The most important information within the cryptosphere for Oct. 12 contains Grayscale’s lawsuit in opposition to the SEC for not approving a U.S. spot Bitcoin ETF, CoinCenter’s lawsuit in opposition to the U.S. Treasury for overstepping its authorized authority by banning Twister Money, and Arbitrium’s mum or dad firm Offchain Labs’ acquisition of main Ethereum shopper Prysmatic Labs.

CryptoSlate High Tales

Grayscale recordsdata opening transient in Bitcoin ETF battle in opposition to SEC

Grayscale Investments have been attempting to get the Securities and Trade Fee (SEC) to approve a U.S. spot Bitcoin (BTC) exchange-traded fund (ETF). The SEC has rejected all makes an attempt of Grayscale thus far.

Grayscale’s mum or dad firm Digital Foreign money Group (DCG) CEO Barry Silbert, mentioned it’s time the SEC authorized a spot Bitcoin ETF and filed a lawsuit in opposition to the SEC, claiming it’s discriminatory to permit Bitcoin futures ETFs however not a spot ETF.

Coin Middle sues US Treasury over Twister Money sanctions

Coin Middle filed a lawsuit in opposition to the U.S. Treasury Division for sanctioning Twister Money (TORN), arguing that it overstepped its authorized authority by banning a protocol that protected Individuals’ privateness rights.

The lawsuit acknowledged:

“On account of the Biden administration’s criminalization of Twister Money, these donors are much less more likely to contribute to Coin Middle. They’re successfully banned from participating in expressive advocacy.”

Arbitrium’s Offchain Labs acquires main Ethereum shopper

Arbitrium’s mum or dad firm Offchain Labs introduced that it acquired a core Ethereum (ETH) growth workforce, Prysmatic Labs.

Prysmatic Labs is behind Ethereum’s main consensus layer shopper, Prysm, which is an Ethereum PoS shopper that pioneered the Ethereum Merge.

21Shares spot Bitcoin ETP goes reside on Nasdaq Dubai

Crypto trade traded-product (ETP) issuing firm 21Shares listed its first physically-backed Bitcoin ETP on Nasdaq Dubai. The brand new ETP will likely be traded underneath the ticker ABTC.

With ABTC, 21Shares elevated its ETP merchandise to 46, that are listed throughout 12 exchanges in seven totally different international locations.

TRON turns into authorized tender in Dominica

Dominica introduced making TRON (TRX) licensed digital currencies within the Caribbean Island. The brand new adoption contains all TRON-based native tokens like BTT, JST, NFT, USDD, USDT, and TUSD as nicely.

The information was introduced by TRON’s CEO, Justin Solar, on his Twitter account.

It’s official! All #TRON cryptos together with #TRX #BTT #JST #NFT #USDD #USDT #TUSD are granted statutory standing as licensed digital forex and medium of trade within the commonwealth of Dominica efficient on October seventh 2022 🇩🇲 https://t.co/p97zJkzhUe pic.twitter.com/kbejwXrkXt

— H.E. Justin Solar🌞🇬🇩🇩🇲🔥 (@justinsuntron) October 12, 2022

Polygon powers new Indian police complaints portal

Police in India’s Firozabad area used Polygon’s (MATIC) blockchain to develop an internet portal residents can use to report crimes.

The portal is reside and accessible by policecomplaintonblockchain.in handle. The portal permits residents to report a criminal offense in an immutable and clear method. This additionally implies {that a} reported crime can’t be deleted or edited.

Bitcoin Amsterdam panel dialogue throws mild on unfixable debt-based system

The three-day Bitcoin Amsterdam occasion began on Oct. 12. Within the first-panel session, individuals agreed that the debt-based system is inherently flawed and incapable of resolving inflation.

Panelists agreed that Bitcoin supplied another system that’s utterly reverse to the standard methods and way more able to combatting present monetary predicaments.

STEPN to put off over 100 workers

Stroll-to-earn platform STEPN (GMT) introduced it might start shedding over 100 of its workers, together with MODs and ambassadors. The corporate pointed on the bear market circumstances as the explanation for downsizing.

STEPN’s mum or dad firm, Discover Satoshi Lab, additionally determined to redirect its investments to STEPN in direction of selling upcoming tasks like its new NFT trade platform.

Crypto.com to take a position €150M in France

Main trade Crypto.com introduced that it spared €150 million to spend money on France to broaden within the area and set up a regional headquarters in France.

The trade has been specializing in extending throughout the globe, and it already acquired the mandatory licenses to function in Singapore, Italy, and Cyprus.

Analysis Spotlight

Analysis: Whales promoting on the third most aggressive price in BTC historical past

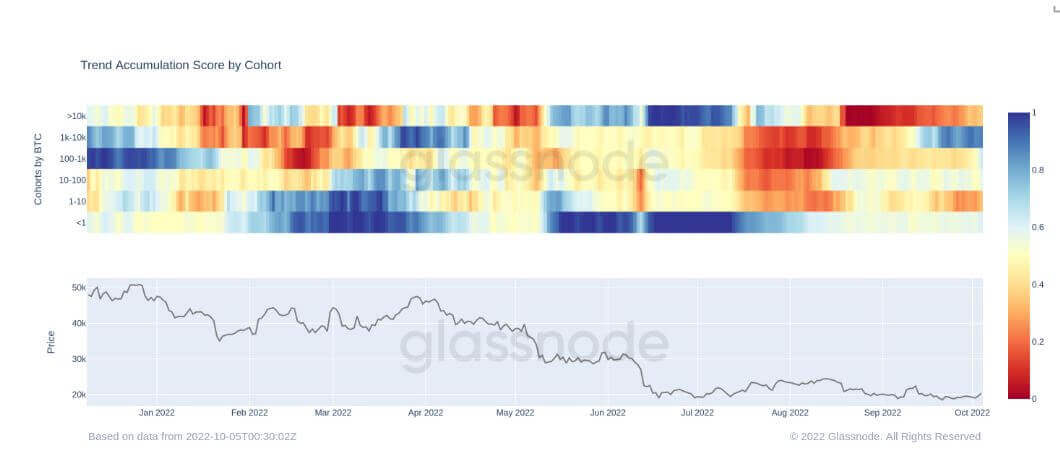

CryptoSlate analysts examined the Accumulation Pattern Rating (ATS) and revealed that that is the third most aggressive dumping by Bitcoin whales in crypto historical past.

The ATS is a metric that gauges the conduct of varied pockets cohorts and signifies every entity’s relative energy of accumulation. If it’s near 1, it signifies that the entity is accumulating. If it’s near 0, it implies that the group is distributing.

The ATS reveals that whales have been the online sellers for many of 2022, particularly just lately. Shrimps, then again, have been actively accumulating.

Information from across the Cryptoverse

nxyz hits $40M in Collection A funding

Web3 information infrastructure supplier nxyz introduced it gained $40 million in its Collection A funding spherical. The spherical was led by the likes of Paradigm, Coinbase Ventures, Sequoia Capital, and Greylock Companions.

Crypto Market

Bitcoin (BTC) elevated by 0.72% to achieve $19,152 within the final 24 hours, whereas Ethereum (ETH) additionally spiked by 1.25% to commerce at $1,298.