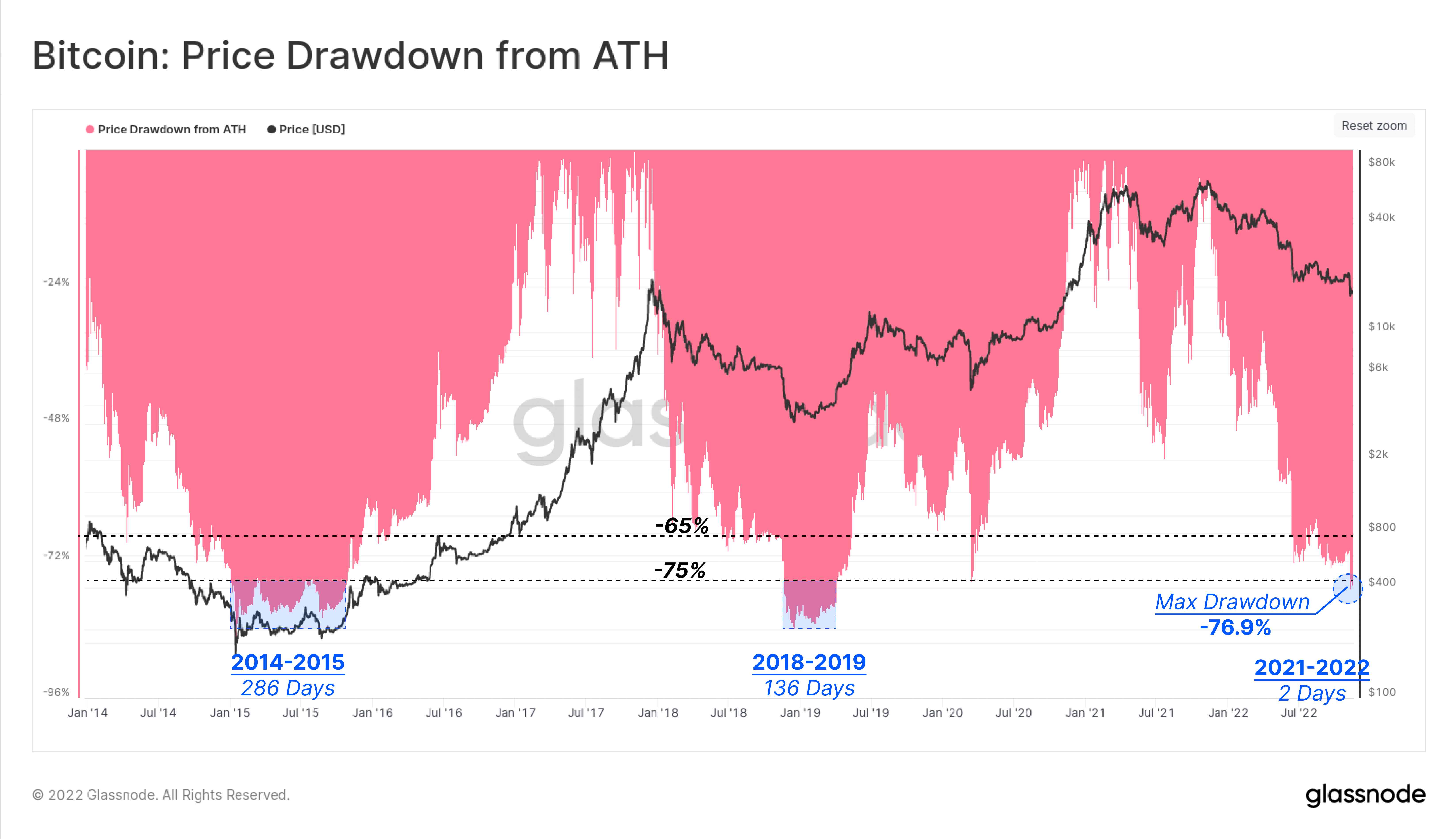

This week, the spot value of Bitcoin dropped to a multi-year low of $15,801 amidst the FTX collapse, with BTC now -76.9% beneath the cycle high set in November 2021. Earlier generational lows have recorded >75% market devaluations from the height, bringing this bear market in step with prior cycle drawdowns.

BTC drawdowns larger than 75% have persevered for a number of months in earlier cycles, suggesting length should still be forward if historical past rhymes.

