After a short wrestle to regain footing, Bitcoin lastly broke by means of the $52,000 barrier on Feb. 14. Whereas $50,000 was a crucial psychological benchmark, buying and selling above $52,000 signifies rising market confidence in Bitcoin and might imply the top of the bear market.

In periods of value volatility, particularly important upward actions, it’s essential to research the provision of Bitcoin’s provide. Understanding how a lot of Bitcoin’s provide is theoretically obtainable for buying and selling can present us the quantity of shopping for or promoting strain the market might take up. A rise in provide able to be traded could cause the value to drop if there’s no demand to satisfy it. Conversely, a lower within the provide of Bitcoin that may be rapidly purchased could cause a provide crunch that results in a rise in value.

Provide availability can’t be seen by means of a single metric. The availability of Bitcoin sitting in trade wallets is often taken as one of the best proxy, but it surely affords little depth. CryptoSlate analyzed a number of different on-chain metrics, together with UTXOs and accumulation addresses, to higher perceive whether or not the tradeable provide is tightening.

There are, in fact, many different metrics that may additional and higher present the state of the market. For instance, the variations in long-term and short-term holder provides can present if there’s a rise within the tradeable (STH) and non-tradeable (LTH) provide, which might create a crunch. Nevertheless, specializing in much less extensively used metrics like UTXOs can present a contemporary view of a heavily-analyzed matter.

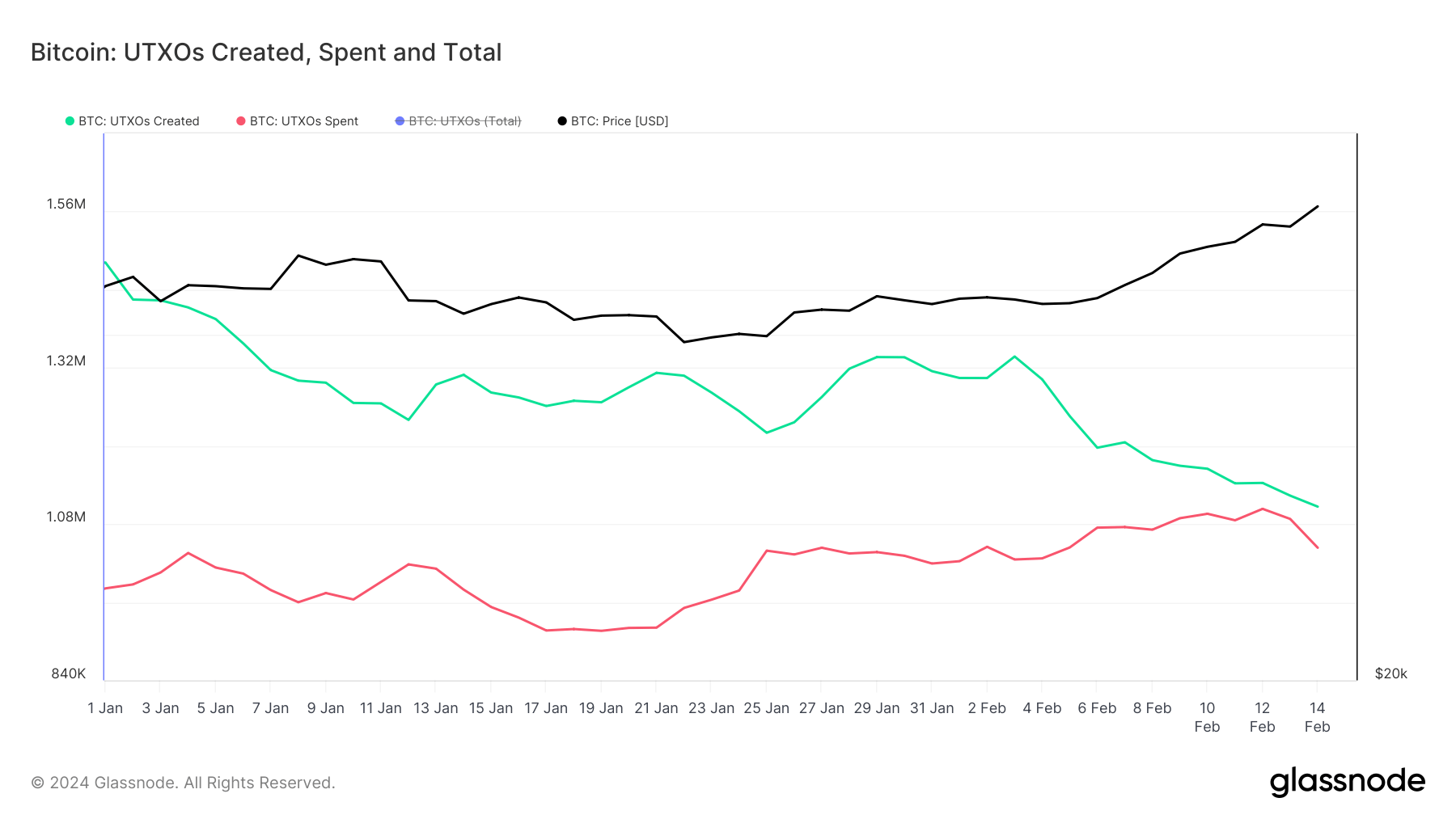

Unspent Transaction Outputs (UTXOs) are important in understanding the Bitcoin community. UTXOs symbolize the quantity of BTC that continues to be unspent and saved in a pockets after a transaction, serving as a basic indicator of Bitcoin’s liquidity and motion inside the market.

