Final month, the NFT market noticed a spike in buying and selling quantity on April fifth, adopted by a major 50% drop by the tip of the month. The variety of NFT sellers exceeds the variety of consumers, indicating a possible oversupply available in the market.

As these markets evolve and develop, traders and merchants should keep abreast of the most recent developments and tendencies. By inspecting the important thing elements driving the cryptocurrency and NFT markets, we are able to higher perceive the alternatives and dangers related to these rising tendencies.

Information from this report was obtained from Footprint’s NFT analysis web page. A simple-to-use dashboard containing essentially the most important stats and metrics to know the NFT trade, up to date in real-time, you will discover all the most recent about trades, initiatives, fundings, and extra by clicking right here.

Key Findings

Crypto Macro Overview

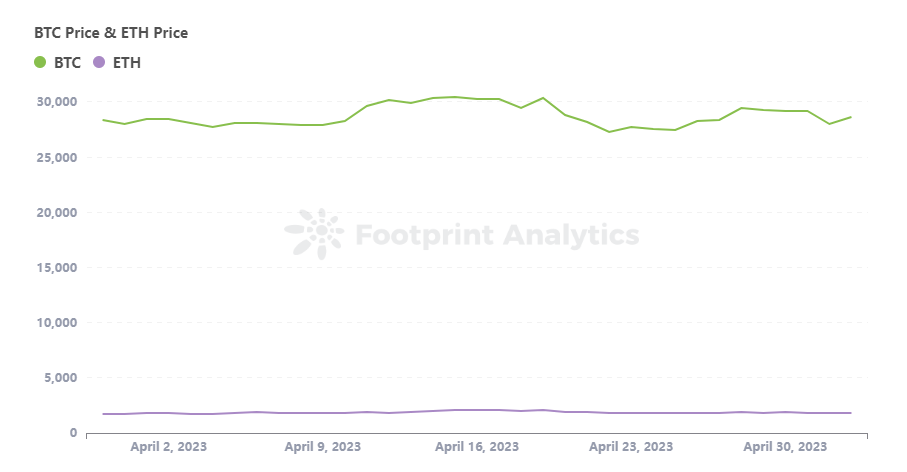

- The cryptocurrency market skilled ups and downs in April, with Bitcoin rising to $30,506 and Ethereum breaking via $2,100 on constructive financial knowledge.

- Regardless of some volatility, the cryptocurrency market stabilized in the direction of the tip of April, with Bitcoin pushing again in the direction of $30,000 and constructive sentiment prevailing.

NFT Market Overview

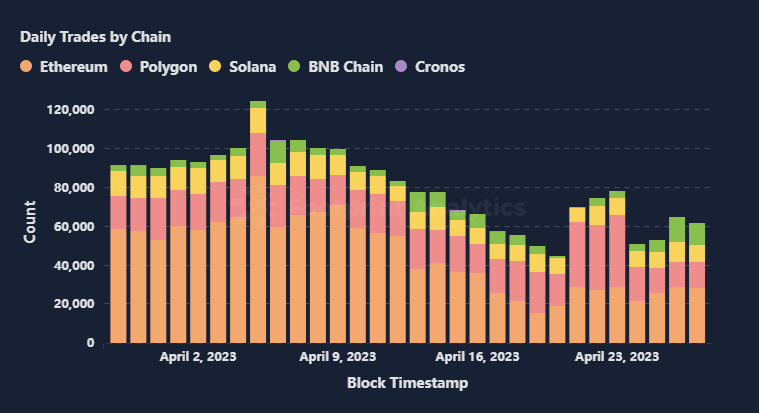

- The NFT market noticed a spike in buying and selling quantity on April fifth however skilled a major 50% drop by the tip of the month.

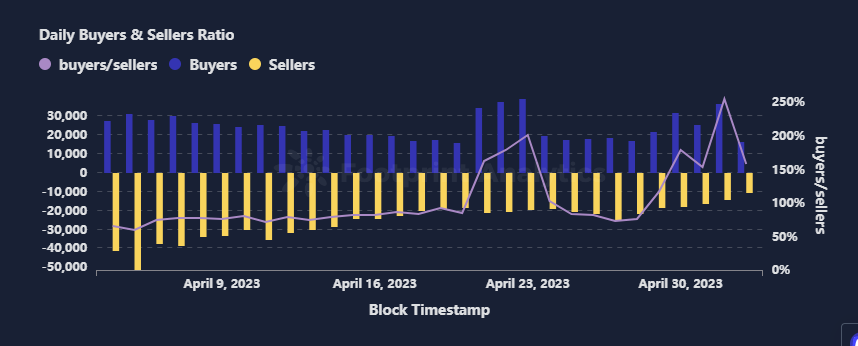

- The variety of NFT sellers exceeds the variety of consumers, indicating a possible oversupply available in the market.

