Bitcoin fell as little as $15,500 on Nov. 21, marking a 106-week low for the main cryptocurrency.

Market sentiment stays fragile as anger over the FTX fiasco turns to acceptance, and the magnitude of what occurred lastly sinks in. Worse nonetheless, the total extent of the black gap will not be recognized presently.

Whereas a number of crypto exchanges scrambled to proof solvency on account of the FTX fallout, contagion threat continues to weigh closely.

The Crypto Worry & Greed Index at the moment reads 22 – excessive worry. Unusually, this compares comparatively favorably versus the Terra implosion in June which noticed a studying of 6 at peak worry.

On-chain Glassnode information analyzed by CryptoSlate revealed, regardless of contagion fears, Lengthy-Time period Holders (LTHs) are persevering with to build up, even regardless of a major proportion who’re nursing losses.

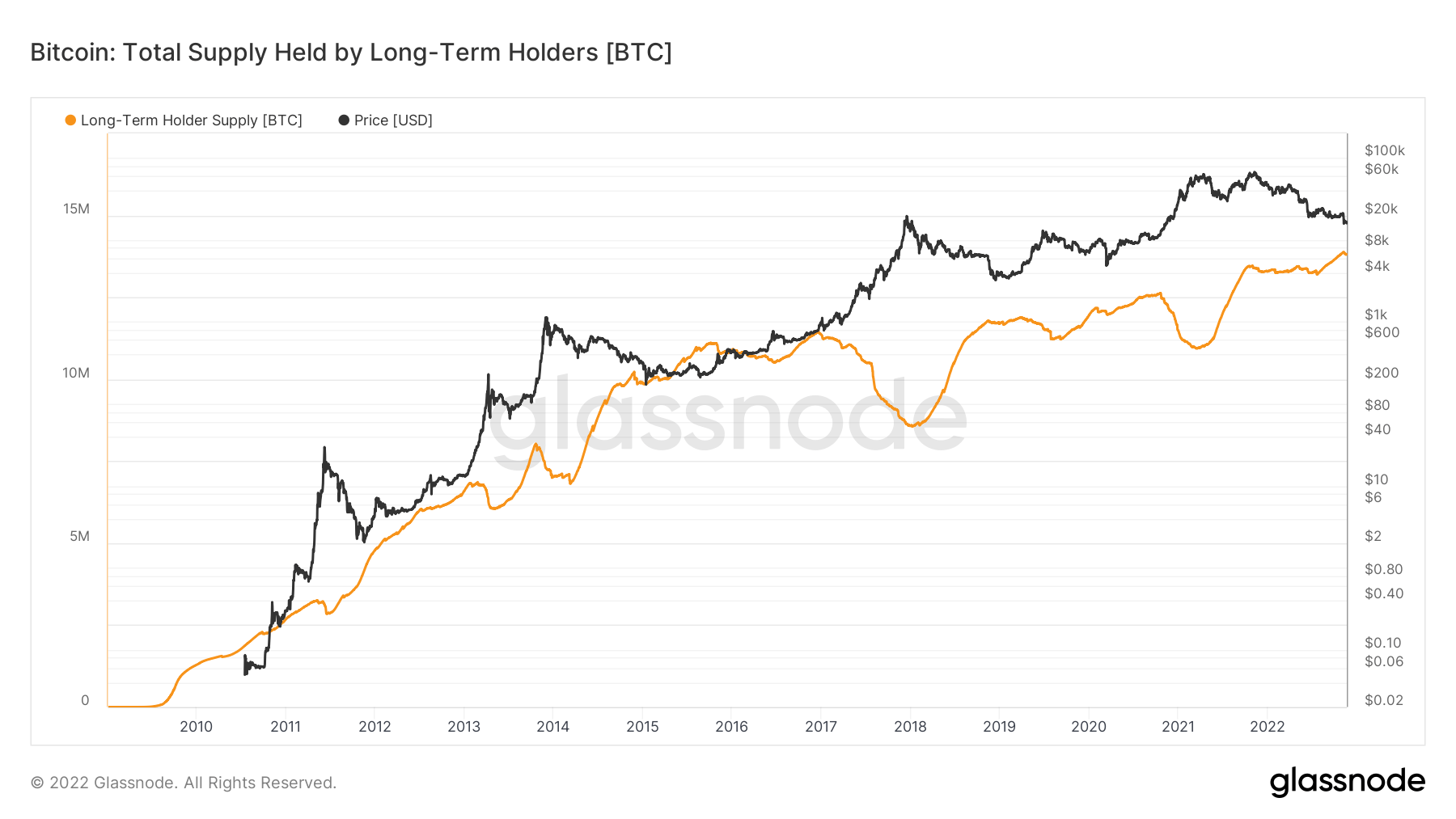

Bitcoin: Whole Provide Held by Lengthy-Time period Holders

The Whole Provide Held by Lengthy-Time period Holders (TSHLTH) refers to BTC held for longer than six months. Tokens that attain this time threshold are typically thought-about dormant and are unlikely to be spent.

