The 2021 GameStop saga, not too long ago featured in a Netflix film, could have surprising parallels with Bitcoin, significantly within the context of a possible provide crunch.

Echoes of the Reddit-fueled’ mom of all brief squeezes’ (MOASS) for GameStop, in Bitcoin’s context, might manifest as a important provide squeeze, or ‘Bitcoin Mom Of All Provide Squeezes’ (Bitcoin MOASS.) I’ve referenced this in a number of articles this yr, however I wished to interrupt down precisely why I believe this might occur.

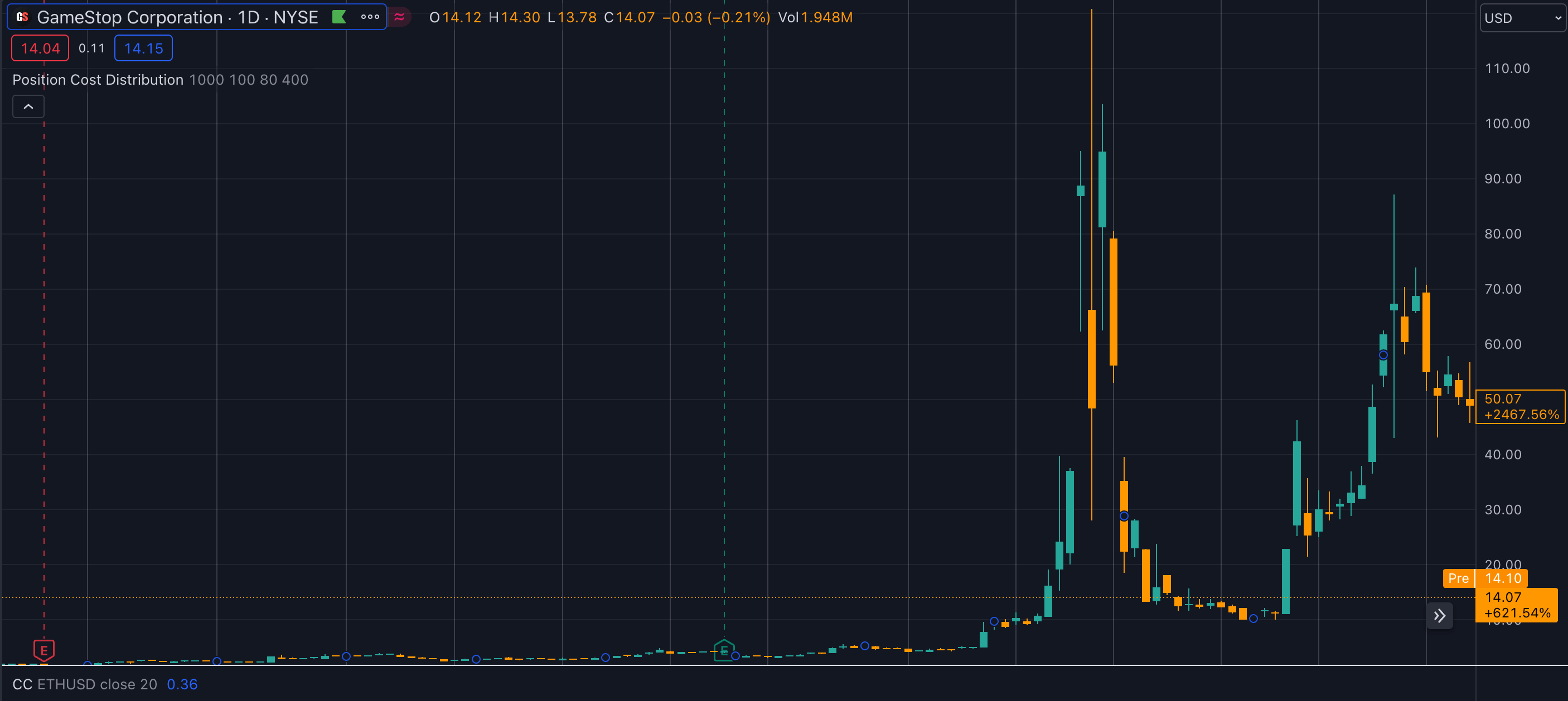

To know this higher, let’s revisit the GameStop phenomenon.

