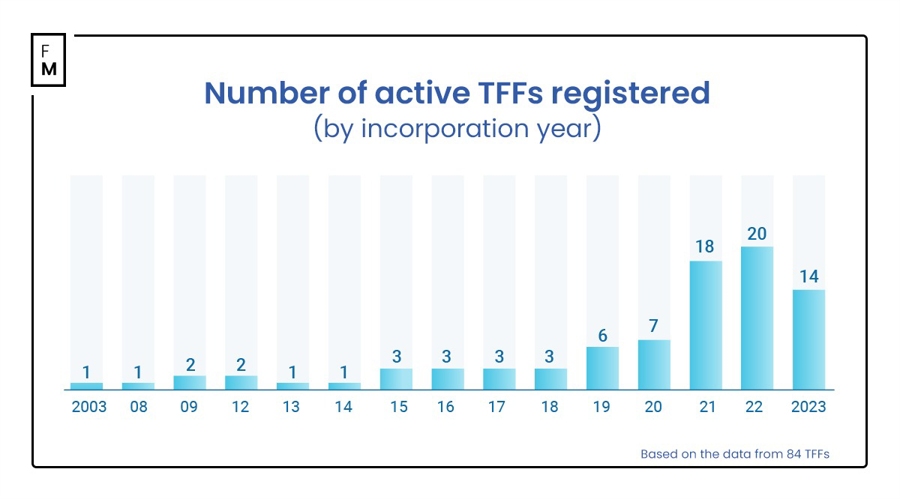

The idea of a trader-funded companies (TFFs), in any other case generally known as prop buying and selling companies, shouldn’t be new. Though these companies have existed for years, their recognition exploded in 2022.

The important thing motive for the sudden rise of those TFFs is that they emerged as a loophole and a low-cost different to the standard retail foreign exchange and contracts for variations (CFDs) brokerage. Many regulatory and non-regulatory crackdowns within the FX and CFDs business in 2021 and 2022 have elevated the barrier to function a daily brokerage.

Regulators to Tech Suppliers: Tightening of Guidelines

Regulatory scrutiny over FX and CFDs brokers has elevated throughout a lot of the jurisdictions, together with for offshore regulators that now want bodily places of work and better capital reserves. Additional restrictions from banking and licensed cost suppliers unwilling to work with unlicensed FX companies, as an example, the challenges of opening a checking account for an offshore foreign exchange dealer beginning in 2021.

Different non-regulatory obstacles, embody restrictions on promoting and rising prices throughout nearly each advertising and marketing channel. To call a couple of: TikTok banned promotions of crypto and foreign exchange in 2021; Google Adverts required an FX license to point out advertisements in nations with out FX regulation, coupled with a common lack of knowledge about FX licensing; and the price for FX-related key phrases/value per click on skyrocketed.

Moreover, MetaQuotes, the developer of two MetaTrader buying and selling platforms, additionally imposed many restrictions on offshore brokers. The corporate has tightened its licensing course of, making it troublesome for unlicensed brokers to get white labels.

On the similar time, the COVID and post-COVID bloom of curiosity in monetary markets persevered. On one hand, there was demand, and on the opposite, restrictions for retail FX. TFFs had been a fairly logical results of each dynamics.

A Fertile Floor for TFFs

Whereas common FX and CFDs brokers had been going through difficulties, the scenario is the other for TFFs due to their sheer construction.

The everyday TFF construction in 2023:

- A license shouldn’t be required.

- White labeling shouldn’t be wanted.

- Advertising and marketing shouldn’t be restricted.

- Banking and Cost Service Suppliers can be found.

This setup is really a dream for a lot of.

Additionally, the variety of startup retail foreign exchange brokerages declined considerably. It was a development I noticed first-hand from the diminishing variety of leads and inquiries acquired as a Vice President of Gross sales from 2010 to 2022, with annually experiencing a progressively bigger drop.

One essential issue for the TFF explosion was the predictability of TFF income, in distinction to retail FX brokerage, in addition to the low entry obstacles. These components made buyers extra prone to make investments, and because it usually occurs, early adopters made essentially the most revenue.

Now, relating to income: Since a license shouldn’t be required to run a dealer funding program, it’s practically inconceivable to gather any public knowledge on these expertise corporations, as most TFFs don’t report back to any jurisdictions. Nonetheless, there are nonetheless methods to gauge this:

- A lawsuit towards My Foreign exchange Funds: $310 million in charges (Nov 2021 – August 2023), with a web earnings of roughly $172 million. With 135,000 shoppers, “Program Charges” vary from $200-$4,900 (max funding of $2 million).

