Introduction

The collapse of Terra (LUNA) in June 2022 was the spark that ignited a fireplace that stored devouring the crypto market. The chain response of outstanding trade gamers bankrupting continued all year long and culminated with the collapse of FTX, one of many largest crypto exchanges within the trade.

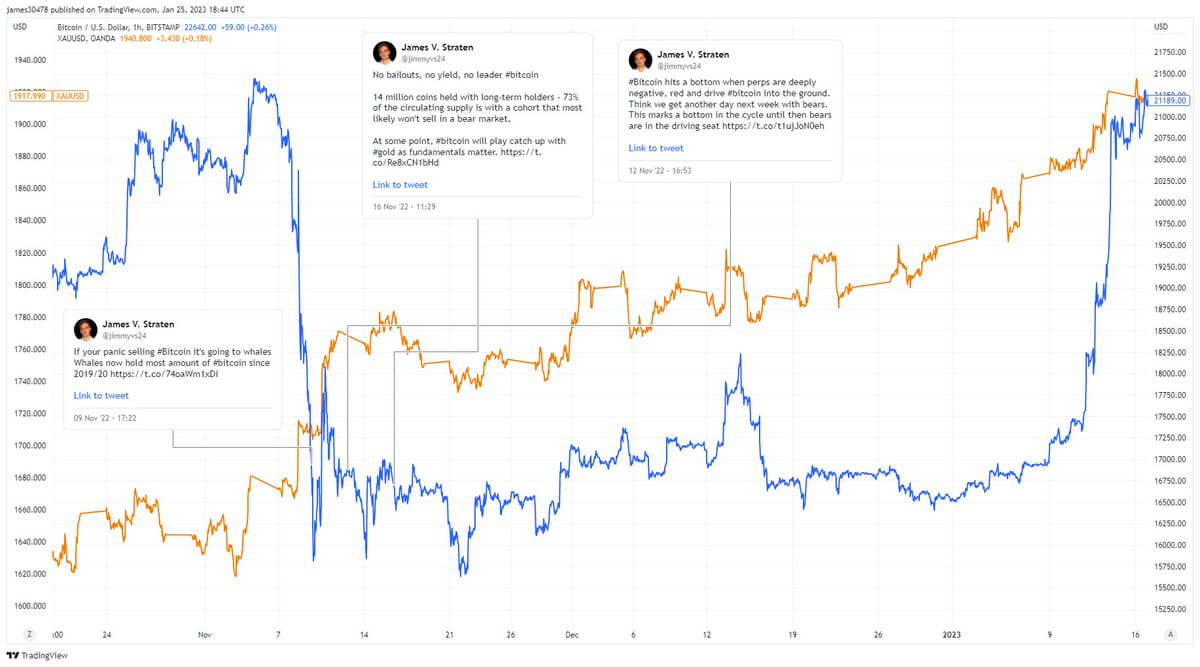

When FTX collapsed, it worn out billions in consumer deposits and pushed the market to its three-year low. Bitcoin reached $15,500 and threatened to drop even additional as contagion from FTX unfold.

Since then, Bitcoin has recovered and posted notable returns, hovering round $23,000 for the reason that finish of January 2023.

Nonetheless, the market nonetheless seems unstable. Chapter proceedings for FTX, Celsius, and different giant corporations are nonetheless ongoing and have the potential to trigger extra value volatility. The incoming recession is creating macro uncertainty that retains the market grounded.

The trade appears divided — some consider Bitcoin bottomed in November 2022, whereas others count on extra volatility and an excellent decrease low within the coming months.

CryptoSlate checked out components that would push Bitcoin all the way down to a brand new low, and components that present a backside was set to current either side of the argument.

Whereas deep diving into the three metrics within the tweet under that analyses a possible market backside.

