Fast Take

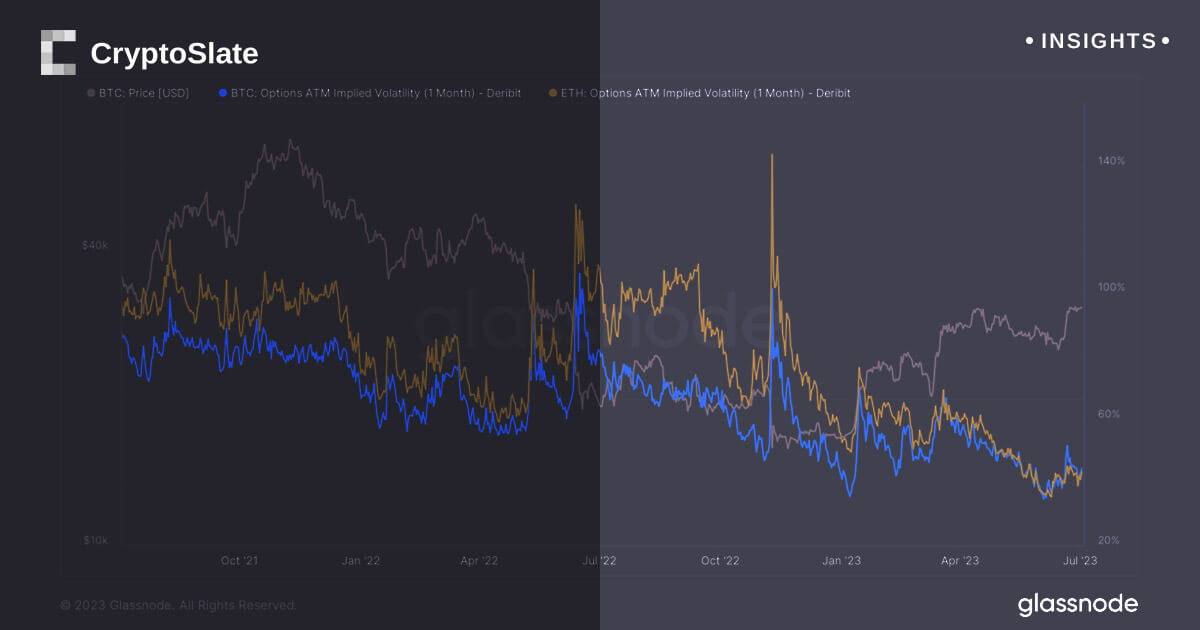

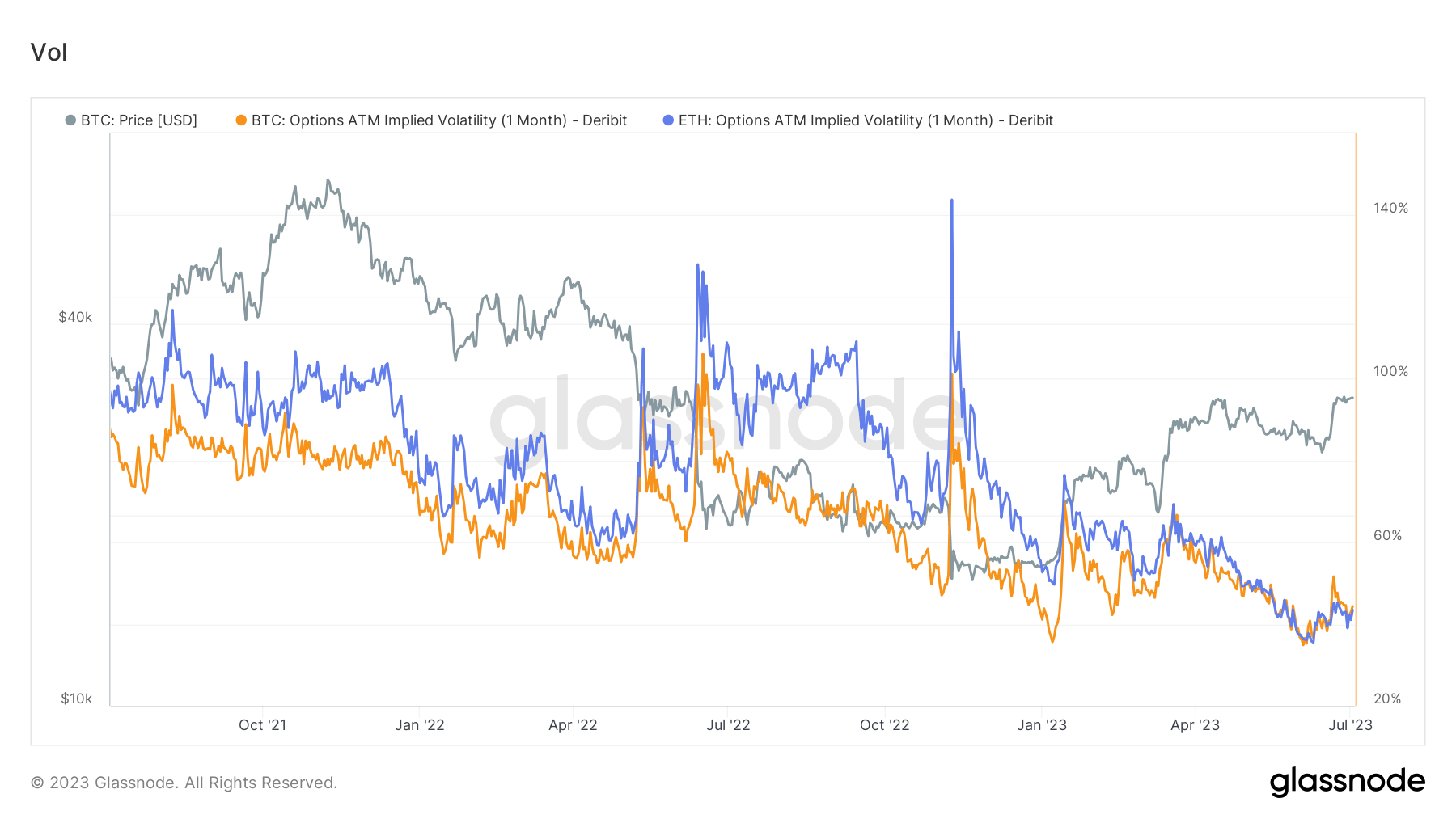

Glassnode describes “Implied Volatility” because the market’s forecast of worth fluctuations. After we know the price of an possibility, we are able to calculate the anticipated volatility of the asset it represents. To place it formally, implied volatility (IV) represents the anticipated vary of an asset’s worth motion over a yr, inside one normal deviation.

By monitoring At-The-Cash (ATM) Implied Volatility (IV) over a time period, we are able to achieve a standardized perspective on the anticipated volatility, which generally varies with precise volatility and the temper of the market. This measurement shows the ATM IV for choices contracts as a consequence of expire one month from the present date.

In latest weeks, there was a wave of positivity inside the Bitcoin group, largely pushed by the introduction of spot Trade-Traded Funds (ETFs). Importantly, the second quarter closing worth of Bitcoin noticed a 7% enhance, ending over the $30,000 mark.

In accordance with information evaluation by Deribit, the volatility skilled in June unveiled vital particulars concerning the particular person volatilities of Bitcoin and Ethereum. Ever since Glassnode began monitoring derivatives information, Ethereum has persistently displayed a better beta worth than Bitcoin, suggesting it has a better stage of volatility.

