Over the previous month, Bitcoin has been buying and selling comparatively flat, ranging between $18,400 and $22,800.

Towards a deteriorating macroeconomic backdrop and an escalation of occasions in Jap Europe, some analysts see this as the beginning of BTC decoupling from legacy markets.

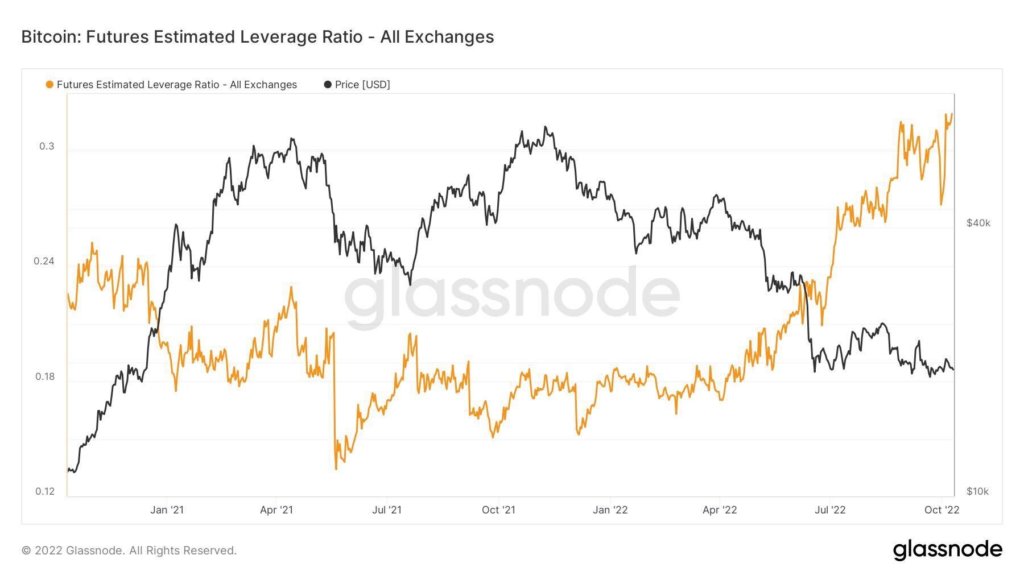

Bitcoin Futures Estimated Leverage Ratio

The Bitcoin Futures Estimated Leverage Ratio (ELR) metric refers back to the proportion of open curiosity divided by the reserves of an alternate. Open curiosity pertains to the variety of excellent (unsettled) derivatives contracts at a given time.

This metric expresses the typical leverage at present utilized by spinoff merchants available in the market. A excessive ELR typically coincides with BTC spot volatility. Below this situation, spinoff merchants are at liquidation danger.

The chart beneath exhibits ELR at an all-time excessive of 0.34, suggesting a excessive liquidation danger. Whereas route calls cannot be made with certainty, the chance of a draw back transfer is stronger, provided that BTC is buying and selling down on larger macro time frames.