Why the market bottomed – Whales are accumulating

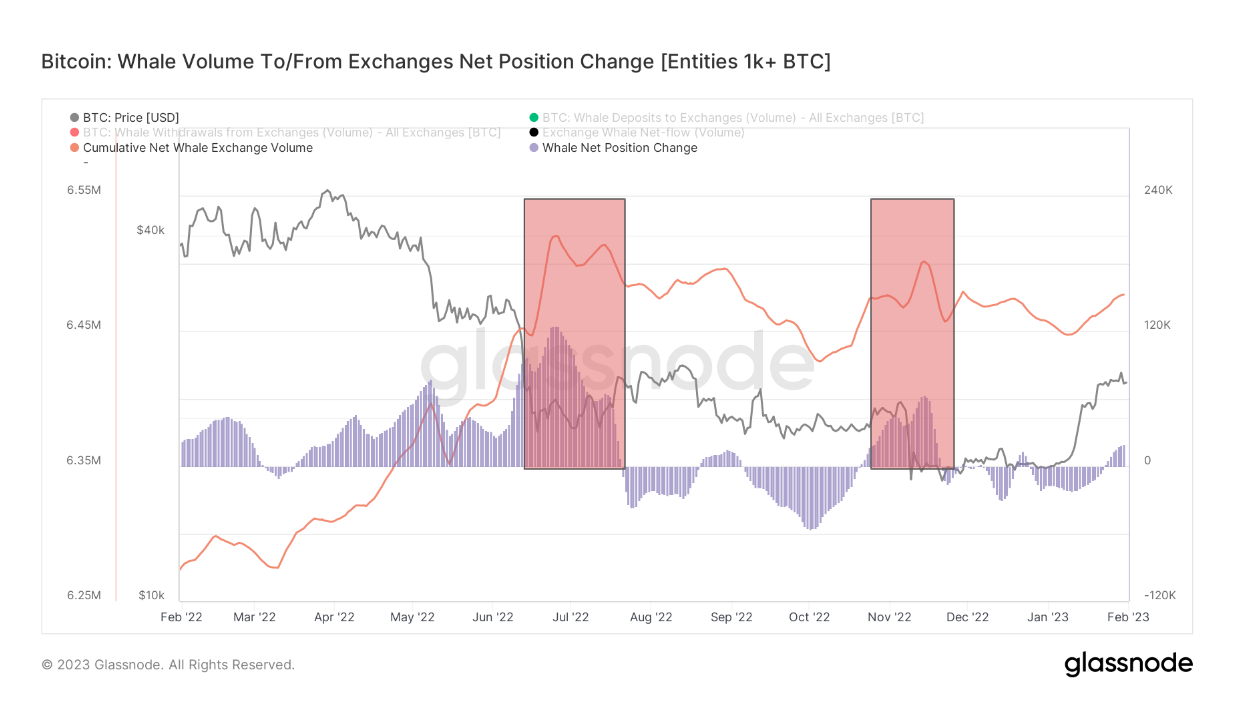

The online place change in addresses holding over 1,000 BTC signifies a powerful cycle backside. These addresses, referred to as whales, have traditionally collected Bitcoin throughout excessive value volatility.

Whales launched into a heavy accumulation spree through the Terra collapse in June 2022, scooping up virtually 100,000 BTC in only a few weeks. After three months of sell-offs, whales started accumulating once more on the finish of November 2022, proper after the collapse of FTX. As soon as Bitcoin’s value stabilized in December, whales started promoting off their holdings and reducing their web positions.

And whereas there was some improve in whales’ web place on the finish of January, trade volumes don’t counsel large accumulation.

Lengthy-term holder provide is rising

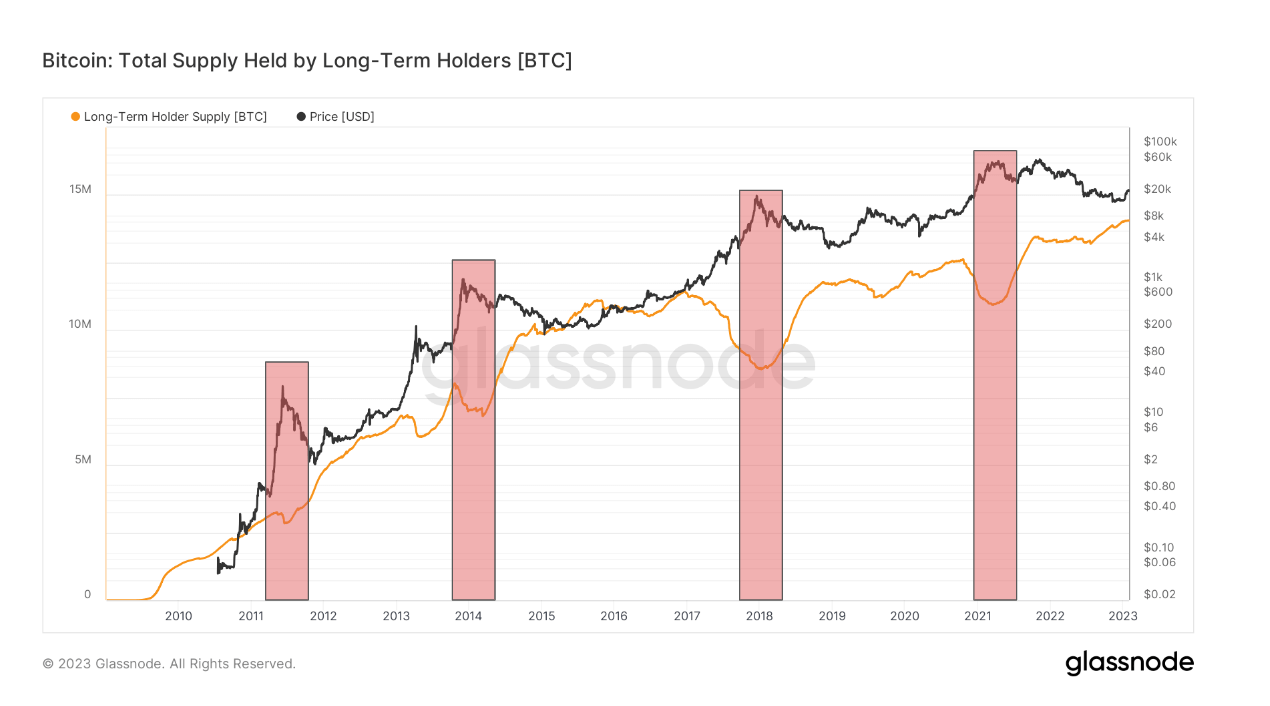

Lengthy-term holders (LTHs) make up the inspiration of the Bitcoin market. Outlined as addresses holding BTC for over six months, they’ve traditionally offered throughout market tops and collected throughout market bottoms.