Chains & Marketplaces for NFTs

- Ethereum dominates the NFT market quantity, however community congestion and costs might drive customers to alternate options corresponding to Polygon.

- Blur and OpenSea cater to high-end and retail merchants, however each encroach on one another’s territory and will combine.

NFT Funding & Funding

- Regardless of a slight improve within the variety of NFT initiatives, the lower in funding signifies traders’ warning about investing.

- Platform constructing and scalability options are important for NFTs, as demonstrated by Stream’s $3 million seed funding of its NFT market.

Scorching Matters of the Month

- Integrating AI and NFT expertise emphasizes the significance of NFT provenance for copyright safety and the worth of human creativity in inventive expression to strike a stability for sustainable growth.

Crypto Macro Overview

In April, the cryptocurrency market skilled some ups and downs. On April 14th, most cryptocurrencies traded greater on account of better-than-expected U.S. financial knowledge, with Bitcoin rising to $30,506, whereas ETH broke via $2,100 on April sixteenth.

On the macro entrance, official inflation rose to five% in March, barely beneath the consensus of 5.1%. Nevertheless, investor focus has shifted to potential recessionary dangers after the banking disaster uncovered the fragility of the market’s monetary system. Latest knowledge additionally factors to a macroeconomic slowdown, because the ISM Buying Managers’ Index fell to its lowest since Might 2020.

Regardless of the volatility, bitcoin pushed again to 30,000 in late April, with constructive sentiment throughout the crypto market.

NFT Market Overview

The NFT market attracted a lot consideration initially of 2021 as quite a few initiatives launched their very own NFT collections. Nevertheless, the NFT market has proven indicators of weak spot this 12 months.

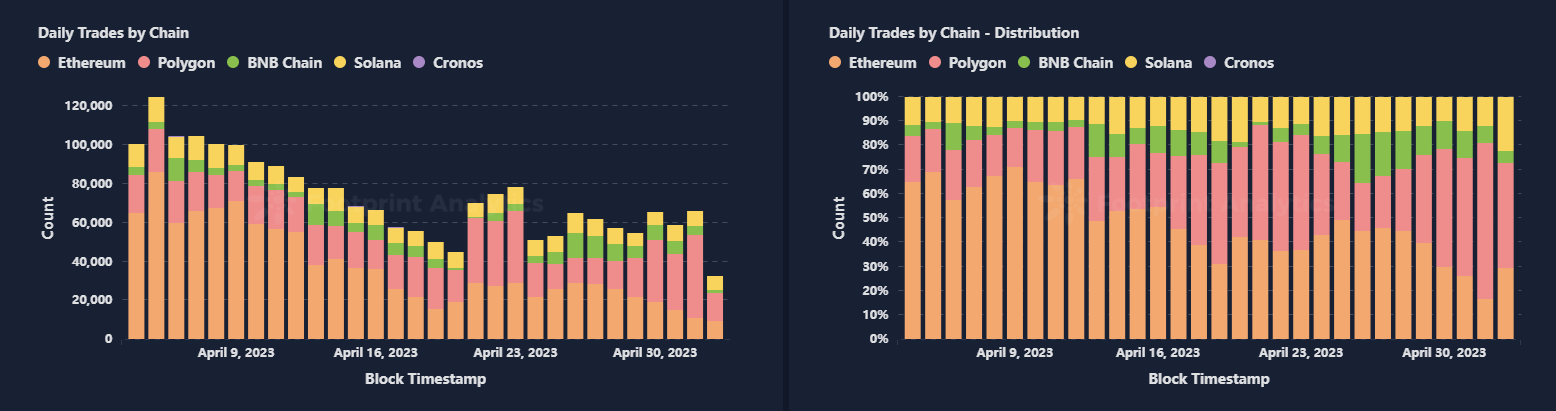

In response to Footprint Analytics, the NFT market peaked in buying and selling numbers on April 5, however every day trades had dropped by 50% by the tip of the month. This decline in buying and selling exercise suggests a rising sense of warning amongst traders because the preliminary enthusiasm for the NFT market seems to be fading.