- Uncommon experiences by regulators or public tax filings: A European-based TFF paid about $10 million in taxes in 2021 and about $23 million in taxes in 2022. Contemplating the nation has a company tax fee of 19%, the income could be estimated.

- Public/Twitter/Instagram posts by TFF homeowners: a UAE-based TFF paid about $130,000 in taxes in 2022.

- Reverse engineering utilizing costs/posted numbers of recent shoppers (not very correct however price contemplating): Agency #A (through Instagram/LinkedIn public posts) has about 1,100 to 1,400 new shoppers monthly, with a median analysis charge of $165. Agency #B (through Instagram) has about 250 shoppers a month, with a median analysis charge of $280.

Moreover, I even have entry to some unpublished knowledge of TFFs, obtained by my private community.

- Agency #1: It has about 100 to 140 new shoppers month-to-month, with a median analysis charge of $200 and $90,000 in web yearly earnings. The corporate was established in 2023.

- Agency #2: It has about 400 to 700 shoppers month-to-month, with 20% of merchants returning and providing different merchandise (programs for a charge). The TFF was established in 2022 and was netting $460,000 yearly.

- Agency #3: It has about $14 million gross yearly, with about $7 million in web earnings. It was established in 2019, however did not develop a lot within the first 2 years.

It could be fascinating (and priceless) to research all the info TFFs have collected through the years. I hope they’re conducting this evaluation internally.

Many are looking for a brand new prop agency to get funded once more and in search of a UAE or a EU based mostly agency to really feel “protected”.

It isn’t simply the jurisdiction that issues. It is essential to know if you’re buying and selling a demo account within the title of funded account.

— BF Fx (@BrightFuture_Fx) September 2, 2023

The Supply of Income

The enterprise of working TFFs is profitable. These corporations have a number of sources of income. Nonetheless, their important income is from merchants’ analysis or audition charges, together with one-time problem charges and ongoing subscription charges (principally for Futures TFF). In addition they generate income from add-on charges (pay further to get a decrease revenue goal or improve allowable drawdown).

One other supplemental earnings supply of the TFFs are mentorship program charges (some companies supply these complimentary), introducing dealer partnerships with retail FX brokers, knowledge reselling, and markup for data-related charges.

Though the TFFs take a small a part of the revenue from the merchants, its is slightly an non-compulsory and uncommon income. Different non-compulsory income sources for TFFs are reselling of buying and selling knowledge, which can happen typically with out correct disclosures.

Revenue from proprietary buying and selling actions is uncommon, primarily as a result of the enterprise mannequin operates below the idea that analysis charges will cowl the uncommon situations of revenue withdrawals. Establishing the proprietary facet of a TFF includes expertise, capital, and essential business information. Some well-established TFFs with respectable Annual Recurring Income nonetheless do not have a proprietary buying and selling desk setup, although they might have connections with Liquidity Suppliers and have interaction in occasional hedging.

If you want to learn extra about expertise and threat administration for TFFs, go away your electronic mail on the ready listing to obtain a 50-page lengthy marketing strategy.

The idea of a trader-funded companies (TFFs), in any other case generally known as prop buying and selling companies, shouldn’t be new. Though these companies have existed for years, their recognition exploded in 2022.

The important thing motive for the sudden rise of those TFFs is that they emerged as a loophole and a low-cost different to the standard retail foreign exchange and contracts for variations (CFDs) brokerage. Many regulatory and non-regulatory crackdowns within the FX and CFDs business in 2021 and 2022 have elevated the barrier to function a daily brokerage.

Regulators to Tech Suppliers: Tightening of Guidelines

Regulatory scrutiny over FX and CFDs brokers has elevated throughout a lot of the jurisdictions, together with for offshore regulators that now want bodily places of work and better capital reserves. Additional restrictions from banking and licensed cost suppliers unwilling to work with unlicensed FX companies, as an example, the challenges of opening a checking account for an offshore foreign exchange dealer beginning in 2021.

Different non-regulatory obstacles, embody restrictions on promoting and rising prices throughout nearly each advertising and marketing channel. To call a couple of: TikTok banned promotions of crypto and foreign exchange in 2021; Google Adverts required an FX license to point out advertisements in nations with out FX regulation, coupled with a common lack of knowledge about FX licensing; and the price for FX-related key phrases/value per click on skyrocketed.

Moreover, MetaQuotes, the developer of two MetaTrader buying and selling platforms, additionally imposed many restrictions on offshore brokers. The corporate has tightened its licensing course of, making it troublesome for unlicensed brokers to get white labels.

