Seven days after the brand new Bitcoin ETFs launched, I analyzed how they might put stress on Bitcoin’s provide dynamics in an article known as “If BlackRock continues 6k BTC day by day buys, we get a provide crunch inside 18 months; right here’s why.’ On the day of publication, Jan. 18, Bitcoin closed at $41,248 after falling from a excessive of $49,000 on Jan. 11. Since then, the flagship digital asset has soared 37% to interrupt $57,000.

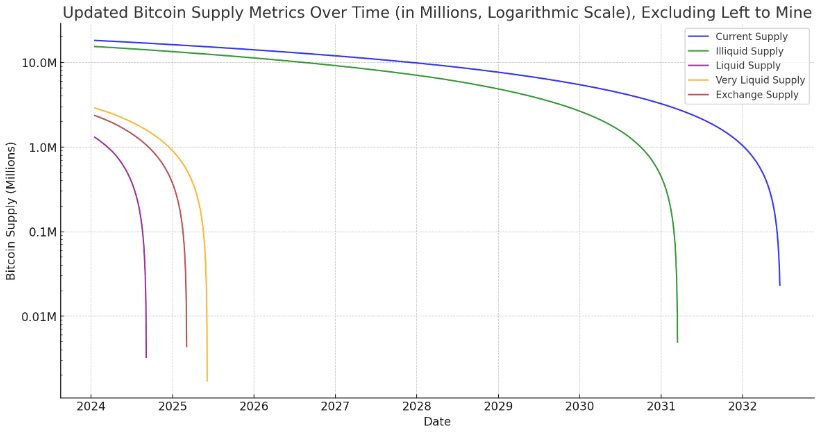

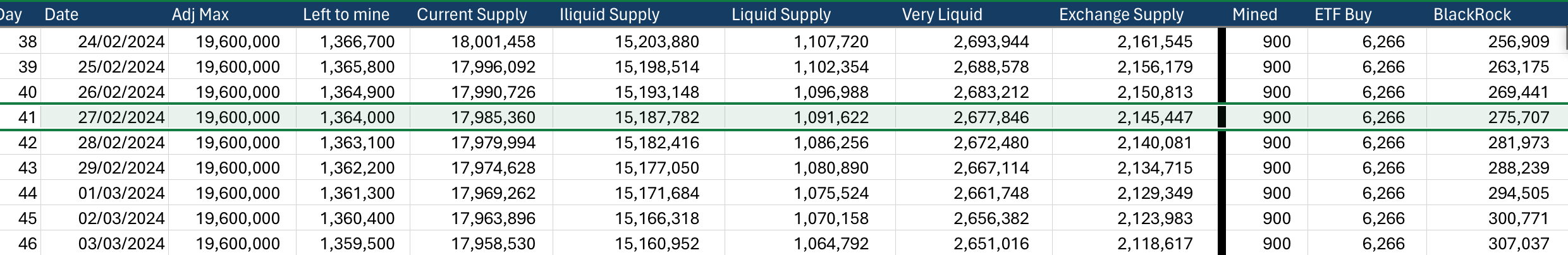

Whereas Bitcoin had fallen constantly after the ETF launched, CryptoSlate famous the persistent BTC inflows, which, on the time, averaged round 6,266 BTC per day for BlackRock alone. The evaluation recognized that had been such inflows proceed, the liquid provide of Bitcoin may very well be absorbed this yr, with the trade balances or very liquid provides targetable by mid-2025.