On Feb. 1, the variety of created UTXOs stood at 1.304 million, which decreased to 1.106 million by Feb. 14. Concurrently, the variety of spent UTXOs remained comparatively secure. This drop means that there was a lower within the willingness to switch BTC between addresses.

This pattern might be seen as the primary signal of a possible liquidity crunch, which might considerably affect Bitcoin’s value within the coming weeks.

The launch of spot Bitcoin ETFs within the US was one of the important milestones for Bitcoin with regards to institutional adoption, introducing a regulated, mainstream funding car for Bitcoin publicity. These ETFs, which have seen over $4.1 billion in flows since they started buying and selling simply over a month in the past, use OTC desks to amass BTC. This technique of acquisition, beforehand analyzed by CryptoSlate, has a big impact on provide availability.

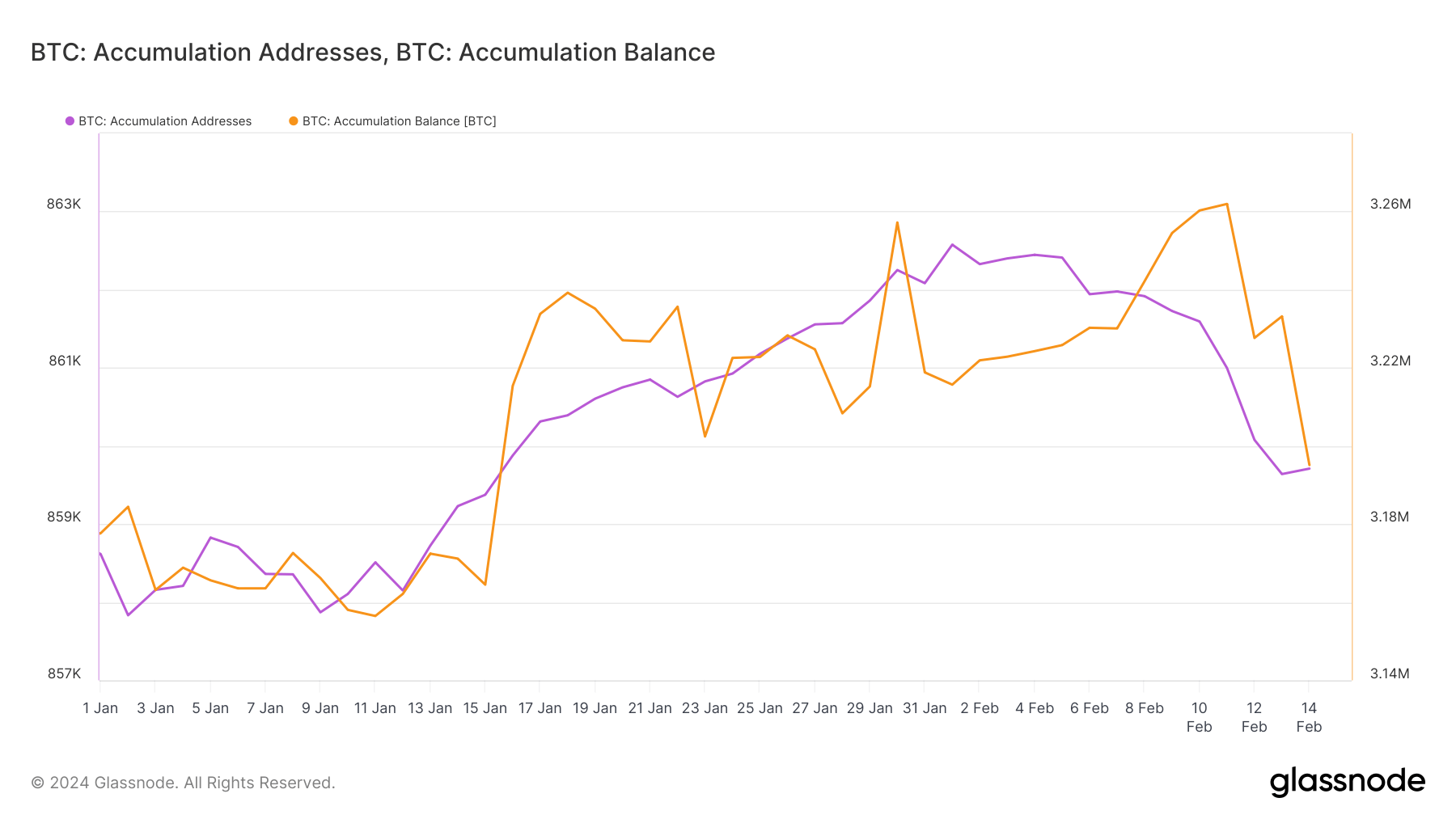

Specifically, there was a notable lower within the quantity of Bitcoin held in accumulation addresses, from 3.215 million BTC on Feb.1st to three.195 million BTC by Feb. 14, and a minor discount within the variety of these addresses.