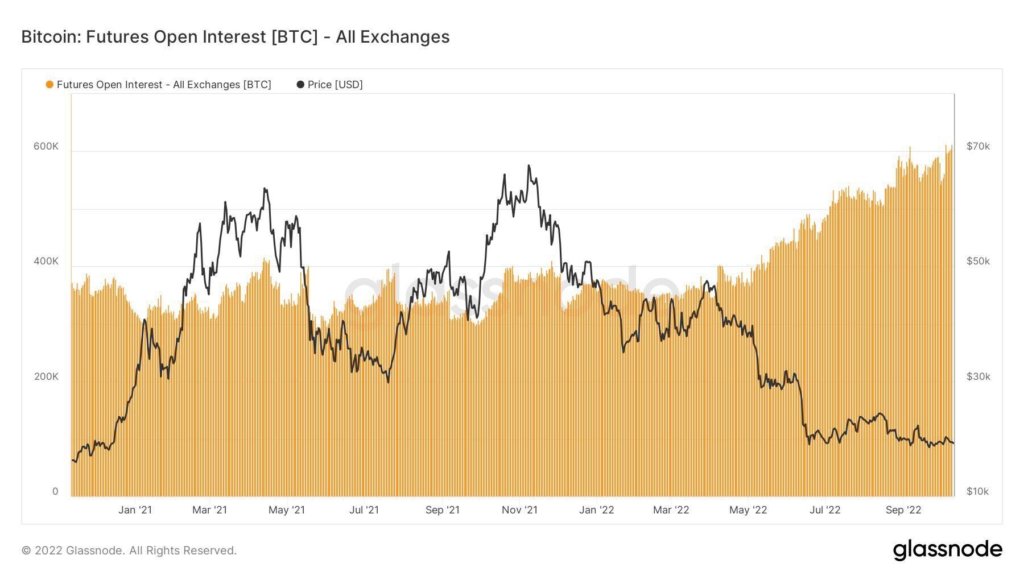

Futures Open Curiosity

As beforehand talked about, Open Curiosity is a measure of the excellent futures contracts at a particular interval in time. Excessive Open Curiosity means new merchants are opening positions giving a web improve.

The chart beneath exhibits Open Curiosity constructing from a yearly low in March, climbing progressively extremely into the current. With a present studying of roughly 600,000 contracts, it’s clear that derivatives merchants are persevering with to pile in, regardless of the deteriorating macro surroundings.