The provision of Bitcoin held by long-term holders is commonly seen as an indicator of market cycles. When the provision will increase quickly, the market tends to backside. The market could possibly be nearing its high when the provision begins to lower.

Nonetheless, the LTH provide isn’t proof against black swan occasions. A uncommon exception from this pattern occurred in November 2022, when the collapse of FTX pushed many LTHs to lower their holdings.

However, regardless of the dip, LTH provide recovered in 2023. Lengthy-term holders maintain over 14 million BTC as of February. This represents a rise of over 1 million BTC for the reason that starting of 2022, with LTHs now holding roughly 75% of Bitcoin’s provide.

CryptoSlate analyzed Glassnode knowledge to seek out that the LTH provide continues to extend. There’s little signal of capitulation amongst LTHs, indicating that the underside could possibly be in.

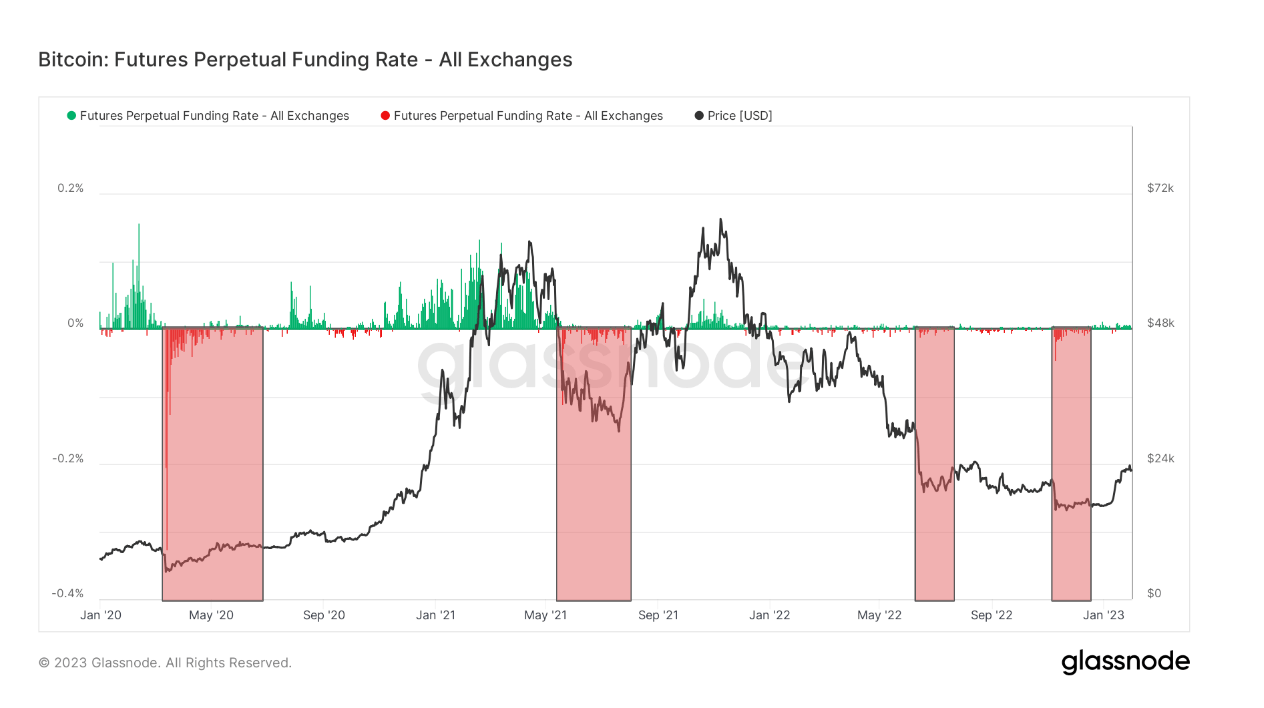

Perpetual funding charges are not destructive

Perpetual futures, native to the crypto market, are a strong gauge of investor confidence in Bitcoin.

Perpetual futures are futures contracts with no expiration dates, permitting traders to shut their positions at any time. To maintain the contracts’ value in line with the market worth of Bitcoin, exchanges make the most of funding charges. When the contract value is larger than BTC’s spot value, lengthy positions pay a payment to quick positions. When the contract value is decrease than BTC’s spot value, quick positions pay the payment to lengthy positions, inflicting the contract’s value to realign with Bitcoin’s market worth.

Optimistic funding charges point out extra lengthy positions in perpetual futures contracts, displaying traders anticipate a rise in Bitcoin’s value. Unfavourable charges present an abundance of quick positions and a market gearing up for a lower in Bitcoin’s value.

For the reason that starting of 2020, each time Bitcoin’s value bottomed, the market noticed extraordinarily destructive funding charges. In 2022, a pointy improve in destructive funding charges was seen in June and in November, displaying that traders shorted the market closely through the collapse of Terra and FTX. Sharp spikes in destructive charges have all the time correlated with the market backside — numerous quick positions in perpetual contracts places additional pressure on a struggling market.