Hashrate Gained’t Gradual Down

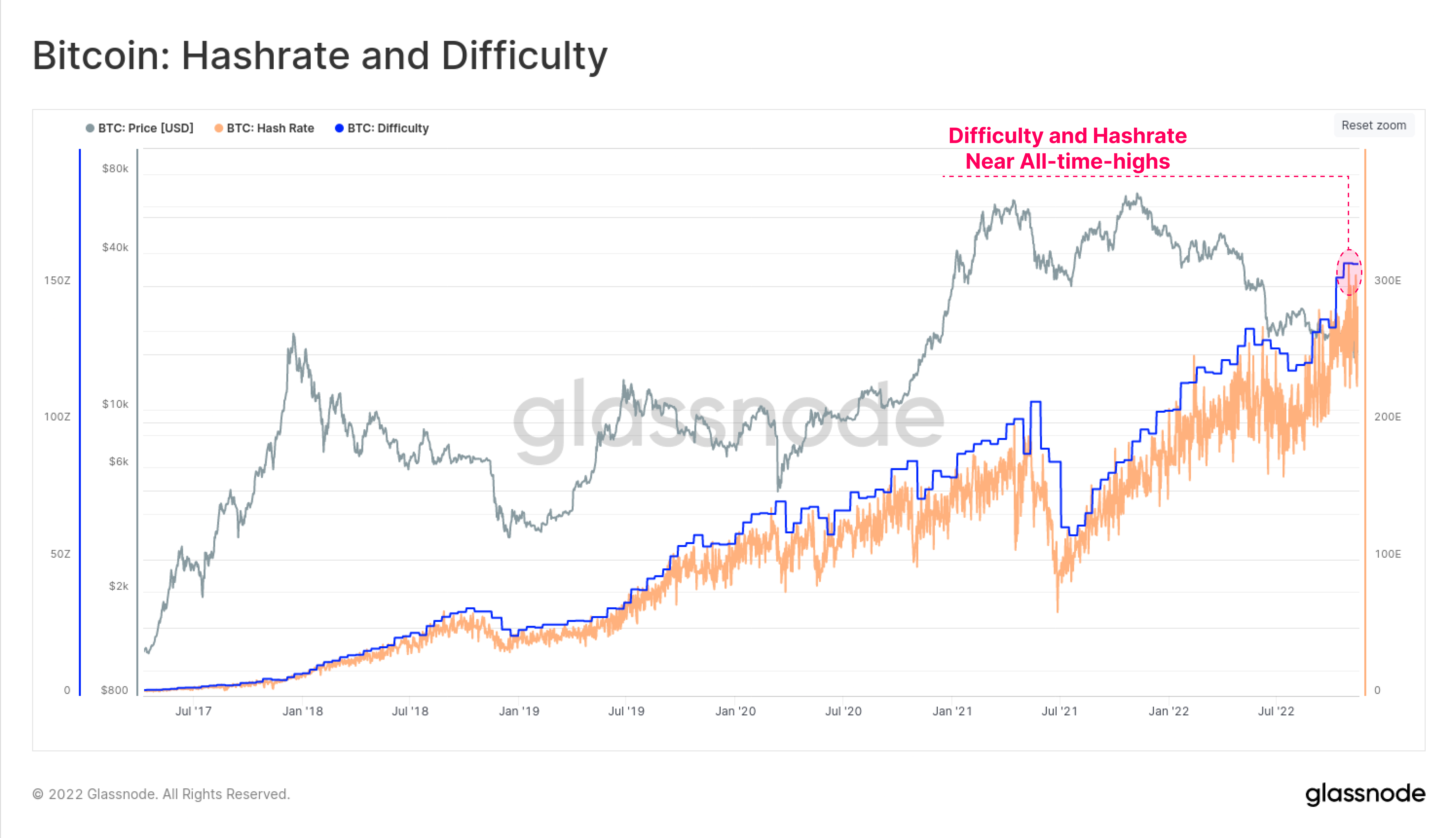

While bear markets could be powerful on traders, there may be one cohort who’re below an excessive quantity of monetary stress: Bitcoin miners. Not solely have coin costs declined, and credit score contracted, however mining enter power prices have additionally been on the rise because of inflation. Moreover, hashrate has relentlessly climbed to new all-time-highs in latest weeks.

Because of this Bitcoin is getting costlier to supply, and is concurrently being bought at depressed costs.

Bitcoin miners are being squeezed from all sides, and on this article, we’ll deal with the implied stress on the business. The objective is to evaluate market dangers which will come up in response to this strain on miners.

All through extended bear markets, it’s typical for the price of Bitcoin manufacturing to exceed the spot value. This squeezes miner revenue margins, and forces essentially the most inefficient miners to change off unprofitable tools. All miners should promote extra of the BTC they mine, and ultimately, could have to dip into their accrued treasuries.