In contrast, Quick-Time period Holders (STHs) typically confer with new traders with “weak fingers” and usually tend to exit the market in occasions of value volatility.

The chart beneath reveals LTHs accumulating throughout occasions of value suppression whereas promoting throughout bull runs. The TSHLTH at the moment reads 13.8 million BTC – an all-time excessive. This represents about 72% of the circulating provide.

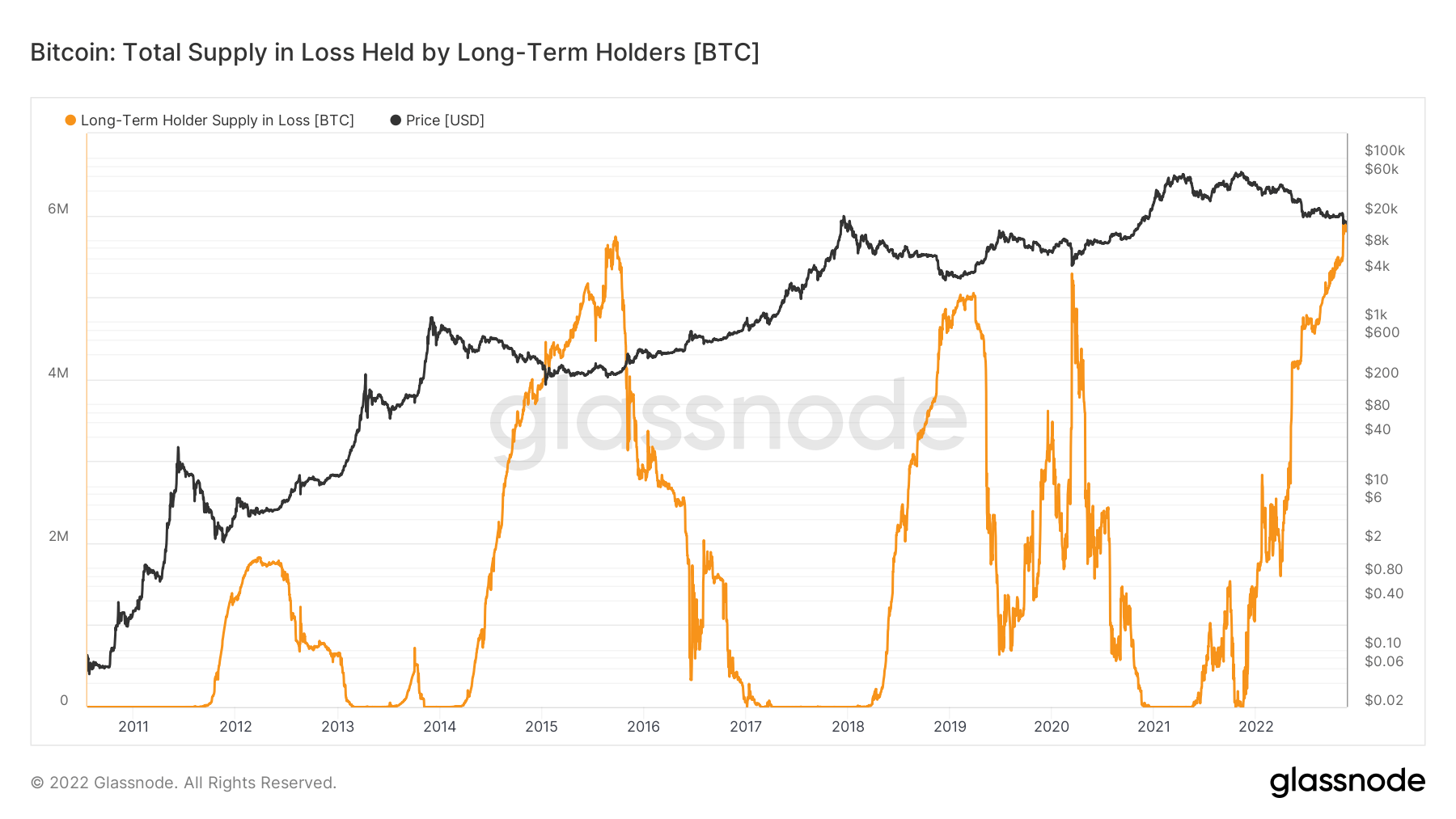

Whole Provide in Loss Held by Lengthy-Time period Holders

LTHs are thought-about good cash, in that they have an inclination to maneuver in accordance with logic and cause somewhat than emotion.

