Liveliness and Vaultedness are pivotal metrics in understanding the modifications within the Bitcoin community.

At their core, these metrics revolve across the idea of ‘coinblocks’. A just lately launched metric from Glassnode, coinblocks signify a selected amount of Bitcoin related to a selected time period since its final motion or transaction. In less complicated phrases, it’s a mix of the quantity of Bitcoin and the time it has remained stationary.

Liveliness captures the community’s exercise by specializing in ‘coinblocks destroyed.’ When a Bitcoin is transacted or spent, its related coinblock is taken into account ‘destroyed’ because it breaks its earlier period of inactivity. The metric is then calculated by taking the cumulative sum of those destroyed coinblocks and dividing it by the cumulative sum of all coinblocks created since Bitcoin’s inception. This provides a ratio representing the relative exercise of the Bitcoin community over time.

Conversely, Vaultedness gives a lens into the community’s ‘inactivity.’ It measures the proportion of coinblocks that stay ‘saved’ or unspent. Mathematically, Vaultedness is the sum of saved coinblocks divided by the sum of all coinblocks created. Alternatively, it may be considered as 1 minus Liveliness, representing the inverse relationship between these two metrics.

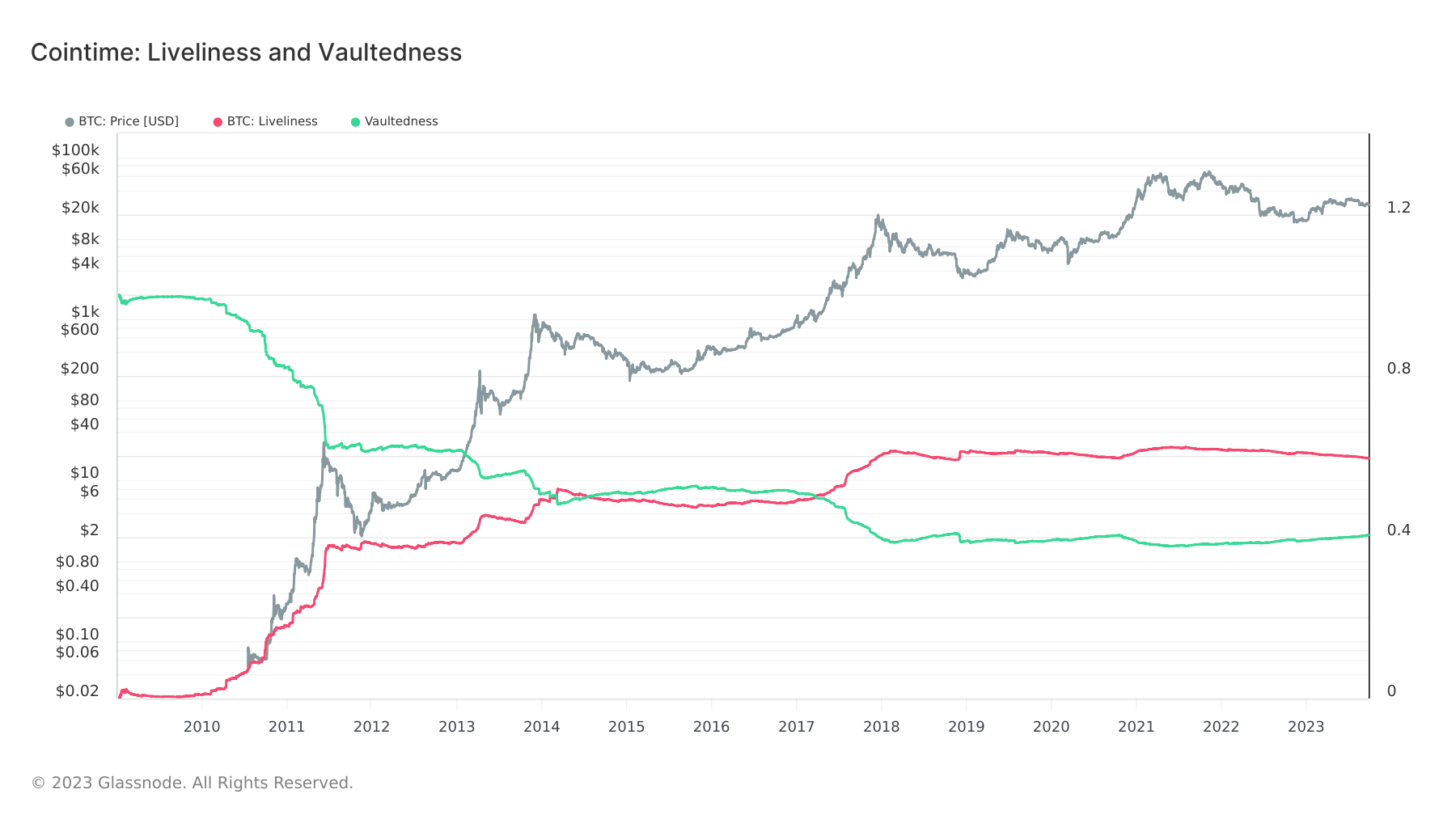

When the Genesis block was mined in January 2008, the Bitcoin community began with a Liveliness of 0 and a Vaultedness of 1. This preliminary state makes intuitive sense — since no cash had been spent, the community’s exercise was non-existent, giving Liveliness its lowest worth. Conversely, all cash had been successfully “vaulted” or unspent, giving Vaultedness its maximal worth.

