Fast Take

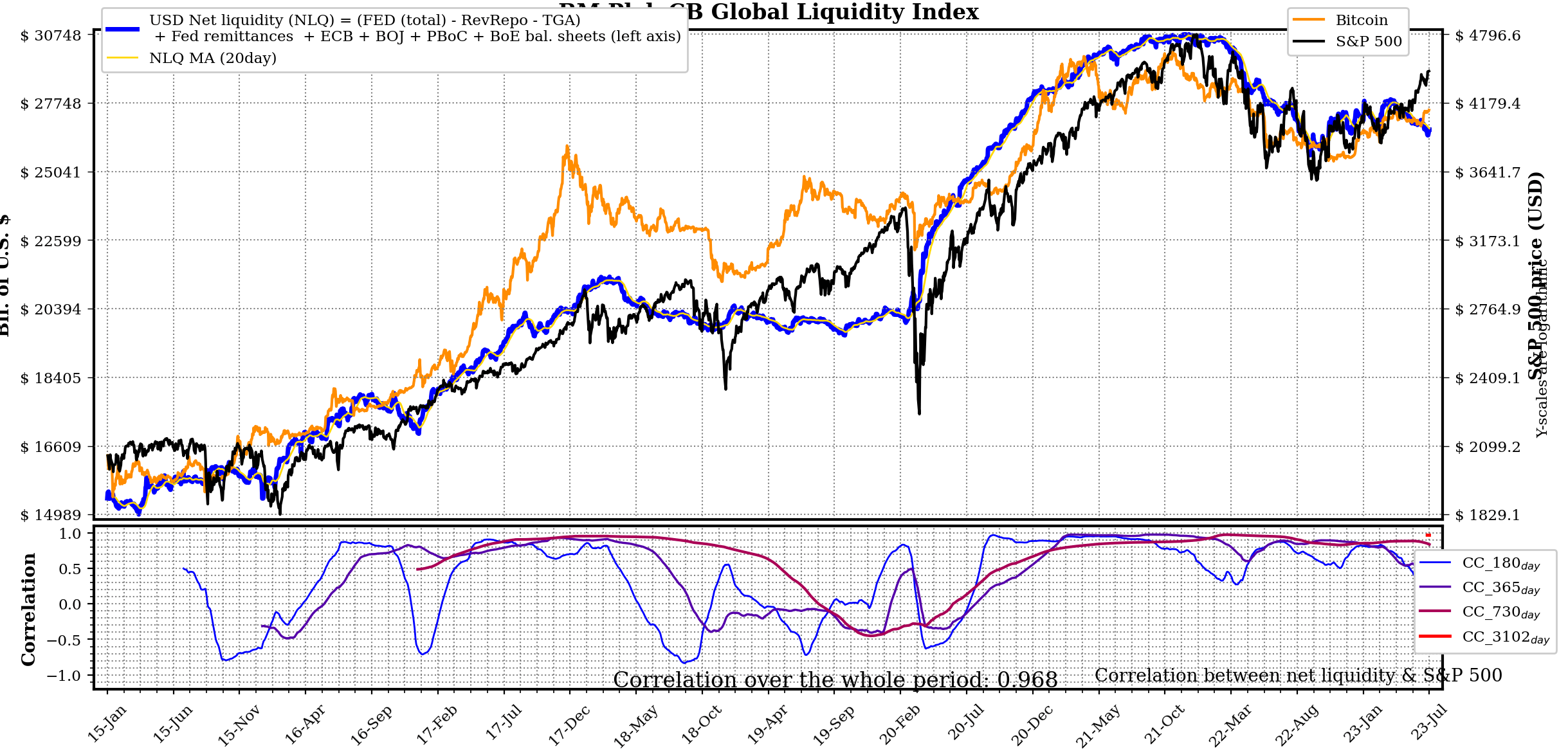

Understanding international liquidity is essential in monetary evaluation, because it offers insights into the accessible monetary sources for funding. It includes a number of elements, together with:

- Federal Reserve (Fed) Stability Sheet

- Reverse Repurchase Agreements (Reverse Repo)

- Treasury Common Account (TGA)

- Fed Remittances

- Stability sheets of main central banks: Financial institution of Japan (BOJ), European Central Financial institution (ECB), Individuals’s Financial institution of China (PBoC), and Financial institution of England (BOE).

In 2023, the Fed’s stability sheet has solely decreased by about 2%. A significant part is the reverse repo operation, which the Fed makes use of to regulate money within the monetary system and regulate inflation. In the meantime, the TGA, which funds authorities expenditures, performs a job in how a lot cash flows into the financial system.

An important side of the Fed’s stability sheet is the remittances to the TGA, which represents the Fed’s earnings. Regardless of current losses, any shortfall is recorded as a “deferred asset,” symbolizing a declare on future earnings.

Central banks of different main economies are additionally experiencing a decline of their stability sheets this 12 months attributable to quantitative tightening:

- ECB: -1.67%

- BOE: -1.79%

- Fed: -1.97%

- BOJ: -7.18%

- PBoC: -8.48%

Apparently, we observe a major divergence between the S&P 500, Bitcoin, and international liquidity. Since 2015, these have been tracked at a excessive correlation of 0.968. Present variations could also be as a result of hype round AI and the announcement of the BlackRock ETF submitting.

The submit International liquidity tightens amid central banks’ stability sheet contraction: impression on S&P 500 and bitcoin appeared first on CryptoSlate.