Be a part of Our Telegram channel to remain updated on breaking information protection

The Worldwide Financial Fund (IMF) has laid out the final framework for a brand new class of cross-border fee methods. The system employs a single ledger to trace transactions utilizing central financial institution digital currencies (CBDCs), programmability, and enhanced knowledge administration.

A Bridge for Safer and Sooner Worldwide Transactions

Usually, it’s simpler to make funds inside a rustic than it’s throughout worldwide borders. The method of transferring cash between nations may be very complicated as a result of variations within the legal guidelines that apply in addition to the dearth of a single system to facilitate the method.

Ultimately, cross-border funds are very costly and take plenty of time to finish. Nations increased up within the financial ranks have tried to streamline the method for his or her residents however most individuals in different nations nonetheless endure by the method.

.@KGeorgieva participated within the Excessive-level Coverage Roundtable on Central Financial institution Digital Currencies in Rabat 🇲🇦.

Learn her press assertion on the significance of collaboration throughout establishments for realizing CBDC advantages & fee system interoperability: https://t.co/8L3E3LK119 pic.twitter.com/8jGqpJPwU4

— IMF (@IMFNews) June 19, 2023

To make such transactions simpler, the IMF believes that new platforms for cross-border CBDCs could be simpler and safe whereas nonetheless guaranteeing that nations can implement compliance checks and capital controls.

On Monday, the IMF offered its new platform idea throughout a roundtable on CBDC coverage. Tobias Adrian, the director of the IMF’s division of financial and capital markets, mentioned through the occasion, that the brand new form of platform might assist each particular person and institutional customers by providing decreased charges and faster transaction occasions.

Adrian acknowledged that a worldwide CBDC platform that enables for capital controls might cut back fee prices. He, nevertheless, clarified that such an idea may be very completely different from the decentralized monetary methods that cryptocurrency lovers envision.

“The fee, sluggishness, and opacity of cross-border funds comes from restricted infrastructure,” Adrian mentioned on the occasion which was organized in partnership with the central financial institution of Morocco. He added:

“Our blueprint for a brand new class of platforms would improve and guarantee better interoperability, effectivity, and security in cross-border funds, in addition to in home monetary markets.”

Based on Adrian, the platform which was named the XC (cross-border fee and contracting) would additionally help central banks in mediating in overseas change markets, compiling knowledge on capital flows, and resolving disputes.

