Monitoring liquidation ranges is essential in periods of value volatility, as they point out the place vital value actions can happen as a consequence of pressured sell-offs or buy-ins.

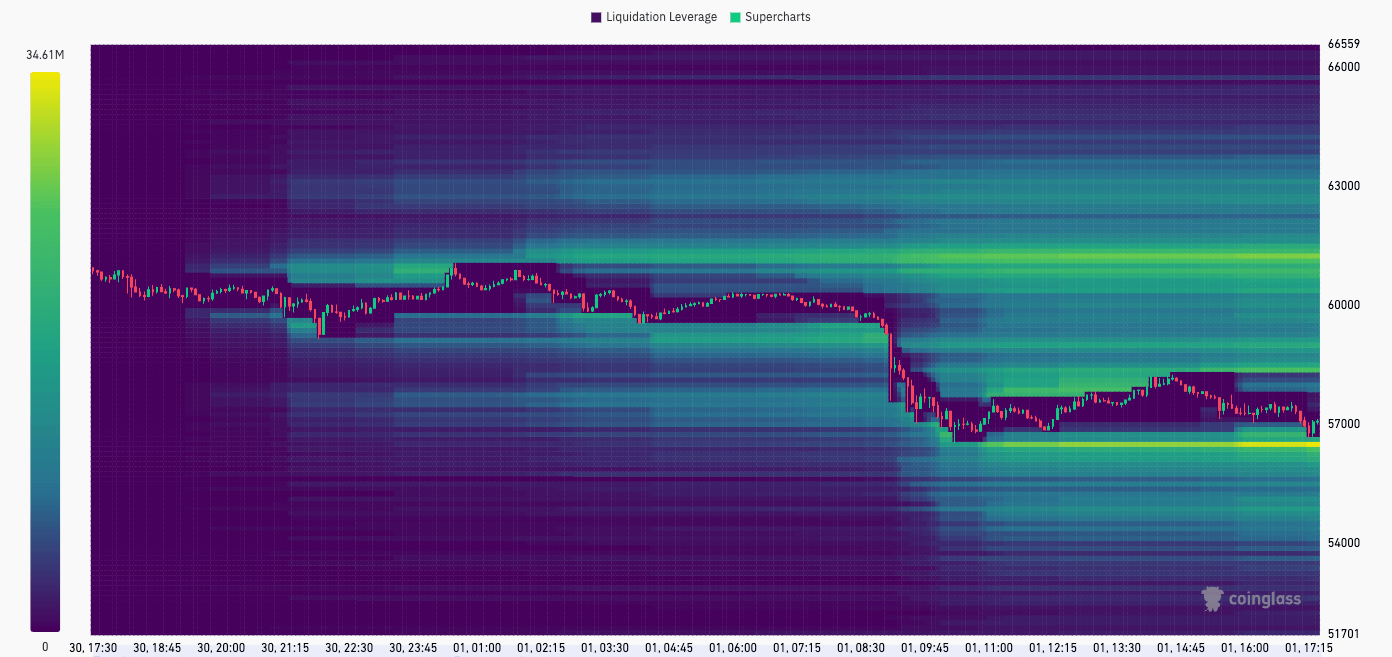

Instruments like Coinglass’s liquidation heatmap are invaluable as they visually symbolize the place the market holds giant quantities of leveraged positions, figuring out potential value factors the place pressured liquidations will happen if the worth reaches these ranges.

Basically, a liquidation heatmap acts as a strategic map, exhibiting merchants potential ‘scorching zones’ the place volatility is more likely to enhance because of the unwinding of leveraged positions. This permits them to make extra knowledgeable selections about entry and exit factors and threat administration and doubtlessly capitalize on the ensuing market actions.

Bitcoin noticed a vital drop on Could 1, dropping the psychologically essential assist at $60,000 and dropping to as little as $56,500. As of press time, its value hovers round $57,000, inflicting widespread losses available in the market and drastically impacting what was, till just lately, a really bullish sentiment.

Bitcoin’s 12% drop induced $381.76 million in liquidations within the 24 hours previous Could 1, 15:30 UTC, with $307.92 million being longs. Its drop from $60,600 to $57,000 in 12 hours worn out $177.36 million in longs.

CoinGlass’s liquidation heatmap confirmed $16 million in liquidation leverage on the $56,880 value level positioned inside the final 24 hours. This degree represented the preliminary vital threshold—if BTC fell up to now, it may immediate the beginning of liquidations, doubtlessly resulting in elevated promoting stress.