As well as, based on Footprint Analytics, the variety of NFT sellers available in the market continues to exceed the variety of consumers, suggesting that there could also be inadequate underlying demand.

The preliminary hype across the NFT market was pushed by the cryptocurrency market and celeb endorsements, resulting in a rush of individuals getting into the market. Nevertheless, the quantity of people that perceive NFTs is comparatively small, resulting in oversupply. It stays to be seen whether or not the basics of NFTs can ultimately help market progress and open up new alternatives.

Chains & Marketplaces for NFTs

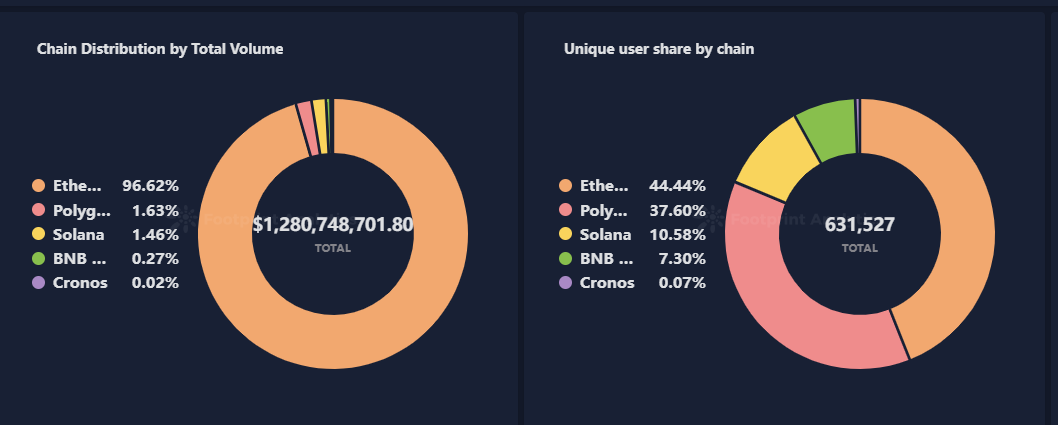

In response to Footprint Analytics, Ethereum holds the lion’s share of NFT transaction quantity, with an enormous 96% market share. Nevertheless, in relation to energetic customers, Ethereum solely accounts for 44%, whereas Polygon’s energetic person base is shut behind at 37%.

Whereas Ethereum stays the platform of selection for many mainstream NFT initiatives, its community congestion and excessive transaction charges might drive some customers to various platforms. In consequence, Ethereum might face challenges in sustaining its dominant place within the NFT market.

Polygon’s every day trades are catching up with Ethereum, with transaction quantity not excessive. Nonetheless, the variety of trades is comparable, indicating that it’s extra appropriate for small merchants on account of decrease limitations to entry. Polygon’s low limitations to entry make it extra appropriate for small transactions and asset exchanges, that means that its market could also be extra decentralized and multi-domain. Nevertheless, gathering high-value and high-quality NFT initiatives and property can also be tougher. Due to this fact, it takes longer to construct a very good ecosystem and accumulate property.

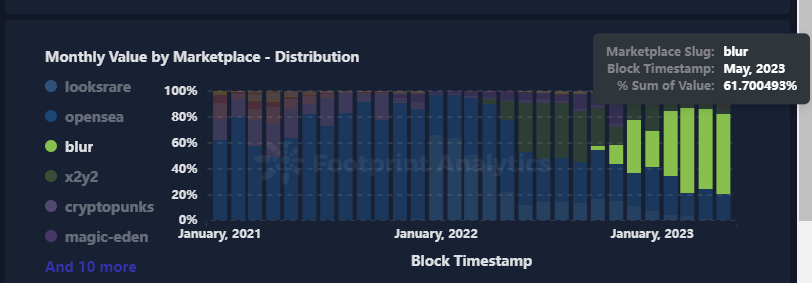

From a market perspective, Blur nonetheless has an absolute benefit relating to transaction quantity. Nevertheless, by way of the variety of transactions, OpenSea nonetheless has the higher hand. Blur’s dominant place suggests it’s extra appropriate for high-value property {and professional} customers with bigger transaction sizes. However, OpenSea’s transactions are looser and extra dispersed, with smaller transaction sizes, making it extra appropriate for retail customers and small every day transactions.

