The 2 largest collectors of Mt. Gox, the now-defunct cryptocurrency trade that acquired hacked in 2014 — resulting in the lack of 850,000 BTC — have chosen an early lump sum fee choice that won’t require a selloff of their Bitcoin holdings.

The fee is scheduled for September 2023, CoinDesk reported Feb. 16.

Whereas the choice to attend for all Mt. Gox litigation to settle might provide increased payouts, it might take one other 5-9 years, as per sources. Choosing the early payout will permit the collectors to obtain their funds sooner and keep away from any potential market impression that would consequence from a large-scale Bitcoin sell-off.

In accordance with sources, the 2 largest collectors of Mt. Gox, the cryptocurrency trade that collapsed on account of a hack almost a decade in the past, have chosen to obtain their chapter restoration in largely bitcoin (BTC).

These collectors, Bitcoinica, a now-defunct New Zealand-based crypto trade, and MtGox Funding Funds (MGIF), which collectively account for about one-fifth of all Mt. Gox claims, will obtain 90% of their recoverable funds, that are estimated to be round 21% of their authentic holdings on the platform on the time of the hack.

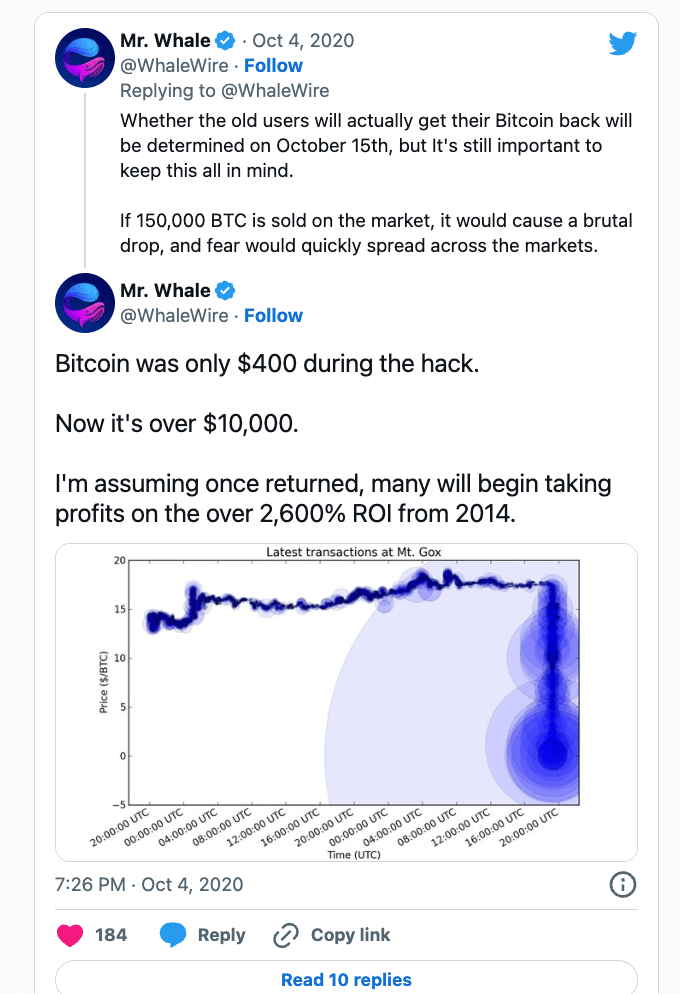

In 2014, hackers stole 850,000 BTC, valued at $460 million on the time. Following the hack, Mt. Gox was left with roughly 142,000 BTC, 143,000 bitcoin money (BCH), and 69 billion Japanese yen.

In accordance with CoinDesk sources, collectors who select the lump sum choice can elect to obtain their fee in a mixture of BTC, BCH, and yen, or they’ll ask for your complete quantity to be given in fiat. By deciding on the early fee, Bitcoinica and MGIF have additionally determined to obtain the crypto choice, which suggests that almost all of their payout will likely be in BTC.

If collectors decline the early lump sum payout, their solely different recourse is to attend for the conclusion of civil rehabilitation litigation, which features a lawsuit by CoinLab towards Mt. Gox’s property. Whereas this feature might yield a barely increased restoration, collectors haven’t any assure that it received’t be probably decrease than the 90% of recoverable holdings assured by the lump sum payout.

Moreover, a authorized evaluation by a Japanese legislation agency indicated that holdouts might wait a few years for his or her cash to be returned.

Collectors should determine by March 10, 2023, whether or not to just accept the provided early lump sum or proceed to attend for a probably bigger payout at an unspecified time sooner or later.

With the anticipated reimbursement now possible solely months away, analysts fear {that a} main sell-off of Bitcoin might comply with.