Decentralized stablecoin DAI, native to Maker protocol, would possibly grow to be a significant chief within the sector over the approaching years. The digital asset was essentially the most secure of the stablecoin in a interval of 9 months, in keeping with analysis revealed by Greatest Brokers.

A stablecoin is a digital asset whose worth is pegged to the U.S. greenback in a 1:1 parity. The idea is controversial within the crypto trade, as among the hottest and beneficial stablecoins have de-pegged and grow to be unstable sooner or later aside from these tokens thought-about “too centralized” by the group.

Customers have been in search of a decentralized stablecoin for years, and with the failed Terra ecosystem, DAI would possibly take this place and take over market share from the most important stablecoins, Tether (USDT) and USD Coin (USDC).

DAI Extra Steady Than Any Different Stablecoin

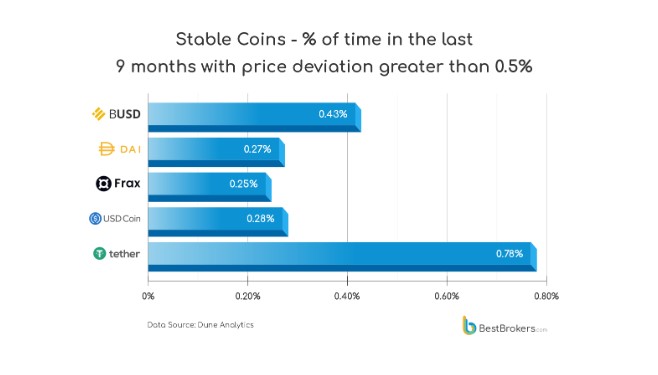

The examine used knowledge from Dune Analytics and discover fashionable stablecoins BUSD, DAI, FRAX, LUSD, USDC, and USDT. The analysis concluded that FRAX noticed the least value deviation over the previous 9 months.

The digital asset was secure at 99.75% of those intervals, adopted by DAI at 95.73%, and USDC at 99.72%. LUSD was essentially the most unstable with a 0.5% deviation from its $1 peg at 53% of the 9-month interval.

Of the stablecoins within the examine, DAI, BUSD, and USDC have by no means deviated under $0.995 to the draw back and $1.005 to the upside. As seen within the chart under, Tether (USDT) was the most important stablecoin with the most important proportion in value deviation over the previous 9 months at 0.78%.

Nonetheless, DAI took the highest spot within the least deviation proportion from its peg. The decentralized stablecoin fluctuated 0.5% from its regular worth, 0.27% of the 9 months probed by the examine.

Thus, DAI is the steadiest stablecoin deviating to solely $0.99640185 of its 1:1 worth with the U.S. greenback. USDC intently follows within the second place with a $0.9962163333 deviation. Tether confirmed the worst efficiency within the analysis with a deviation of $0.97, as seen within the chart under.

Alan Goldberg, market analyst at BestBroker, said the next on their outcomes, and DAI’s potential to draw establishments purely based mostly on its stability:

DAI’s stability is appreciable. A whole lot of company adopters would like having property that aren’t unstable as they already need to cope with competitors, inflation, market situations, and so on. Having that in thoughts makes DAI very severe competitors to the likes of USDC.

Stablecoins have been a controversial subject in crypto because the collapse of LUNA and TerraUSDT. Nonetheless, the demand for a decentralized secure medium of trade stays excessive with DAI poised to proceed gaining relevance on this sector. Goldberg added:

Though the DAI’s provide is low, in comparison with USDC, USDT and BUSD, it’s nonetheless sizeable and makes it usable by large corporations. Once we contemplate each the low deviation and essentially the most secure value, DAI may be thought-about as essentially the most secure coin for the final 9 months and a severe contender to compete with the opposite ‘large’ stablecoins.