This decline can counsel a strategic mobilization of long-held BTC. With a constant improve in long-term holder provide, this might be attributed to the rise in promoting to OTC desks, which cater to the rising demand from ETFs.

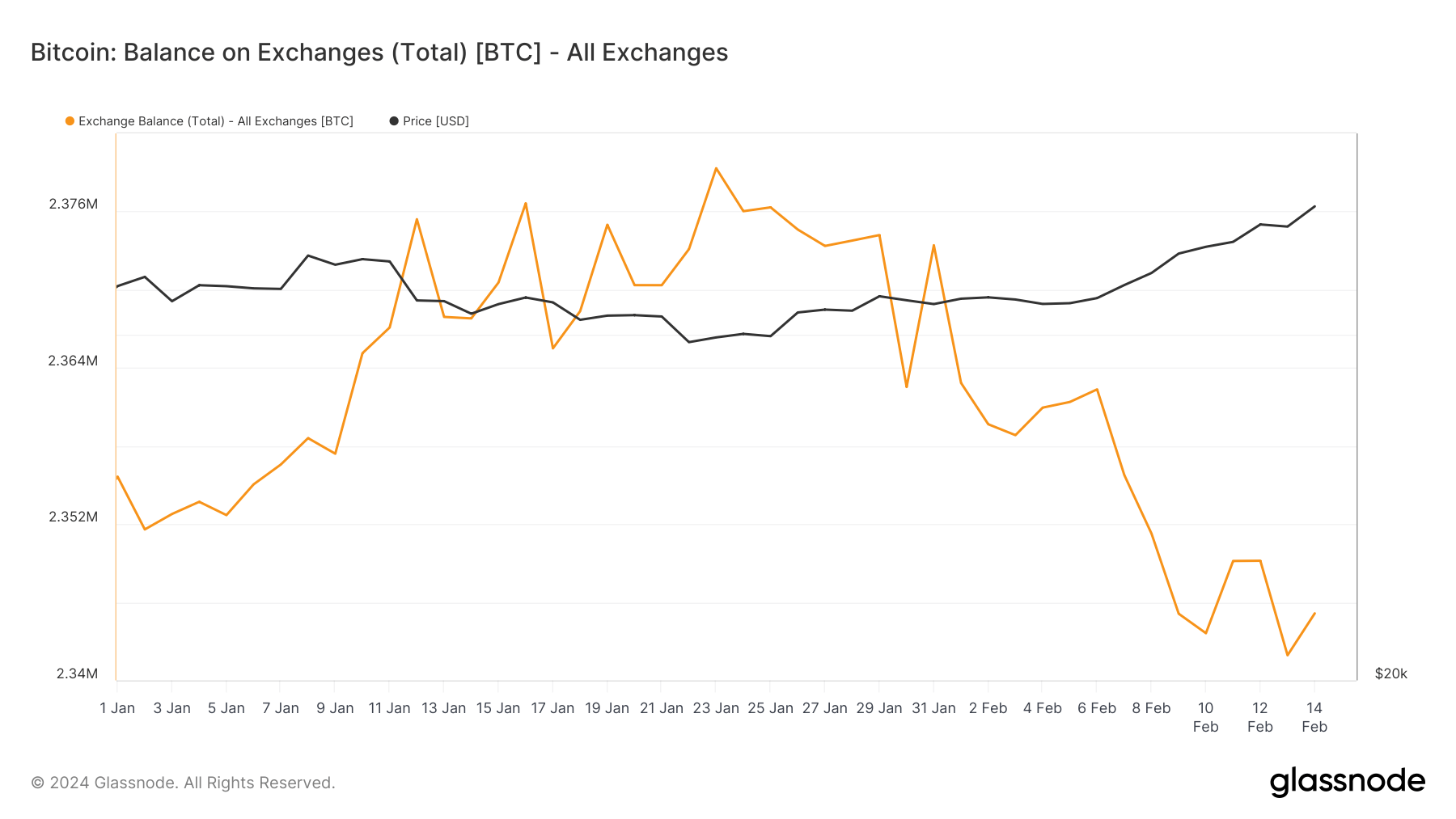

Moreover, there has additionally been an observable lower within the quantity of Bitcoin held in trade wallets, dropping from 2.363 million BTC on Feb. 1 to 2.345 million BTC on Feb. 14. Whereas this can be a continuation of a year-long pattern, it reveals that there’s a really tangible tightening of the provision obtainable for buying and selling.

The compounded elements of a drop in UTXO creation, a discount in Bitcoin held in accumulation addresses, a decline in trade balances, and substantial inflows into spot Bitcoin ETFs present a big change out there. This transformation can doubtlessly trigger a good additional lower within the provide obtainable for buying and selling in opposition to a backdrop of accelerating demand, notably from institutional buyers by means of ETFs.

The publish On-chain knowledge reveals Bitcoin provide is tightening appeared first on CryptoSlate.