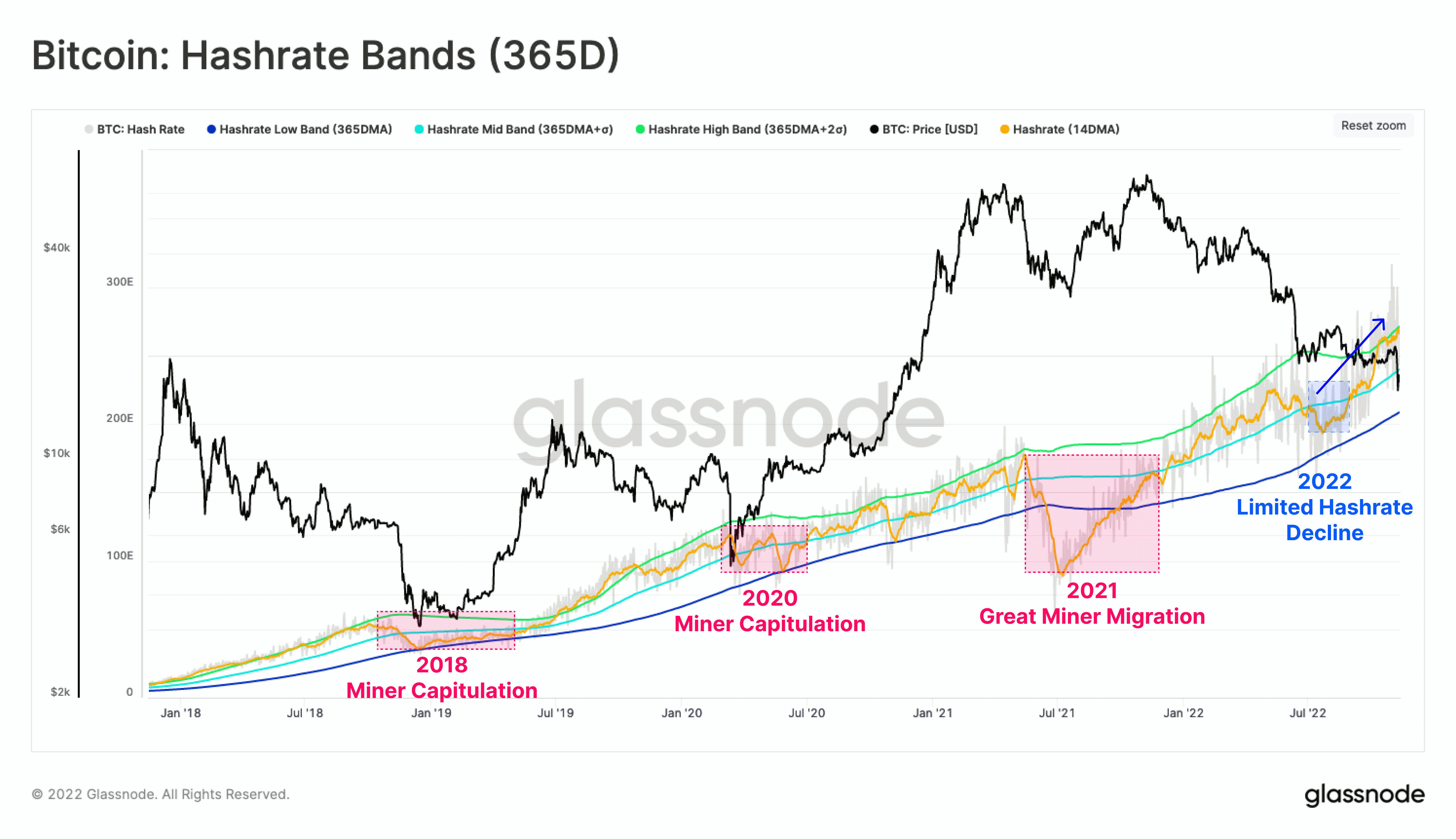

The next metric tracks this cyclical conduct, by defining two bands derived from hashrate:

- Decrease Band 🔵: 1yr transferring common of hashrate.

- Higher Band 🟢: 1yr transferring common of hashrate, plus two normal deviations.

Discover how hashrate oscillates between the Decrease and Higher bands over the long run.

One of many standout phenomena of the 2022 bear market is that Hashrate has not seen any vital decline in the direction of the decrease band, even with ongoing monetary stress on the business. We are able to additionally see the huge scale of the Nice Miner Migration in Might-July 2021, when roughly 52% of the hashpower in China was shutdown nearly over-night.

This regular hashrate progress noticed on this bear market is probably going a hangover from manufacturing and provide chain delays for subsequent era ASIC chips in 2021. These ASIC machines had been bought final 12 months, however have solely simply arrived, been put in, and turned operational, driving manufacturing prices greater on the lows of an already savage bear market.