Between $56,750 and $56,620, we see larger leverages added at $22.31 million and $19.22 million, respectively. The proximity of those ranges suggests {that a} drop by these thresholds may lead to a compounding impact, the place sequential liquidations at every degree intensify the downward value motion.

Nevertheless, probably the most vital level is the $56,490 degree, with $34.04 million in liquidation leverage. Given the substantial quantity of leverage concerned, a drop to this degree may act as a serious catalyst for a sharper value decline.

Subsequent Ranges ($56,360, $56,230, and $56,100), with liquidation leverages of $23.24 million, $19.52 million, and $19.37 million, respectively, additional illustrate a densely packed space the place every small drop in value may set off further sell-offs, contributing to a possible cascading impact in liquidations.

These ranges present a stacked association of potential triggers just under the present value, suggesting {that a} minor value decline may result in a collection of liquidations. Every degree acts as a possible breakpoint the place the worth may both stabilize briefly as a consequence of shopping for exercise or proceed to drop if promoting stress overwhelms. The focus of liquidation factors in a comparatively slim value vary implies that the market may expertise vital volatility if these ranges are examined.

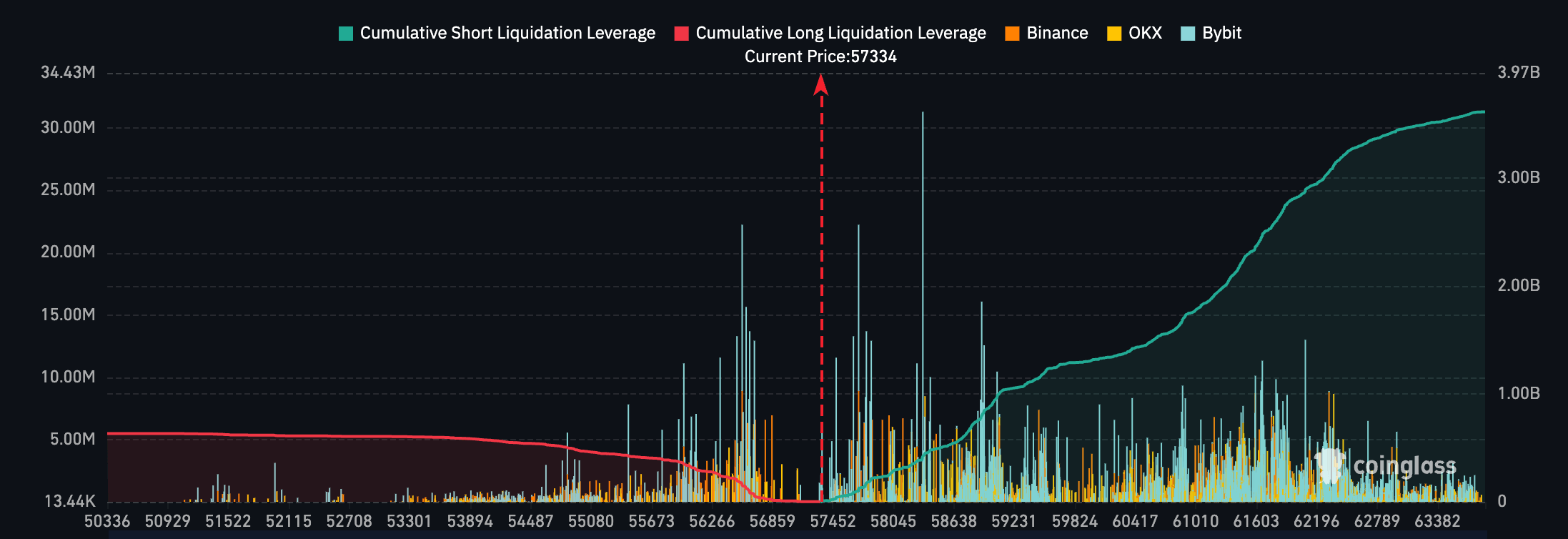

Cumulatively, the quantity of leverage throughout OKX, Binance, and Bybit over the previous day involves over $3.5 billion. The vast majority of the leverage is made up of brief positions as much as $63,380, with solely round $5 million in leveraged longs.

The put up Liquidation heatmap exhibits volatility forward as Bitcoin drops to $57k appeared first on CryptoSlate.