I wasn’t early sufficient to observe Roaring Kitty via his preliminary thesis on GME at round $3 per share. Nonetheless, I used to be lively inside the WallStreetBets subreddit, and by the point the inventory hit $13, it was exhausting to disregard his every day updates. Across the $50 (pre-stock break up) worth, I cracked and ‘YOLOed’ in and took the trip as much as $500, decided to carry for the moon or bust. Finally, I bust, however I loved being part of one thing.

GameStop brief squeeze thesis fundamentals.

For these unfamiliar, GameStop shares had been closely shorted by a number of hedge funds who noticed simple prey in a retail retailer headed for chapter with the added ache of the pandemic. Seemingly, the aim was to brief the inventory to zero. This technique, usually employed towards faltering corporations (like Blockbuster earlier than its demise), is basically betting on the corporate’s failure.

Nonetheless, hedge funds underestimated the attachment many avid gamers needed to the GameStop model and the ability of retail buyers uniting behind a trigger. There was additionally a extra philosophical side to why many buyers, myself included, bought shares associated to the damaged conventional finance system. As a Bitcoiner, this message resonated with me, and I purchased shares desiring to HODL ‘to the moon.’

Lengthy story brief, retail buyers, primarily via Robinhood (but additionally all around the globe,) actively piled in, shopping for GME shares aggressively within the hope that it will pressure the hedge funds to shut their shorts at greater costs and set off a brief squeeze. This tactic did inflict important losses on some hedge funds, though many had the monetary buffer to soak up these losses.

The dearth of real-time short-interest reporting additional sophisticated issues. Hedge funds had been capable of shut their brief positions with out the information of retail buyers, perpetuating the brief squeeze narrative and leaving it unclear whether or not all brief positions have really been coated.

Additional, as many buyers entered the fray above $100, they weren’t as impressed with the 2x or 3x enhance in worth. Finally, from the $3 authentic worth level to the place it peaked earlier than Robinhood turned off purchase orders, GME rallied round 11,000% in just a few months.

For all intents and functions, GME had a monumental brief squeeze, adopted by an additional 700% secondary squeeze just a few months later.

But, to today, there are buyers on Reddit who’re adamant that the shorts have nonetheless not been coated, and a MOASS that can take GME costs over $1 million is on the horizon.

Now, how does this relate to Bitcoin?

Bitcoin’s mom of all provide squeezes.

Bitcoin and GameStop differ in some ways. Finally, GameStop is a standard fairness that was being bullied out of existence by TradFi, whereas Bitcoin is an answer to the inherent issues of TradFi as an entire.

Nonetheless, GameStop, particularly GME, represented an identical ethos at one level in its historical past. Earlier than it grew to become the poster youngster for ‘meme’ shares, to many, GME was about unifying retail buyers towards ‘the person.’ It was a method to struggle again towards company greed, devouring the whole lot in its path.

This perfect nonetheless drives these of r/superstonk or regardless of the present subreddit is for the die-hard GME diamon arms. Nonetheless, in my opinion, whereas that’s now however a mere misguided dream, there’s a real alternative with Bitcoin for an actual MOASS.

The chart under highlights some key points of the GameStop and Bitcoin comparability. The important thing drivers are the halving, Bitcoin ETF inflows, and scarce provide.

| GameStop | Bitcoin |

|---|---|

| Excessive brief curiosity | Majority of BTC in private chilly storage |

| Retail purchases scale back provide | ETFs launch and purchase Bitcoin |

| Value enhance to cowl shorts | ETF demand outpaces provide |

| 5 million new shares issued value $1.2 billion | Fastened issuance per block |

| Limitless provide of shares | Fastened provide of Bitcoin |

| Value falls as shorts cowl | Value will increase after halving |

| Value falls as shares diluted | Value will increase as provide dries up |

Bitcoin’s mounted provide contrasts starkly with GameStop’s means to problem extra shares, which occurred six months after the brief squeeze. Bitcoin’s restricted provide and rising inflows into Bitcoin ETFs counsel a looming provide squeeze. This might mirror the GameStop situation however in a singular, Bitcoin-specific context.

In distinction, the Bitcoin market operates with higher transparency, because of blockchain expertise. This brings us to the relevance of this comparability to Bitcoin. In contrast to GameStop, which might problem extra shares, Bitcoin has a strictly restricted provide. With the present charge of inflows into Bitcoin ETFs, a provide squeeze is turning into more and more probably. This case might parallel the GameStop brief squeeze however in a distinct context.

