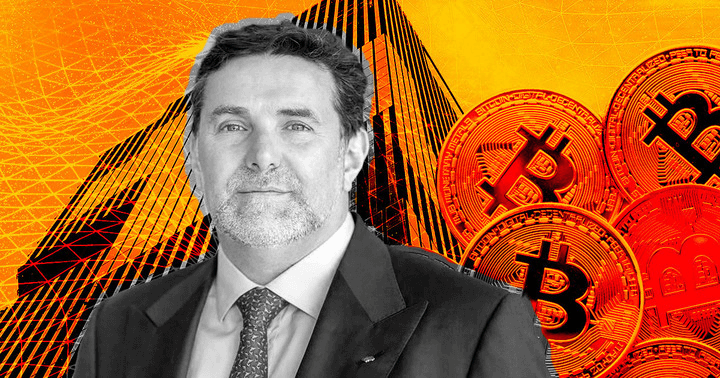

Japan-based funding financial institution Nomura Holdings is launching a brand new crypto unit in Switzerland known as Laser Digital.

Nomura’s head of buying and selling and funding Steven Ashley will step down from his present position to function Laser Digital’s chairman, whereas Nomura’s head of crypto Jaz Mohideen will function the unit’s CEO.

Christopher Willcox, former head of asset administration at JP Morgan, will exchange Ashley as head of buying and selling and funding at Nomura.

Looking for progress through crypto

Nomura has struggled to generate steady revenue flows and primarily depends on merchants’ outsized bets.

To show the enterprise round, Nomura has been adopting crypto lately. Nomura Holdings’ president and CEO, Kentaro Okuda, commented on the present purpose of the corporate and stated:

“Staying on the forefront of digital innovation is a key precedence for Nomura. For this reason, alongside our efforts to diversify our enterprise, we introduced earlier this yr that Nomura could be establishing a brand new subsidiary targeted digital property. “

He additional continued:

“We sit up for sustainable progress on this new enterprise below the management of Steven and Jez“

Laser Digital has a really bold roadmap deliberate. It should give attention to secondary buying and selling, enterprise capital, and investor merchandise because the three principal areas throughout the cryptosphere. Based on the announcement, the brand new department will launch a number of merchandise within the upcoming months.

The primary one is Laser Enterprise Capital, which can search for DeFi, CeFi, Web3, and blockchain initiatives to spend money on to construct a digital ecosystem.

Nomura’s earlier crypto work

Nomura has been launching new crypto options because the starting of the yr. Nonetheless, the corporate’s first entrance into crypto dates again to 2020, when it launched Bitcoin (BTC) and crypto custody companies for institutional traders. Naming this service “Komainu,” Nomura included Bitcoin, Ethereum (ETH), and varied different currencies with giant marker caps below this perform.

On Could 2022, the corporate introduced that it’s enhancing its crypto companies to reply the calls for of institutional purchasers. It stated it began providing Bitcoin derivatives for its purchasers in Asia. To do that, Nomura partnered with CME Group to make use of its platform for derivatives companies.