Constructing on CryptoSlate’s current evaluation of the competing Bitcoin inflows and outflows between BlackRock and Grayscale, I extrapolated the information even additional to see simply how lengthy BlackRock may maintain its present common Bitcoin accumulation.

At a excessive stage, BlackRock’s entry by means of Bitcoin ETFs is a considerable second for Bitcoin’s popularity in the USA. Together with the opposite ‘New child 9‘ ETFs, BlackRock’s endorsement is more likely to lower the liquid and really liquid provides as extra buyers achieve entry to Bitcoin as a long-term funding. Additional, it’s going to enhance investor confidence for these unfamiliar with blockchain and improve the credibility of Bitcoin as an asset class, thereby affecting its liquidity and volatility profiles.

Earlier than I am going any additional, I need to add a really clear disclaimer right here. The evaluation beneath is a hypothetical take a look at potential accumulation ranges from spot Bitcoin ETFs. I’ve used the debut inflows for BlackRock because the yardstick. There is no such thing as a assure these ranges will persist, and in the event that they did, it might very seemingly end in a rise within the value of Bitcoin. The demand for Bitcoin is unlikely to stay constant at any value, so assuming the identical BTC inflows over a chronic interval is unbelievable.

That stated, wanting on the numbers from a purely theoretical standpoint does reveal some extraordinarily headline-worthy knowledge factors, which may then be used alongside different analyses to determine if and when a provide crunch is on the horizon for Bitcoin.

The longer these new ETFs proceed to accumulate Bitcoin at these elevated ranges, the higher for long-term HODLers and laser eyes.

For my part, now, greater than ever, HODLing Bitcoin has an actual function. The less Bitcoins obtainable for buy inside ETFs, the nearer we come to a MOASS (Mom Of All Provide Squeezes) the place Bitcoin moons, not as a result of shorts must cowl, however as a result of establishments have to purchase Bitcoin on the open market like the remainder of the world.

Liquidity in Bitcoin and BlackRock’s fast impression.

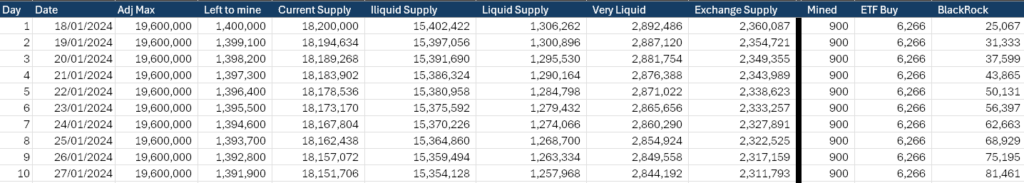

Because the debut of spot Bitcoin ETFs within the US final week, BlackRock has acquired a mean of 6,266 BTC each day for a cumulative complete of 25,067 BTC as of press time. The whole acquired by the New child 9 over simply 4 buying and selling days is now at 70,000 BTC ($2.9 Billion.) After we embrace Grayscale, the whole Bitcoin below administration is 660,540 BTC ($27.6 billion.)

To know the evaluation, I’ll first define the buckets used, as outlined by Glassnode knowledge.

“The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.”

Extra data on calculating L may be discovered on Glassnode’s weblog.

- Present Provide: The whole variety of bitcoins which were mined and are presently in circulation.

- Illiquid Provide: Bitcoins held in wallets with out vital motion, suggesting a long-term funding technique.

- Liquid Provide: Bitcoins which are actively traded or spent, indicating increased market exercise.

- Very Liquid Provide: This class represents bitcoins that aren’t simply traded however are available for buying and selling on exchanges inside a brief timeframe.

- Trade Provide: Bitcoins held in trade wallets, able to be traded or bought.

The chart beneath exhibits the totally different liquidity cohorts for Bitcoin throughout time. The illiquid provide is by far the biggest sector. Nevertheless, curiously, the extremely liquid portion is bigger than the liquid portion, indicating a dichotomy amongst buyers. Bitcoin holders are both hodlers or merchants, with only a few on the fence about whether or not to carry or transact with Bitcoin.

Now we perceive the liquidity scenario, let’s take a look at how the totally different cohorts stack up. The official max provide of Bitcoin is 21,000,000 cash. The present circulating provide is nineteen,600,000. Based on Glassnode, the whole quantity of misplaced cash is roughly 1,400,000; this contains Satoshi’s cash, amongst others. There are different increased estimates of misplaced cash; nonetheless, provided that this quantity has remained comparatively constant since 2012, I believe it’s the most dependable quantity.

