The Ethereum Merge was accomplished on Sept. 15, marking the community’s transition to a Proof-of-Stake (PoS) chain and a major milestone on the highway to ETH 2.0, AKA “Consensus Layer.”

A month on, what do on-chain metrics recommend relating to ETH’s community efficiency post-Merge?

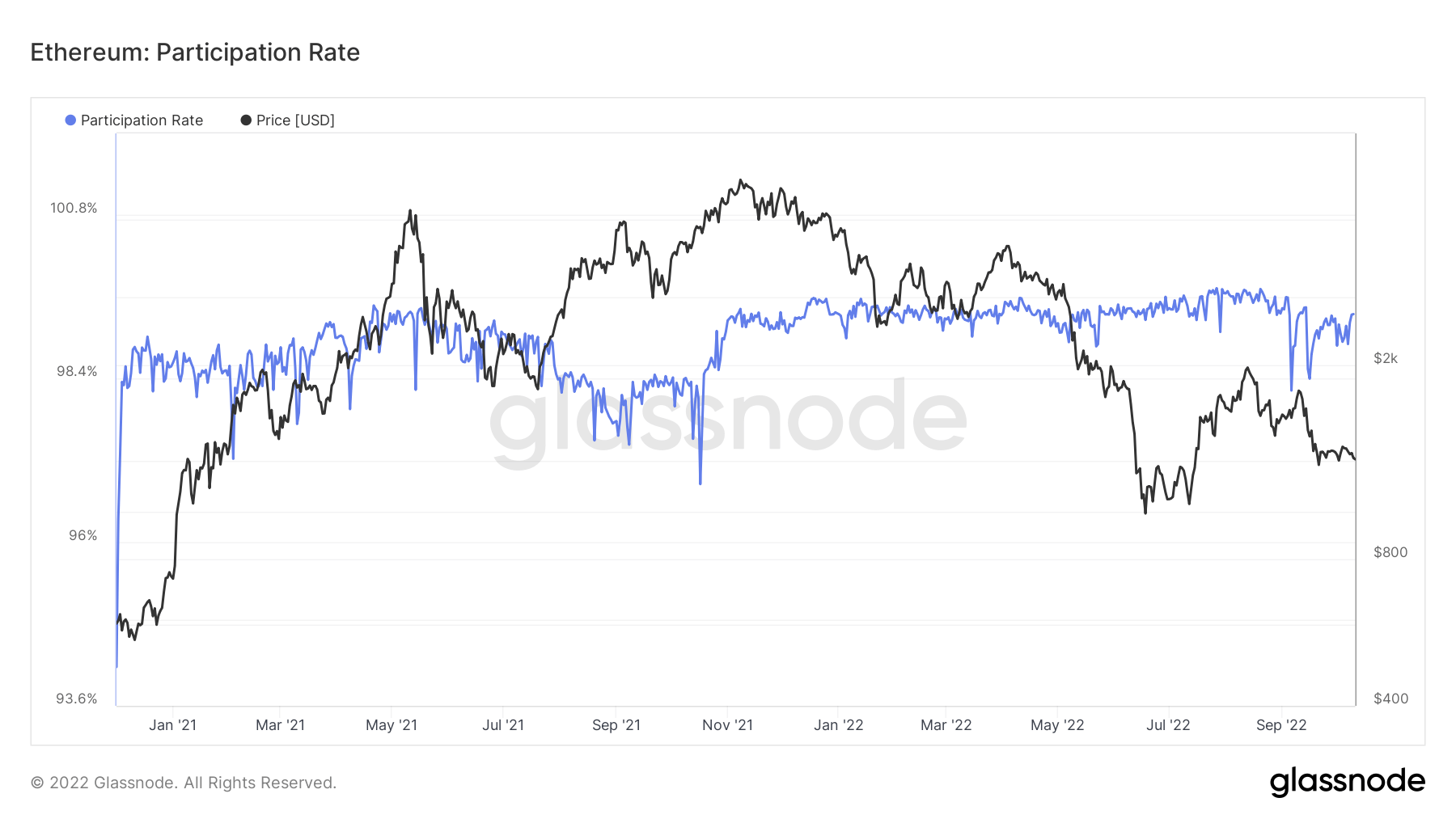

Ethereum Participation Charge

Reliability and uptime are important features of any blockchain. One technique to assess that is by way of the Participation Charge, which refers back to the share of validators on-line and validating transaction blocks successfully – calculated by (Whole Slots – Slots Missed) / Whole Slots.

This metric may be thought-about a gauge of validator responsiveness and community effectivity. A excessive participation charge positively correlates with excessive validator node uptime, fewer missed blocks, and blockspace effectivity.

The chart beneath reveals the Ethereum Participation Charge has run, on common, above 99%. Put up-Merge, a number of dips beneath this threshold had been famous. Nevertheless, in these situations, the Participation Charge quickly snapped again above the typical level.

