With the crypto trade struggling by a document bear market state of affairs, one asset that has polarized analysts is Coinbase inventory which has fallen to new lows.

Bitwise Make investments Chief funding officer Matt Hougan thinks Coinbase inventory is undervalued regardless of falling considerably in 2022.

In line with Hougan, Coinbase raised cash at a valuation of $8 billion in 2018. On the time, it had 22 million customers, generated $520 million in income, and had $11 billion in belongings on the platform.

Quick ahead to 2022, the income is $3.3 billion, it has 101 million customers, and the platform’s belongings at the moment are $101 billion. Regardless of these clear indications of development, the corporate is buying and selling at a valuation of $9 billion.

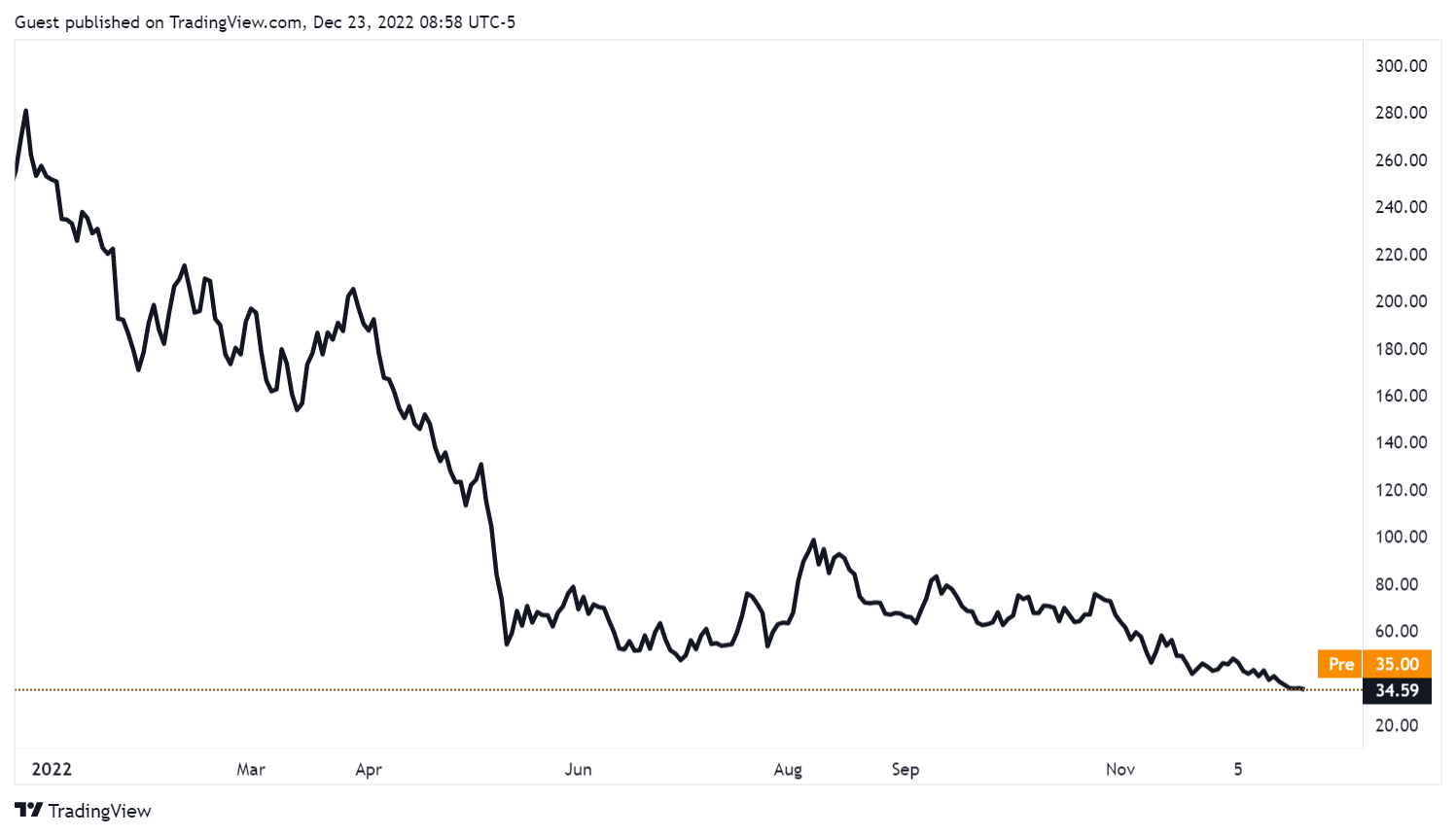

Coinbase inventory is at an all-time low

Coinbase shares have fallen for the reason that begin of the 12 months, buying and selling round $35 as of press time. This represents a greater than 86% drop within the year-to-date metric.

Following its inventory worth decline, the alternate’s market cap dropped to round $8 billion, whereas even Dogecoin’s market cap surpassed it at $10 billion. Whereas this doesn’t mirror the alternate’s intrinsic worth, it exhibits how the present market circumstances have affected it.

Analysts have tied its inventory decline to a number of elements, which included the present crypto winter and the truth that the alternate has been burning by money at a document tempo. Through the first three quarters of 2022, the alternate recorded over $2 billion in losses.

Coinbase’s main income supply is from buying and selling charges, and the present market has impacted that. Whereas it has extra prospects, buying and selling charges are decrease as a result of crypto asset values are down. Rivals like Binance.US have additionally tried to entice merchants with new options like zero-trading charges for belongings like Bitcoin (BTC).

CEO Brian Armstrong advised Bloomberg that he expects the alternate’s income to drop by as a lot as 50% within the present 12 months.

Business views

Some assume Coinbase is overvalued, pointing to its money burn, lack of serious enhancements over time, and worker inventory compensation. A number of market analysts have downgraded the inventory. Mizuho just lately downgraded the inventory to underperform, setting a $30 worth goal.

Earlier than then, the Financial institution of America had downgraded the inventory from Purchase to Impartial, setting a $50 worth goal. It famous that whereas the alternate is nothing like FTX, the fabric decline within the worth of Bitcoin will have an effect on its shares.

Many within the crypto neighborhood additionally share this view, noting that Coinbase was overvalued in 2018. Lazar Wolf tweeted that E*Commerce offered for two.5% of its belongings underneath administration, whereas JP Morgan is valued at round 10% of its AUM.

Wolf added that he was a sequence C investor within the alternate and dumped all his shares final 12 months at $340.

Bullish views stay

In the meantime, regardless of the pessimism shared by some analysts, others share Hougan views.

21.co CEO Hany Rashwan expressed the idea that Coinbase shares are undervalued. In line with him, though Coinbase has misplaced some huge cash this 12 months, it has doubled its share of the fiat alternate market since September.

Rashwan stated that anybody who believes in crypto’s long-term potential and values Coinbase’s current development charges and market share would see the one or two years of poor market circumstances as an aberration. He added:

“They’re dropping some huge cash, sure. They need to clearly scale back these losses, however I nonetheless see a essentially good enterprise beneath.”

In the meantime, Coinbase CEO Brian Armstrong insists that the corporate will nonetheless exist within the subsequent twenty years and believes traders can purchase COIN inventory simply as they purchase crypto belongings. Armstrong stated:

“We’ll even be a beneficiary of elevated regulation and diversifying our income stream away from buying and selling charges.”