But, a captivating shift occurred over the previous fortnight. Bitcoin’s implied volatility unexpectedly overtook Ethereum’s. This shocking flip of occasions may be traced again to the explanations beforehand mentioned.

Though there was a modest rise in volatility, Deribit identified that this enhance was counterbalanced by the buying and selling quantity. Moreover, it largely stayed inside the decrease restrict vary, even throughout unstable market circumstances. In accordance with Deribit, this section of heightened Bitcoin volatility is the longest ever noticed, suggesting it might be an rising development.

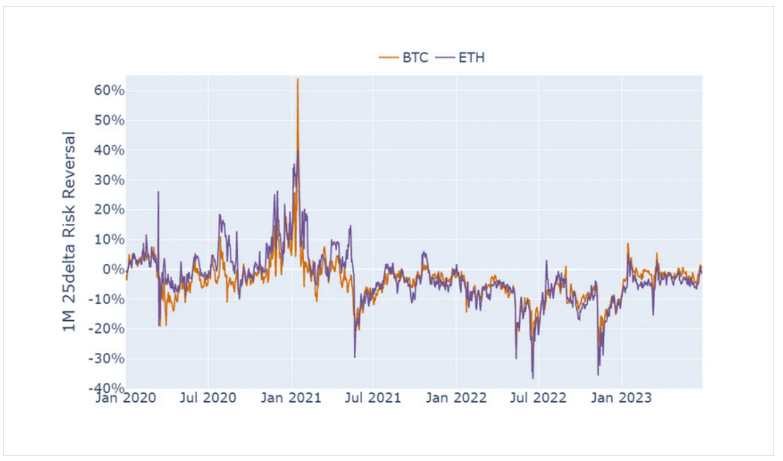

For the reason that begin of the yr, Bitcoin has seen a powerful enhance of 82%, fueled by a number of encouraging elements. Deribit ready a one-month 25 delta danger reversal chart, illustrating that regardless of the upward development in worth, the skew maintains a comparatively regular state

The submit Navigating the Bitcoin surge: A deep dive into Implied Volatility appeared first on CryptoSlate.