Funding charges have been virtually completely optimistic in 2023. With no knowledge suggesting the onset of utmost spikes in destructive funding charges, the market could possibly be in a restoration part.

Whole provide in revenue is rising

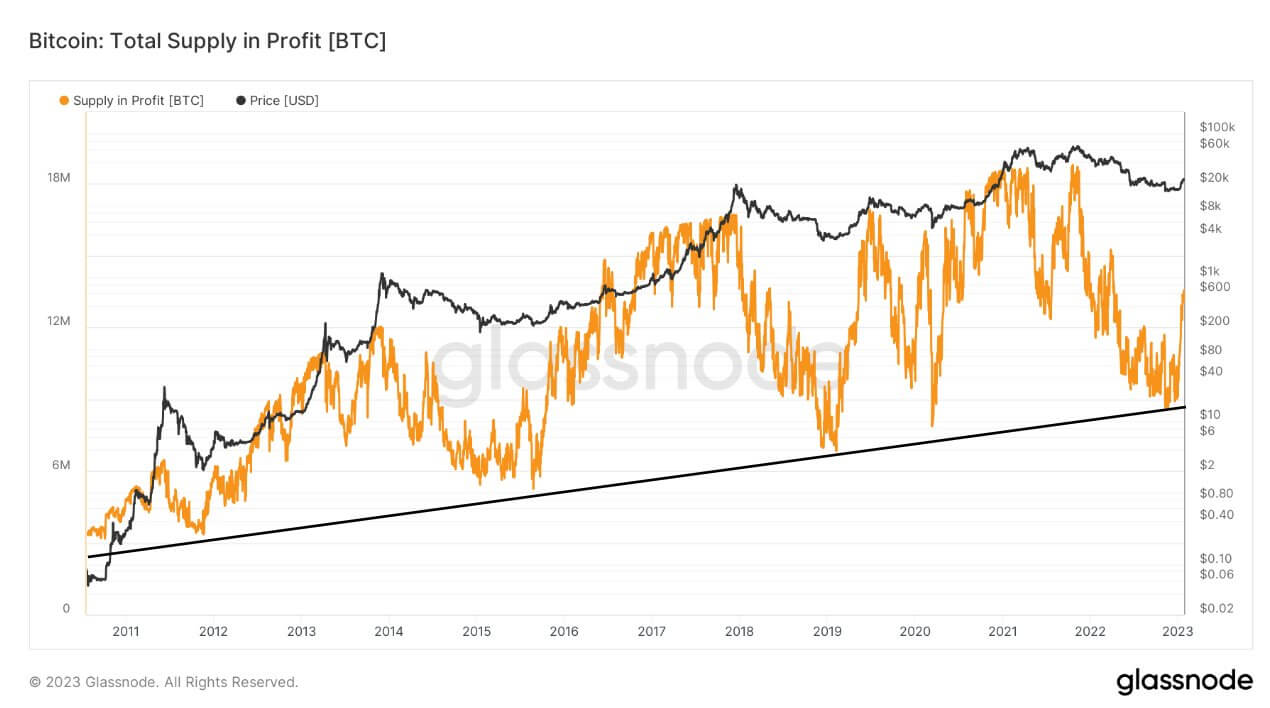

The repetitive nature of market cycles permits us to acknowledge patterns in Bitcoin’s value volatility. Since 2012, each bear market noticed Bitcoin submit a better low than within the earlier cycle. These lows are measured by calculating the drawdown from the ATH value BTC reached within the cycle.

- 2012 – 93% drawdown from ATH

- 2015 – 85% drawdown from ATH

- 2019 – 84% drawdown from ATH

- 2022 – 77% drawdown from ATH

Greater lows every cycle result in the whole provide of Bitcoin in revenue getting larger. That is additionally as a consequence of misplaced cash as this quantity continues to develop every cycle, basically turning into a pressured maintain.

