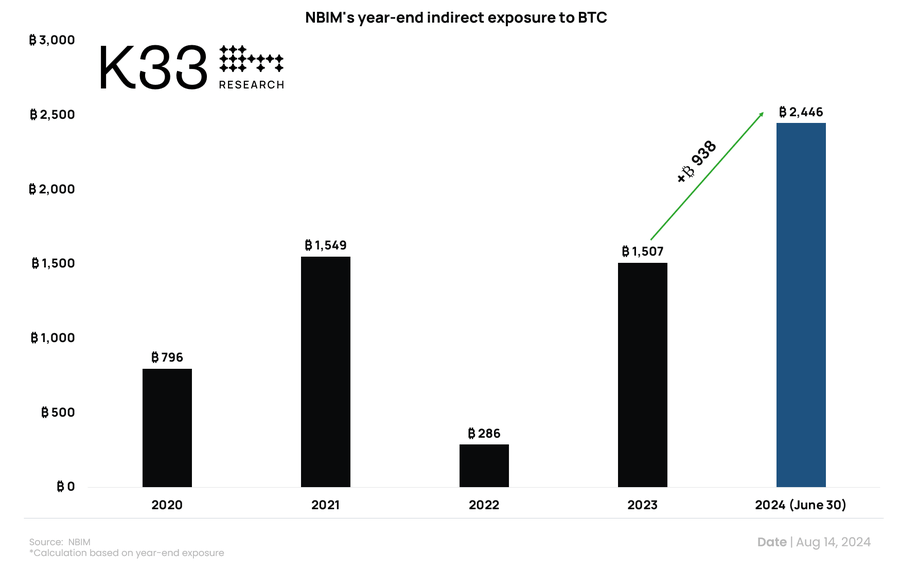

The Norwegian Authorities Pension Fund, generally often known as the Oil Fund, has oblique publicity to Bitcoin that rose by 62% throughout the first half of this yr to the equal of two,446 BTC, in accordance with the Senior Analyst at K33 Analysis Vetle Lunde.

This equates to a rise of 938 BTC since December 2023, when the agency not directly held the equal of 1,507 BTC.

The Norwegian Pension Fund is the world’s largest sovereign wealth fund, with belongings amounting to $1.7 trillion, in accordance with its newest experiences.

NIBM’s Bitcoin publicity

Lunde attributed this progress extra to automated sector changes and threat diversification than a deliberate technique to extend Bitcoin holdings.

He defined:

“[This increase was] unlikely to stem from an intentional option to amass publicity—if elevated BTC publicity was the goal, we’d see extra proof of direct publicity initiatives (and considerably bigger publicity).”

In the meantime, the fund’s Bitcoin publicity comes from investments in main Bitcoin-related corporations, together with MicroStrategy, Marathon Digital, Coinbase, and Block Inc.

Within the first half of 2024, the fund’s stake in MicroStrategy rose from 0.67% to 0.89%, as MicroStrategy boosted its holdings in Bitcoin phrases by 37,181 BTC. Moreover, the fund elevated its shares in Coinbase from 0.49% to 0.83% and Block Inc from 1.09% to 1.28%. It additionally added a 0.82% place in Marathon Digital.

Lunde identified that the fund’s oblique Bitcoin publicity amounted to 44,476 sats (roughly $27) per capita on the finish of the yr’s first half.

Different funds publicity

The Norwegian fund’s publicity to Bitcoin aligns with present tendencies noticed in different pension funds, such because the Wisconsin Pension Fund, which have additionally elevated their publicity to the highest crypto.

Market observers famous that these investments replicate the rising acceptance of BTC as a viable different funding. This shift started earlier this yr after spot Bitcoin exchange-traded fund (ETF) merchandise had been launched within the US, making the asset class a viable possibility amongst conventional buyers.

Lunde defined that these strikes confirmed that “Bitcoin is maturing as an asset and getting woven into any well-diversified portfolio!”