Mining Will get Costly

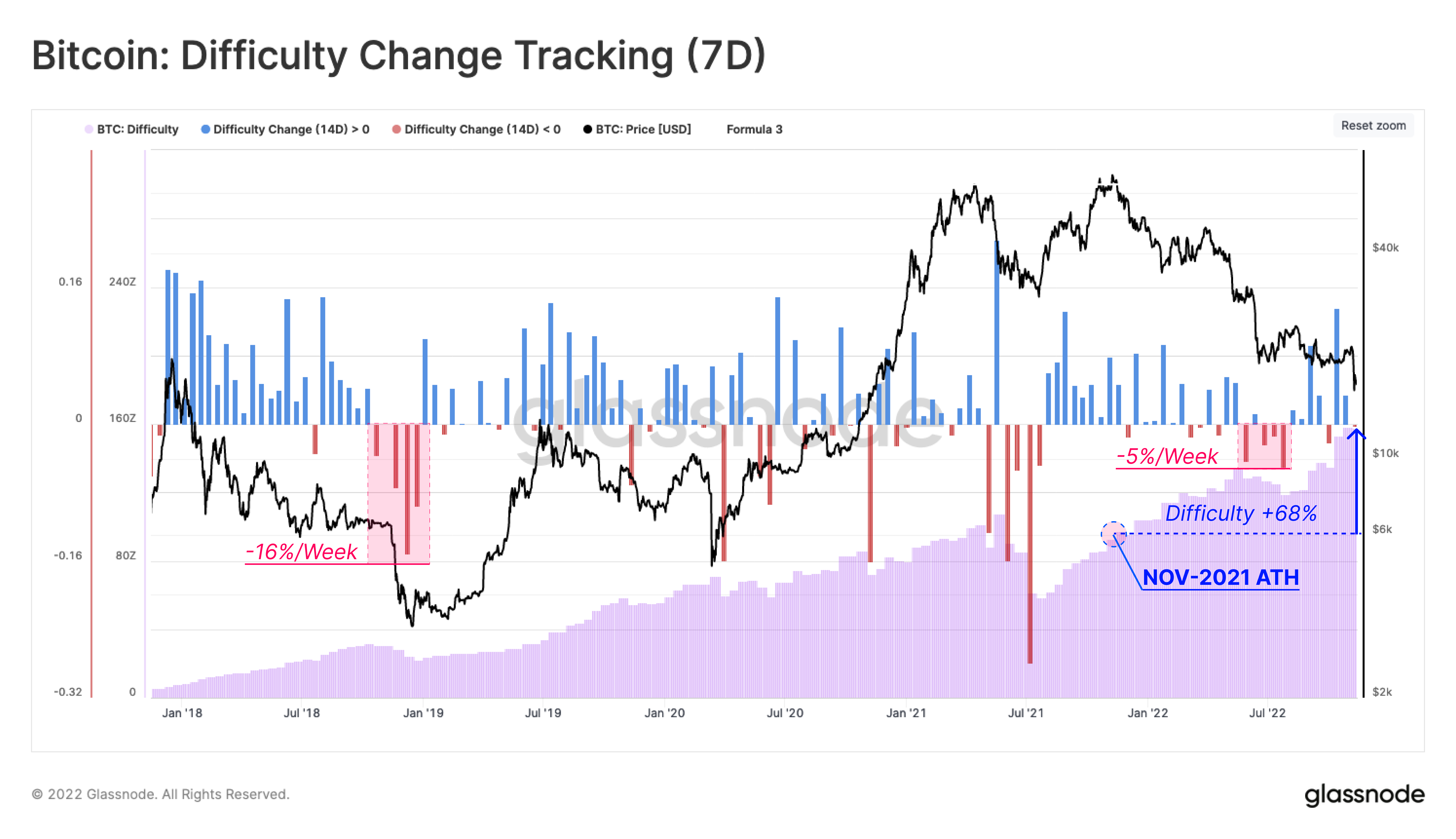

In the course of the backside formation section of the 2018-2019 cycle, we are able to see that problem skilled a number of massive declines of as much as -16% per week. This exhibits that miners had been going offline because of monetary pressure.

This sample has not repeated this cycle. In truth, after a brief interval of modest problem reductions throughout the LUNA capitulation, mining problem has been growing, reaching ranges +68% greater than the November 2021 ATH.

Because of this BTC denominated miner income has decreased 68% during the last 12 months, earlier than we even account for the -76.9% decline in BTC costs.

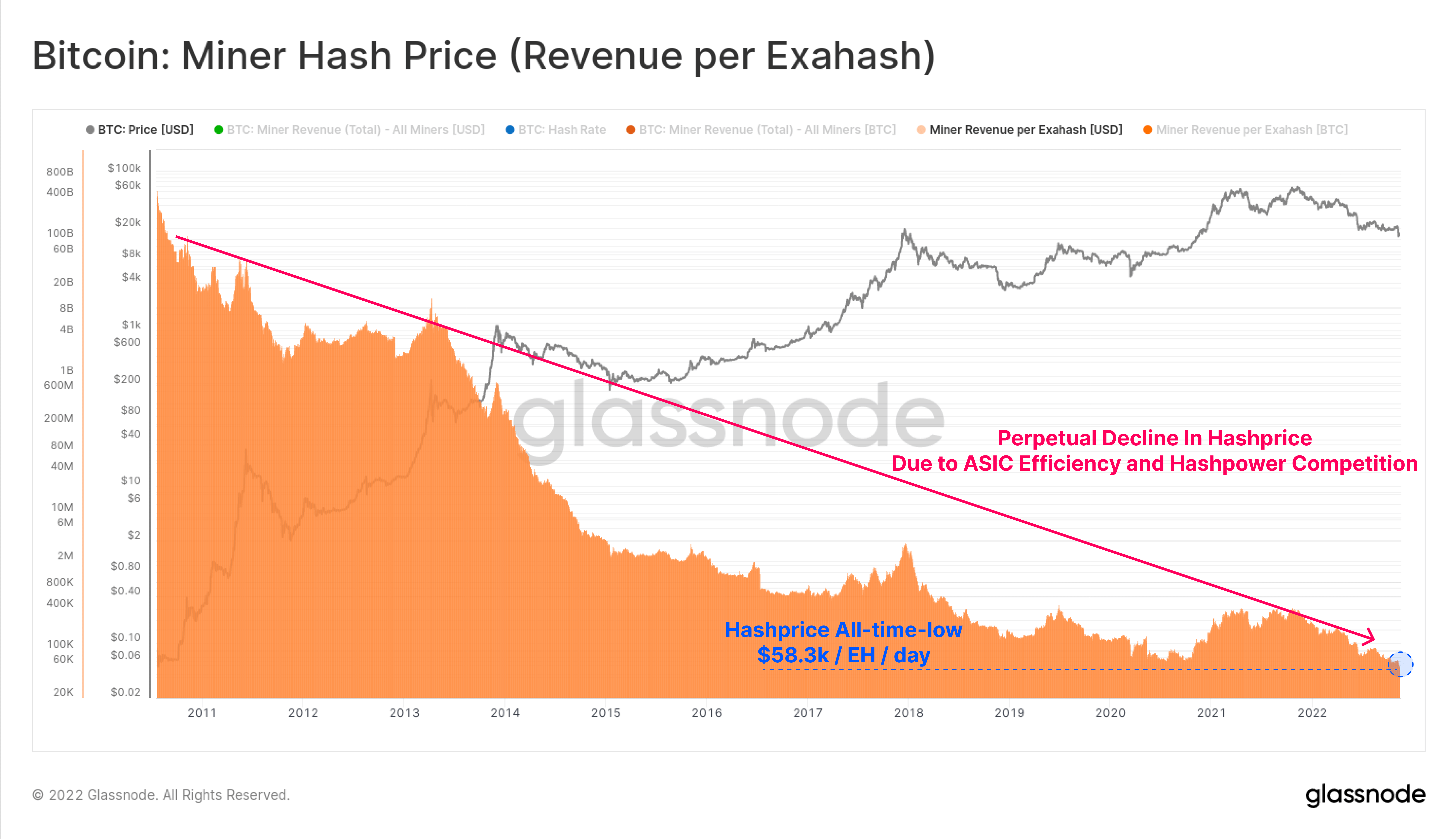

To trace USD denominated revenues, we are able to use a metric known as the Hash Worth, which fashions the income earned per Exahash. That is now at an all-time-low of $58.3k earned per Exahash per day, displaying that mining is essentially the most aggressive it has ever been.