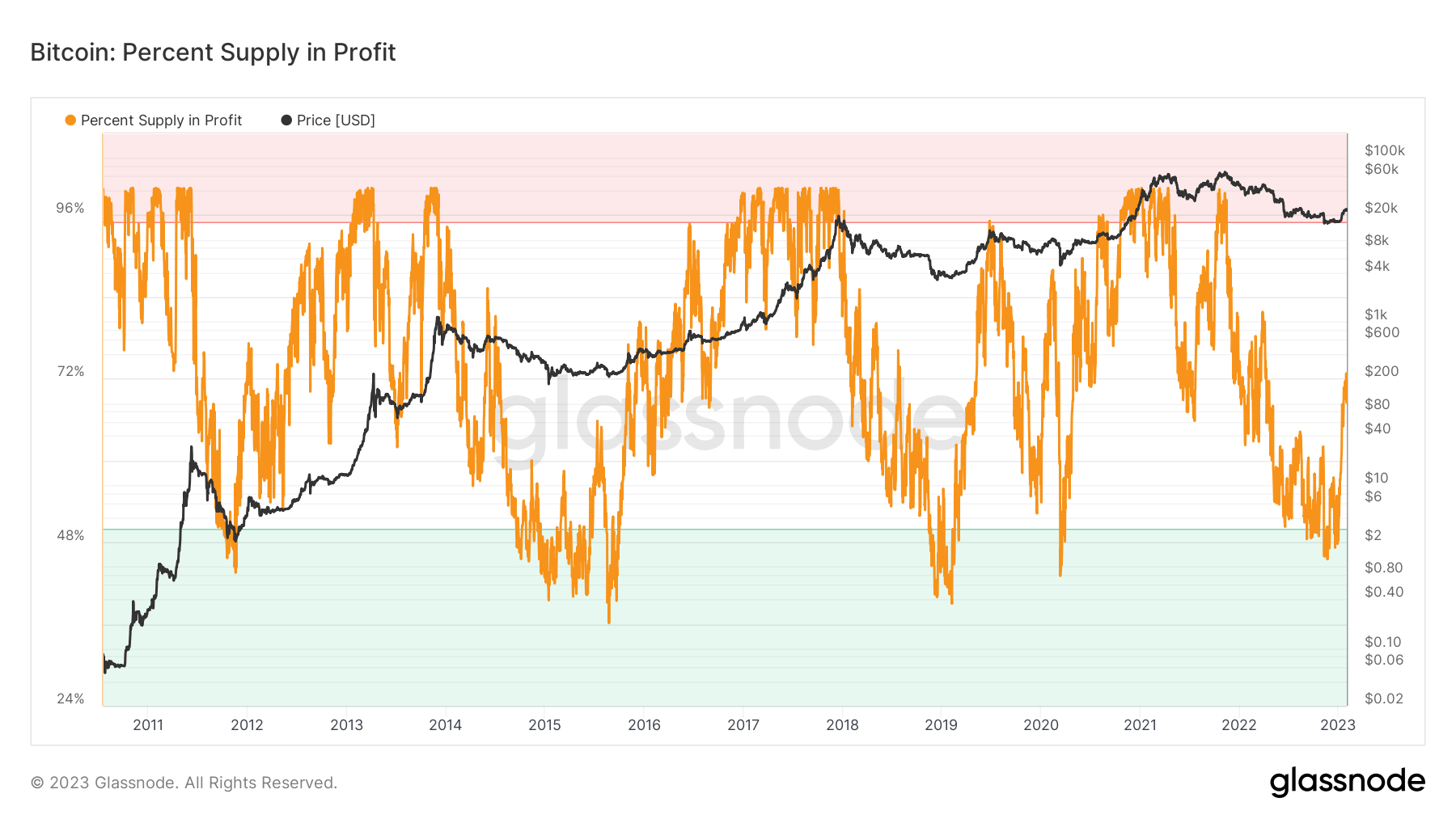

Each time the % of Bitcoin provide in revenue dropped under 50%, a backside of the cycle was fashioned. This occurred in November 2022, when the provision in revenue was as little as 45%. Since then, the provision in revenue elevated to round 72%, indicating market restoration.

