CryptoSlate’s evaluation of on-chain Glassnode metrics indicated combined outcomes for a Bitcoin bottoming.

Earlier analysis printed on Sep. 27 regarded on the % Provide in Revenue (PSP,) Market Worth to Realized Worth (MVRV,) and Provide in Revenue and Loss (SPL) metrics, all of which indicated a backside was forming on the time.

In revisiting these similar metrics, it was famous that the PSP and MVRV nonetheless level to a bottoming, however the SPL not does.

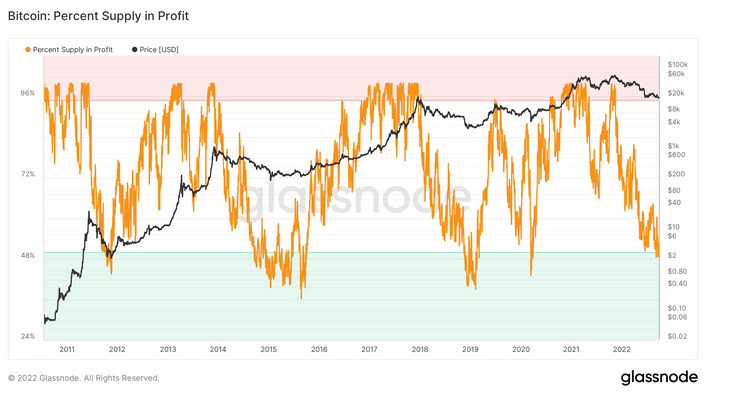

Share of Bitcoin addresses in revenue

The Bitcoin: % Provide in Revenue (PSP) metric refers back to the proportion of distinctive BTC addresses with a mean purchase worth decrease than the present worth.

Throughout bear markets, the proportion of Bitcoin addresses in revenue had at all times dropped beneath 50%. Transferring again above this threshold typically coincided with bullish worth actions.

The chart beneath, which dates again to 2010, reveals a present studying beneath 50%, suggesting a bottoming is on the playing cards.

Nonetheless, evaluation reveals the proportion of BTC provide in revenue dipping a lot decrease than 50% prior to now, with worthwhile addresses sinking as little as 30% in 2015, this being probably the most excessive instance on file.

2015 was an irregular interval, recording a number of swings above and beneath the 50% threshold earlier than a decisive PSP breakout in direction of the tip of the 12 months. This corresponded with BTC recapturing $1,000.

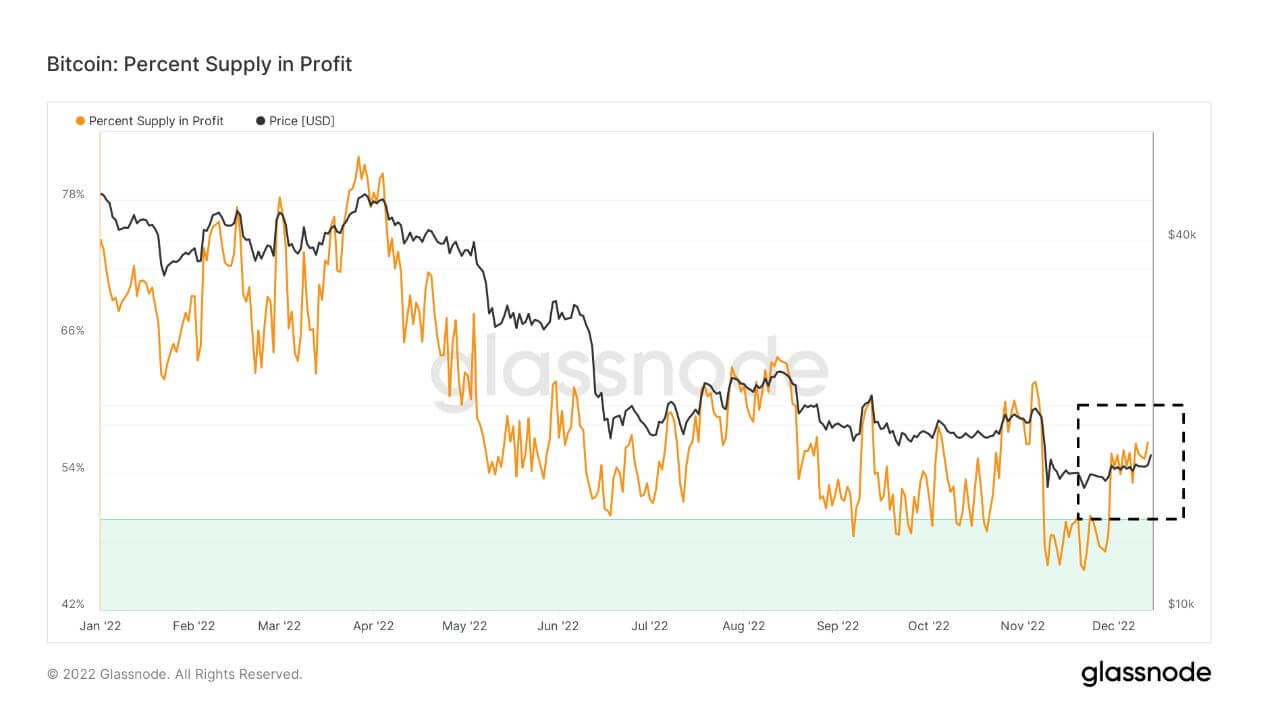

Zooming in on 2022’s motion reveals PSP dipping beneath the 50% threshold but crossing again above it in December.