Curiously, which means that after we take away the misplaced cash from the utmost provide, we find yourself with the identical quantity as the present circulating provide. Whereas that is purely coincidental for this actual second in time, it offers an concept of the way it will really feel when all of the cash have been mined, no less than by way of market liquidity. In fact, in any case cash are mined, the dearth of block rewards for miners will add one other facet to the combination I received’t get into proper now. I’ll say that I imagine charges will probably be greater than sufficient to proceed to safe the community given the present course Bitcoin is heading in.

| Metric | Worth |

|---|---|

| Max Provide | 21,000,000 |

| Present Provide | 19,600,000 |

| Adj. Max Provide | 19,600,000 |

| Adj. Present Provide | 18,200,000 |

| Illiquid Provide | 15,402,422 |

| Liquid Provide | 1,306,262 |

| Very Liquid Provide | 2,892,486 |

| Trade Stability | 2,360,087 |

The present provide will also be adjusted to take away misplaced cash. The three important cohorts to investigate are the liquidity ranges, as defined beneath, and the steadiness of Bitcoin on crypto exchanges. The whole liquid and really liquid cash quantity to only 4,198,748 BTC ($175 billion,) which accounts for round 21% of the $815 billion Bitcoin market cap.

What if BlackRock retains shopping for up all of the Bitcoin?

Now, for the enjoyable half that you’re all studying for What if BlackRock inflows had been to proceed on the stage seen throughout its debut? Whereas some have bemoaned the launch of spot Bitcoin ETFs as a failure, and Bitcoin’s value has even dropped to $41,300 from its current excessive of practically $49,000, I believe they are going to certainly find yourself with the ‘egg on their face,’ as we are saying within the UK. Right here’s why!

At the moment, 900 new Bitcoins are mined each day, and this may drop to 450 BTC round April 18, 2024. Moreover, as I stated beforehand, BlackRock is buying round 6,266 BTC each day. If BlackRock had been to try to purchase straight from miners, this may result in a internet deficit of 5,266 BTC.