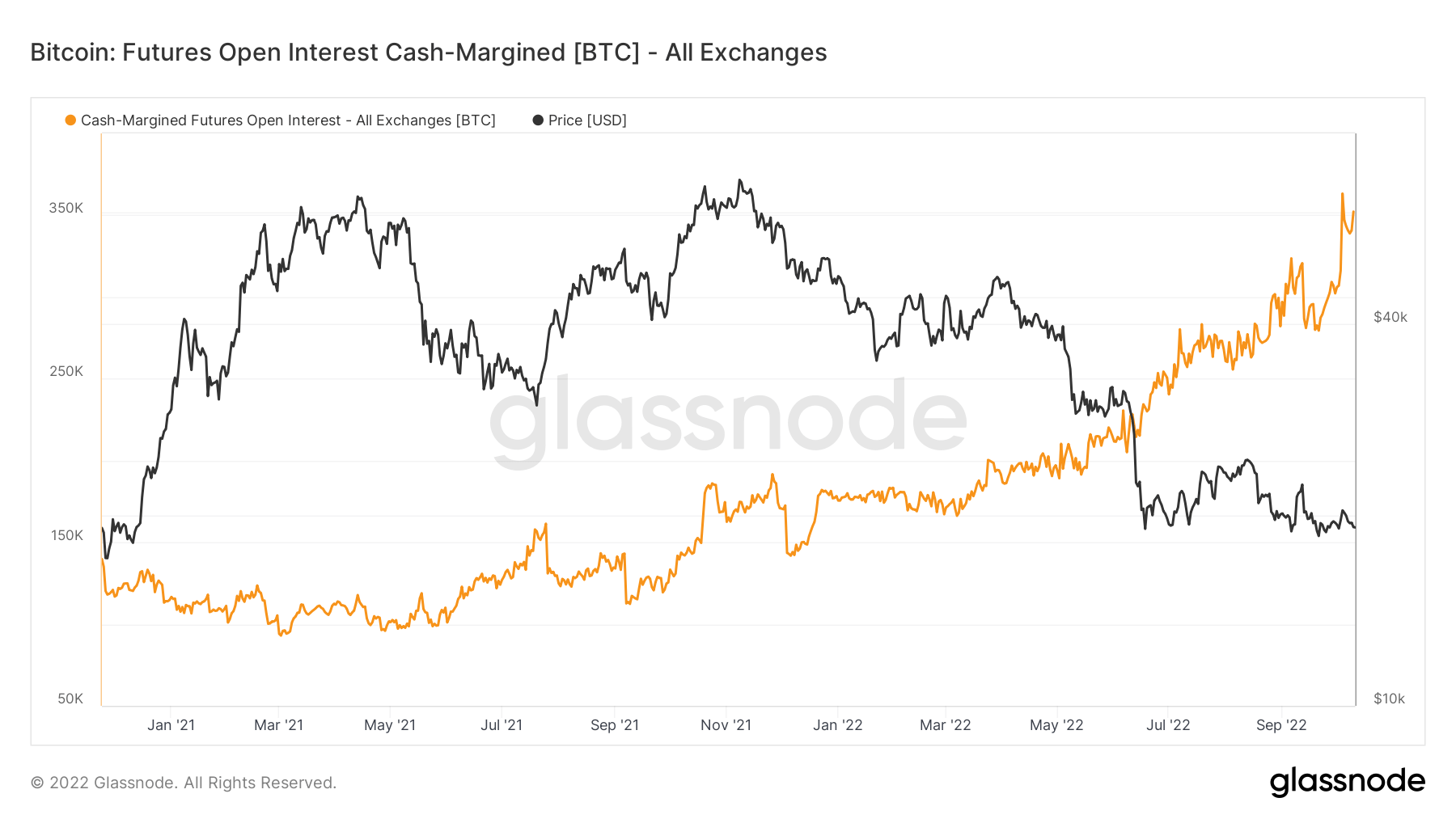

Equally, Open Curiosity Money-Margined (OICM) additionally represents curiosity however from a cash circulation perspective. As anticipated, with Open Curiosity spiking larger because the March lull, cash flowing into Bitcoin Futures has additionally trended upwards.

Apart from a dip in mid-September, the OICM has resumed its uptrend to peak at roughly 360,000.