A decisive break above the earlier native high of round 60% may sign a worth reversal. Nonetheless, the choice state of affairs could also be a repeat of 2015, with choppiness across the threshold, a drop to decrease PSP ranges, and promote strain being the dominant issue.

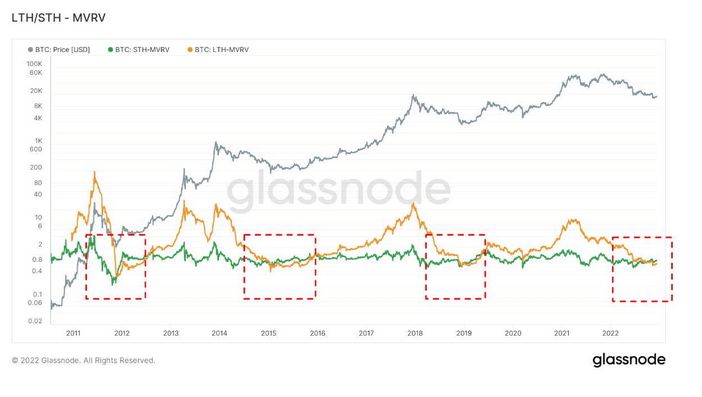

Market Worth to Realized Worth

Market Worth to Realized Worth (MVRV) refers back to the ratio between the market cap (or market worth) and realized cap (or the worth saved). By collating this info, MVRV signifies when the Bitcoin worth is buying and selling above or beneath “honest worth.”

MVRV is additional cut up by long-term and short-term holders, with Lengthy-Time period Holder MVRV (LTH-MVRV) referring to unspent transaction outputs with a lifespan of no less than 155 days and Quick-Time period Holder MVRV (STH-MVRV) equating to unspent transaction lifespans of 154 days and beneath.

Earlier cycle bottoms had been characterised by a convergence of the STH-MVRV and LTH-MVRV strains, with the previous crossing above the latter to sign a bullish reversal in worth.

The STH-MVRV shifting above the LTH-MVRV was famous on Sep. 27’s analysis report. An up to date chart reveals this sample holding at current, suggesting a bottoming remains to be within the offing.