Blur and OpenSea characterize high-end and small merchants, respectively. Nevertheless, with the market’s total growth, each are encroaching on one another’s territory, and the competitors is changing into extra intense. The longer term development could also be additional integrating high-end and small markets, making a sure synergy impact. Continued monitoring of the efficiency of each platforms can be essential to predict their future growth.

NFT Funding & Funding

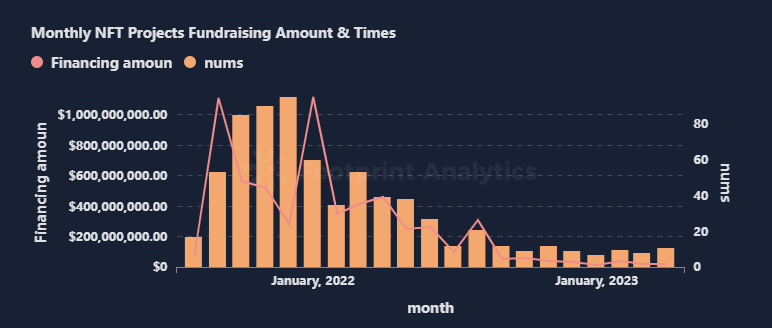

Whereas the variety of NFT funding initiatives barely elevated from 8 to 11 in comparison with final month, the quantity of funding has decreased, indicating a extra cautious strategy by traders.

Many builders are engaged on the NFT market. Stream, which secured $3 million in seed funding to construct a rollup-centric NFT ecosystem, highlights the rising want for layer 2 and scalability options to deal with Ethereum community points. Additionally, the entry of huge corporations corresponding to Amazon into the NFT market is anticipated to extend market visibility and dimension but in addition improve trade dangers.

As well as, the music and leisure industries are exploring NFT, as evidenced by Muverse and Daniel Allan Leisure, which obtained funding this month, opening up new alternatives for NFT purposes.

Scorching Matters of the Month

As Chatgpt grew to become well-known, individuals began speaking about integrating AI and NFT, as NFT is a good instance of a artistic financial system within the crypto world.

KOL 6529 offered a consultant dialogue on this matter. On the one hand, as the quantity of AI-generated content material will increase, the significance of NFT provenance expertise is additional highlighted. NFT provenance will help distinguish the supply and possession of content material and shield the copyright of content material creators.

Conversely, the proliferation of AI-generated content material makes authentic human content material extra invaluable. The distinctiveness of human creation is troublesome to fully substitute by AI, making authentic works extra scarce and invaluable. Due to this fact, the power of creators to construct their reputations is particularly essential in an period of digital content material overload. Solely by permitting extra individuals to know and acknowledge their work can creators stand out within the fierce competitors for content material.

Industrial content material creation is extra simply changed by AI, whereas inventive creation is troublesome to interchange. Industrial content material is often accomplished round a sure demand and will be effectively generated by AI expertise, making it extra simply changed by machines. In distinction, the worth of art work lies within the creator’s ideas and emotional expression, which is troublesome for AI to realize and requires the distinctive perspective and creativity of human artists.

Though AI creation is growing, human creativity stays irreplaceable within the type of inventive expression. Putting a stability between copyright safety, artistic instruments, and human expression is essential to the sustainable growth of NFT and encryption applied sciences.

Closing Ideas

The world of NFTs is quickly evolving, with new tendencies and developments rising month-to-month. April was no exception, as the marketplace for these digital property skilled important fluctuations and new developments. Whereas the spike in buying and selling quantity initially of the month adopted a drop in the direction of the tip, the NFT market stays a dynamic and promising sector.

Because the NFT market grows and matures, staying abreast of the most recent tendencies and developments is essential. By understanding the alternatives and dangers related to this rising expertise, traders and merchants could make knowledgeable selections and capitalize on the potential of NFTs.

This piece is contributed by Footprint Analytics group,

We’re thrilled to ask establishments and initiatives to construct out your customized analysis pages like this. With our assist, you’ll be able to simply personal your knowledge web site for analysis with none coding expertise or technical enter. Merely fill in this kind to use for the waitlist and get began as we speak.

The Footprint Group is the place knowledge and crypto fans worldwide assist one another perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or another space of the fledgling blockchain world. Right here you’ll discover energetic, various voices supporting one another and driving the group ahead.