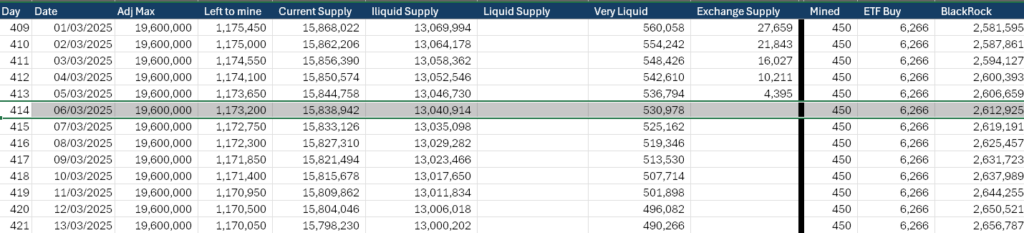

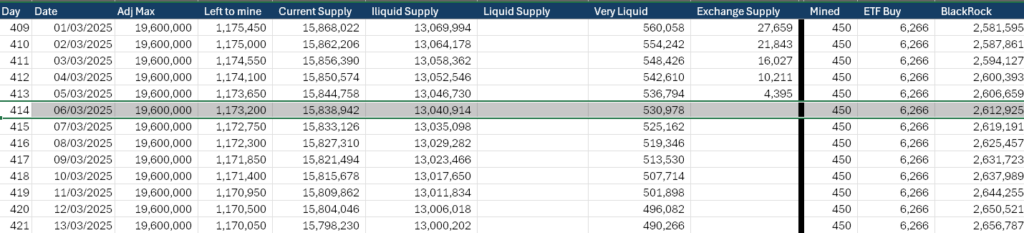

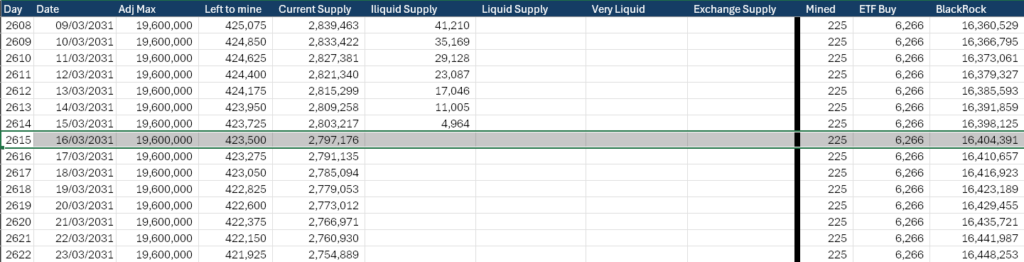

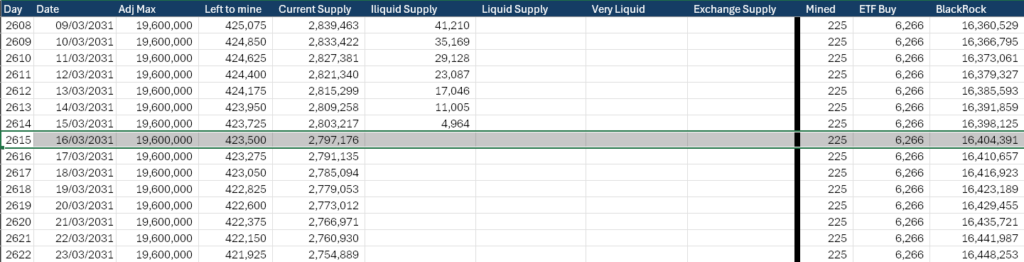

So, it must get Bitcoin from some place else. Thus far, the Coinbase OTC desks have had enough liquidity to take in the requirement. Nevertheless, this can not final eternally; there is no such thing as a infinite liquidity. The desk beneath exhibits what would occur if BlackRock purchased from every cohort with miner participation.

At its present fee, over the subsequent 10 days, BlackRock would obtain round 81,481 BTC with little to no vital impression on any cohort. So, the launch is a failure?

I don’t suppose so.

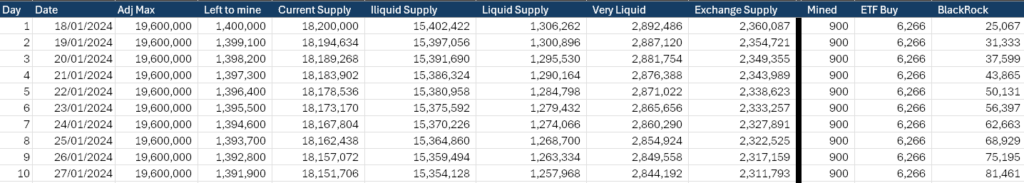

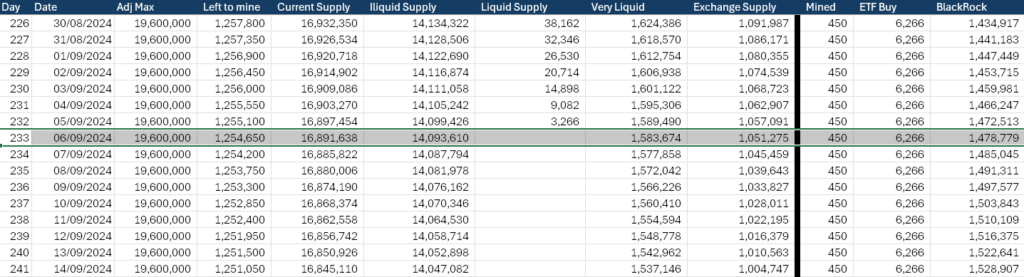

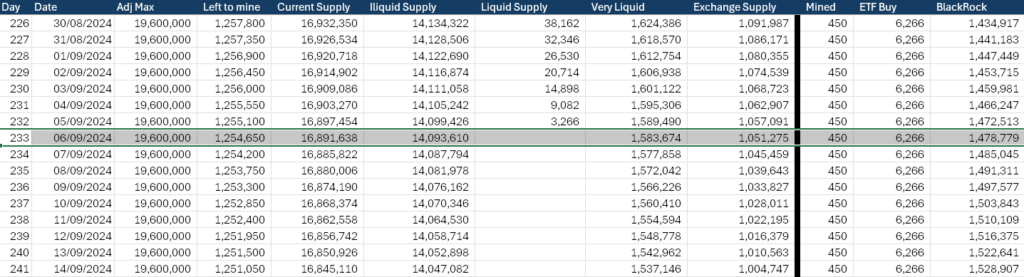

If we lengthen this all the way down to Sept. 6, 2024, and BlackRock is just shopping for from the liquid provide, with miners including to this cohort and decreasing the impression, the whole cohort can be absorbed.

Let’s keep it up.

To maintain it good and clear, every desk going ahead will probably be below the next hypothetical state of affairs.

What if BlackRock purchased completely from this cohort on the fee it has throughout the first 4 days and newly mined Bitcoin was additionally included, thus decreasing the impression of BlackRock’s shopping for?

By March 3, 2025, the Bitcoin held on exchanges can be gone, and BlackRock would have 2.6 million BTC.

