A brand new report by the Financial institution of Indonesia highlights the nation’s 2023 financial development plan which can embody the digitalization of fee methods and the creation of a Digital Rupee. This may comprise growing the supply and use of digital funds, akin to e-wallets and on-line banking. The federal government has been actively selling the usage of digital funds for the reason that launch of the nationwide e-payment system, the Nationwide Cost Gateway (NPG), in 2019.

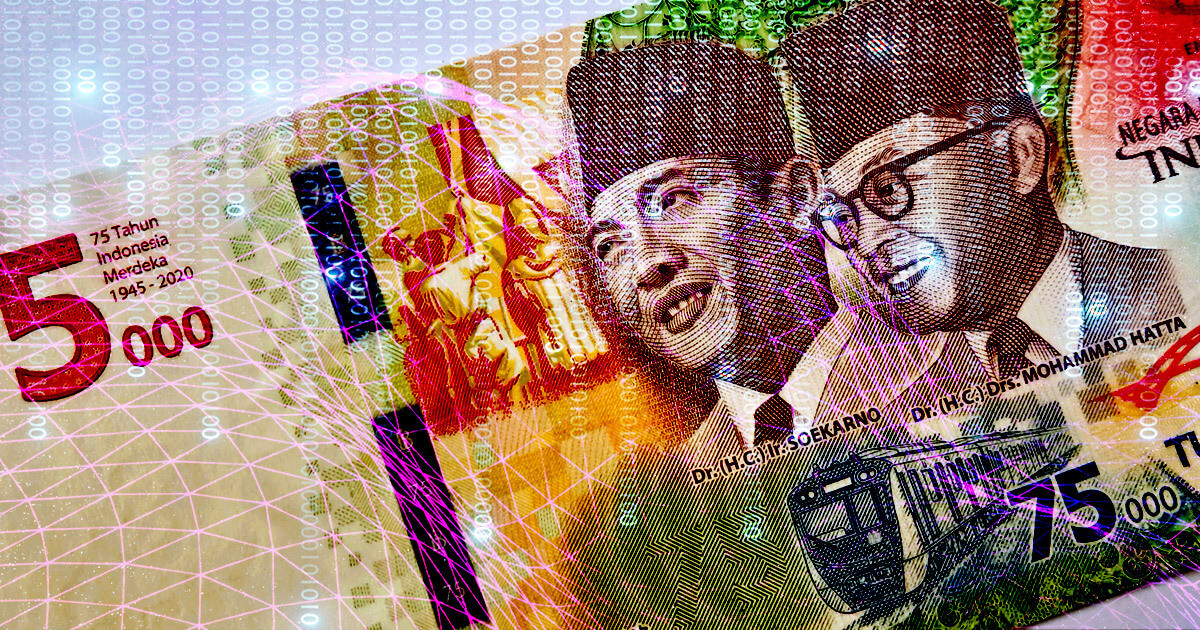

The Indonesian authorities additionally introduced plans to roll out a Digital Rupee in 2023 in an effort to spice up the nation’s financial development. The Digital Rupee, which is predicted to be launched quickly by a venture code-named “Mission Garuda”, shall be a digital foreign money issued and managed by the nation’s central financial institution, Financial institution Indonesia.

The Digital Rupee is designed to advertise monetary inclusion and spur financial development by offering entry to digital fee providers for people, companies and different stakeholders. It’s also anticipated to cut back transaction prices and simplify funds.

Indonesia is using a three-pronged method to constructing a dependable digital fee system

Based on the Central Financial institution’s report, the federal government will make use of a three-pronged method to constructing a nationwide digitized monetary infrastructure.

To begin with, the Financial institution of India will design a basis upon which the complete construction of the fee system will lie and shall be impressed by honest regulatory practices, innovation help and end-to-end consolidation. Second, the establishment will construct an interoperable, interconnected and built-in fee system infrastructure. This is not going to solely speed up inclusion but in addition reduce the prices of transactions throughout the fee market. Lastly, the central financial institution will push ahead honest market practices and go on to construct an equitable marketplace for the funds business.

An built-in and interoperable fee system will make it doable for the deployment of the Digital Rupee, which shall be accessible by cellular wallets and banks for permitting customers to make funds and transfers simply and conveniently by the blockchain

The federal government hopes that the Digital Rupee will assist promote monetary literacy, scale back transaction prices and promote financial development. The federal government has additionally introduced plans to encourage the usage of the Digital Rupee by offering incentives and subsidies to companies that settle for it as a type of fee. As well as, it’s hoped that the Digital Rupee will assist to cut back the danger of fraud and cash laundering.

The federal government has set a objective of getting a minimum of 10 p.c of all funds made digitally by 2023. To realize this objective, it’s working to broaden entry to digital fee providers, improve digital literacy, and promote the usage of digital funds by public consciousness campaigns and incentives.

Moreover, the federal government is investing in infrastructure and know-how to make digital funds safer and environment friendly. A part of the roadmap is concentrated on the event of digital fee methods for small and medium-sized enterprises, in addition to for giant enterprises.