Knowledge from Glassnode suggests Bitcoin long-term holder capitulation hasn’t reached a scale that may indicate a widespread lack of conviction but.

Bitcoin Lengthy-Time period Holder Provide Has Declined By 61.5k BTC Since 6 Nov

In keeping with the most recent weekly report from Glassnode, the BTC long-term holder provide has noticed a notable lower not too long ago.

The “long-term holders” (LTHs) make up a cohort that features all Bitcoin buyers who’ve been holding onto their cash since at the least 155 days in the past.

Holders belonging to this group are statistically the least prone to promote at any level, so actions from them can have noticeable implications for the market.

The “long-term holder provide” is an indicator that measures the whole variety of cash presently saved within the wallets of those resolute buyers.

Adjustments within the worth of this metric can inform us whether or not the LTHs are accumulating or promoting in the intervening time.

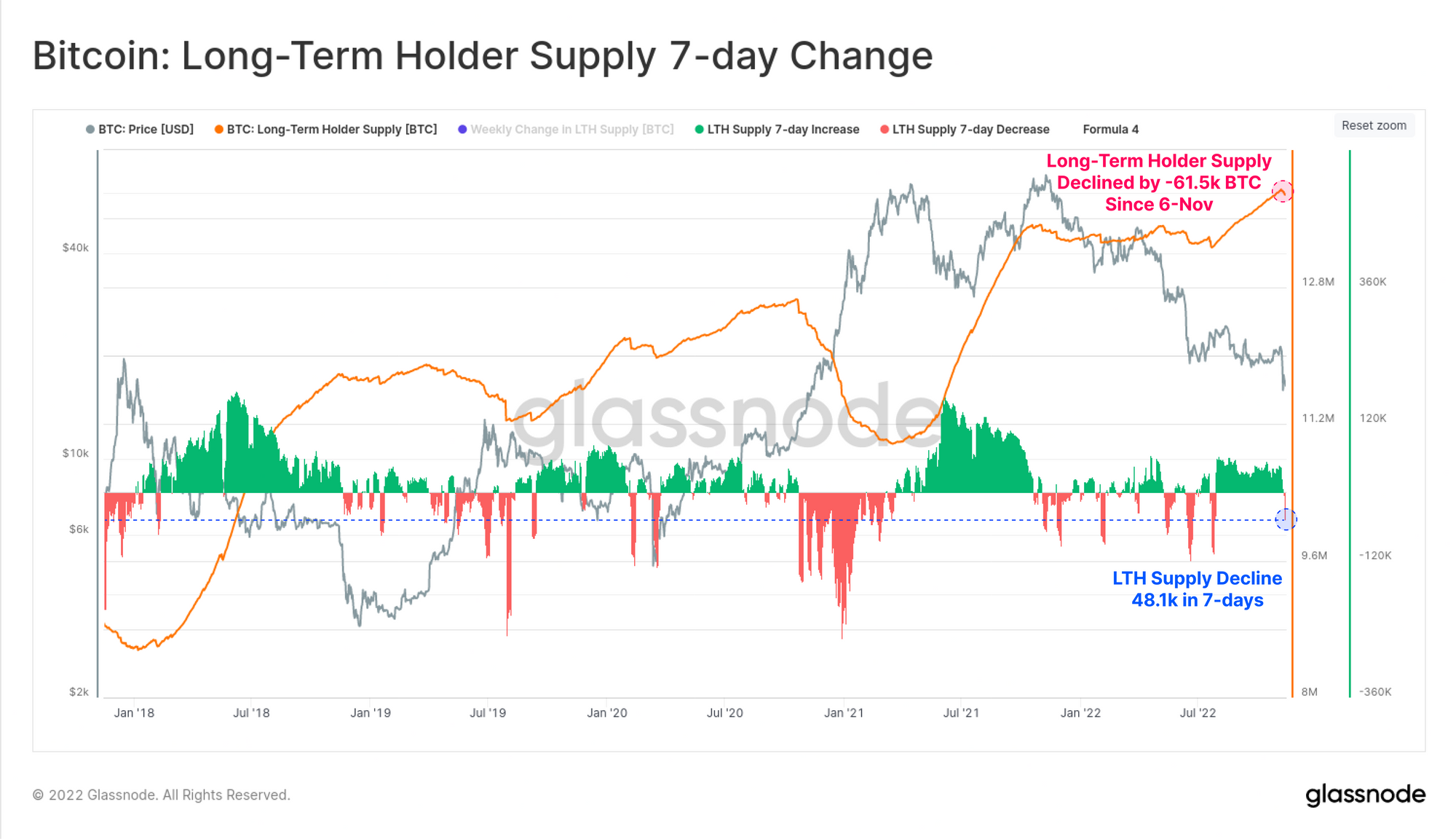

Now, here’s a chart that reveals the development within the Bitcoin LTH provide over the previous few years:

Seems like the worth of the metric has decreased in the previous few days | Supply: Glassnode's The Week Onchain - Week 46, 2022

As you may see within the above graph, the Bitcoin LTH provide had been using a continuing uptrend for a lot of months earlier than final week, and set new all-time highs.

Because of this the market had been repeatedly accumulating the crypto because the bear market went on.

Nonetheless, because the sixth of November (when the crash triggered by the FTX collapse started), the indicator has sharply declined, suggesting that LTHs have participated in some promoting.

In complete, the decline has amounted to round 61.5k BTC exiting the wallets of the LTHs on this interval thus far.

The chart additionally contains the info for the 7-day adjustments on this Bitcoin indicator, and it looks as if the metric has a destructive worth of 48.1k proper now.

This worth isn’t negligible, however as is clear from the graph, this crimson spike isn’t on the extent of those noticed through the earlier selloffs.

The report notes that this might indicate there hasn’t been a widespread lack of conviction amongst Bitcoin’s most resolute holders but.

Nonetheless, it stays to be seen the place the metric goes from right here. “Ought to this develop right into a sustained LTH-supply decline nevertheless, it might counsel in any other case,” cautions Glassnode.

BTC Value

On the time of writing, Bitcoin’s worth floats round $16.8k, down 15% within the final week. During the last month, the crypto has misplaced 13% in worth.

The worth of the crypto appears to nonetheless be buying and selling sideways | Supply: BTCUSD on TradingView

Featured picture from Daniel Dan on Unsplash.com, charts from TradingView.com, Glassnode.com