Coinbase, the main US-based crypto alternate, has seen a surge in its market share following the introduction of a number of spot Bitcoin exchange-traded funds (ETFs) in January.

In response, analysts at Goldman Sachs have upgraded their score on Coinbase shares from promoting to impartial and adjusted their worth goal to $282.

Coinbase shares

The financial institution analysts wrote:

“We’re upgrading shares of COIN to Impartial from Promote, as crypto costs have surged to all time highs, and COIN every day volumes have reached ranges not seen since 2021 driving a 48% enhance to our income estimates since early February.”

The analysts defined that their choice displays the altering panorama of the crypto market and the corresponding influence on Coinbase’s efficiency.

Beforehand, JPMorgan analysts had downgraded Coinbase’s inventory from Impartial to Underweight resulting from pressures within the crypto market and potential income shifts away from Coinbase following the launch of the brand new ETFs.

Coinbase’s inventory has grown considerably in the course of the previous month, buying and selling at round $244 throughout pre-market buying and selling at present, marking a exceptional 105% enhance over the previous month, in accordance with Yahoo Finance information.

Market share progress

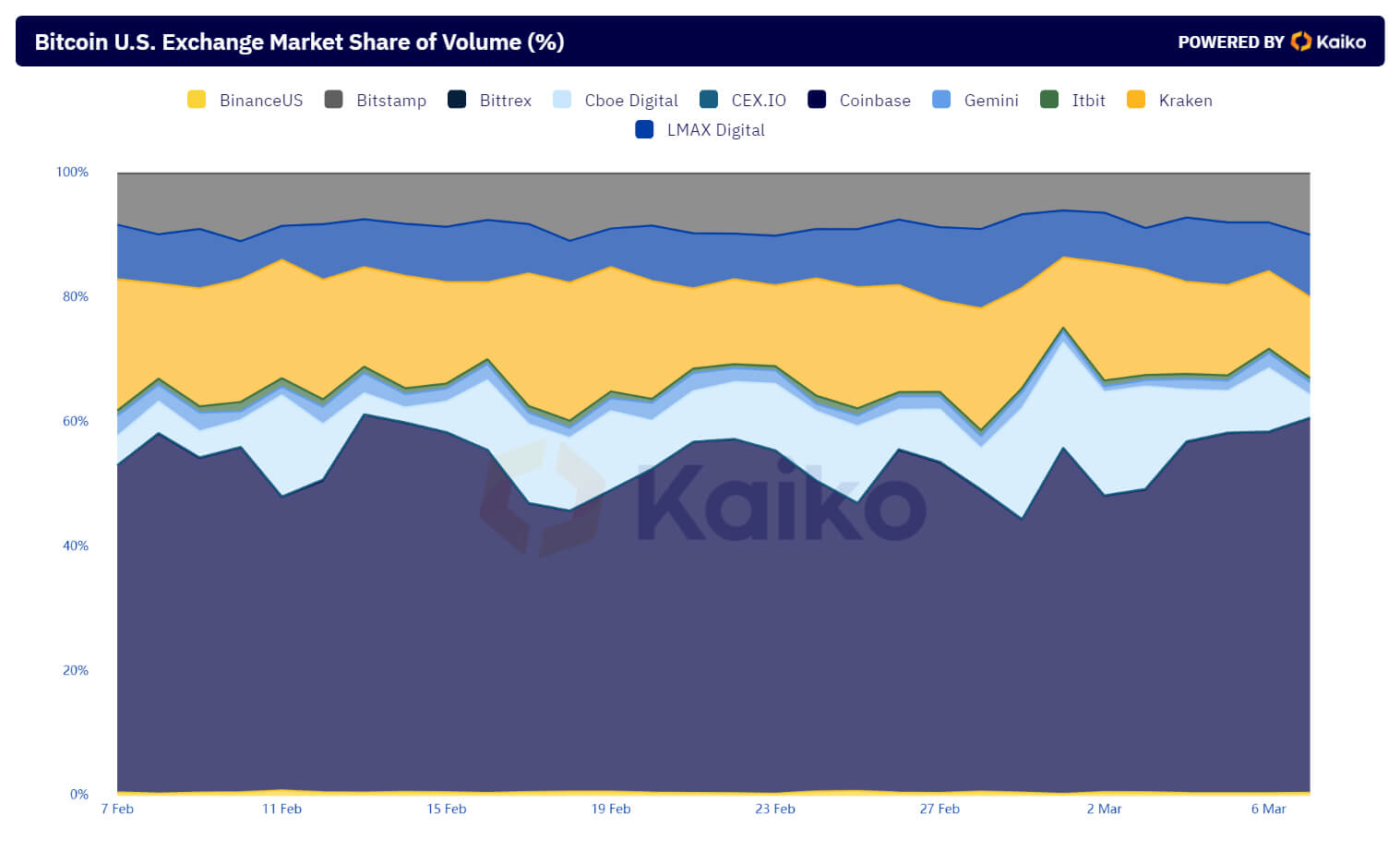

Coinbase’s market dominance has surged from 47% to 60% within the final three months following the approval of Bitcoin ETFs in January, in accordance with information from blockchain analytics agency Kaiko.

The platform’s exceptional progress stems from heightened person engagement, propelling its app to notable rankings. At present, Coinbase is the thirteenth hottest US finance utility, as tracked by a platform monitoring app progress, Sensor Tower.

Nonetheless, Coinbase has grappled with technical challenges amid this ascent, leading to customers encountering zero balances of their accounts. Coinbase CEO Brian Armstrong attributed this glitch to the numerous spike in visitors brought on by the BTC’s ascent to new document highs.

Past technical setbacks, Coinbase can be navigating a panorama fraught with regulatory hurdles, significantly with the US Securities and Alternate Fee over the previous yr.

The submit Goldman Sachs upgrades Coinbase score amid crypto surge and market dominance enhance appeared first on CryptoSlate.