The chart beneath reveals roughly 6 million cash held by LTHs are at a loss. Though this sample suits with bear market bottoms in 2015, 2019, and 2020, that is the best quantity thus far.

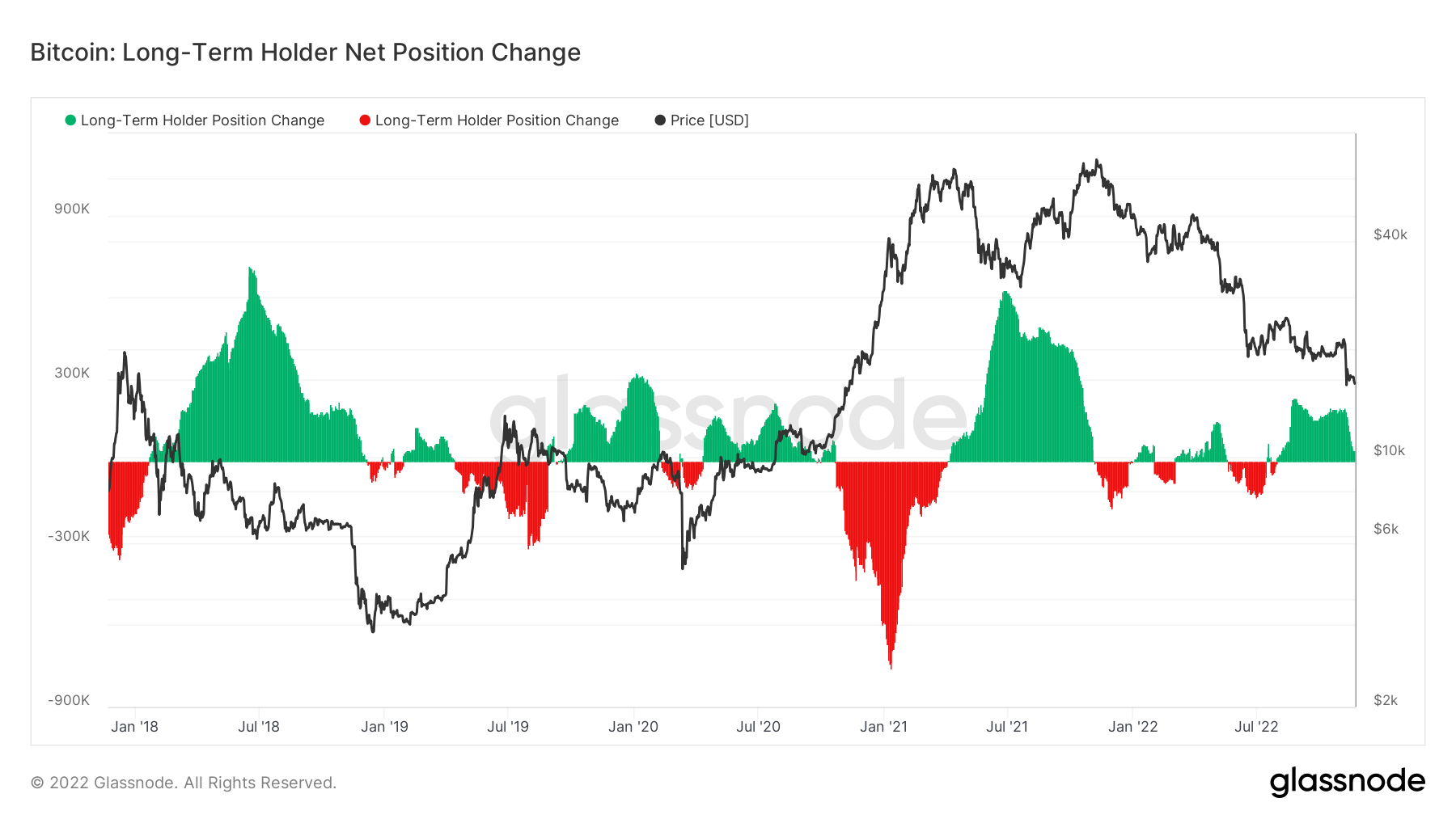

Lengthy-Time period Place Internet Change Place

Internet Change Place (NCP) refers back to the internet quantity of Bitcoin getting into or exiting trade wallets.

