Nasdaq-listed medical know-how agency Semler Scientific has expanded its Bitcoin holdings by buying an extra 83 BTC for $5.0 million, in accordance with an Aug. 26 assertion.

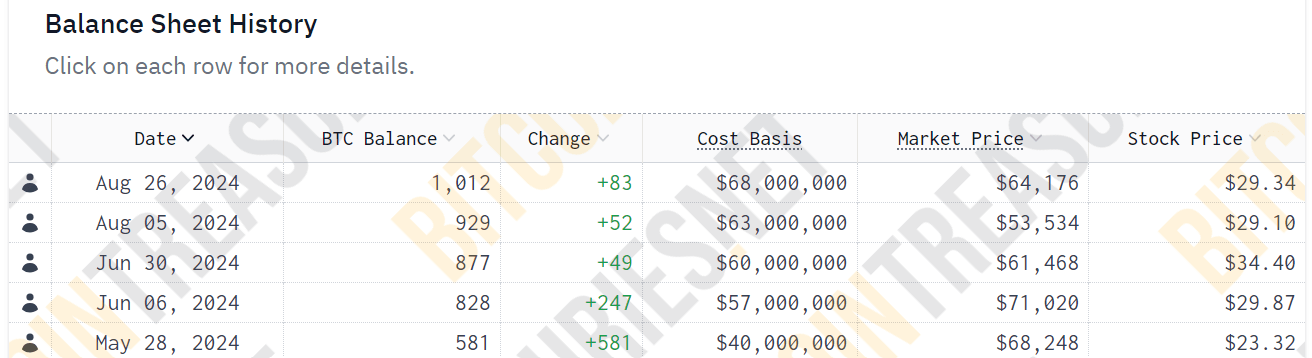

This acquisition brings the corporate’s whole Bitcoin holdings to 1,012 BTC, acquired at a cumulative price of $68 million, together with charges and bills.

The corporate’s chairman, Eric Semler, defined that the acquisition was primarily funded via money generated from the agency’s operations and supplemented by funds from its at-the-market fairness program.

He added:

“We’re inspired by the rising institutional adoption of Bitcoin. It was not too long ago reported that establishments now personal greater than 20% of Bitcoin ETF property below administration. We consider this growing institutionalization will drive worth for each Bitcoin costs and our shareholders.”

Semler Bitcoin purchases

Semler Scientific started investing in Bitcoin in Could when it acquired 581 BTC for $40 million.

Since then, the corporate has continued its shopping for spree, buying 247 BTC for $17 million on June 6 and 49 BTC for $3 million on June 28. By Aug. 5, the agency had bought an extra 52 BTC for one more $3 million.

With the newest buy, Semler Scientific now ranks among the many prime 20 company Bitcoin holders, primarily based on Bitcoin Treasuries information.

Within the second quarter report, CEO Doug Murphy-Chutorian reaffirmed the corporate’s dedication to Bitcoin, emphasizing that it enhances its healthcare enterprise technique.

Institutional adoption

Semler’s rising Bitcoin stash highlights the growing confidence amongst firms in utilizing the flagship digital asset as a treasury reserve.

This development, which was kicked off by MicroStrategy in 2020, has gained appreciable momentum this 12 months, with different companies, like Japan-based funding firm Metaplanet and publicly listed DeFi Applied sciences, making vital Bitcoin acquisitions.

As well as, the introduction of Bitcoin exchange-traded fund (ETF) merchandise has resulted in a notable improve in institutional publicity to the rising trade. Bitwise CIO Matt Hougan predicted that this development would additional improve within the coming years because the trade continues to mature.