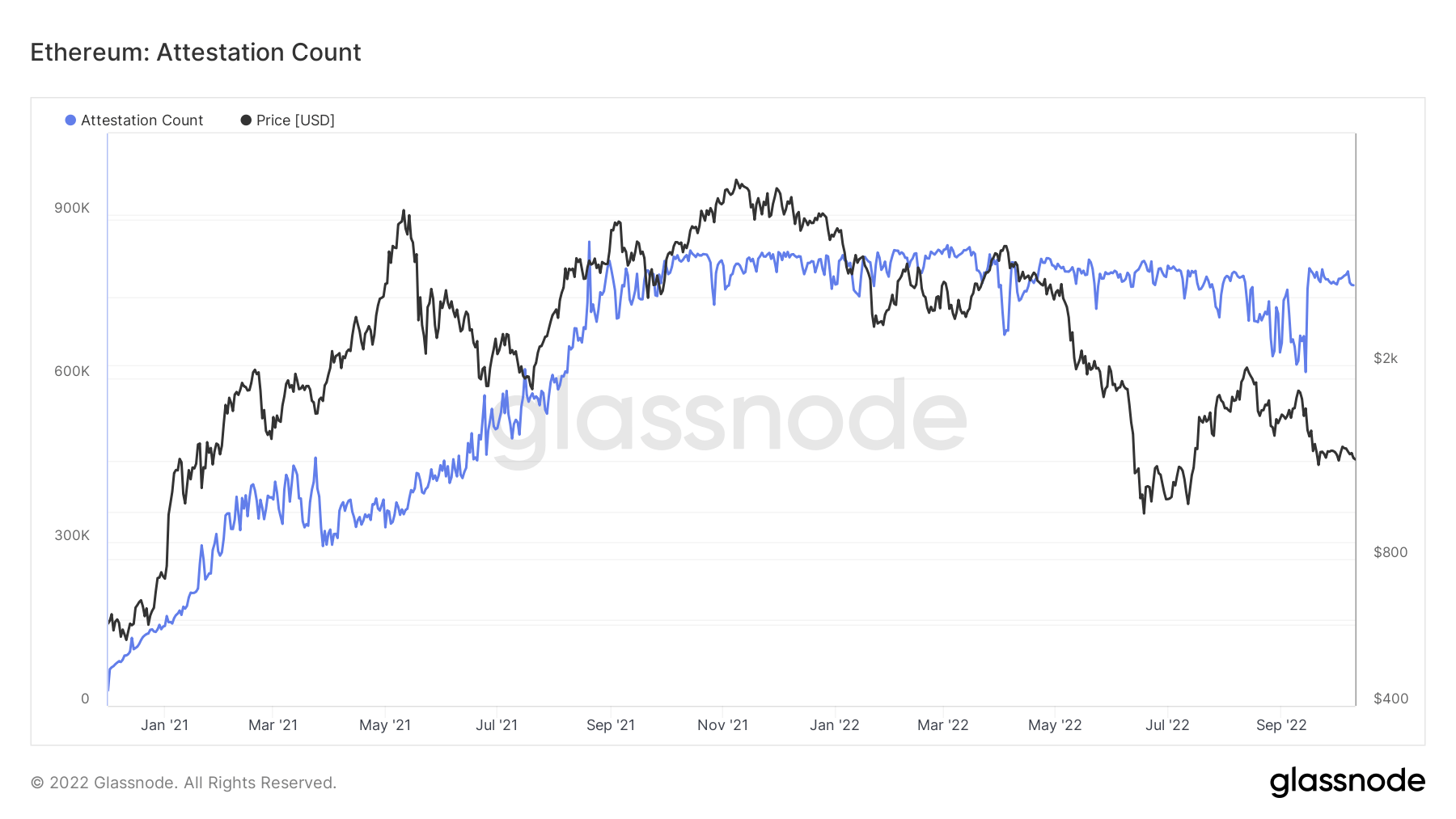

Attestation Depend

Every Ethereum epoch happens roughly each six minutes. Throughout that interval, validators are anticipated to create, signal, and broadcast an attestation. Primarily, this can be a vote in favor of the validator’s view of the chain.

The Attestation Depend refers to collating the validators’ votes that the blockchain is right, which informs the community in reaching a consensus. A excessive Attestation Depend means extra settlement amongst validators.

Put up-Merge, the Attestation Depend climbed larger, highlighting elevated settlement amongst validators because the PoS chain went reside.