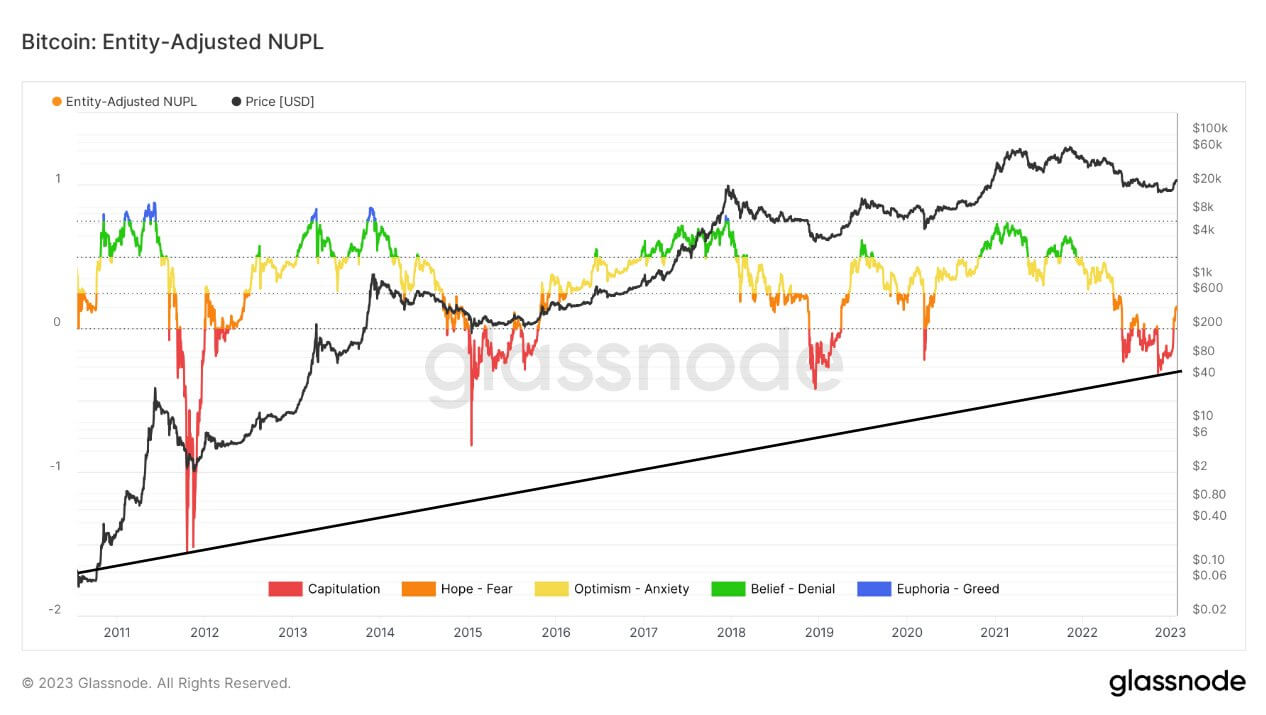

These metrics counsel that the underside was reached in November with Bitcoin’s drop to $15,500. Internet Unrealized Revenue/Loss (NUPL), a metric evaluating the market worth and realized worth for Bitcoin, is an effective gauge of investor sentiment.

Entity-adjusted NUP at present reveals that Bitcoin is out of the capitulation part and has entered a hope/concern part, which has traditionally been a precursor to cost progress.

On-chain indicators are flashing inexperienced

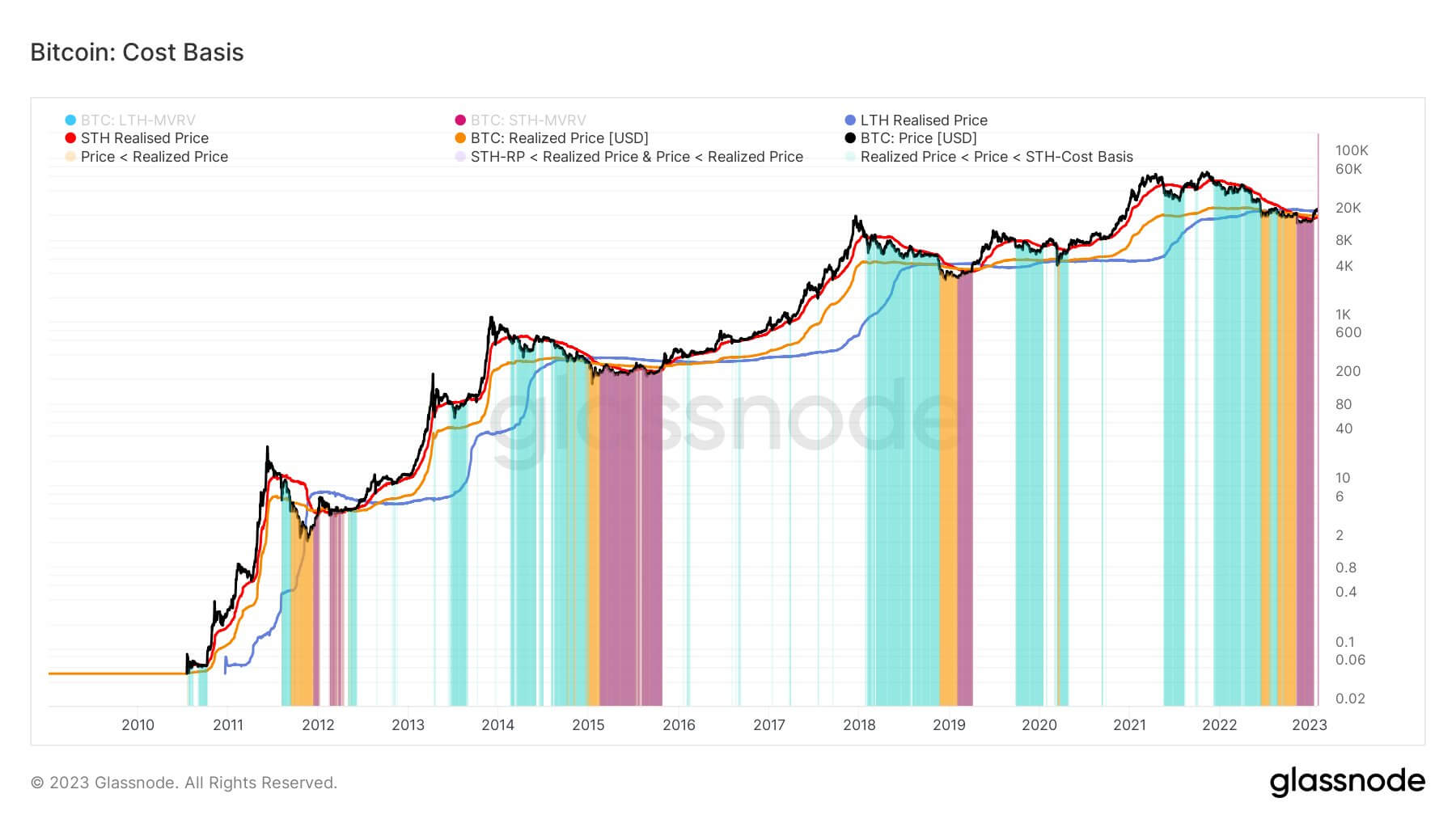

Since its November drop, Bitcoin has reclaimed a number of price foundation. Every time BTC’s spot value surpassed the realized value, the market started recovering.