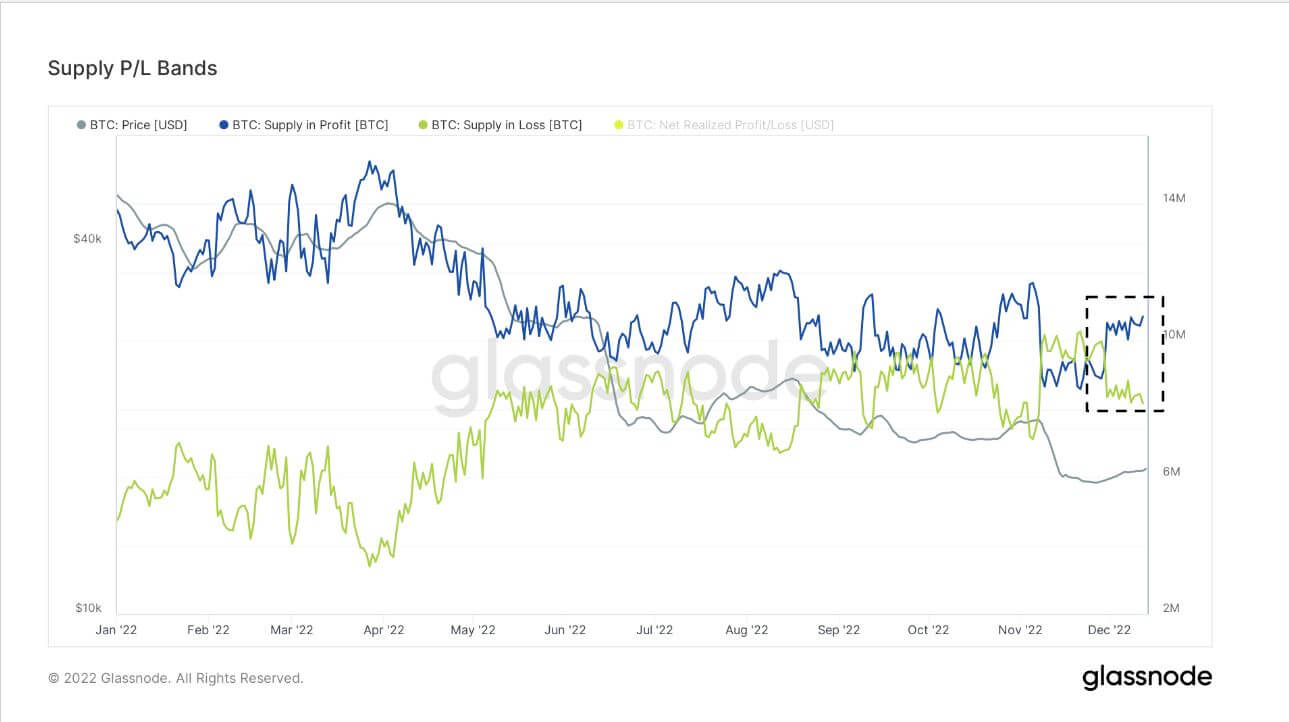

Provide in Revenue and Loss

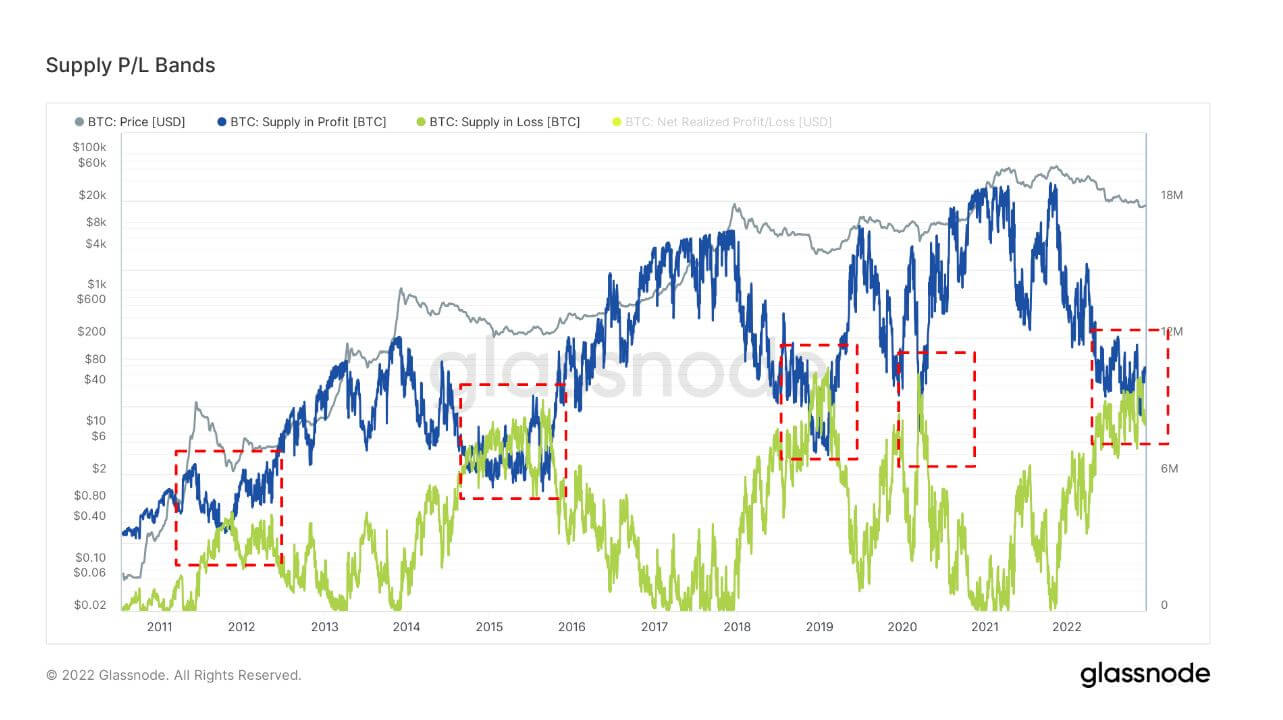

By analyzing the variety of BTC tokens whose worth was decrease or larger than the present worth when final moved, the Provide in Revenue and Loss (SPL) metric reveals the circulating provide in revenue and loss.

Market cycle bottoms coincide with the Provide in Revenue (SP) and Provide in Loss (SL) strains converging. Value reversals happen when the SL line crosses above the SP line. Presently, a convergence of SP and SL has occurred.

Analyzing this on a zoomed-in timeframe for 2022 reveals convergence occurring round September, indicating a bottoming enjoying out. Nonetheless, since December, the SP and SL strains have diverged considerably, thus invalidating a bottoming.