Roughly 50,000 Bitcoin (BTC) have been withdrawn from Coinbase on Oct. 18, making it the primary time since June that such an enormous quantity of the flagship token has left the trade.

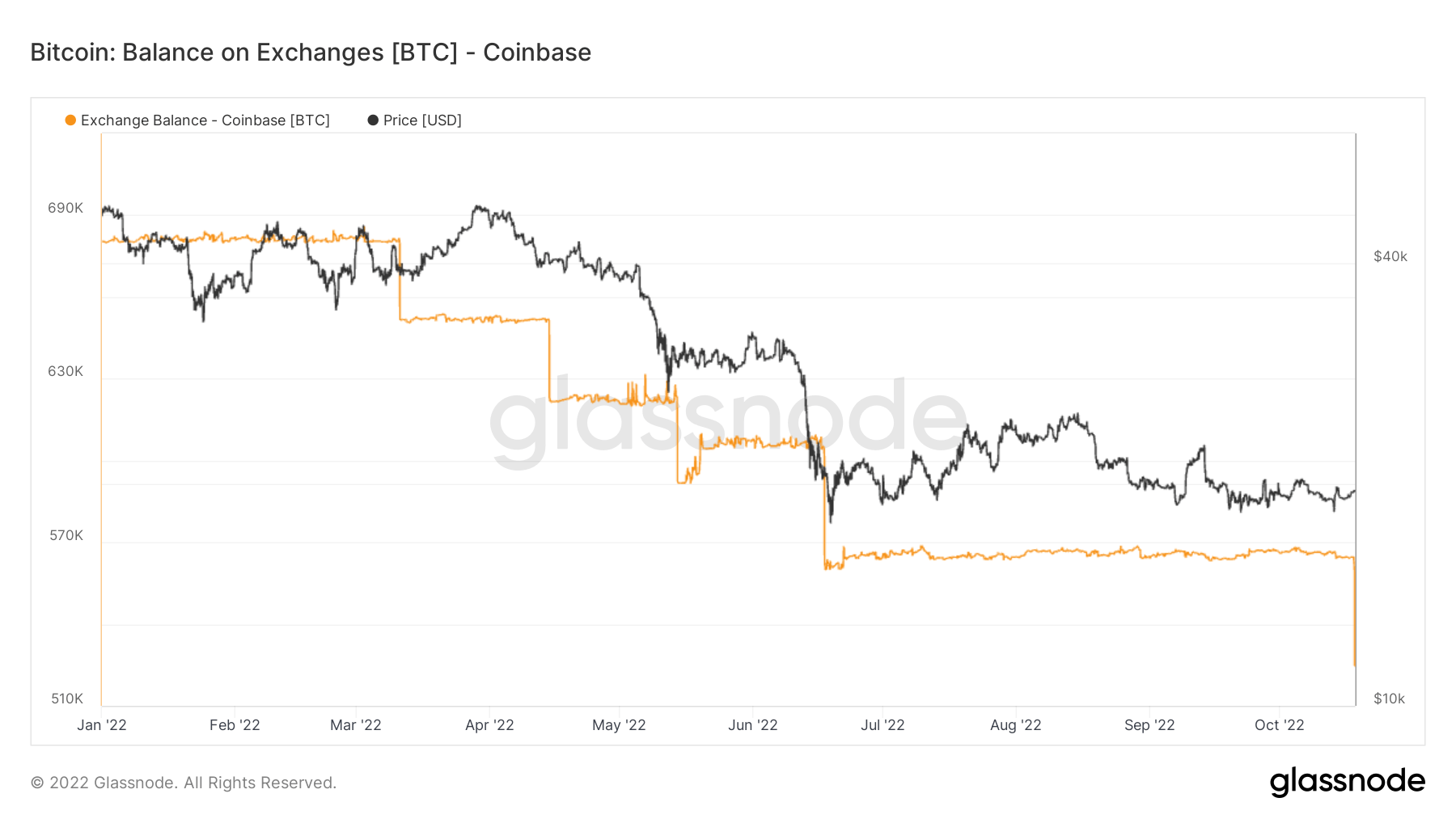

The chart under demonstrates the Bitcoin withdrawals from Coinbase for the reason that starting of the 12 months with the orange line.

Based on the chart, Coinbase has been steadily shedding its Bitcoin reserves since late March. Withdrawals solely accelerated after the Terra-Luna crash, which led to the coldest winter in crypto historical past.

This left Coinbase with round 525,000 Bitcoins in its reserve — 22% decrease than the practically 680,000 Bitcoins it held at first of the 12 months.