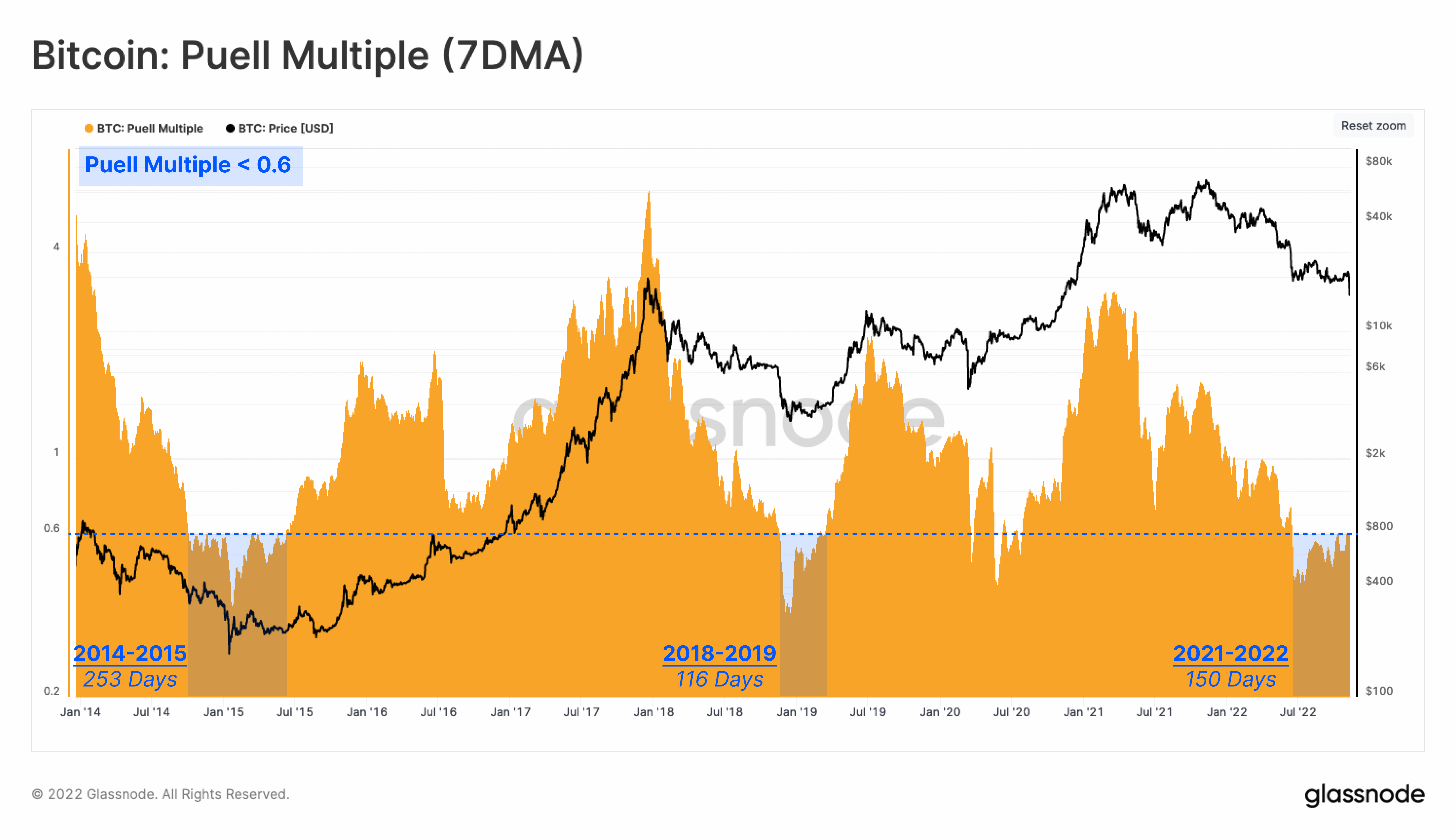

The Puell A number of is an oscillator monitoring USD miner revenue relative to the yearly common. We are able to at the moment see that Bitcoin miners are experiencing a -41% contraction of their revenue stream in comparison with final 12 months.

Mining incomes have been below this excessive stress for 150-days thus far, which is akin to earlier bear market lows.

