Earlier on-chain analysis instructed the Bitcoin market backside was in. CryptoSlate revisited a number of Glassnode metrics, which proceed to point a bottoming of value.

Nonetheless, macro elements, which can not have been current in earlier cycles, stay in play, doubtlessly impacting the present cycle.

Bitcoin Provide P/L Bands

Bitcoin Provide P/L Bands present the circulating provide that’s both in revenue or loss, primarily based on the value of the token being greater or decrease than the present value on the time of final transferring.

Market cycle bottoms coincide with the Provide in Revenue (SP) and Provide in Loss (SL) traces converging, which occurred most not too long ago round This autumn 2022. The next act of the traces diverging has corresponded with value reversals up to now.

Presently, the SP band has moved up sharply to diverge from the SL band, suggesting a macro upturn in value could possibly be on the playing cards if the sample holds.

Market Worth to Realized Worth

Market Worth to Realized Worth (MVRV) refers back to the ratio between the market cap (or market worth) and realized cap (or the worth saved). By collating this info, MVRV signifies when the Bitcoin value is buying and selling above or under “truthful worth.”

MVRV is additional cut up by long-term and short-term holders, with Lengthy-Time period Holder MVRV (LTH-MVRV) referring to unspent transaction outputs with a lifespan of no less than 155 days and Quick-Time period Holder MVRV (STH-MVRV) equating to unspent transaction lifespans of 154 days and under.

Earlier cycle bottoms featured a convergence of the STH-MVRV and LTH-MVRV traces, with the previous crossing above the latter to sign a bullish reversal in value.

Throughout This autumn 2022, a convergence between the STH-MVRV and LTH-MVRV traces occurred. And, inside current weeks, the STH-MVRV has crossed above the LTH-MVRV, signaling the potential of a value development reversal.

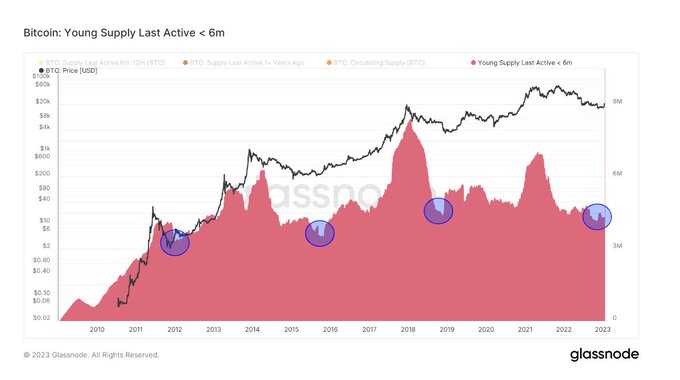

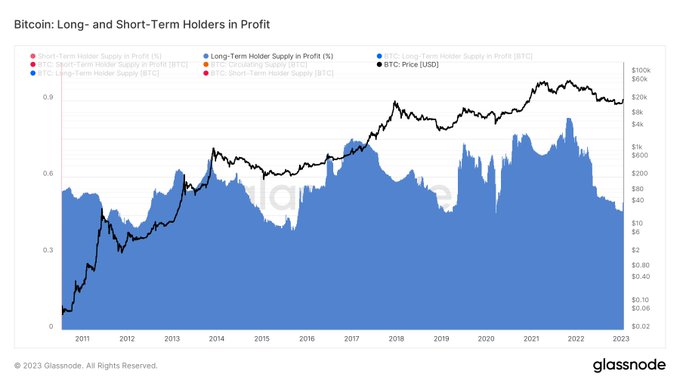

Younger Provide Final Energetic < 6m & Holders in Revenue

Younger Provide Final Energetic <6m (YSLA<6) refers to Bitcoin tokens which have transacted throughout the final six months. The opposing state of affairs can be long-term holders sitting on their tokens and never actively taking part within the Bitcoin ecosystem.

At bear market bottoms, YSLA<6 tokens account for lower than 15% of the circulating provide as non-believers/hit-and-run speculators go away the market through the cycle of depressed costs.

The chart under reveals YSLA<6 tokens reached the “lower than 15% threshold” late final 12 months, suggesting a capitulation of speculative curiosity.

Equally, the chart under reveals Lengthy-Time period Holders in Revenue at the moment near All-Time Lows (ATLs.) This corroborates that long-term holders maintain many of the provide and stay unfazed by the -75% value drawdown from the market prime.

Futures Perpetual Funding Price

The Futures Perpetual Funding Price (FPFR) refers to periodic funds made to or by derivatives merchants, each lengthy and brief, primarily based on the distinction between perpetual contract markets and the spot value.

In periods when the funding fee is constructive, the value of the perpetual contract is greater than the marked value. On this occasion, lengthy merchants pay for brief positions. In distinction, a unfavorable funding fee reveals perpetual contracts are priced under the marked value, and brief merchants pay for longs.

This mechanism retains futures contract costs according to the spot value. The FPFR can be utilized to gauge merchants’ sentiment in {that a} willingness to pay a constructive fee suggests bullish conviction and vice versa.

The chart under reveals durations of unfavorable FPFR, particularly throughout black swan occasions, which have been usually adopted by a value reversal. The exception was the Terra Luna de-peg, probably as a result of it triggered a string of centralized platform bankruptcies, subsequently appearing as a headwind in opposition to constructive market sentiment.

From 2022 onwards, the magnitude of the funding fee, each constructive and unfavorable, has considerably diminished. This is able to recommend much less conviction in both route in comparison with pre-2022.

Following the FTX scandal, the FPFR has been primarily unfavorable, indicating normal market bearishness and the potential of value bottoming. Apparently, the FTX scandal triggered essentially the most excessive transfer within the funding fee since earlier than 2022.