Fast Take

- In a deflationary collapse, a sell-off happens that first ends in leverage being worn out first earlier than then affecting panic sellers.

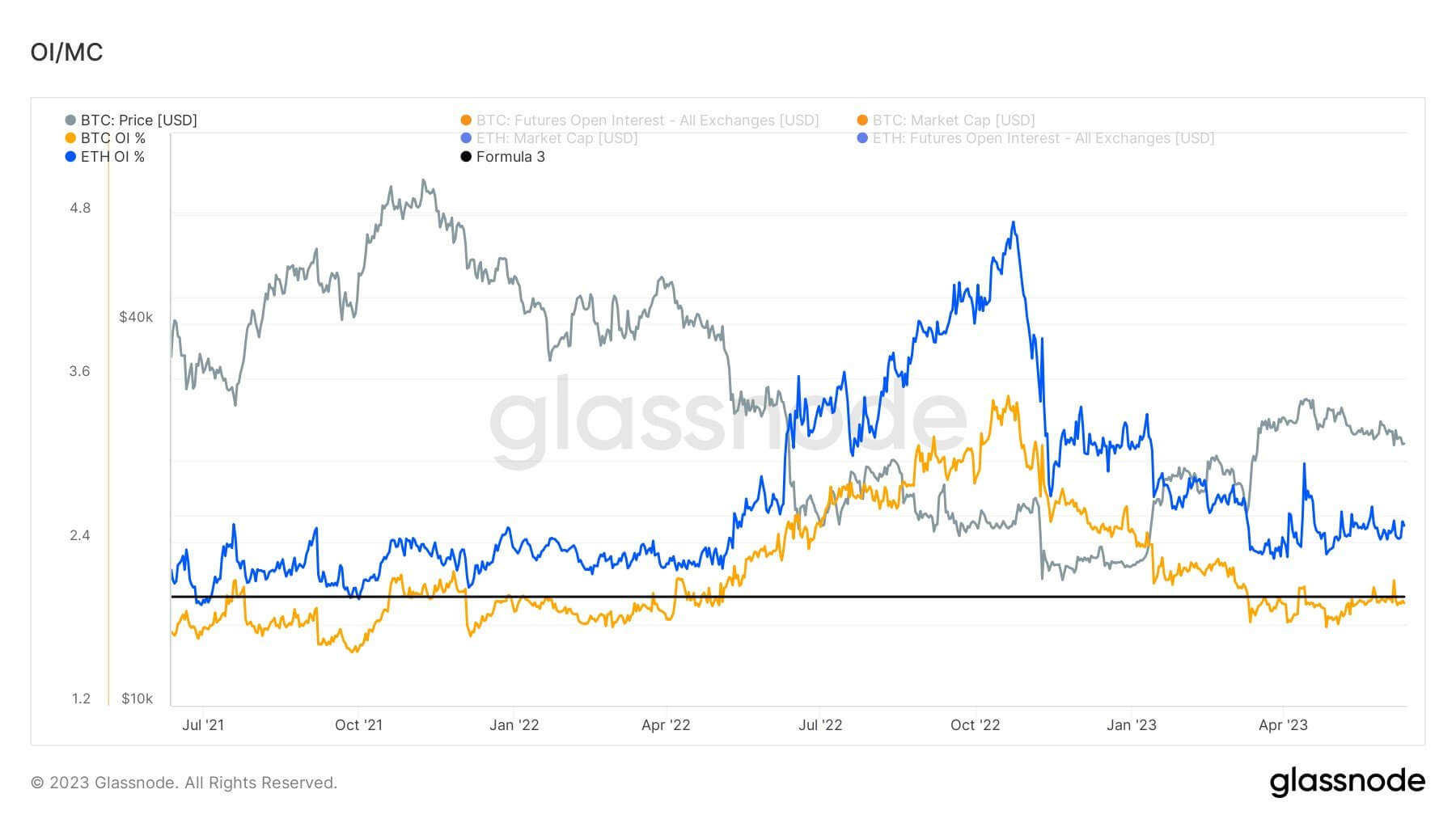

- Bitcoin open curiosity is minimal, remaining at or under 2% of the market cap since Silicon Valley Financial institution’s collapse, whereas holders stay worth agnostic.

- The present worth of the futures open curiosity is roughly $9.8 billion, whereas the market cap is simply over $500 billion.

- Ethereum’s open curiosity is barely extra leveraged than Bitcoin when it comes to open curiosity in comparison with market cap.

- Ethereum’s open curiosity divided by market cap is 2.5%, roughly $5.2 billion in open curiosity with a market cap of $210 billion.

- We are able to additionally see a scarcity of long-term holders sending Bitcoin to exchanges because the SVB collapse in March.

The publish Ought to we worry a deflationary collapse in Bitcoin? appeared first on CryptoSlate.