IMF’s XC Platform

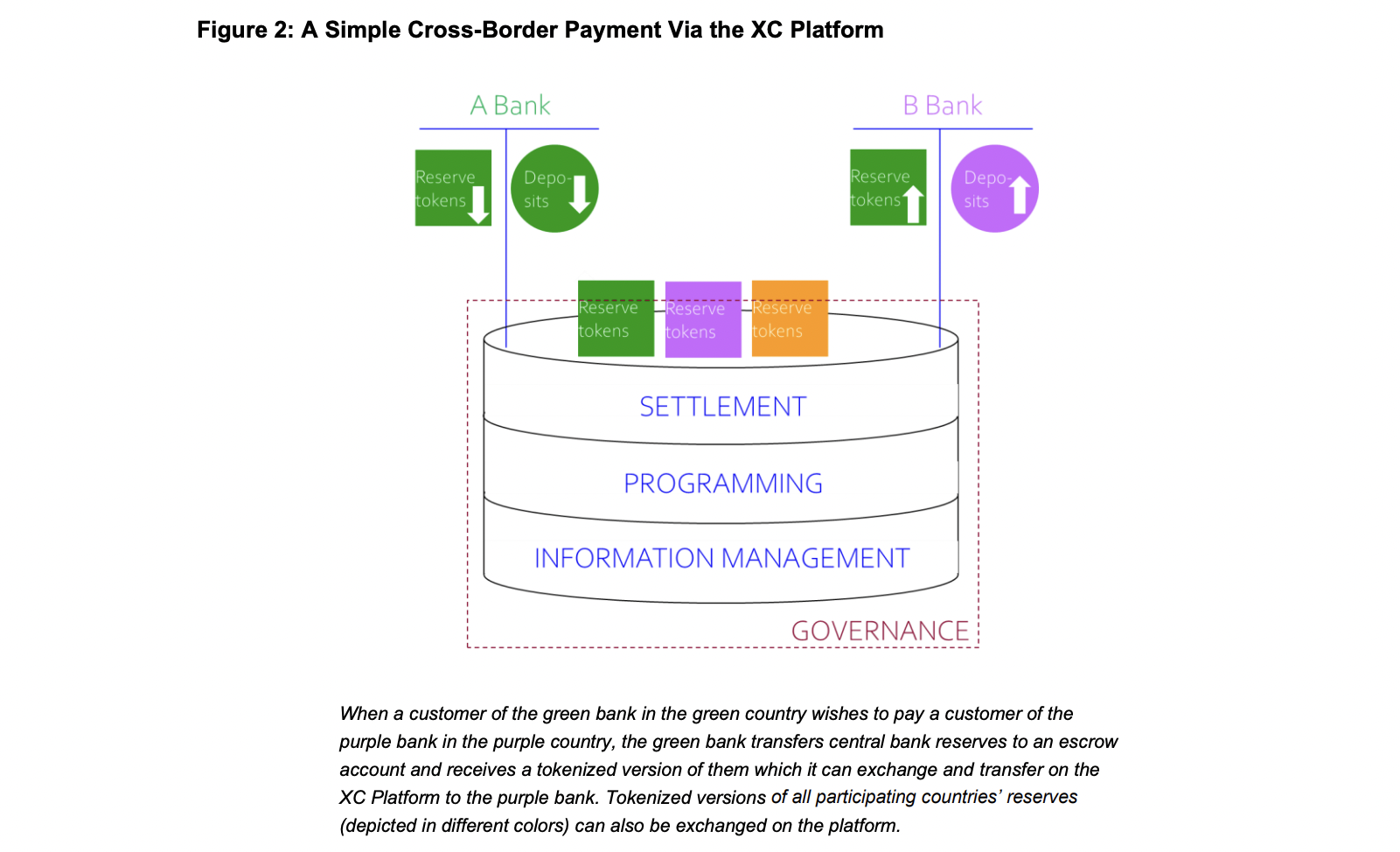

The XC platform was designed with inspiration from the CBDC infrastructure mannequin. The in-depth particulars of its functioning are mentioned in an IMF FinTech Notice dubbed “The Rise of Cost and Contracting Platforms” that was printed on Monday.

Nonetheless, Adrian defined that the XC platform can have a settlement layer with a single ledger. The one ledger would guarantee there’s a distinctive description of who owns what, so no double spending can happen.

XC can have an data layer that can include the anti–cash laundering data required to fulfill belief necessities and supply privateness protections. Moreover, a programming layer would current the prospect to innovate and modify companies.

To facilitate cross-border funds on the platform, the IMF selected central financial institution reserves which it proposes needs to be digitized to make them interchangeable between nations.

As such, collaborating banks might be required to have a reserve account with their nation’s central financial institution.

“To make a fee, collaborating banks would deposit their home central financial institution reserves in an escrow account managed by the platform operator, and in return get hold of a digital model to commerce on the platform,” Adrian mentioned.

Primarily based on the thought offered, one would surprise why the IMF didn’t implement the platform on the already present blockchain platforms that are decentralized and know no jurisdictions.

Nonetheless, the IMF within the launched doc, acknowledged that blockchains have “essential limitations” when it comes to validator charges, safety, effectivity, and privateness. The doc argued that Ethereum‘s proof-of-stake know-how is pricey and unproven, whereas Bitcoin-style proof-of-work know-how makes use of plenty of power.

To allow nations to keep up management over monetary actions of their jurisdiction, governments will maintain the best to restrict their residents’ transactions in overseas forex in addition to impose anti-money laundering checks.

Associated articles

Wall Avenue Memes – Subsequent Large Crypto

- Early Entry Presale Dwell Now

- Established Neighborhood of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Greatest Crypto to Purchase Now In Meme Coin Sector

- Group Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection