Gold, traditionally seen as a retailer of worth and a hedge towards financial turbulence, is usually the benchmark asset towards which many others are gauged. Within the crypto age, Bitcoin (BTC) and Ethereum (ETH) have emerged as contenders to gold’s throne, not as direct replacements however as trendy options representing a brand new breed of digital belongings.

Evaluating their efficiency towards gold supplies insights into market sentiment, the evolving panorama of funding, and the potential dangers and rewards related to each conventional and digital belongings. In 2023, the trajectories of Bitcoin, Ethereum, and gold had been notably distinct.

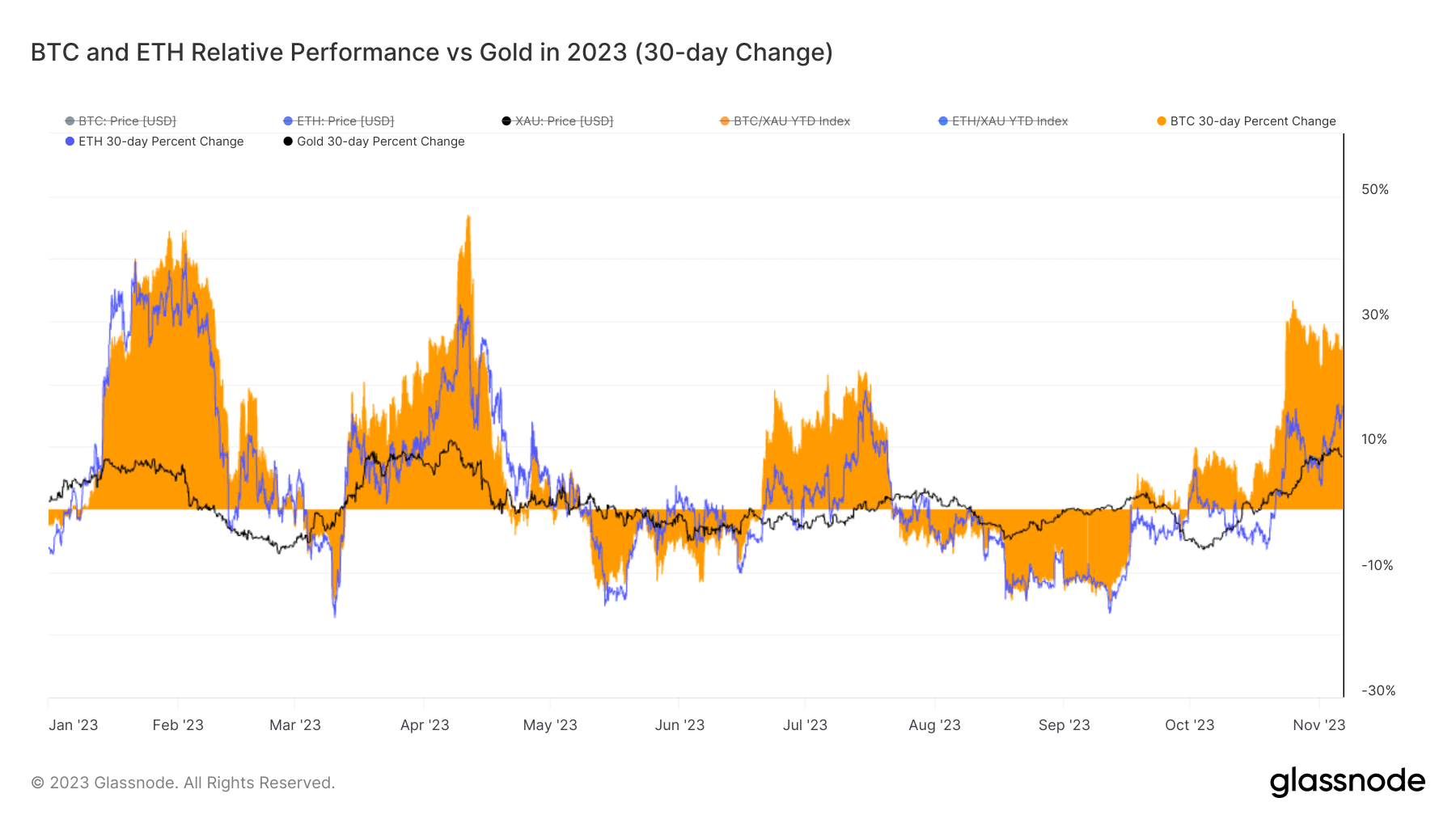

Bitcoin confirmed its risky nature all year long. On common, BTC grew by 6.90% month-to-month. In April, it reached a outstanding peak efficiency of 46.99%, however the winds shifted in June, pushing it to a dip of 14.99%. Ethereum adopted an identical sample, albeit with barely subdued fluctuations. Ethereum’s month-to-month common ascent was 3.70%. Its peak was in Could, touching 40.82%, however by July, it confronted a decline of 17.34%.

Contrasting sharply with the 2 main cryptocurrencies, gold moved with extra predictability. Throughout 2023, its common month-to-month worth adjustment was a modest 0.87%. March witnessed its highest surge, hitting 11.04%, whereas September noticed a dip of seven.09%.

Reflecting on the whole 12 months, Bitcoin’s assertive presence within the crypto market was plain. By November, it surged 111.76%. Ethereum, whereas not mirroring Bitcoin’s meteoric rise, nonetheless recorded a year-to-date progress of 58.72%. Gold, ever the regular performer, elevated by 8.84% because the starting of the 12 months.

These dynamics underscore a number of pivotal market narratives. Firstly, the pronounced volatility in cryptocurrencies underscores each their potential for vital returns and their susceptibility to sharp declines. This dual-edged nature of digital belongings is a testomony to their nascent stage within the monetary ecosystem, influenced by elements starting from regulatory developments to technological developments.

Gold’s modest but regular efficiency reinforces its popularity as a stabilizing asset, one much less inclined to the fast market actions typically related to cryptocurrencies. It stays a popular selection for traders searching for a hedge towards broader market uncertainties, whilst its returns are overshadowed by the extra aggressive progress trajectories of digital belongings.

The put up Gold stays secure whereas volatility rocks Bitcoin and Ethereum’s 2023 appeared first on CryptoSlate.