Fast Take

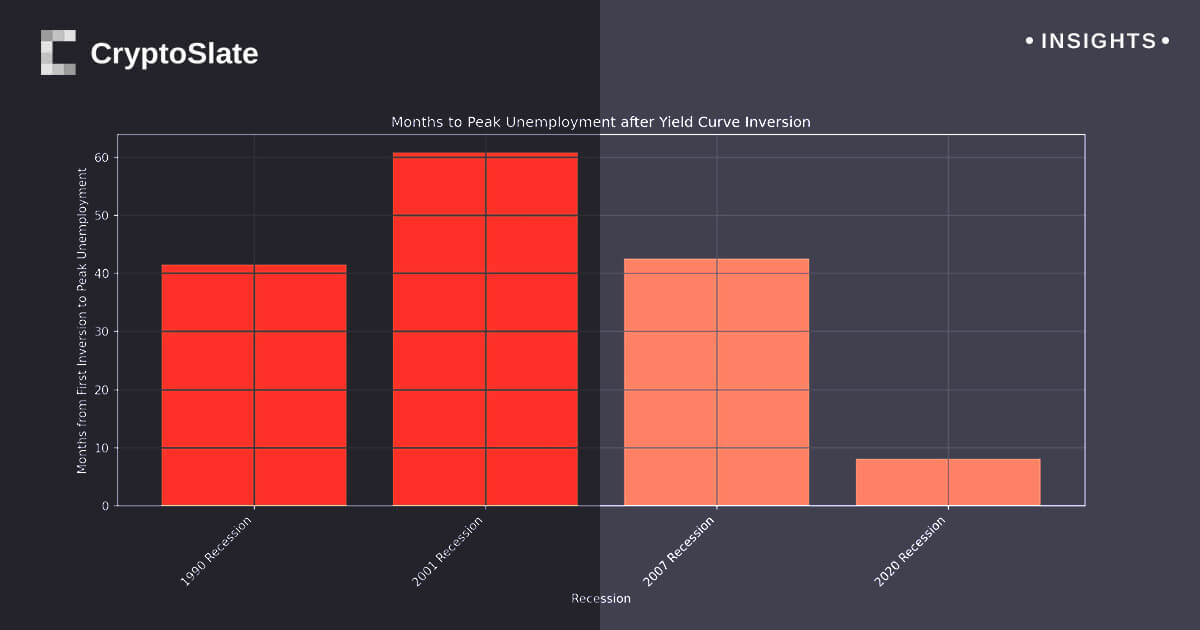

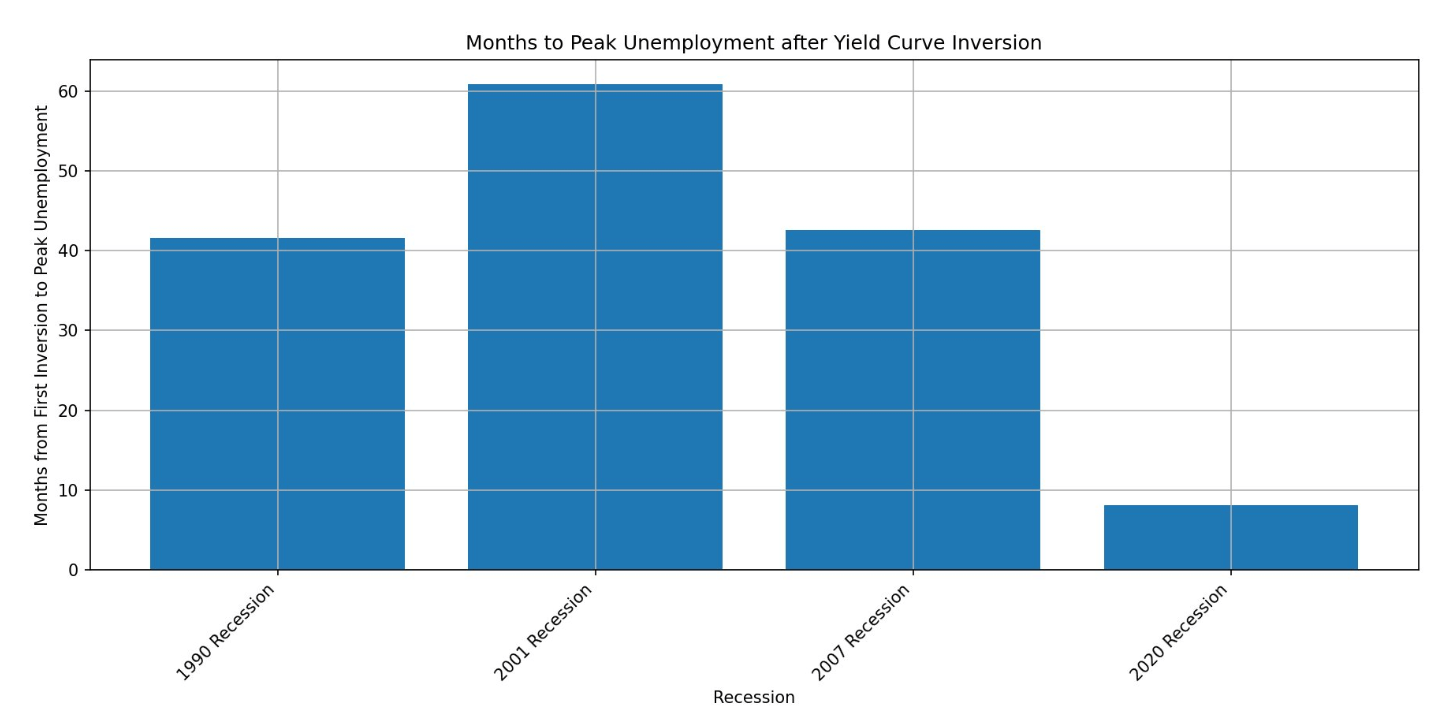

Primarily based on historic knowledge from the previous three recessions (excluding the consequences of COVID-19), peak unemployment can take as much as 40 months or longer to manifest following the preliminary inversion of the yield curve.

The yield curve used for this evaluation is the distinction between the 10-year and 2-year U.S. Treasury yields (US10Y – US02Y).

This specific yield curve has been acknowledged as an correct predictor of recessions for the previous fifty years. Its preliminary inversion in April 2022 indicated that assuming historic patterns maintain true, the height of unemployment will not be realized till 2025.

Unemployment in america is presently at 3.6%, one of many lowest ranges for 40 years.

The publish Historic yield curve evaluation for peak US unemployment price appeared first on CryptoSlate.