As of February 2023, Bitcoin has surpassed the realized value for short-term holders ($18,900), the realized value for long-term holders ($22,300), and the common realized value ($19,777).

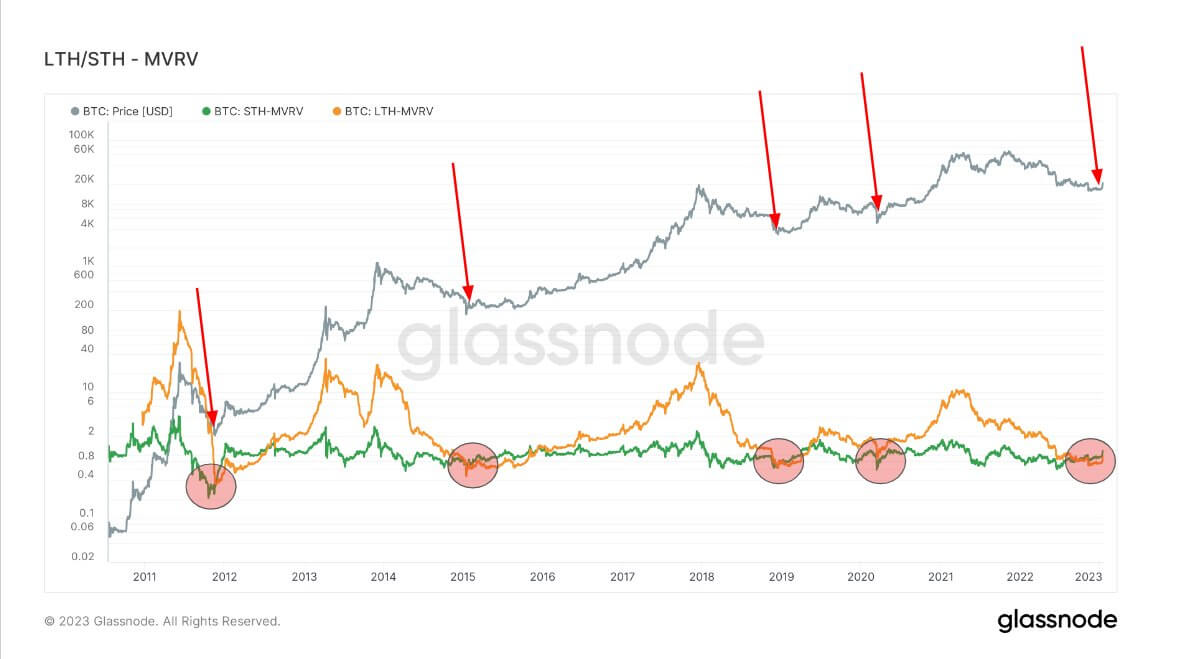

The MVRV ratio is a metric used to measure community valuation via its realized cap. In contrast to market cap, realized cap approximates the worth paid for all cash the final time they had been moved. The MVRV ratio may be utilized to cash belonging to long-term holders (LTHs) and short-term holders (STHs) to offer a greater image of how hodlers behave.

When the LTH MVRV ratio drops under the STH MVRV ratio, the market varieties a backside. Information from Glassnode reveals the 2 bands converge in November.

Each time the ratios diverged, the market entered a restoration part that led to a bull run.

The Fed is pausing rate of interest hikes

Since 1998, the highest of the Federal Reserve’s charge mountaineering schedule correlated with the underside in gold costs. The chart under marks the bottoms with black arrows.

Every of those bottoms was adopted by a rise within the value of gold — after a drop to $400/oz in 2005, gold rose to $1,920/oz in simply over six years.

Whereas Bitcoin has lengthy been in comparison with gold, it wasn’t till 2022 that they started displaying a major correlation. As of February, the worth of Bitcoin and gold has proven an 83% correlation.

If gold repeats its historic reactions to rate of interest hikes, its value might proceed rising properly into the spring. An 83% correlation might additionally see Bitcoin’s value improve within the coming months and suggests a backside has already been fashioned.

Why the market hasn’t bottomed – Uncertainty round narratives

The collapse of Terra (LUNA) in June 2022 triggered a sequence of occasions that shook investor confidence available in the market. The following chapter of different giant trade gamers like Three Arrows Capital (3AC) and Celsius revealed the over-leveraged nature of the crypto market. It confirmed simply how harmful this corporatization was.

Whereas some consider this culminated with the demise of FTX in November 2022, many are nonetheless frightened that the chain response to its collapse might proceed properly into 2023. This led to the market questioning the integrity of Binance, Tether, and Grayscale and questioning whether or not DCG, a fund invested in virtually each nook of the market, could possibly be the following to fall.

Bitcoin’s climb to $23,000 didn’t put these worries to relaxation. The fallout from FTX is but to be felt within the regulatory house, with many trade gamers anticipating tighter regulation at finest. A market weakened with uncertainty is susceptible to volatility and will simply as rapidly see one other backside forming.