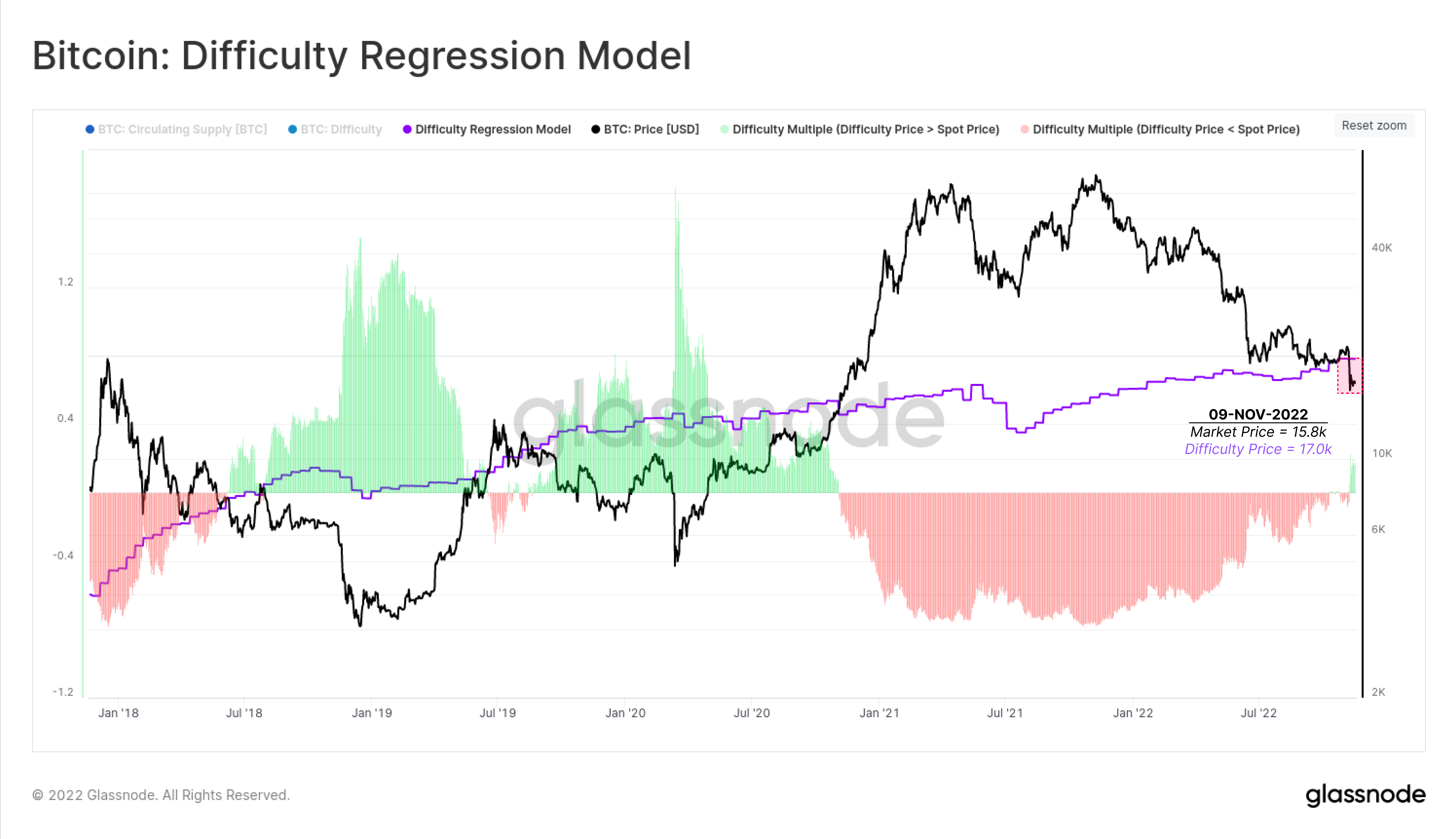

As Mining Problem climbs, so does the BTC manufacturing price. The mannequin beneath derives a relationship between Problem and Market Cap to estimate the typical manufacturing price per unit of BTC.

This manufacturing price mannequin is at the moment buying and selling at $17,008, which is 7% greater than the spot value. Consequently, the typical miner is at, or above their ache threshold, and it’s more and more seemingly that hashrate will start to stall, or decline within the months forward.

Elevated Capitulation Danger

Now that we have now confirmed that mining revenues are squeezed, and manufacturing prices are excessive, we have now a really high-risk atmosphere for a miner capitulation occasion. The following step is to research the potential market affect if this involves move.

