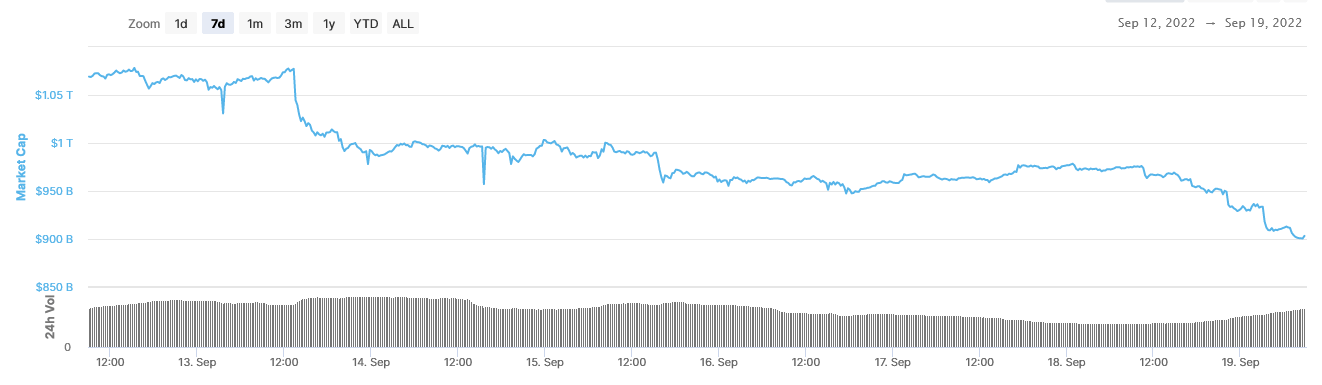

The overall crypto market cap is down 15% over the previous seven days, dropping from $1.069 trillion to $903 billion at writing.

Many of the losses got here on Sunday, September 18, with a gentle uptick in outflows starting within the morning (UTC). This sample continued into Monday morning, with the early hours seeing important dips on the trail down.

A neighborhood backside was reached at 08:00 (UTC) after hitting $900.9 billion, marking a nine-week low. Since bottoming, roughly $3 billion of capital inflows re-entered the market.

What subsequent for crypto now the Merge is finished?

On the crypto entrance, essentially the most important occasion to happen over the previous week was the Ethereum Merge.

After months of hype, the Merge was accomplished on September 15 at roughly 07:00 UTC. The occasion was polarizing, with some advocates claiming it might carry the remainder of the market greater. However as Enter Output CEO Charles Hoskinson identified, the Merge has not improved Ethereum’s “efficiency, working price, nor liquidity.”

Quite a few different criticisms have come to mild post-Merge, together with claims that Ethereum is now thought of a safety, and maybe most regarding, the centralization of the community because it emerged simply two nodes management 46% of transactions.

Since then, Ethereum has misplaced 21% of its worth, dropping from a worth of $1,640 and exemplifying a traditional purchase the rumor, promote the information occasion.

YouTuber Lark Davies just lately commented that there are not any equally hyped occasions to prop up the crypto market going into the remainder of this yr.

The macro

Likewise, there have been no important developments on the macro entrance. The squeeze on family incomes from spiking inflation and the next strain to boost rates of interest stay the dominant narrative.

The Federal Open Market Committee (FOMC) is scheduled to satisfy on Tuesday, with many anticipating a 75 foundation level hike.

Nonetheless, given the latest launch of CPI knowledge which confirmed a 0.1% enhance in inflation for August in opposition to a red-hot labor market, it’s clear that inflationary pressures will not be underneath management.

Chief Funding Strategist at Yardeni Analysis, Ed Yardeni, just lately commented that the Fed ought to “get it over with” and implement a 100 foundation level hike.

The upcoming FOMC will probably be a key level for markets. The crypto sell-off is probably going right down to market contributors pricing within the looming fee hike.