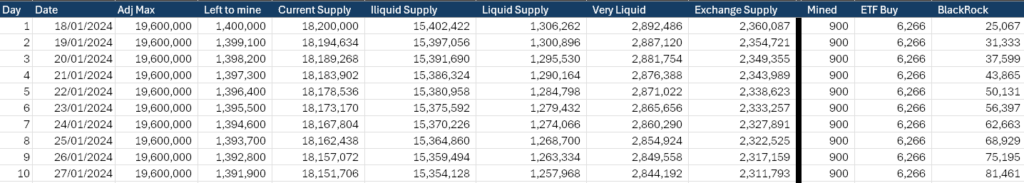

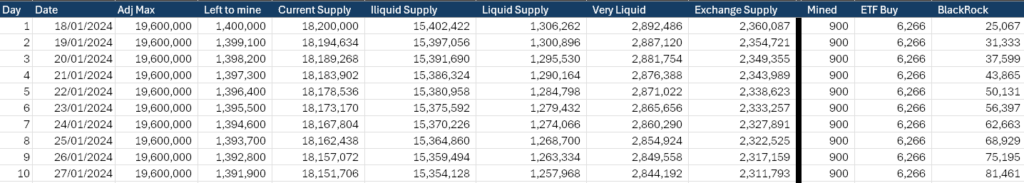

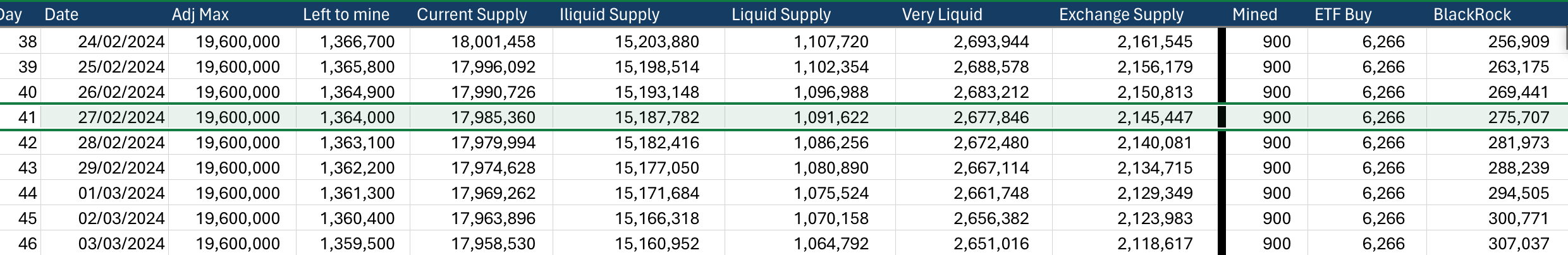

As famous on the time, the evaluation was purely hypothetical and didn’t contemplate the outflows from Grayscale GBTC. Moreover, it solely checked out BlackRock, the most important fund’s inflows, to simplify the info at that time. The train aimed to emphasise the potential for a provide squeeze and the shortage of liquid Bitcoin to facilitate persistent ETF stress on the provision. On Jan. 18, BlackRock had 25,067 BTC underneath administration, valued at $1 billion.

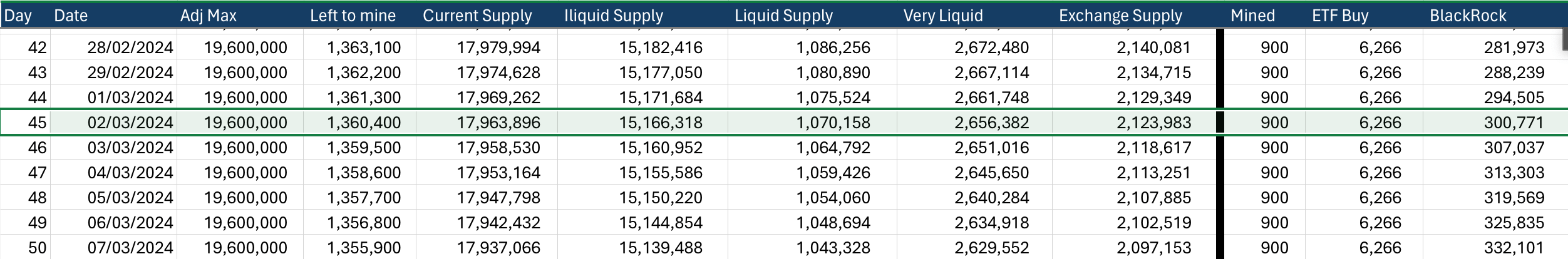

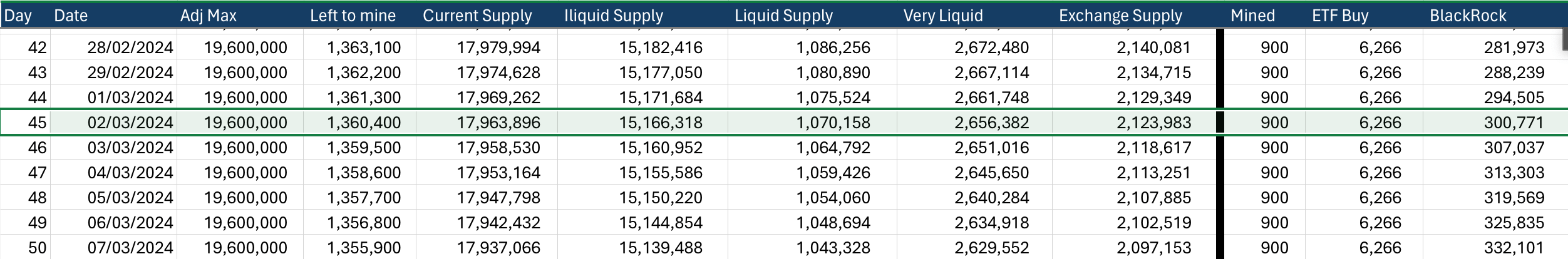

Curiously, whereas the inflows into BlackRock didn’t keep the 6,266 BTC day by day common stress, inflows into the New child 9 have surpassed this stage. BlackRock presently has 130,231 BTC underneath administration, whereas the fund would have 275,707 BTC if it continued at 6,266 BTC day by day. Nonetheless, on Jan. 18, 6,266 BTC was valued at $258 million, which might now signify an influx of $357 million, given the dramatic value surge.

It’s essential to keep in mind that the spot Bitcoin ETFs are bought with {dollars} and denominated in {dollars} in a brokerage account. Thus, whereas inflows into the ETF have been constant in greenback phrases, they’ve been diminished by way of Bitcoin purchases.

Throughout the New child 9, 303,002 BTC is now held underneath administration per K33 Analysis. Trying on the CryptoSlate desk used for the Jan. 18 article, this aligns with inflows projected for BlackRock by March 2, 2024.

Utilizing this knowledge, ought to the New child 9 proceed to soak up Grayscale’s declining outflows and buy further Bitcoin from the broader market at this tempo, 1 million BTC may very well be underneath administration by June. Additional, this fee would swallow the BTC equal of your entire present liquid provide of Bitcoin (roughly 1.3 million BTC) by September.

On Feb. 8, I mentioned the potential for the ‘Mom of all Provide Squeezes‘ for Bitcoin, which is akin to the GameStop saga however much more efficient. The worth has surged 29% since that article went reside in simply 19 days, a mean of 0.65% per day. Bitcoin ETFs have continued to purchase, and Grayscale’s outflows are slowing.

The necessities for a provide squeeze look like current; the one query I see is, at what stage does the demand develop into affected by the value? Do Bitcoin ETF purchasers proceed to purchase if Bitcoin is at $100,000? Nicely, at that value, BlackRock’s IBIT can be round $60 per share. That doesn’t sound fairly as costly to new buyers now, does it?