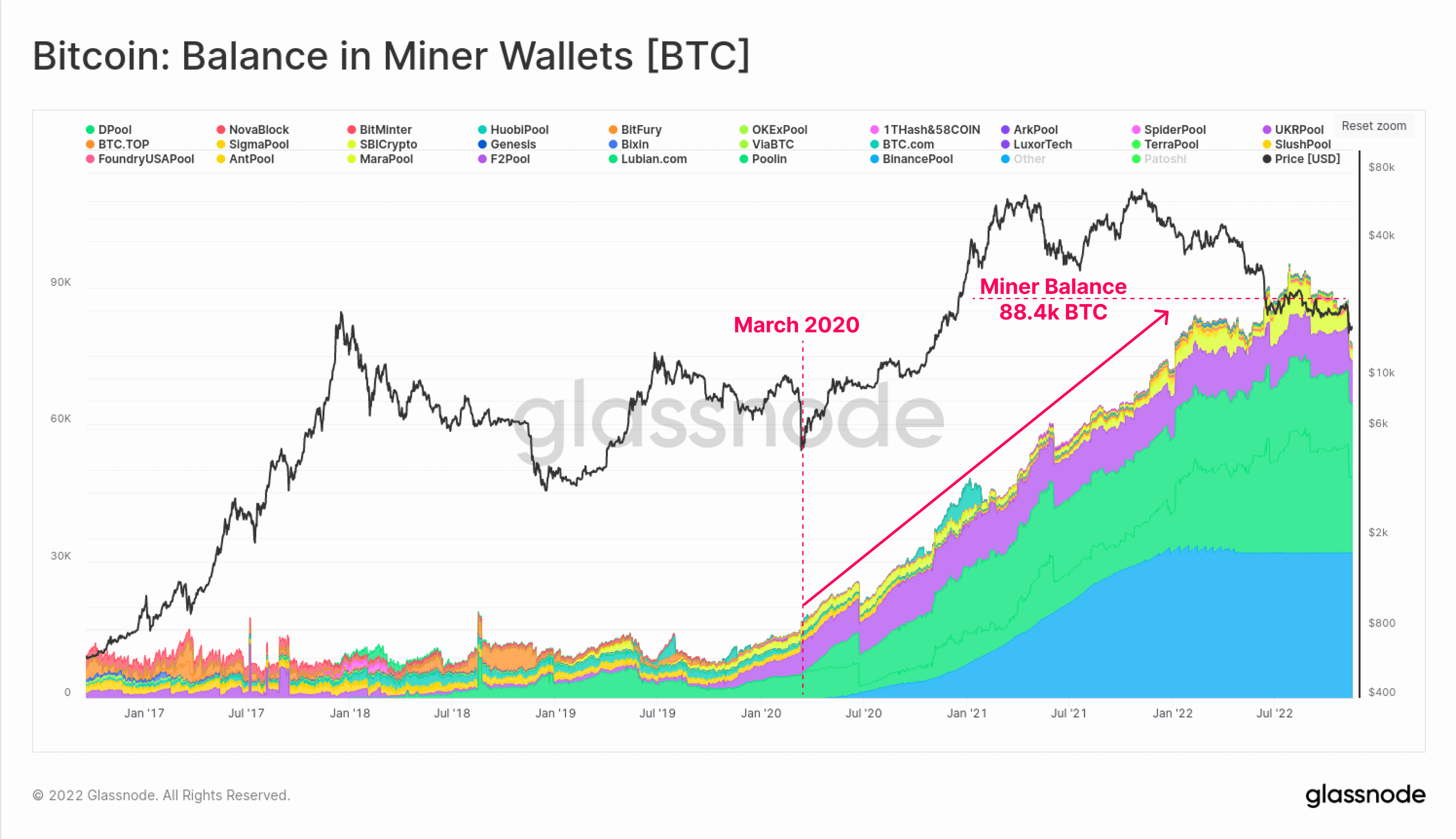

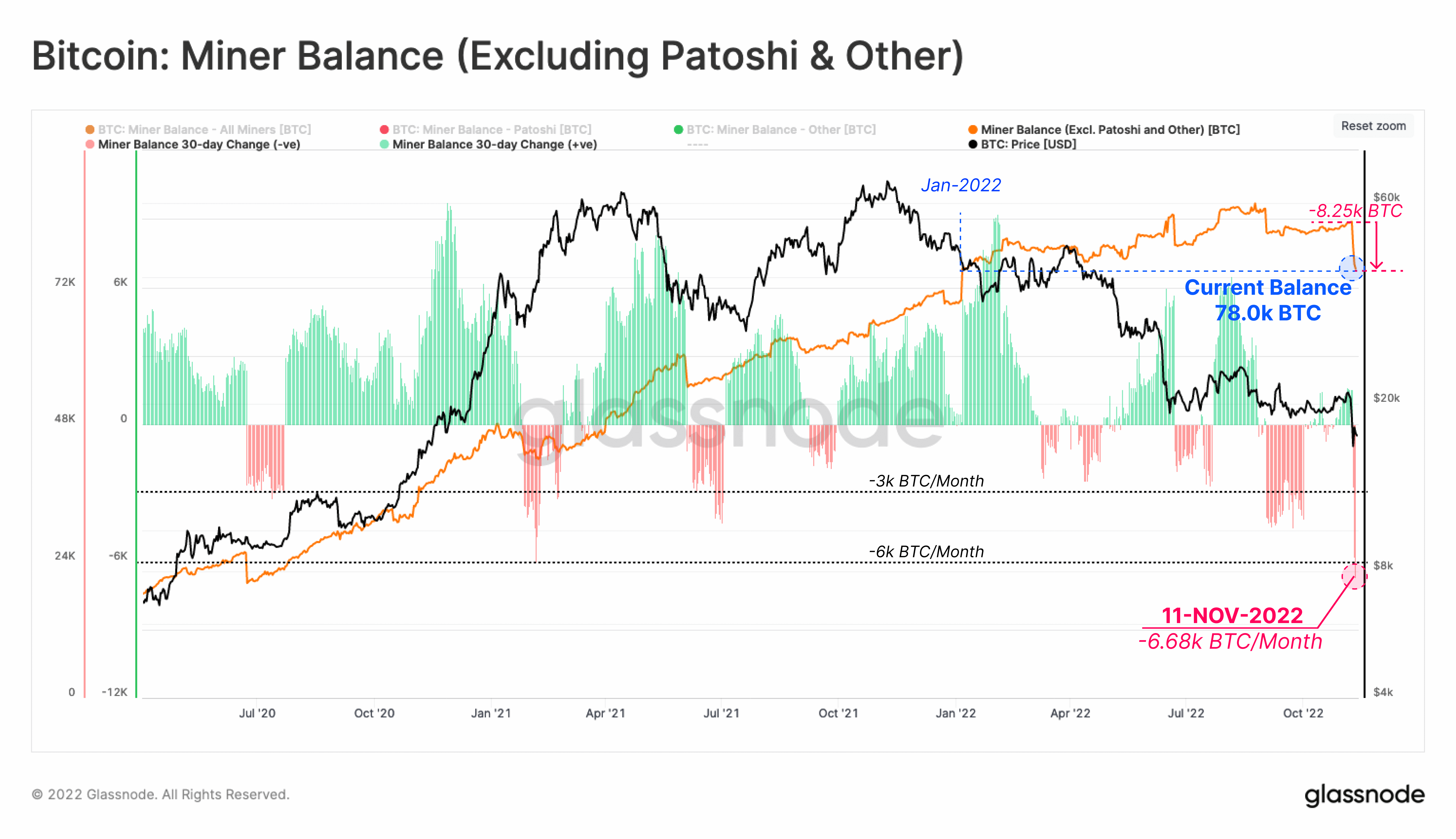

For the reason that March 2020 sell-off, miners have been vital accumulators of BTC, amassing over 88.4k BTC of their treasuries as of the beginning of November. Discover nevertheless that their stability began to plateau initially of 2022. This means early miner stress could have began at BTC costs as excessive as $40k.