On the similar time, the COVID and post-COVID bloom of curiosity in monetary markets persevered. On one hand, there was demand, and on the opposite, restrictions for retail FX. TFFs had been a fairly logical results of each dynamics.

A Fertile Floor for TFFs

Whereas common FX and CFDs brokers had been going through difficulties, the scenario is the other for TFFs due to their sheer construction.

The everyday TFF construction in 2023:

- A license shouldn’t be required.

- White labeling shouldn’t be wanted.

- Advertising and marketing shouldn’t be restricted.

- Banking and Cost Service Suppliers can be found.

This setup is really a dream for a lot of.

Additionally, the variety of startup retail foreign exchange brokerages declined considerably. It was a development I noticed first-hand from the diminishing variety of leads and inquiries acquired as a Vice President of Gross sales from 2010 to 2022, with annually experiencing a progressively bigger drop.

One essential issue for the TFF explosion was the predictability of TFF income, in distinction to retail FX brokerage, in addition to the low entry obstacles. These components made buyers extra prone to make investments, and because it usually occurs, early adopters made essentially the most revenue.

Now, relating to income: Since a license shouldn’t be required to run a dealer funding program, it’s practically inconceivable to gather any public knowledge on these expertise corporations, as most TFFs don’t report back to any jurisdictions. Nonetheless, there are nonetheless methods to gauge this:

- A lawsuit towards My Foreign exchange Funds: $310 million in charges (Nov 2021 – August 2023), with a web earnings of roughly $172 million. With 135,000 shoppers, “Program Charges” vary from $200-$4,900 (max funding of $2 million).

- Uncommon experiences by regulators or public tax filings: A European-based TFF paid about $10 million in taxes in 2021 and about $23 million in taxes in 2022. Contemplating the nation has a company tax fee of 19%, the income could be estimated.

- Public/Twitter/Instagram posts by TFF homeowners: a UAE-based TFF paid about $130,000 in taxes in 2022.

- Reverse engineering utilizing costs/posted numbers of recent shoppers (not very correct however price contemplating): Agency #A (through Instagram/LinkedIn public posts) has about 1,100 to 1,400 new shoppers monthly, with a median analysis charge of $165. Agency #B (through Instagram) has about 250 shoppers a month, with a median analysis charge of $280.

Moreover, I even have entry to some unpublished knowledge of TFFs, obtained by my private community.

- Agency #1: It has about 100 to 140 new shoppers month-to-month, with a median analysis charge of $200 and $90,000 in web yearly earnings. The corporate was established in 2023.

- Agency #2: It has about 400 to 700 shoppers month-to-month, with 20% of merchants returning and providing different merchandise (programs for a charge). The TFF was established in 2022 and was netting $460,000 yearly.

- Agency #3: It has about $14 million gross yearly, with about $7 million in web earnings. It was established in 2019, however did not develop a lot within the first 2 years.

It could be fascinating (and priceless) to research all the info TFFs have collected through the years. I hope they’re conducting this evaluation internally.

Many are looking for a brand new prop agency to get funded once more and in search of a UAE or a EU based mostly agency to really feel “protected”.

It isn’t simply the jurisdiction that issues. It is essential to know if you’re buying and selling a demo account within the title of funded account.

— BF Fx (@BrightFuture_Fx) September 2, 2023

The Supply of Income

The enterprise of working TFFs is profitable. These corporations have a number of sources of income. Nonetheless, their important income is from merchants’ analysis or audition charges, together with one-time problem charges and ongoing subscription charges (principally for Futures TFF). In addition they generate income from add-on charges (pay further to get a decrease revenue goal or improve allowable drawdown).

One other supplemental earnings supply of the TFFs are mentorship program charges (some companies supply these complimentary), introducing dealer partnerships with retail FX brokers, knowledge reselling, and markup for data-related charges.

Though the TFFs take a small a part of the revenue from the merchants, its is slightly an non-compulsory and uncommon income. Different non-compulsory income sources for TFFs are reselling of buying and selling knowledge, which can happen typically with out correct disclosures.

Revenue from proprietary buying and selling actions is uncommon, primarily as a result of the enterprise mannequin operates below the idea that analysis charges will cowl the uncommon situations of revenue withdrawals. Establishing the proprietary facet of a TFF includes expertise, capital, and essential business information. Some well-established TFFs with respectable Annual Recurring Income nonetheless do not have a proprietary buying and selling desk setup, although they might have connections with Liquidity Suppliers and have interaction in occasional hedging.

If you want to learn extra about expertise and threat administration for TFFs, go away your electronic mail on the ready listing to obtain a 50-page lengthy marketing strategy.