Fast Take

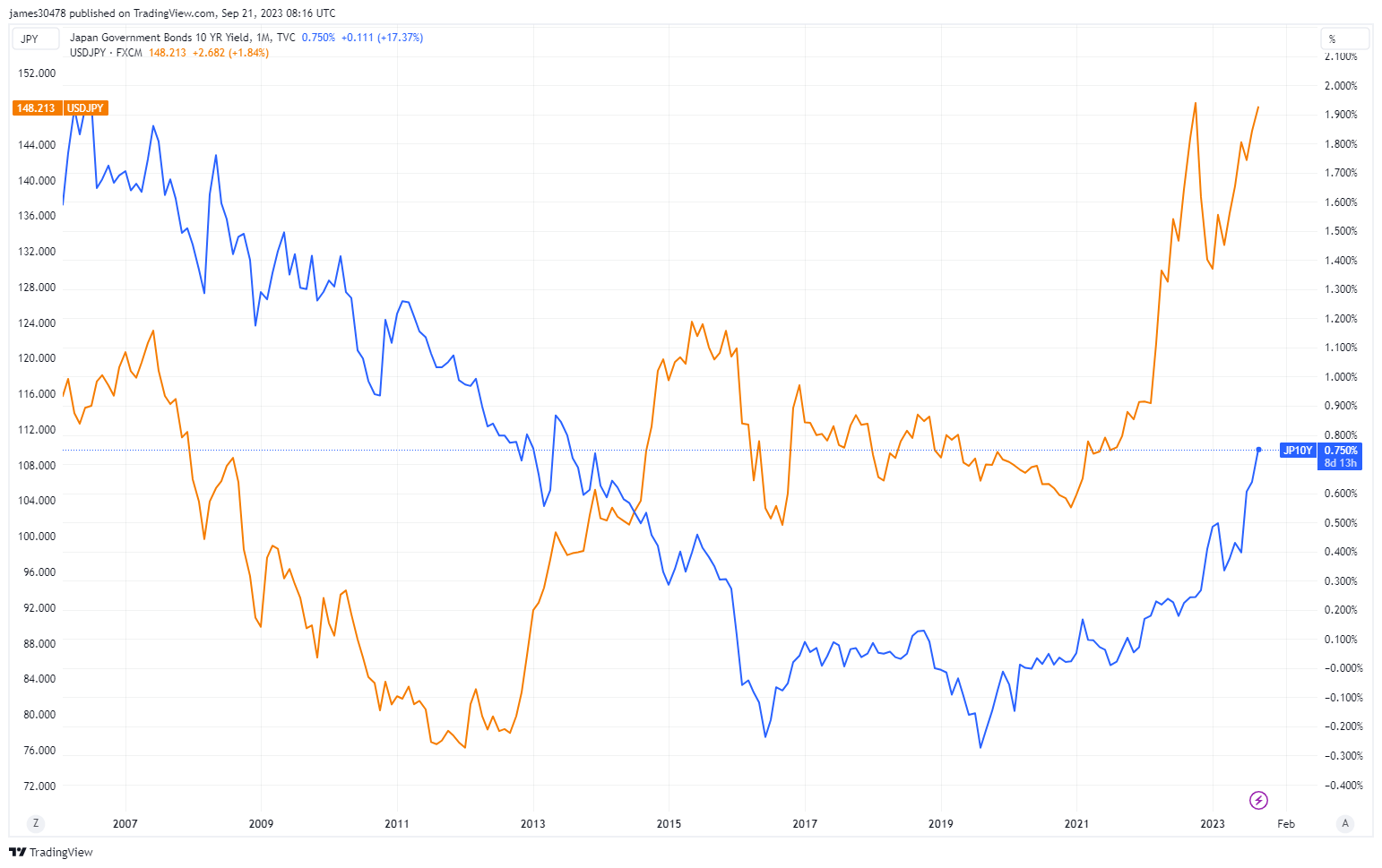

As Japan contends with a depreciating yen and rising 10-year bond yields, its financial system stands at a singular crossroads. The yen’s fall to a 148-year-to-date low in opposition to the US greenback brings with it a combined bag of financial implications.

On the flip facet, a weaker yen can doubtlessly enhance Japanese exporters by making their merchandise extra aggressive globally. Nevertheless, it additionally threatens to boost import prices, doubtlessly fueling inflation and affecting these with overseas forex holdings or money owed.

Concurrently, the 10-year Japanese authorities bond yield has reached its highest degree since 2013, indicating that buyers could also be demanding a better return for holding these securities. This might replicate considerations about Japan’s fiscal well being, expectations about future inflation, or tighter financial coverage. The rise in yields, whereas reflecting investor sentiment, additionally poses a problem by doubtlessly elevating the federal government’s borrowing prices.

The Financial institution of Japan (BoJ) now faces the intricate job of sustaining forex stability and preserving yields low amidst a excessive public debt setting. Complicating the duty additional is the Yen-dollar carry commerce, which may intensify the stress on the yen because the rate of interest distinction between Japan and the US widens. .

The put up Japan’s financial system on the brink as yen stumbles to 148-year low, bond yields soar appeared first on CryptoSlate.