High Tales This Week

Binance founder CZ should keep in US till sentencing, decide orders

Binance founder Changpeng “CZ” Zhao has been ordered to remain in the USA till his sentencing in February, with a federal decide figuring out there’s an excessive amount of of a flight threat if the previous crypto trade CEO is allowed to return to the United Arab Emirates. On Dec. 7, Seattle District Courtroom Choose Richard Jones ordered Zhao to remain within the U.S. till his Feb. 23, 2024 sentencing date. He faces as much as 18 months in jail after pleading responsible to cash laundering on Nov. 21 and has agreed to not enchantment any potential sentence as much as that size.

Home committee passes invoice to ‘protect US management’ in blockchain

A United States Congress committee has unanimously handed a pro-blockchain invoice, which might process the U.S. commerce secretary with selling blockchain deployment and thus probably enhance the nation’s use of blockchain expertise. The act covers an array of actions the commerce secretary should take if handed, together with making greatest practices, insurance policies and proposals for the private and non-private sector when utilizing blockchain tech. The invoice will now go to the Home for a vote. If handed, it should additionally cross within the Senate earlier than returning for closing congressional and presidential approval.

SEC pushes deadline to determine on Grayscale spot Ether ETF

The USA Securities and Change Fee has delayed its choice on whether or not to approve or reject a spot Ether exchange-traded fund (ETF) providing from asset supervisor Grayscale. In a discover, the SEC stated it could designate an extended interval for contemplating a proposed rule change that might permit NYSE Arca to listing and commerce shares of the Grayscale Ethereum Belief. Grayscale first filed with the SEC to transform shares of its Grayscale Ethereum Belief right into a spot Ether ETF in October, including its title to the listing of firms awaiting a choice from the regulator.

Elon Musk’s xAI information with SEC for personal sale of $1B in unregistered securities

Elon Musk’s X-linked synthetic intelligence modeler, xAI, has an settlement for the personal sale of $865.3 million in unregistered fairness securities, in keeping with a submitting with the USA Securities and Change Fee made on Dec. 5. The corporate is looking for to lift $1 billion. XAI’s product, a chatbot referred to as Grok, has not too long ago rolled out to X’s Premium+ subscribers. Musk introduced the launch of xAI in July and claimed its aim was to “perceive the universe.”

Bitcoin new excessive set for late 2024, Binance to lose prime spot — VanEck

Bitcoin will hit a brand new all-time excessive in late 2024 due to a long-feared United States recession and regulatory shifts after the following U.S. presidential election, asset supervisor VanEck predicts. The agency is assured that the primary spot Bitcoin ETFs can be accepted within the first quarter of 2024. Nonetheless, it additionally made a dismal prediction for the overall U.S. economic system. VanEck is amongst a number of corporations, together with BlackRock and Constancy, which are vying for an accepted spot Bitcoin ETF. VanEck additionally believes that the BTC halving, due in April or Could, “will see minimal market disruption,” however there can be a post-halving value rise.