It’s not simply Coinbase

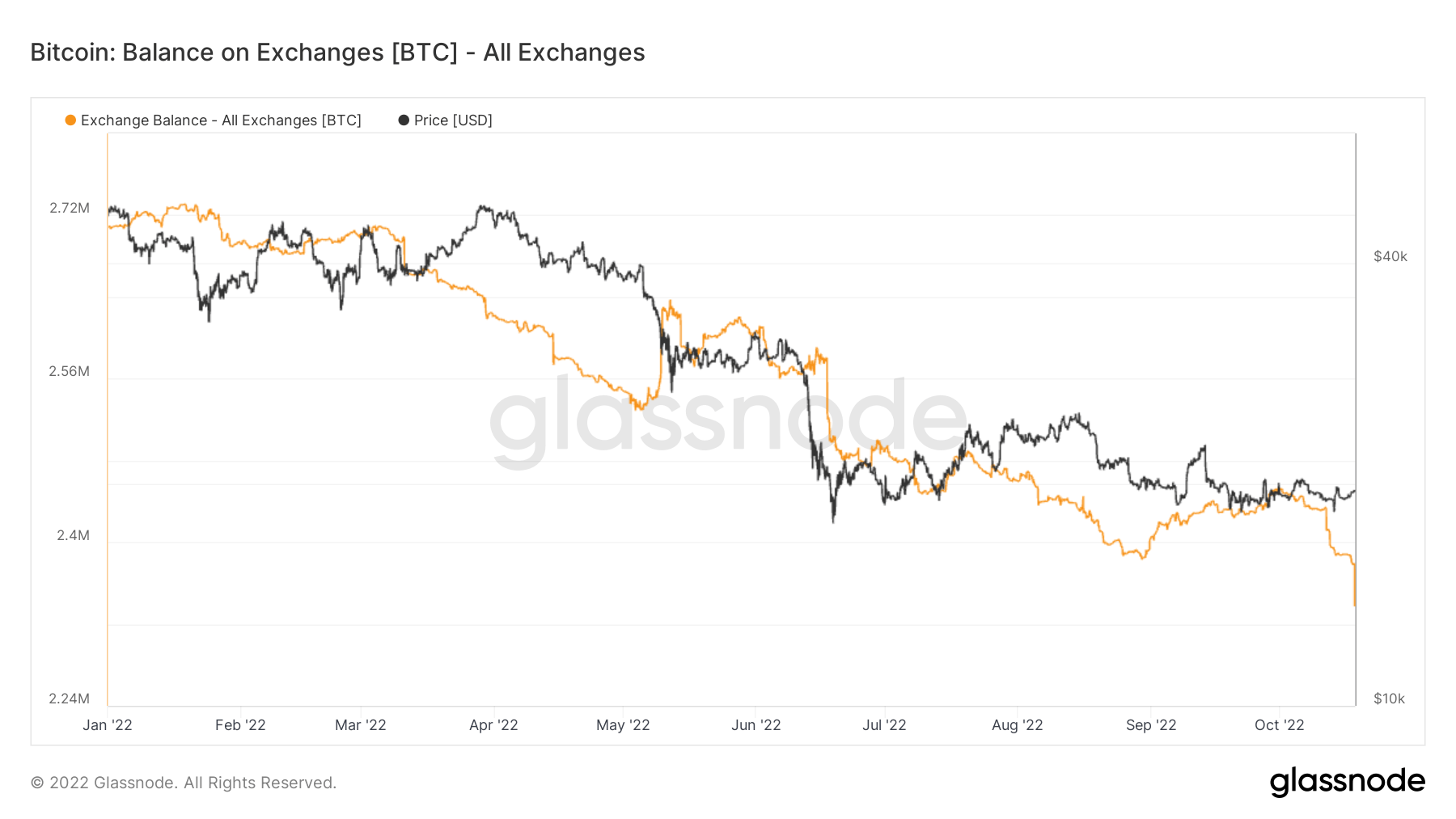

Whereas Coinbase took the latest hit, shedding Bitcoin is a standard downside of all crypto exchanges.

The chart above represents the Bitcoin balances held by all crypto trade platforms, and it exhibits a gentle lower for the reason that starting of the 12 months, in parallel with Coinbase.

Nearly 2.27 million Bitcoins have been held within the exchanges in January 2022. As of Oct. 18, the quantity stands simply above 2.23 million — 14.7% decrease than at first of the 12 months.