Circumstances required for a provide squeeze.

Sure situations have to be met for such a Bitcoin provide squeeze.

First, the continual influx into Bitcoin ETFs is essential. The latest addition of Bitcoin ETFs into different funds is a good signal of this enduring.

Secondly, Bitcoin holders must switch their holdings into chilly storage, making it inaccessible to over-the-counter (OTC) desks.

In contrast to conventional brokerages, platforms like Coinbase can’t merely lend out Bitcoin because it’s not commingled, providing a layer of safety towards such practices. Nonetheless, the latest outflows from Grayscale point out that there’s nonetheless ample liquidity available in the market for main gamers like BlackRock, Bitwise, Constancy, and ARK to buy Bitcoin.

The state of affairs might shift dramatically if the New child 9 ETFs amass holdings within the vary of $30-40 billion every. Contemplating that roughly 2.3 million Bitcoins are on exchanges and about 4.2 million are liquid and recurrently traded, a good portion of Bitcoin might be absorbed or grow to be illiquid. If the pattern in the direction of storing Bitcoin in chilly storage continues and buying and selling diminishes, the accessible Bitcoin for OTC desks might lower markedly.

Ought to ETFs persist in buying Bitcoin, and particular person customers proceed to purchase and retailer it in chilly storage, we might see a notable rise in Bitcoin costs inside 18 months resulting from diminishing market availability. This case might immediate ETFs to buy at greater costs, elevating questions concerning the sustainability of demand for these ETFs at elevated Bitcoin valuations.

Bitcoin in chilly storage vs GameStop ComputerShare.

The true GameStop HODLers transferred their GME shares to Computershare to forestall shares from being lent out for shorting, akin to placing Bitcoin in chilly storage. They did this to try to restrict provide. Nonetheless, this didn’t cease the GameStop board from issuing extra shares, which can by no means occur with Bitcoin.

Thus, the market might witness a major shift if the pattern of transferring Bitcoin to chilly storage accelerates, coupled with persistent ETF purchases. About 4.2 million Bitcoins are actually thought of liquid and accessible for normal buying and selling. Nonetheless, if this liquidity decreases via decreased buying and selling exercise or elevated storage in chilly wallets, the availability accessible to over-the-counter (OTC) desks might diminish quickly.

This potential shortage raises intriguing eventualities. Ought to ETFs proceed their shopping for spree, and retail customers additionally maintain buying Bitcoin, directing it into chilly storage, we might be on the cusp of a major provide squeeze. Based mostly on present knowledge, if influx charges stay fixed, this convergence may happen as quickly as subsequent yr, primarily influenced by main gamers like BlackRock shopping for from the accessible liquid provide. If retail customers take away all Bitcoin from exchanges, there’s scope for it to occur sooner.

Pyschology of buyers and momentum buying and selling.

The whole provide of Bitcoin that may be thought of probably liquid continues to be substantial, round 15 million. Which means the potential provide at any worth must be thought of, as even long-term HODLers might be satisfied to promote at costs above the final all-time excessive. Whereas it’s not a assured end result, the chance is intriguing.

The psychology of retail buyers, already confirmed important in instances like GameStop, might additionally play a vital position in Bitcoin’s situation. The recommendation to ‘HODL,’ purchase Bitcoin, and put money into ETFs might resonate strongly with buyers who share this mindset.

Notably, the attraction of Bitcoin ETFs lies partly of their affordability and accessibility; they’re priced a lot decrease than an precise Bitcoin, making them engaging to a broader viewers. This psychological side, just like the perceived affordability of tokens like Shiba Inu or Dogecoin, might drive investor habits towards Bitcoin ETFs.

Finally, the parallels between the GameStop saga and the potential provide dynamics within the Bitcoin market are placing. The mixed impact of continued purchases by ETFs and the pattern of Bitcoin holders transferring their belongings to chilly storage might result in a ‘mom of all provide squeezes’ within the Bitcoin market. Whereas numerous components are at play, and the result will not be inevitable, the potential for a major shift within the Bitcoin market is an thrilling prospect. Because the state of affairs unfolds, it will likely be fascinating to look at how the interaction of retail investor psychology, ETF inflows, and Bitcoin’s distinctive provide traits shapes the market.