Instantly after Bitcoin’s inception, Liveliness started its ascent, and Vaultedness began its descent. These trajectories continued till they intersected in March 2014. A subsequent interval from July 2014 to April 2017 noticed Vaultedness overshadowing Liveliness. Nonetheless, post-April 2017, Liveliness took the lead and has maintained its dominance. It’s important to notice a development reversal initiated in June 2021, the place Vaultedness started to rise, and Liveliness began to say no.

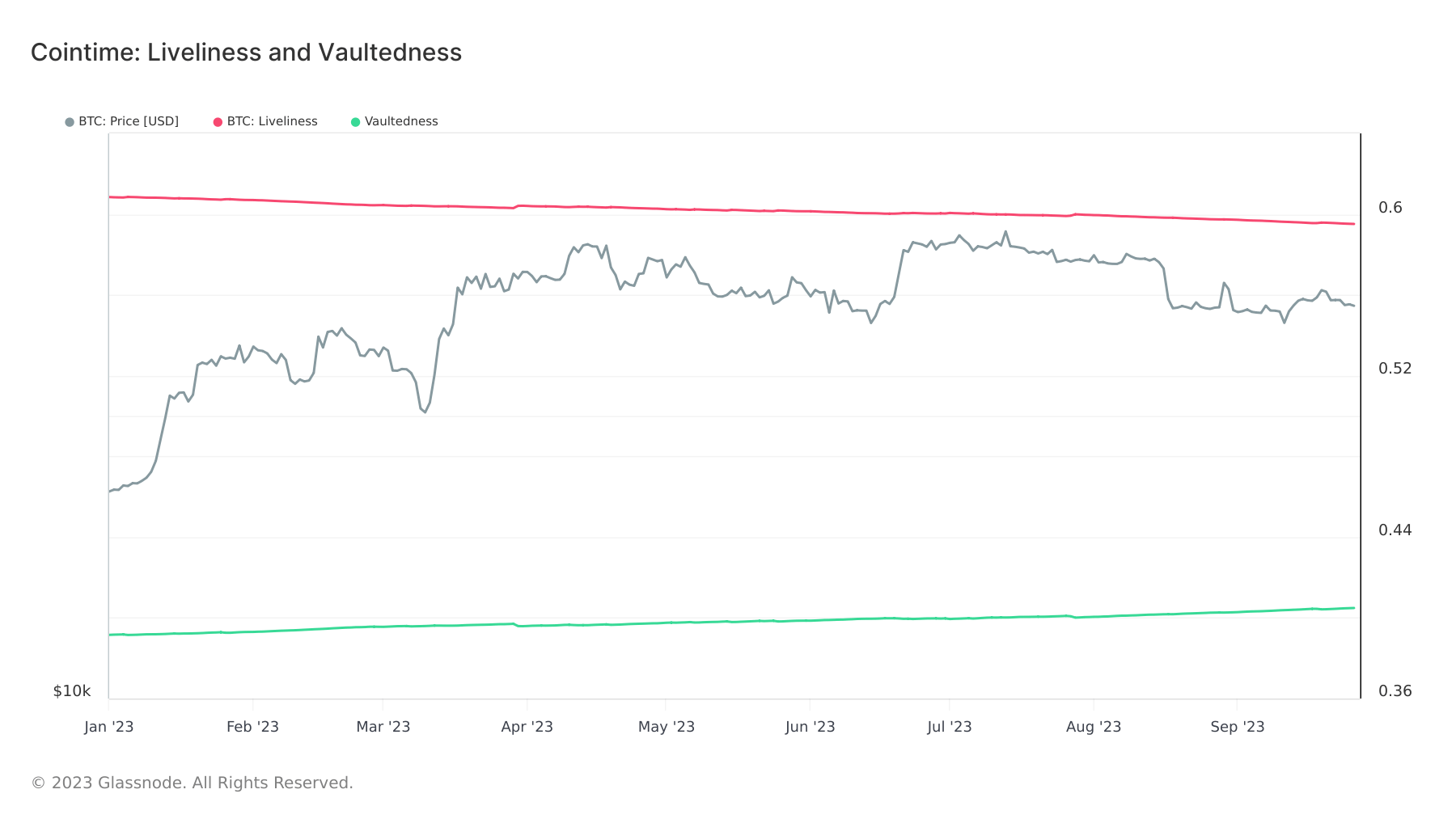

For the reason that starting of the yr, Liveliness decreased from 0.6 to 0.59—a relative change of -2.5% when considered in opposition to its maximal potential worth of 1. In the meantime, Vaultedness elevated from 0.39 to 0.4, reflecting a relative uptick of roughly 1.64%.

The rise in Vaultedness, a development in the direction of hodling, suggests rising confidence in Bitcoin’s worth proposition. Curiously, the development of elevated Vaultedness has defied Bitcoin’s worth motion, remaining constant by each bull and bear markets.

The info signifies a steadiness between energetic buying and selling and long-term holding, signaling Bitcoin’s evolving position within the monetary panorama. The constant dominance of Liveliness post-2017 and the current development reversal in 2021 would possibly point out a maturing market and shifting investor sentiments. Because the market continues to evolve, metrics like Liveliness and Vaultedness will stay essential in decoding the broader narrative surrounding Bitcoin’s worth and potential.

It’s changing into evident that the cryptocurrency market isn’t just about worth dynamics. The dominance shift between Liveliness and Vaultedness underscores Bitcoin’s journey from a speculative novel asset to a acknowledged retailer of worth, with the current developments suggesting a renewed perception in its long-term potential.