The lower is regular regardless of the market’s bearish sentiment, which has been dominant since Could.

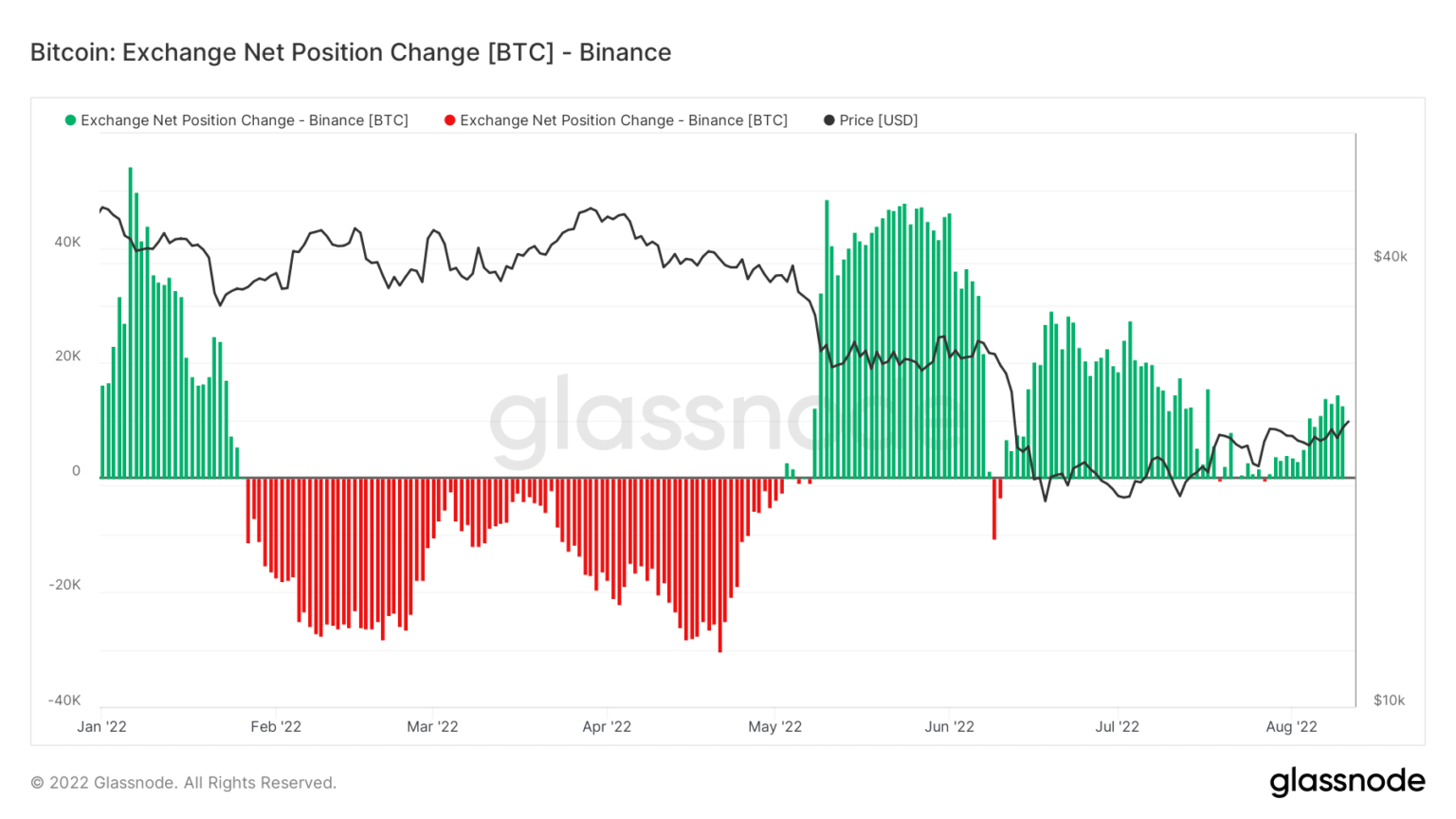

Binance is gathering

Main trade platform Binance appears to be an exception to exchanges shedding Bitcoins. Based on a CryptoSlate report from August, Binance misplaced BTC solely between February and Could.

Binance skilled main Bitcoin withdrawals simply earlier than the bear market began. Throughout February and March, which have been Binance’s shedding months, Coinbase’s Bitcoin reserves remained regular.

After the bear market hit in Could, Binance began accumulating Bitcoin, whereas Coinbase and all different exchanges misplaced important quantities of it.