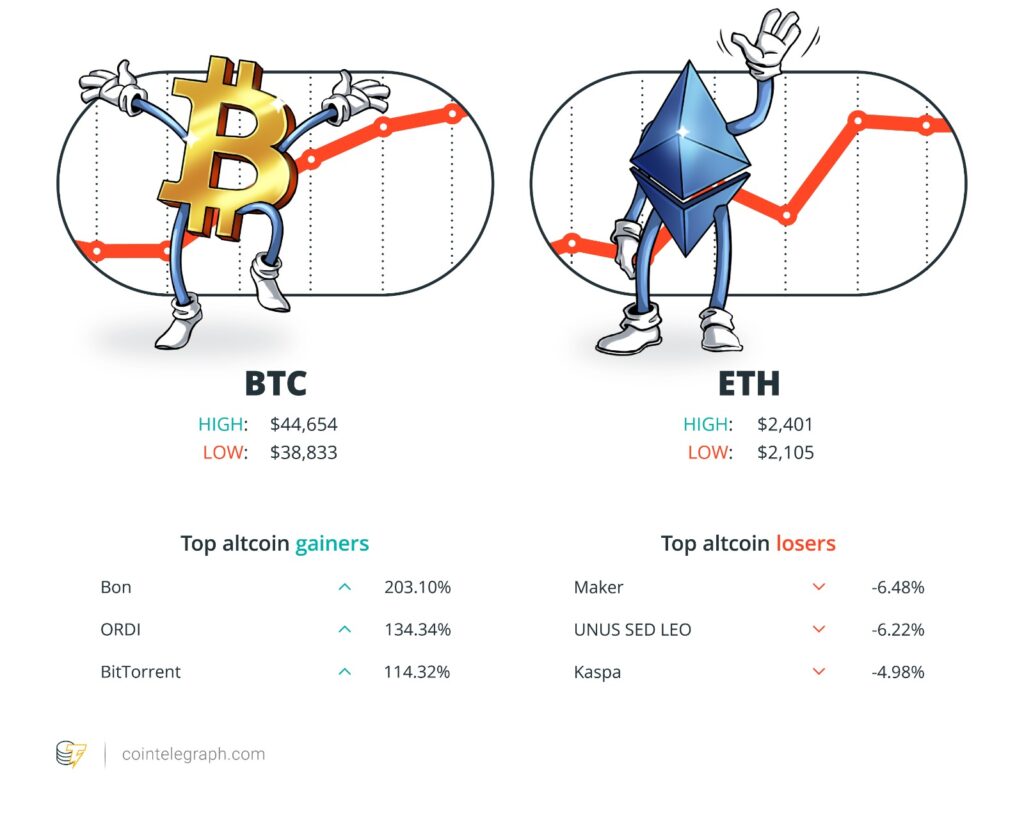

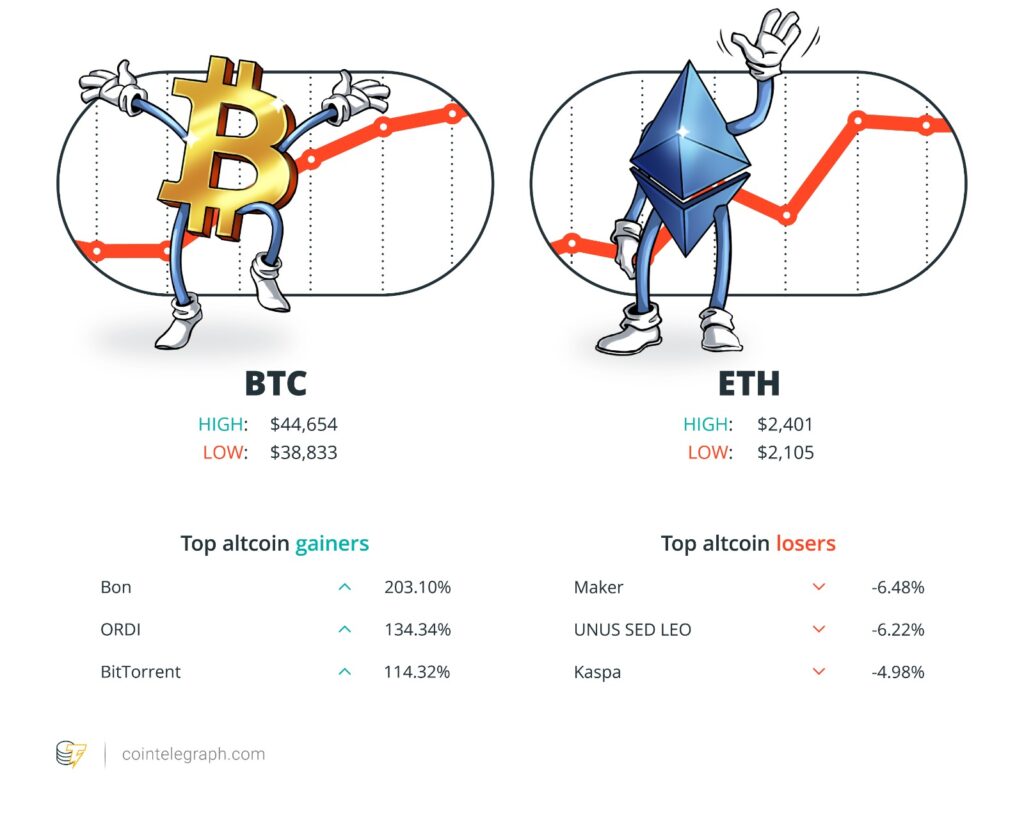

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $44,402, Ether (ETH) at $2,364 and XRP at $0.66. The whole market cap is at $1.65 trillion, in accordance to CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Bonk (BONK) at 203.10%, ORDI (ORDI) at 134.34% and BitTorrent (BTT) at 114.32%.

The highest three altcoin losers of the week are Maker (MKR) at -6.48%, UNUS SED LEO (LEO) at -6.22% and Kaspa (KAS) at 4.98%.