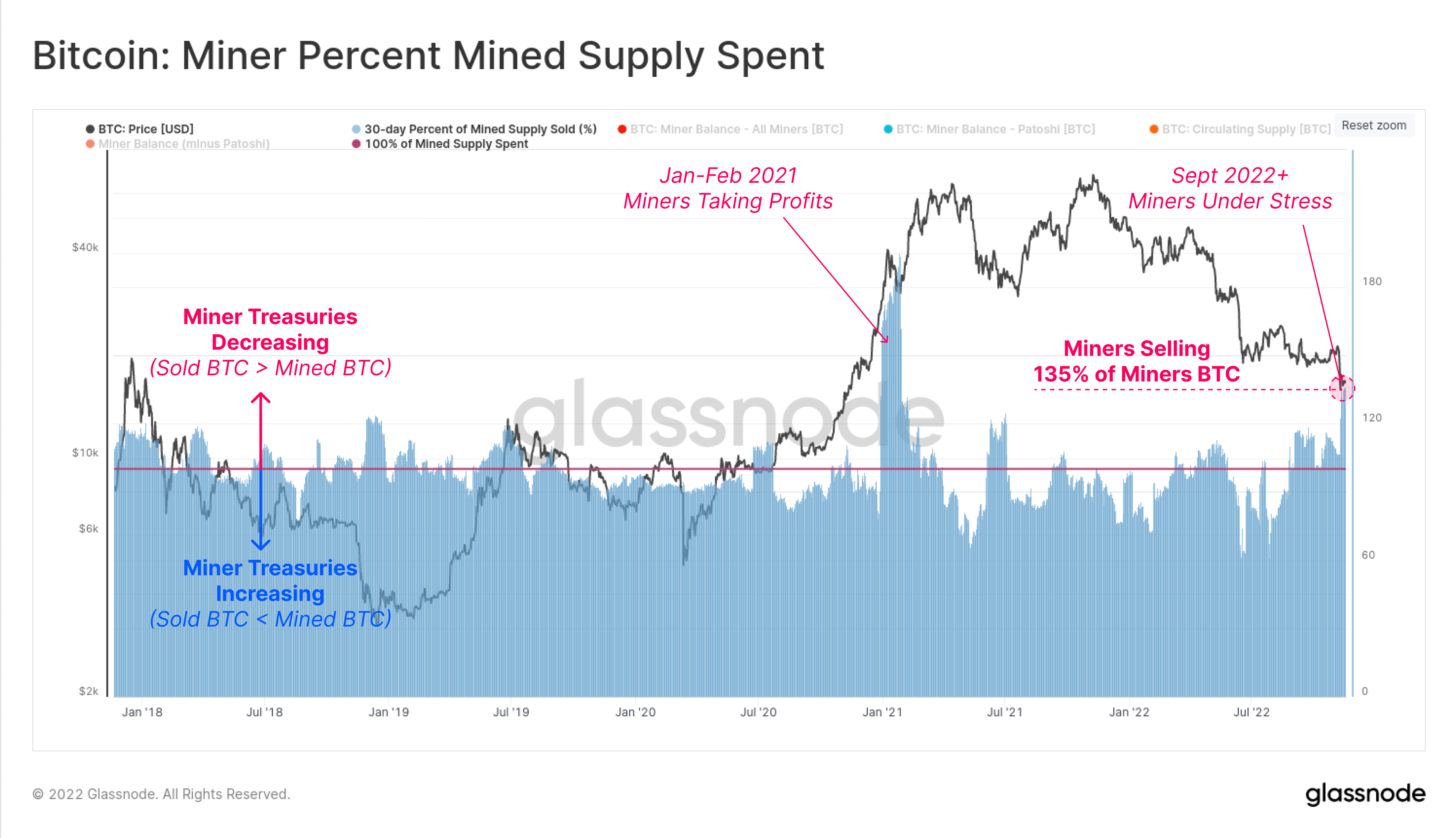

The chart beneath exhibits the p.c of each day mined provide that miners are spending, which has just lately hit 135%. Given the present block reward is ~900 BTC per day, which means miners in mixture are distributing all 900 newly minted cash, in addition to depleting their treasuries at a fee of 315 BTC per day (whole of 1,215 BTC/day).

As information of the FTX insolvency broke this week, miners responded by liquidating a further 8.25k BTC during the last two weeks. This brings their present holdings right down to 78.0k BTC, and erases all miner stability will increase in 2022.

With BTC costs nonetheless languishing beneath the $17.0k common price of manufacturing, this leaves a possible danger of a $1.287B provide overhang sourced from miner treasuries except costs can get well.

Conclusion

Amidst the chaotic occasions unfolding across the FTX insolvency, the mining business is quickly changing into one other space of concern out there. Mining revenues have skilled a big discount of their income streams, with manufacturing prices up +68%, and coin costs down -76% during the last 12 months.

Miner balances at the moment sit at round 78.0k BTC, equal to over $1.2B at present BTC costs of $16.5k. While it’s unlikely that the whole lot of those reserves will probably be distributed, it supplies a gauge on the potential danger. Till BTC costs have cleared a long way above the estimated price of manufacturing stage at $17.0k, it’s seemingly that miners are going to be below acute monetary stress, and internet distributors of BTC.