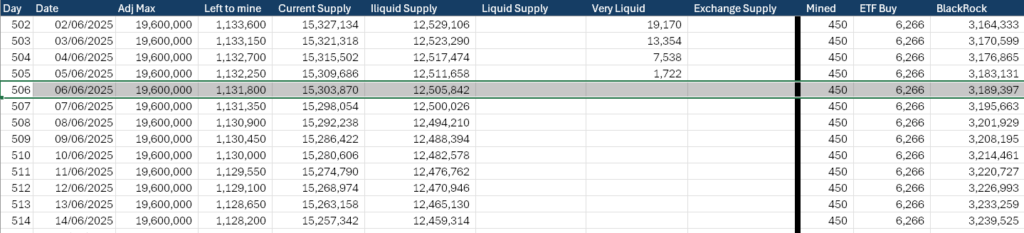

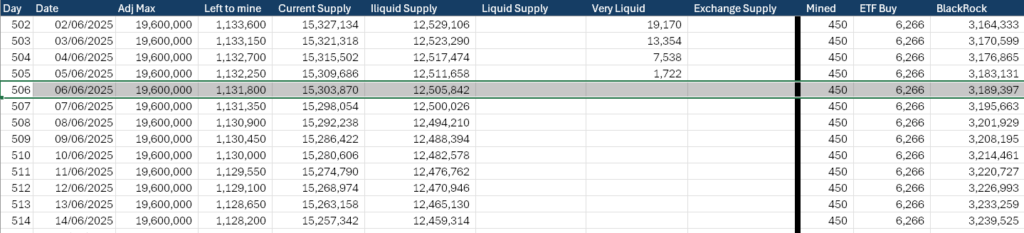

The ‘very liquid’ cohort can be absorbed by June 6, 2025. This group might be essentially the most simply accessible for BlackRock to search out liquidity, and it’s nonetheless simply 18 months away.

In simply eight years, by 2032, BlackRock’s Bitcoin holding can be price $686 billion by right now’s requirements and encompass 16,404,391 BTC. This may require it to have discovered a manner to purchase the entire Bitcoin from the ‘illiquid’ provide and provides it round 79% of all Bitcoin in circulation below administration.

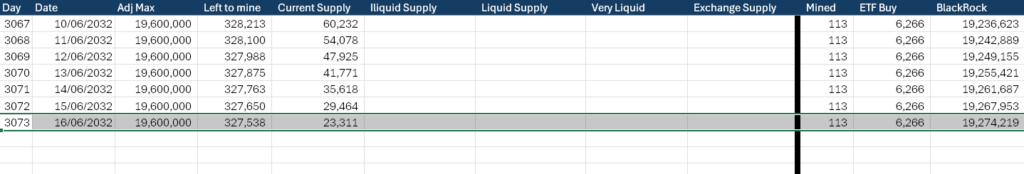

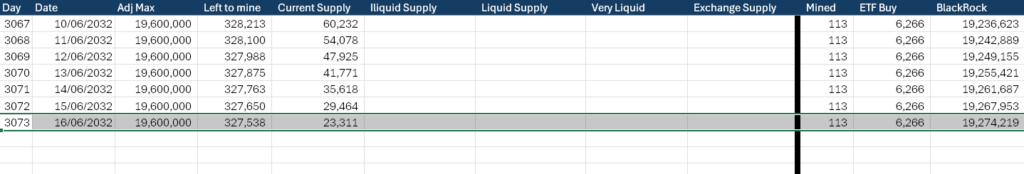

Lastly, in simply 3,073 brief days, on June 16, 2032, BlackRock would have purchased the entire Bitcoin in circulation and at last must cease its 6,266 BTC per day buy. Going ahead, there would solely be 113 BTC obtainable every day from newly mined Bitcoin, of which there can be 327,538 BTC left to mine.

In fact, few of the above situations are going to occur. BlackRock is unlikely to have the ability to maintain these ranges of inflows in Bitcoin phrases with out Bitcoin’s value both falling considerably or demand growing together with value.

For instance, 6,266 BTC is price $262 million at $41,840 per Bitcoin. At $200,000, this quantity turns into $1.25 billion each day. Conversely, at $10,000, it is just $62.6 million.

So except Bitcoin stays round $40,000 for the subsequent eight years, BlackRock is ready to persuade buyers to purchase its ETF on the similar tempo, and it could actually discover HODLers keen to promote, we aren’t going to see BlackRock take custody of all of the Bitcoin.

Nevertheless, we will now begin to see what kind of an impression constant Bitcoin ETF inflows can have on totally different elements of the availability. Personally, my Bitcoin is illiquid and stays that manner. I see the advantages of spot Bitcoin ETFs, and I additionally see the provide crunch that’s coming in some form or type. Positively not right now, most likely not this quarter, however after that…

CryptoSlate will proceed to dig into the numbers and nerd out on chain for you, so in case you loved this exploration into Bitcoin provide, please tell us on our X account @cryptoslate or attain out to me straight @akibablade.