Fast Take

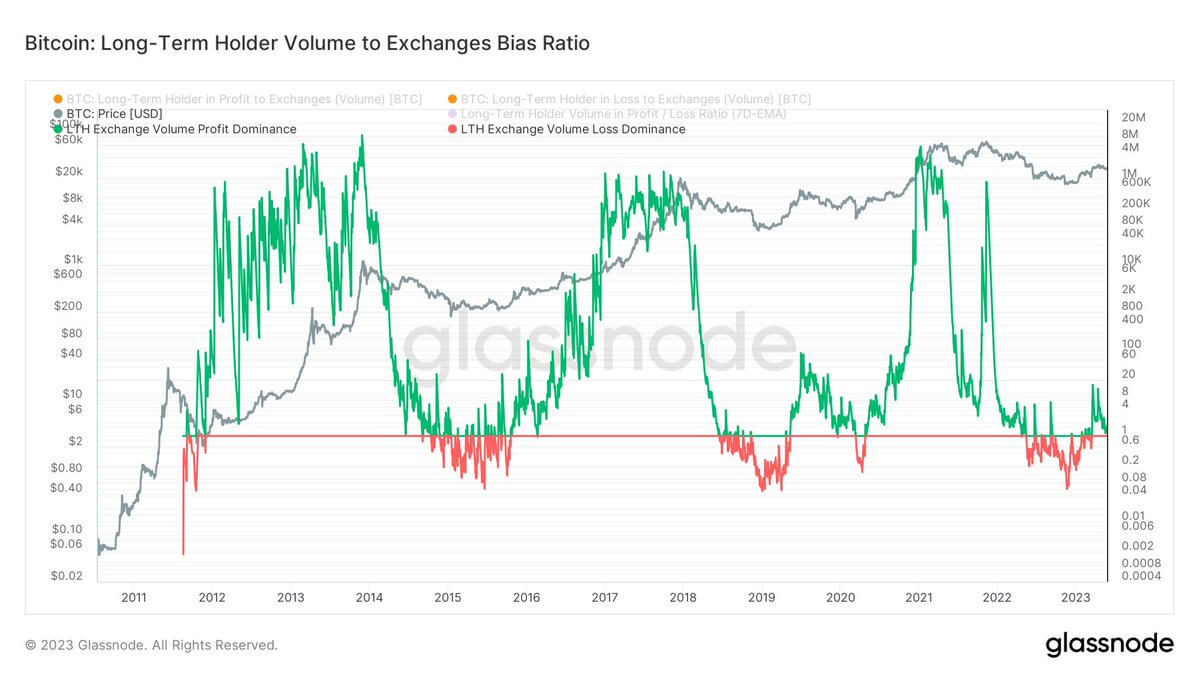

- The Bitcoin Lengthy-Time period Holder (LTH) volume-to-exchanges bias ratio exhibits LTHs are sending better volumes of cash in revenue to exchanges relative to cash in loss, denoted by the inexperienced.

- LTH volume-to-exchanges bias ratio is at present at 1.73, in response to Glassnode knowledge as of Might 25, which exhibits a slight dominance by way of long-term holders sending cash to exchanges at a revenue.

- Lengthy-term holder provide not too long ago hit an all-time excessive of 14.463M, as reported by CryptoSlate on Might 19.

- When the ratio is crimson, often throughout bear markets, it exhibits that LTHs are sending better volumes of cash in loss to exchanges relative to cash in revenue.

- The bear market backside occurred in November 2022 on this cycle, and the same sample emerged in 2016 and 2019 when the ratio of 1 was examined and it might be re-tested a number of occasions.

- For the present cycle to be deemed a brand new bull market, the dominance ratio has to remain constructive.

The publish Lengthy-term holders’ bias ratio hints at Bitcoin’s potential return to bull market appeared first on CryptoSlate.