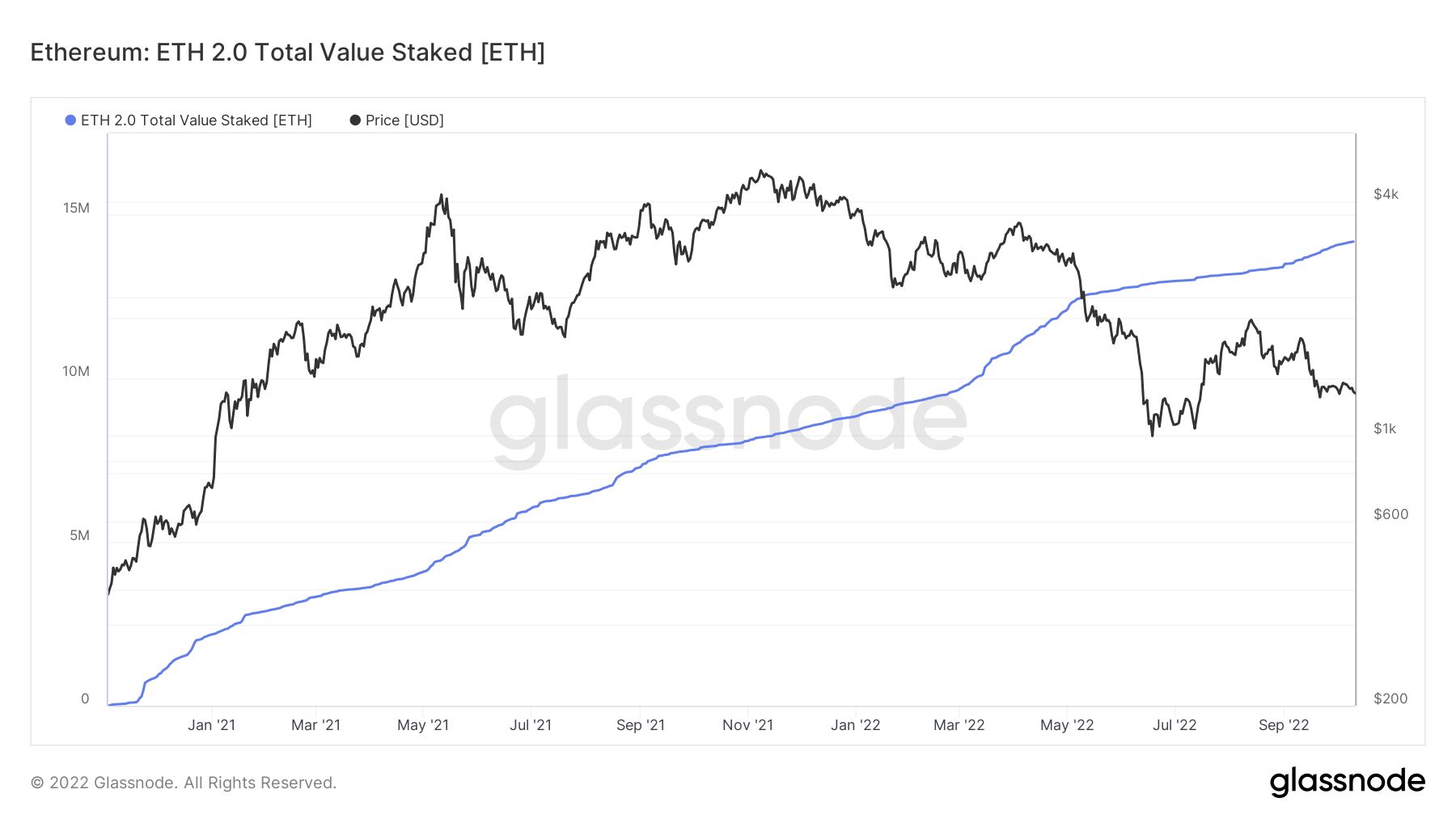

Whole Worth Staked

PoS is a consensus mechanism that randomly assigns the fitting to validate the subsequent block. To turn out to be an Ethereum validator, technical data is required to arrange a node, with many utilizing third-party cloud computing providers.

As well as, a minimal of 32 ETH is required to activate community participation. At immediately’s worth, the price is above $42,000. Given the boundaries to entry, most laypeople supply their tokens to validators.

Usually talking, the chance of a validator being chosen to write down the subsequent block is proportional to the variety of tokens held.

As soon as a validator is chosen, charges are collected and distributed among the many holders who supported the profitable validator. That means, a level of decentralization is maintained with out the necessity to resolve hash puzzles, and token holders take part in securing the community whereas being rewarded for doing so.

If a validator misses blocks or behaves dishonestly, slashing happens, which entails the community confiscating some or the entire validator’s staked ETH.

The Whole Worth Staked chart beneath reveals the quantity of ETH staked is at an all-time excessive, at over 14 million. Put up-Merge, an extra 1.5 million ETH was staked on the community, suggesting rising conviction amongst token holders.