For more information on crypto costs, be sure that to learn Cointelegraph’s market evaluation.

Learn additionally

Most Memorable Quotations

“The anticipated approval of the ETF can be optimistic information for the crypto market, possible resulting in important progress.”

Adam Berker, senior authorized counsel at Mercuryo

“The one true use case for it [crypto] is criminals, drug traffickers, cash laundering, tax avoidance.”

Jamie Dimon, CEO of JPMorgan Chase

“Jamie Dimon is in no place to criticize Bitcoin with this form of observe file.”

Gabor Gurbacs, technique adviser at VanEck

“So, for us, I feel Bitcoin is our central financial institution. With that in thoughts, I consider Ethereum as our funding financial institution.”

Robby Yung, CEO of Animoca Manufacturers

“The ETF is actually a key driver in sentiment.”

Jon de Moist, funding chief of Zerocap

“It takes a group and the entire business to determine find out how to higher educate folks. That’s the arduous half. It’s not a expertise difficulty; it’s an operational drawback.”

Eowyn Chen, CEO of Belief Pockets

Prediction of the week

‘Early bull market’ — Bitcoin value preps 1st ever weekly golden cross

Bitcoin is lining up an “early bull market” as a novel chart function performs out for the primary time in historical past.

In a submit on X (previously Twitter) on Dec. 7, entrepreneur Alistair Milne famous that ought to present efficiency proceed, Bitcoin will witness a crossover of two weekly shifting averages (MAs), which have by no means delivered such a bull sign earlier than.

The 50-week and 200-week MAs are key trendlines for Bitcoin merchants and analysts alike. The latter is the last word bear market assist degree, and it has thus far by no means decreased in worth.

BTC value power is on the best way to taking the 50-week MA trendline above the 200-week counterpart. Often known as a “golden cross,” on decrease timeframes, that is thought of a traditional bullish sign, and for Milne, the impetus is that appreciable upside might be in retailer ought to the phenomenon play out.

“The 50-week shifting common will now quickly cross again above the 200-week MA making a ‘golden cross’ for the first time. QED: Early bull market,” he wrote.

FUD of the Week

Crypto is for criminals? JPMorgan has been fined $39B and has its personal token

JPMorgan Chase CEO Jamie Dimon is being criticized by the crypto group after claiming Bitcoin and cryptocurrency’s “solely true use case” is to facilitate crime. Nonetheless, in keeping with Good Jobs First’s violation tracker, JPMorgan is the second-largest penalized financial institution, having paid $39.3 billion in fines throughout 272 violations since 2000. About $38 billion of those fines got here underneath Dimon’s watch, who has been CEO since 2005.

British regulator provides Justin Solar-linked Poloniex to warning listing after $100M hack

The UK’s Monetary Conduct Authority (FCA) has added crypto trade Poloniex to its warning listing of non-authorized firms. The Seychelles-based trade is among the three firms owned by or affiliated with entrepreneur Justin Solar which have suffered 4 hacks within the final two months. The warning to Poloniex was revealed on the FCA’s web site on Dec. 6. It doesn’t provide a purpose however says that “corporations and people can not promote monetary providers within the UK with out the required authorization or approval.”

US senators goal crypto in invoice implementing sanctions on terrorist teams

A bipartisan group of lawmakers in the USA Senate launched laws geared toward countering cryptocurrency’s position in financing terrorism, explicitly citing the Oct. 7 assault by Hamas on Israel. The invoice would increase U.S. sanctions to incorporate events funding terrorist organizations with cryptocurrency or fiat. In line with Senator Mitt Romney, the laws would permit the U.S. Treasury Division to go after “rising threats involving digital belongings.”

Learn additionally

High Journal Items of the Week

Lawmakers’ worry and doubt drives proposed crypto rules in US

If the Digital Asset Anti-Cash Laundering Act had been to grow to be legislation, many cryptocurrency suppliers must learn to adjust to the identical rules as conventional monetary establishments.

Anticipate ‘data damaged’ by Bitcoin ETF: Brett Harrison (ex-FTX US), X Corridor of Flame

Brett Harrison taught a promising younger Sam Bankman-Fried programming for merchants at Jane Avenue, however wasn’t so impressed with the person SBF grew to become.

Web3 Gamer: Video games want bots? Illuvium CEO admits ‘it’s robust,’ 42X upside

Video games overrun with bots simply present bot house owners care, claims Pixels founder. Plus we overview Galaxy Battle Membership, chat to Illuvium’s CEO and extra.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.