The volatility of the U.S. greenback

The buying value of the U.S. greenback has been persistently eroding for the previous 100 years. Any makes an attempt to maintain the cash provide in examine had been thrown out the window through the COVID-19 pandemic when the Federal Reserve launched into an unprecedented money-printing spree. Round 40% of all of the U.S. {dollars} in circulation had been printed in 2020.

The DXY has gone deflationary relating to M2 cash provide, inflicting important volatility throughout different fiat forex markets. An unpredictable fiat forex makes it laborious to denominate Bitcoin’s value and make sure a backside.

Unstable fiat currencies have traditionally prompted unnatural volatility within the value of laborious property and commodities.

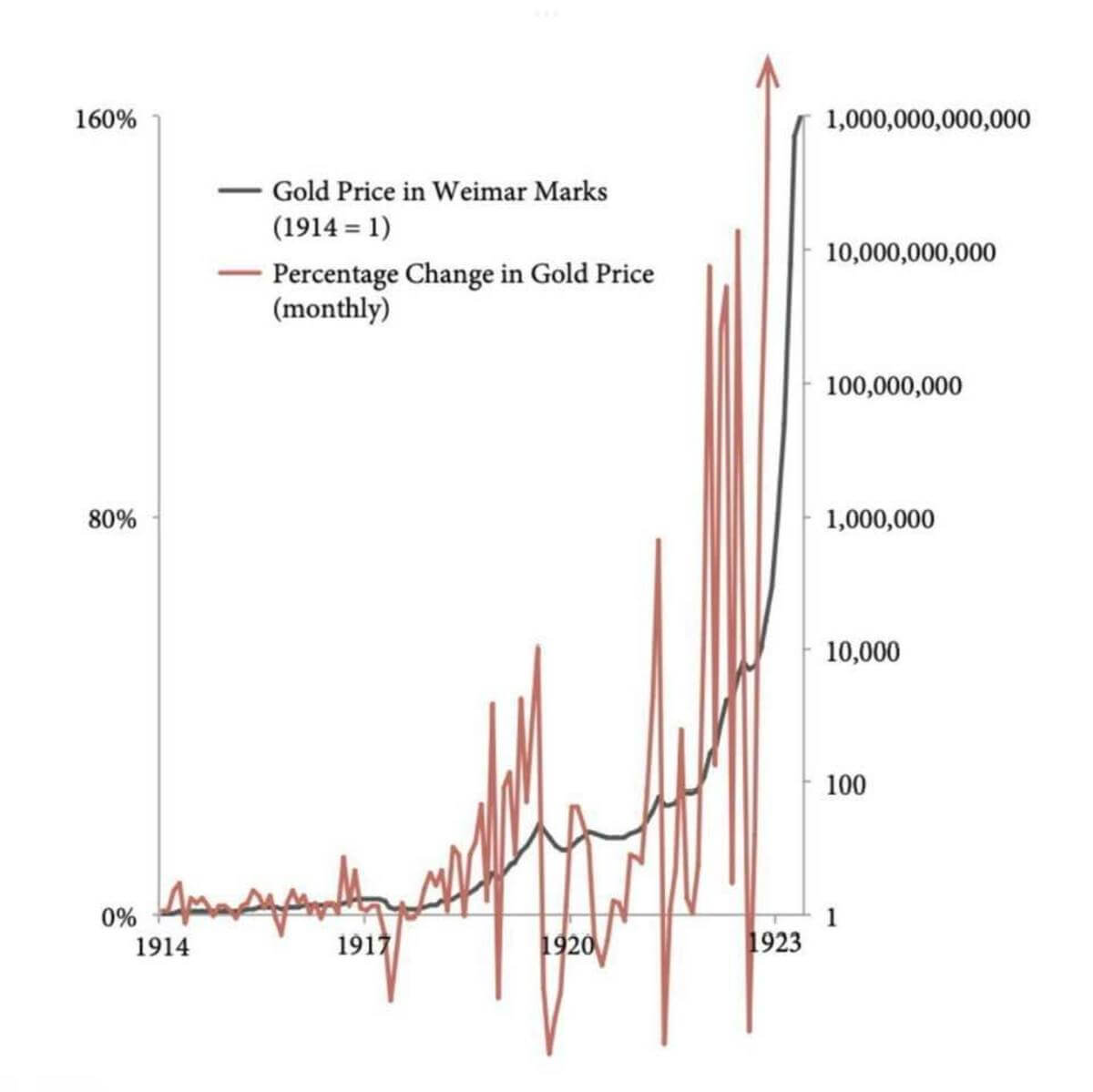

Following World Battle I, the Weimar Republic struggled with hyperinflation that rendered its Papiermark nugatory. This led to a major improve within the value of gold, as individuals rushed to place the quickly devaluing fiat forex right into a extra steady asset.

Nonetheless, whereas the general value of gold elevated from 1917 to 1923, its worth in Papiermarks skilled unprecedented volatility. The fiat value for gold would improve as a lot as 150% and drop as a lot as 40% MoM. The volatility wasn’t within the buying value of the gold however within the buying energy of the Papiermark.

And whereas the U.S. and different giant economies are removed from this kind of hyperinflation, the volatility in fiat currencies might have the identical impact on the worth of Bitcoin.