The crypto derivatives market has grown so huge up to now few years that it may be used as an indicator of future worth actions. Bitcoin choices have captured the crypto trade and have shortly became mature merchandise whose actions have the ability to sway the remainder of the market.

Identical to within the conventional monetary market, Bitcoin choices grant their holders the correct, however not the duty, to purchase BTC at a preset worth on the contract’s expiration date. Choices are often priced utilizing a metric referred to as implied volatility (IV), which reveals the market’s view of the chance of modifications in a given safety’s worth.

Implied volatility (IV) is commonly utilized by buyers to estimate future volatility in a safety’s worth. Nevertheless, whereas IV can predict worth swings, it may well’t predict the path through which the value will go. Excessive implied volatility means there’s a excessive likelihood of a giant worth swing, whereas low IV implies that the value of the underlying asset almost certainly received’t change.

As such, IV is taken into account proxy of market threat.

Trying on the implied volatility for Bitcoin reveals that the market sees little threat in BTC.

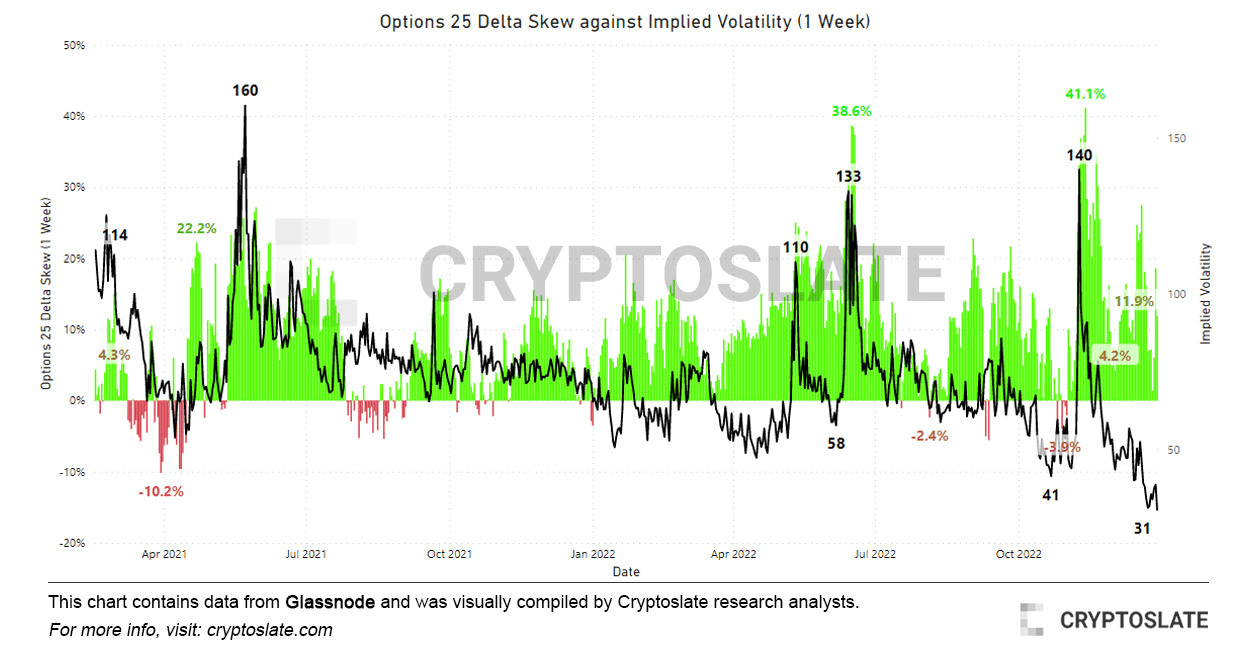

Bitcoin’s implied volatility presently stands at a two-year low. The sharp drop in IV has traditionally adopted aggressive spikes attributable to black swan occasions — spikes have been seen in the course of the 2021 Defi Summer time, the Terra collapse in June 2022, and the FTX downfall in November 2022.

Nevertheless, the drop in implied volatility seen on the finish of 2022 reveals that the derivatives market sees no main worth actions within the close to future.

Evaluating Bitcoin’s implied volatility with the choices 25 delta skew additional confirms this.

When utilized to choices contracts, skew measures the implied volatility between totally different strike costs with the identical expiration. Put merely, it presents the ratio between put and name choices. Delta is a measure of change in an choice’s worth ensuing from a change within the underlying safety.

The 25 delta skew appears to be like at places with a delta of -25% and calls with a delta of 25%, netted off to reach at an information level. A 25-delta put skew of -25% implies that the put choice prices 25% lower than the spot worth of the underlying asset, and vice versa.

The metric primarily measures how delicate an choice’s worth is to modifications in Bitcoin’s spot worth. Information analyzed by CryptoSlate reveals that the premium for put choices has come down from excessive ranges recorded in November and June. Spikes within the 25 delta skew are often a stable gauge for bear markets as they correlate with excessive bouts of worth volatility.

December introduced on a pointy drop within the 25-delta skew, which noticed a slight improve within the first few days of 2023. Identical to the drop in implied volatility, this means a a lot calmer market within the days and weeks to come back.