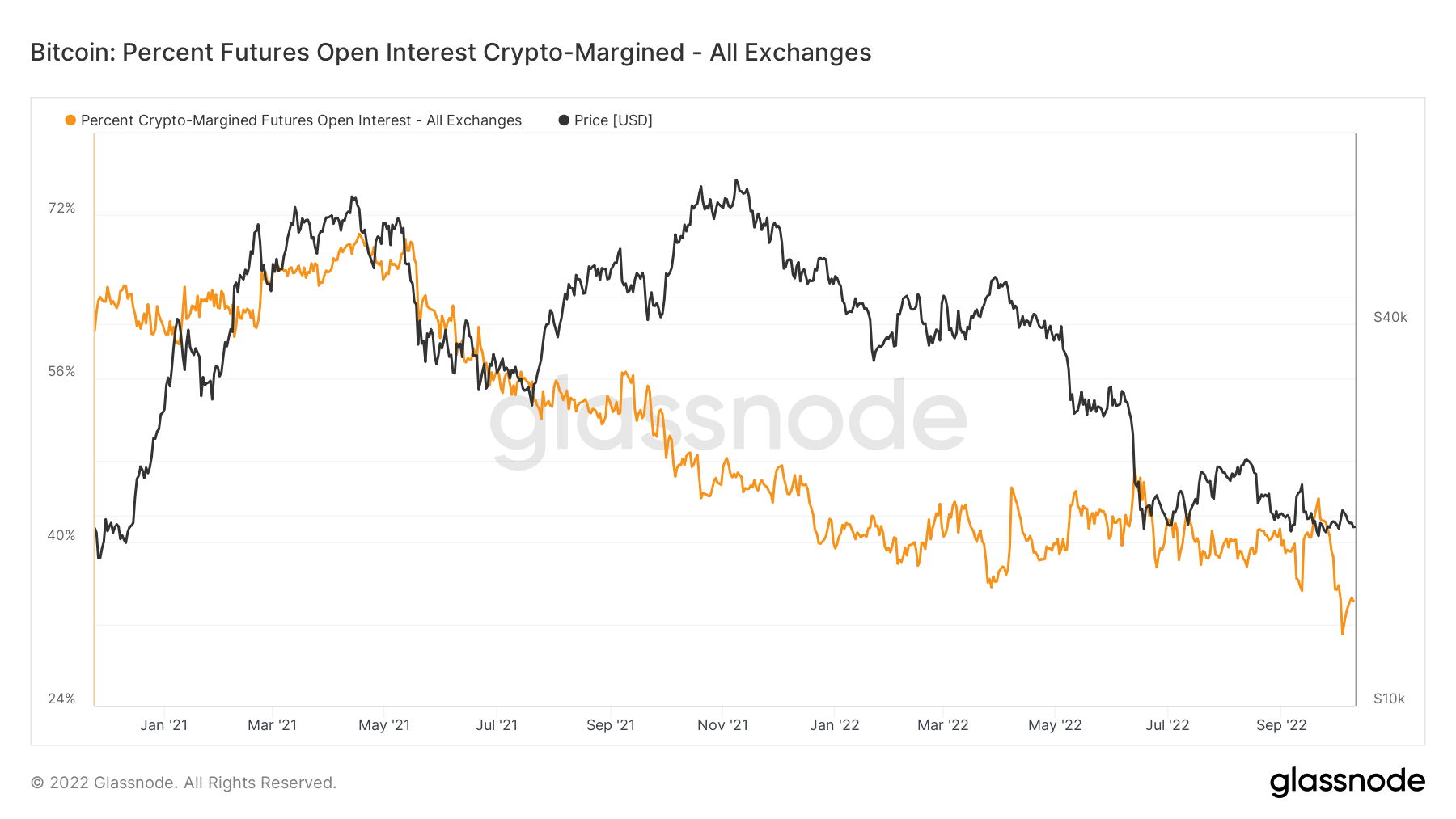

Through the 2021 bull run, merchants had been majority utilizing Bitcoin to open futures contracts, presenting a major however acceptable danger throughout euphoric instances.

Now, within the bear market, merchants have switched to money, leading to a drop within the Open Curiosity Crypto-Margined metric from a peak of 70% in April 2021 to 38% at current.

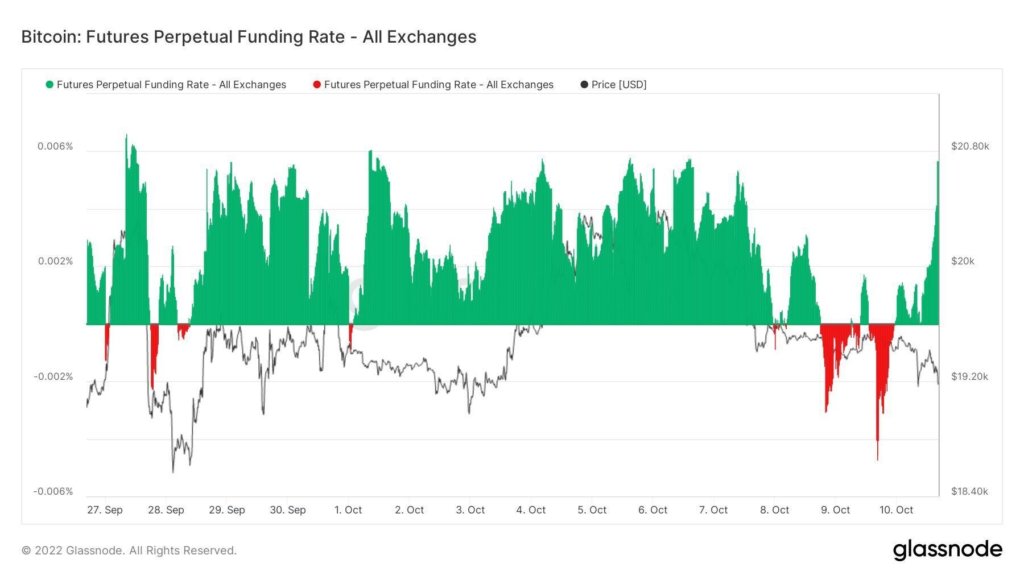

Futures Perpetual Funding Charges

The Futures Perpetual Funding Charge (FPFR) refers to periodic funds made to or by derivatives merchants, each lengthy and brief, primarily based on the distinction between perpetual contract markets and the spot value.

During times when the funding price is optimistic, the value of the perpetual contract is larger than the marked value. Subsequently, lengthy merchants pay for brief positions. In distinction, a detrimental funding price exhibits perpetual contracts are priced beneath the marked value, and brief merchants pay for longs.

The mechanism was designed to maintain futures contract costs consistent with the spot value. The FPFR can be utilized to gauge merchants’ sentiment in {that a} willingness to pay a optimistic price suggests bullish conviction and vice versa.

Since Could, the funding price has been broadly impartial. However from late September onwards, the chart beneath exhibits that the funding price has been majority optimistic, with latest days seeing a flip between detrimental and optimistic funding.

Over the weekend ending October 9, a pointy dip within the discovering price to -0.005% was proceeded by a powerful transfer in the other way, hitting +0.0058%

The Estimated Leverage Ratio and Open Curiosity are at all-time highs, and with optimistic funding charges prevailing, the crypto market is considerably scorching and overleveraged to the upside.

Widespread liquidations could happen within the close to time period, triggering a decline in asset costs led by Bitcoin.