Intel introduced the tip of first-gen Blockscale 1000-series Bitcoin-mining ASICs on April 18, regardless of the chips contributing each effectivity and an increase in income in 2022 — up from 2021.

The announcement — initially reported by Tom’s {Hardware} — cited “a tighter deal with its IDM 2.0 operations” because the rationale behind the choice to discontinue the chips.

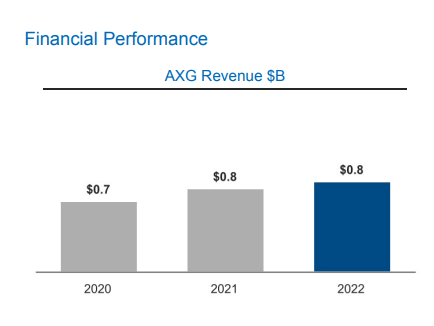

Nonetheless, the chip was a part of the Accelerated Computing Methods and Graphics Group (AXG) income section — which registered a $63 million improve in 2022 compared to 2021.

Environment friendly however not cost-efficient

Intel Blockscale 1000-series chips have been deployed by a minimum of one public Bitcoin (BTC) mining firm via 2022 and proven to be each environment friendly and worthwhile.

In December 2022, Canadian Bitcoin mining agency Hive Blockchain mined a complete of 213.8 BTC — value $3.15 million — using Intel Bitcoin-mining ASICs to take action.

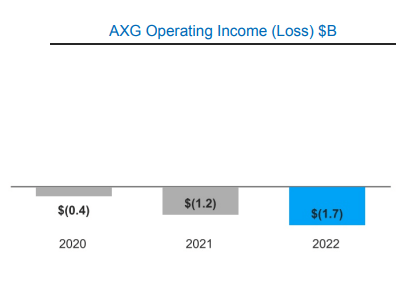

Nonetheless, regardless of the advance in effectivity and profitability provided by Intel’s Blockscale 1000-series chips, Intel working revenue prices 12 months-on-12 months (YOY) elevated virtually 50% to $1.7 billion in 2022, from $1.2 billion in 2021.

These working prices have been “because of elevated stock reserves taken and investments” in Intel’s product roadmap, in line with the corporate’s annual report.

Committing to “delivering 5 know-how nodes in 4 years” in 2022 — certainly one of which was the primary Intel Blockscale ASIC — Intel sought to speed up its IDM 2.0 technique by “investing in manufacturing capability around the globe.”

Intel famous that its 2022 outcomes have been “impacted by an unsure macroeconomic surroundings arising from inflation, the struggle in Ukraine, and COVID-19 shutdowns in [its] provide chain in China.”

Causation of the discontinuation

Intel’s reasoning behind the discontinuation of its Bitcoin-mining chips is supported by the additional $500M in working prices YoY in 2022 — lending additional rationale to the finality of the corporate’s choice.

As regards to the IDM 2.0 technique, the agency mentioned:

“Although we aggressively adjusted capital investments in 2022 to reply to altering enterprise circumstances, we nonetheless made vital investments in assist of our IDM 2.0 technique throughout the 12 months.”

The put up Intel Bitcoin mining chips discontinued regardless of chip effectivity, $63M income increase in 2022 appeared first on CryptoSlate.