Fast Take

The cryptocurrency market has seen vital exercise after Grayscale Bitcoin Belief’s (GBTC) victory over the SEC.

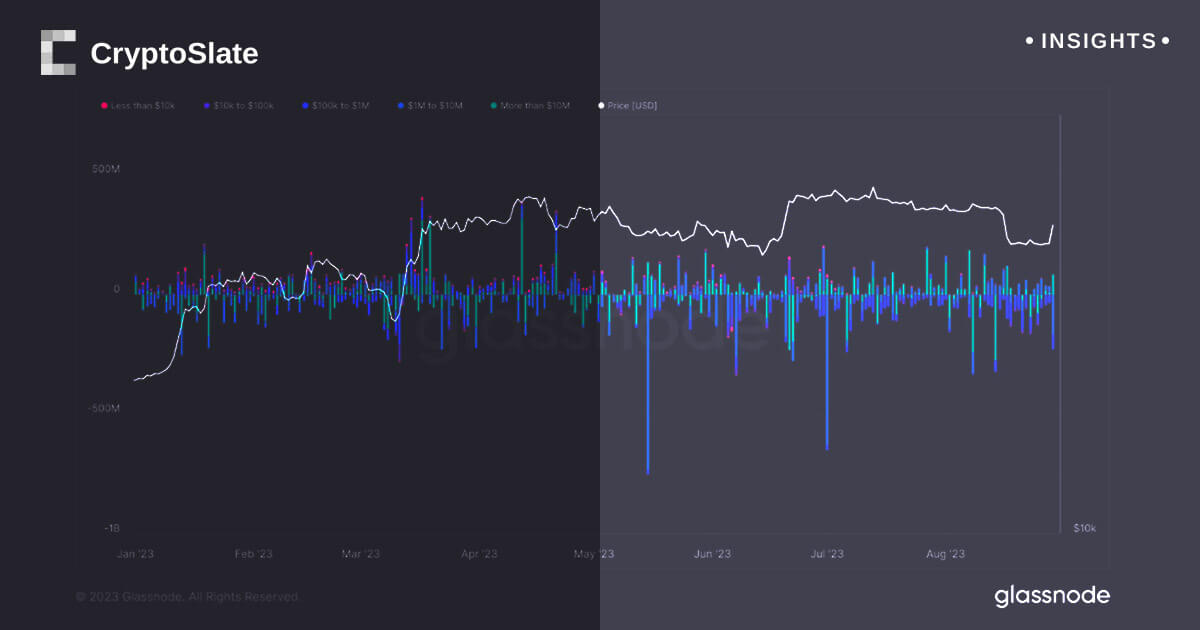

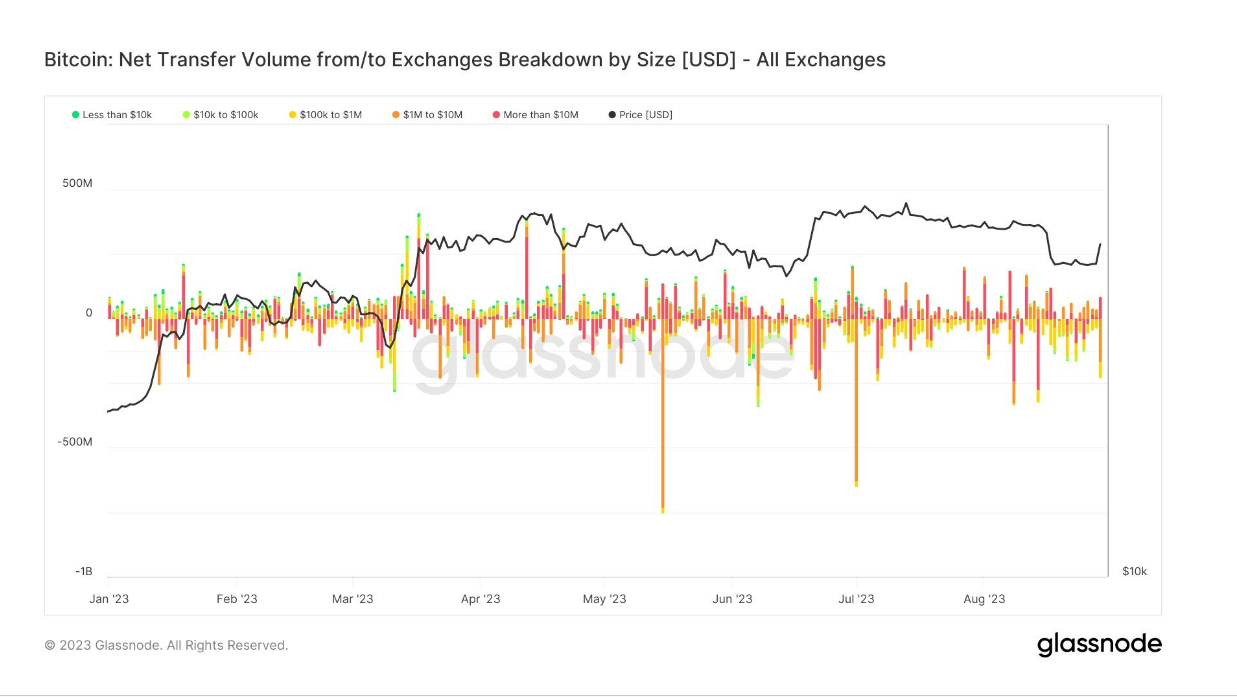

Over the previous 24 hours, liquidations within the crypto market amounted to $171 million, whereas shorts represented an much more vital section at $119 million. This flurry of buying and selling exercise, probably influenced by GBTC’s authorized triumph, is mirrored in a notable 6% rise in futures open curiosity. This improve primarily stems from crypto margin trades on the Bitmex trade.

Moreover, a purchase order of roughly $200 million in spot bitcoin was noticed, with most of those transactions originating from Binance. This surge in acquisition signifies a rising confidence in Bitcoin’s market place.

Concurrently, the GBTC low cost, which refers back to the distinction between the worth at which GBTC shares commerce and the worth of the underlying Bitcoin, narrowed to roughly 18% of the Web Asset Worth (NAV). This decline suggests a possible improve in investor confidence in GBTC.

Moreover, this unfolding state of affairs additionally positively impacted Bitcoin mining shares and different crypto equities, signifying a positive day within the broader digital asset market.

The put up Grayscale Bitcoin Belief victory sparks surge in market exercise and narrows GBTC low cost appeared first on CryptoSlate.