The chart beneath reveals LTHs are at the moment internet accumulating on the highest fee in 2022. Though H1 noticed NCP flipping between accumulation and distribution, H2 is basically characterised by internet accumulation. This development is interpreted as bullish, in that LTHs proceed to maintain the religion and are prepared to purchase, even in fearful market situations.

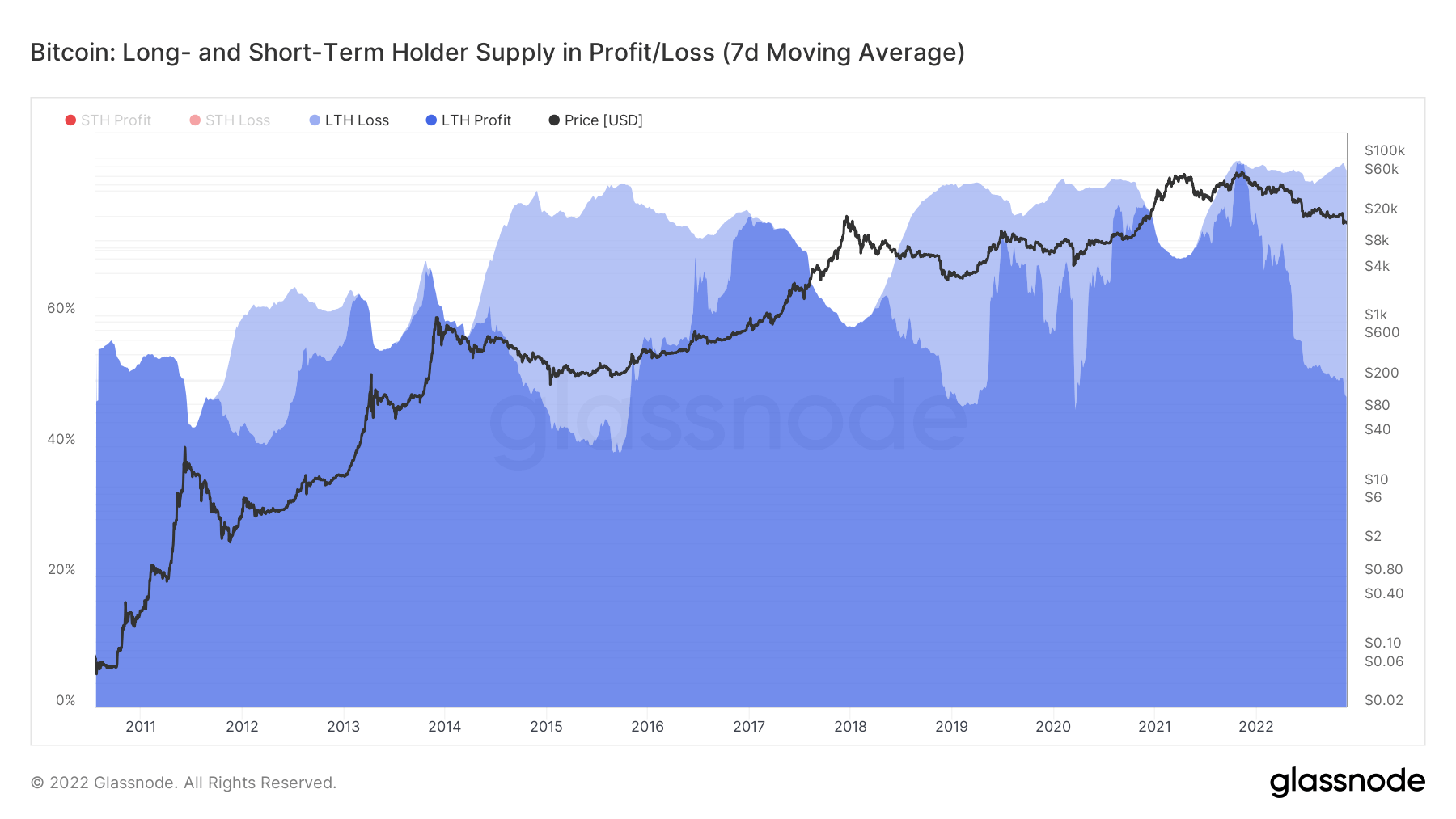

Provide in Revenue/Loss

Analyzing LTHs in revenue and loss reveals 50% of LTHs are in revenue on the present value, whereas 33% are working at a loss.

In comparison with earlier bear markets, this counts as one of many highest discrepancies, with the 2015 bear market a notable contender.

Usually, a brand new cycle of development reversal follows capitulation. However the above information reveals LTHs have but to lose hope and capitulate on the present value.